Title: Understanding the Rhode Island Bylaws of First American Insurance Portfolios, Inc. Introduction: The Rhode Island Bylaws of First American Insurance Portfolios, Inc. serve as essential guidelines governing the operations and procedures of this insurance company. By adhering to these bylaws, First American Insurance Portfolios ensures compliance with relevant laws, maintains transparency, and protects the rights and interests of stakeholders. Let's delve into a detailed description of these crucial bylaws. 1. Corporate Purpose: The Rhode Island Bylaws establish the company's corporate purpose, outlining its primary objectives, such as providing insurance coverage, risk management solutions, and financial services. These bylaws also define the scope of the company's activities to ensure it operates within the limits of the law. 2. Membership and Shareholders: The bylaws outline the qualifications and procedures for becoming a member or shareholder of First American Insurance Portfolios. They detail the rights, responsibilities, and obligations of each member so that all participants are aware of their roles within the organization. 3. Board of Directors: The Rhode Island Bylaws establish the composition, term duration, and responsibilities of the Board of Directors. They outline the election process and the criteria for selecting directors, ensuring diversity and expertise. The bylaws also define the Board's decision-making processes, responsibilities regarding strategic planning, risk management, and financial oversight. 4. Meetings and Quorum: The bylaws detail the procedures for calling, conducting, and documenting meetings, ensuring transparency and effective communication among stakeholders. They also specify the minimum number of members required to constitute a quorum, ensuring that decisions are made with adequate participation. 5. Officers and Management: These bylaws describe the roles and responsibilities of various officers, including the Chief Executive Officer (CEO), Chief Financial Officer (CFO), and other key management positions. They establish the appointment, terms, and fiduciary duties of officers, ensuring efficient management and leadership within the organization. 6. Committees: If applicable, the Rhode Island Bylaws might establish different committees such as an Audit Committee, Risk Management Committee, or Governance Committee. These committees have specific responsibilities, ensuring oversight, compliance, and effective decision-making within their respective areas of expertise. The bylaws outline the composition, appointment, and powers of these committees. 7. Amendments and Dissolution: The bylaws highlight the procedure for amending, modifying, or repealing the bylaws to accommodate changes within the company or comply with legal requirements. In cases of dissolution, the bylaws establish the protocols for the distribution of company assets and liabilities, ensuring an orderly wind-up process. Conclusion: The Rhode Island Bylaws of First American Insurance Portfolios, Inc. serve as a comprehensive framework to govern the operations and management of the company. By considering aspects such as corporate purpose, membership, Board composition, meetings, officers, committees, and amendments, these bylaws facilitate a transparent and efficient functioning of the insurance organization. Adhering to these bylaws ensures compliance with legal obligations while protecting the interests of shareholders, members, and other key stakeholders.

Rhode Island Bylaws of First American Insurance Portfolios, Inc.

Description

How to fill out Rhode Island Bylaws Of First American Insurance Portfolios, Inc.?

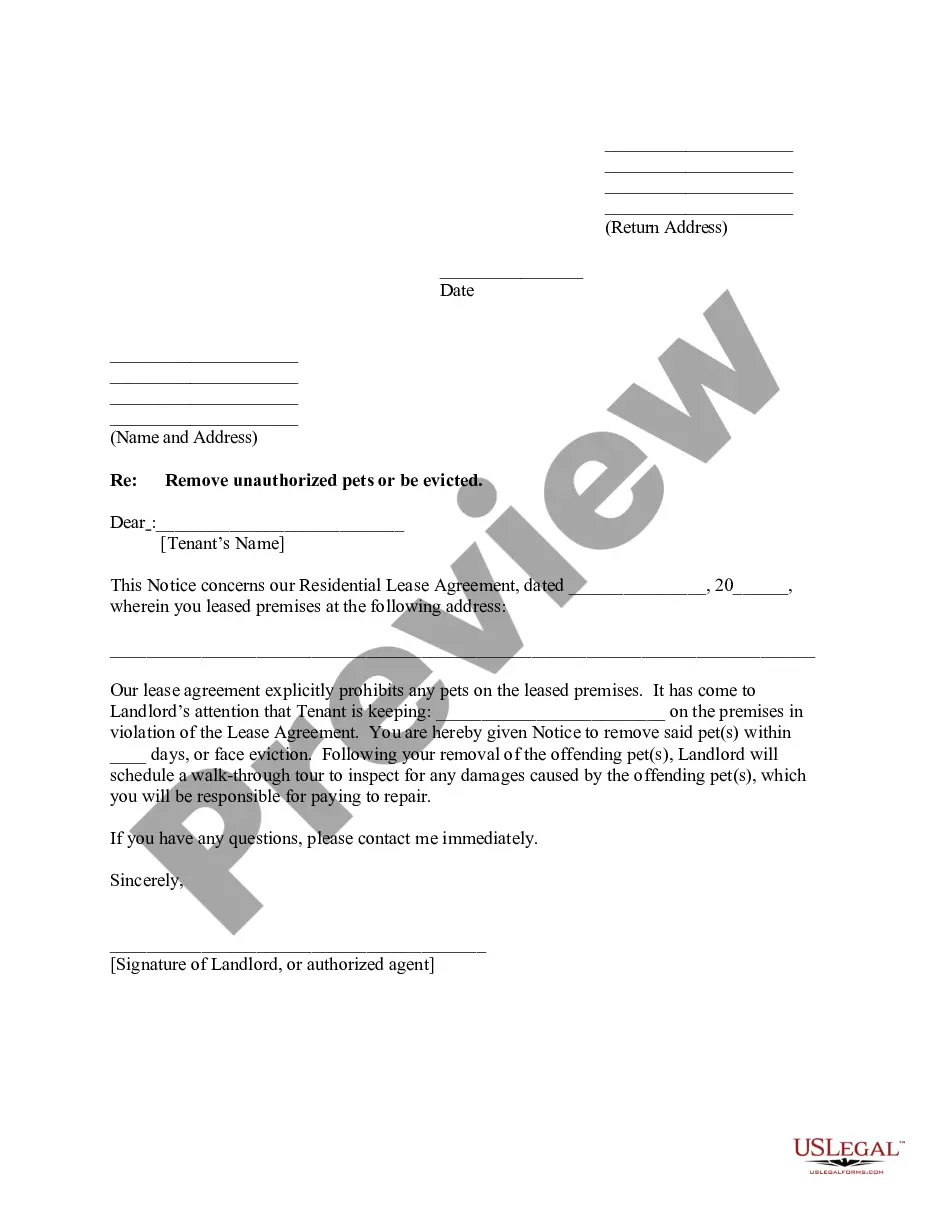

You may commit time on the web searching for the authorized file format which fits the federal and state needs you need. US Legal Forms offers thousands of authorized types that happen to be evaluated by specialists. You can easily down load or print the Rhode Island Bylaws of First American Insurance Portfolios, Inc. from the service.

If you currently have a US Legal Forms account, you can log in and then click the Down load button. Following that, you can full, revise, print, or indicator the Rhode Island Bylaws of First American Insurance Portfolios, Inc.. Every authorized file format you buy is the one you have eternally. To acquire an additional backup for any acquired kind, go to the My Forms tab and then click the corresponding button.

Should you use the US Legal Forms site the first time, keep to the easy instructions under:

- Initially, make certain you have chosen the proper file format for the region/city of your choosing. Look at the kind description to ensure you have picked the right kind. If offered, take advantage of the Preview button to look from the file format as well.

- In order to discover an additional version in the kind, take advantage of the Research discipline to find the format that meets your requirements and needs.

- Upon having identified the format you would like, just click Purchase now to proceed.

- Find the costs program you would like, type your accreditations, and register for your account on US Legal Forms.

- Comprehensive the purchase. You should use your Visa or Mastercard or PayPal account to pay for the authorized kind.

- Find the format in the file and down load it to your system.

- Make modifications to your file if possible. You may full, revise and indicator and print Rhode Island Bylaws of First American Insurance Portfolios, Inc..

Down load and print thousands of file layouts utilizing the US Legal Forms site, which offers the largest variety of authorized types. Use expert and status-specific layouts to take on your organization or person needs.