The Rhode Island Pooling and Servicing Agreement is a legal document that outlines the terms and conditions for the sale of mortgage loans to a Trustee, who includes the loans in a Trust Fund. This agreement is common in the mortgage industry and provides clear guidelines for the transfer and management of mortgage assets. The agreement covers various aspects such as the definition of mortgage loans, identification of the Trustee, creation of the Trust Fund, and the responsibilities of both parties involved. It sets out the specific terms regarding loan servicing, payments, loan modifications, and other important factors that impact the trust's overall performance. The Rhode Island Pooling and Servicing Agreement ensures transparency and legal compliance throughout the loan sale and servicing processes. It protects the interests of both the seller (company) and the Trustee, often a financial institution or specialized entity responsible for managing the Trust Fund. In Rhode Island, there may be different types of Pooling and Servicing Agreements contemplating the sale of mortgage loans to Trustees for inclusion in Trust Funds. These agreements can vary based on specific provisions, parties involved, and the purpose of the Trust Fund. Some common types of Pooling and Servicing Agreements include: 1. Residential Mortgage-Backed Securities (RMBS) Agreement: This agreement pertains to the sale of residential mortgage loans to Trustees for inclusion in Trust Funds, usually aimed at securitizing these loans and creating investment opportunities. 2. Commercial Mortgage-Backed Securities (CMOS) Agreement: This type of agreement focuses on the sale of commercial mortgage loans to Trustees for inclusion in Trust Funds. CMOS agreements allow for the pooling of various commercial mortgages into a single security, offering investors exposure to a diversified portfolio. 3. Collateralized Mortgage Obligation (CMO) Agreement: CMO agreements involve the sale of mortgage loans to Trustees, who subsequently issue multiple classes of bonds backed by the cash flows from these mortgage loans. These agreements enable the division of mortgage loans into different risk and return classes, accommodating investors with varying risk appetites. These are just a few examples of the various types of Pooling and Servicing Agreements related to the sale of mortgage loans to Trustees for inclusion in Trust Funds in Rhode Island. Each agreement serves specific purposes and may contain unique provisions tailored to the specific mortgage assets and investment objectives of the involved parties.

Rhode Island Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company

Description

How to fill out Rhode Island Pooling And Servicing Agreement Contemplating The Sale Of Mortgage Loans To Trustee For Inclusion In The Trust Fund By The Company?

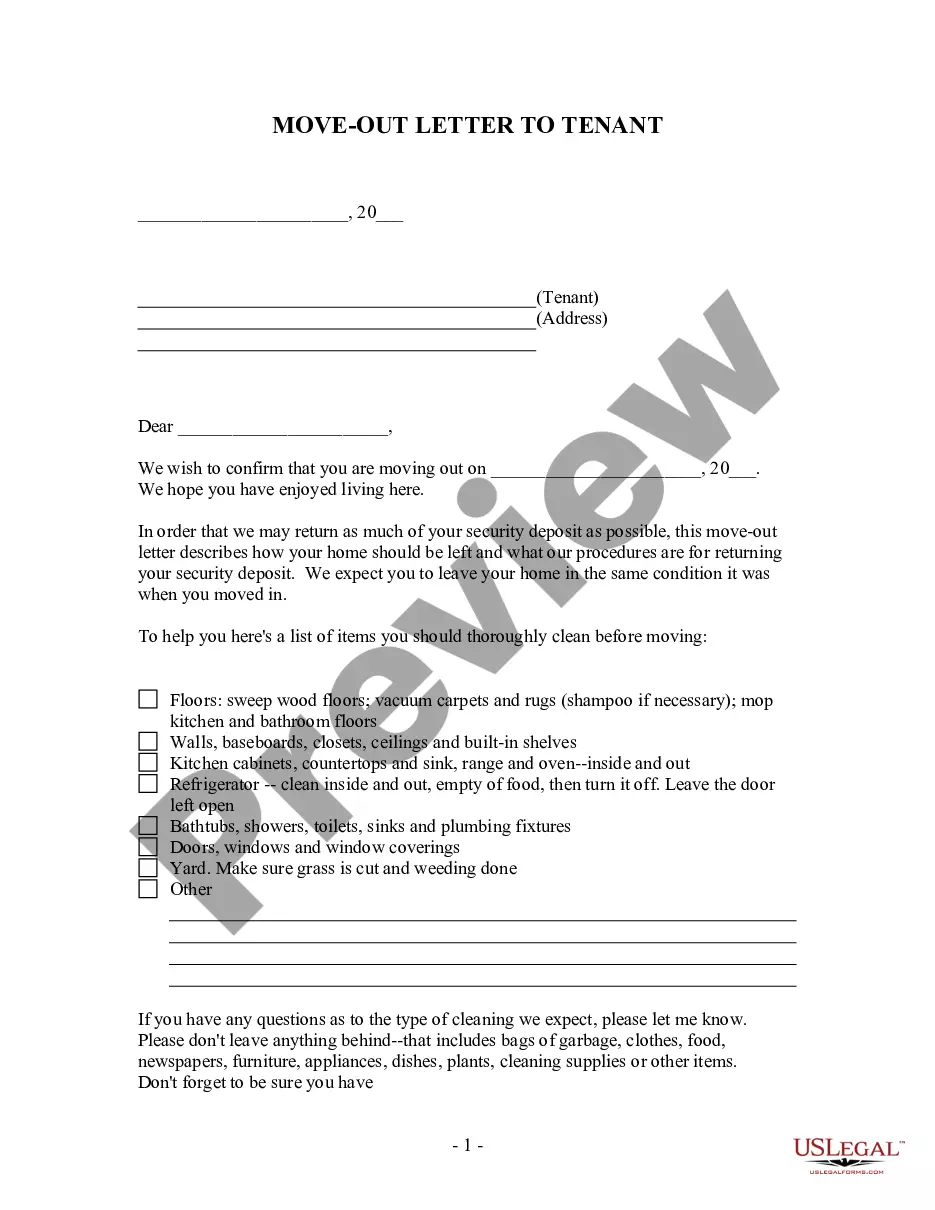

Have you been in a place in which you need papers for either company or person functions just about every day time? There are a lot of lawful papers templates accessible on the Internet, but getting versions you can trust is not easy. US Legal Forms provides a large number of form templates, such as the Rhode Island Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company, which can be created in order to meet state and federal needs.

If you are previously informed about US Legal Forms site and possess a free account, simply log in. After that, you may acquire the Rhode Island Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company format.

Should you not come with an bank account and would like to begin to use US Legal Forms, follow these steps:

- Obtain the form you will need and make sure it is to the correct town/region.

- Make use of the Preview key to analyze the shape.

- Browse the information to actually have selected the right form.

- In case the form is not what you`re trying to find, make use of the Research discipline to obtain the form that suits you and needs.

- If you obtain the correct form, click on Get now.

- Choose the pricing prepare you want, submit the specified information to generate your bank account, and buy an order using your PayPal or credit card.

- Decide on a handy data file structure and acquire your version.

Get each of the papers templates you may have bought in the My Forms menus. You can get a additional version of Rhode Island Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company anytime, if possible. Just click the needed form to acquire or printing the papers format.

Use US Legal Forms, one of the most extensive variety of lawful varieties, in order to save some time and avoid mistakes. The services provides professionally made lawful papers templates that you can use for a range of functions. Create a free account on US Legal Forms and initiate generating your daily life a little easier.

Form popularity

FAQ

No. To be confirmed as a successor in interest does not mean you are automatically liable on another person's mortgage loan obligation. Am I Liable for the Loan Once Confirmed as a Successor in Interest? tellusapp.com ? mortgage ? loan-servicing tellusapp.com ? mortgage ? loan-servicing

Once a successor in interest effectively returns and confirms the acknowledgement form, then they legally assume a third person's mortgage loan obligation. Servicing companies must clearly explain that a confirmed successor in interest is not liable for the mortgage debt as long as they do not assume the loan.

The successor borrower is a special purpose entity (SPE) that assumes ownership of the defeasance collateral, and holds legal claim to any residual value that accrues from this collateral (capable of reaching six figures). Defeasance best practices for borrowers, brokers, counsel chathamfinancial.com ? insights ? defeasanc... chathamfinancial.com ? insights ? defeasanc...

A Successor in Interest usually occurs when an heir is bequeathed property that is subject to a mortgage. Circumstances that may lead to you becoming a Successor in Interest include: Death of a relative or owner of the property. Transfer of property from a spouse or parent.

The party that comes later in time than another, as the holder of an estate or interest in property. Successor in title - Oxford Reference oxfordreference.com ? view ? acref ? acref-... oxfordreference.com ? view ? acref ? acref-...

Home Equity Line of Credit (HELOC) It allows the borrower to take out money against the credit line up to a preset limit, make payments, and then take out money again.

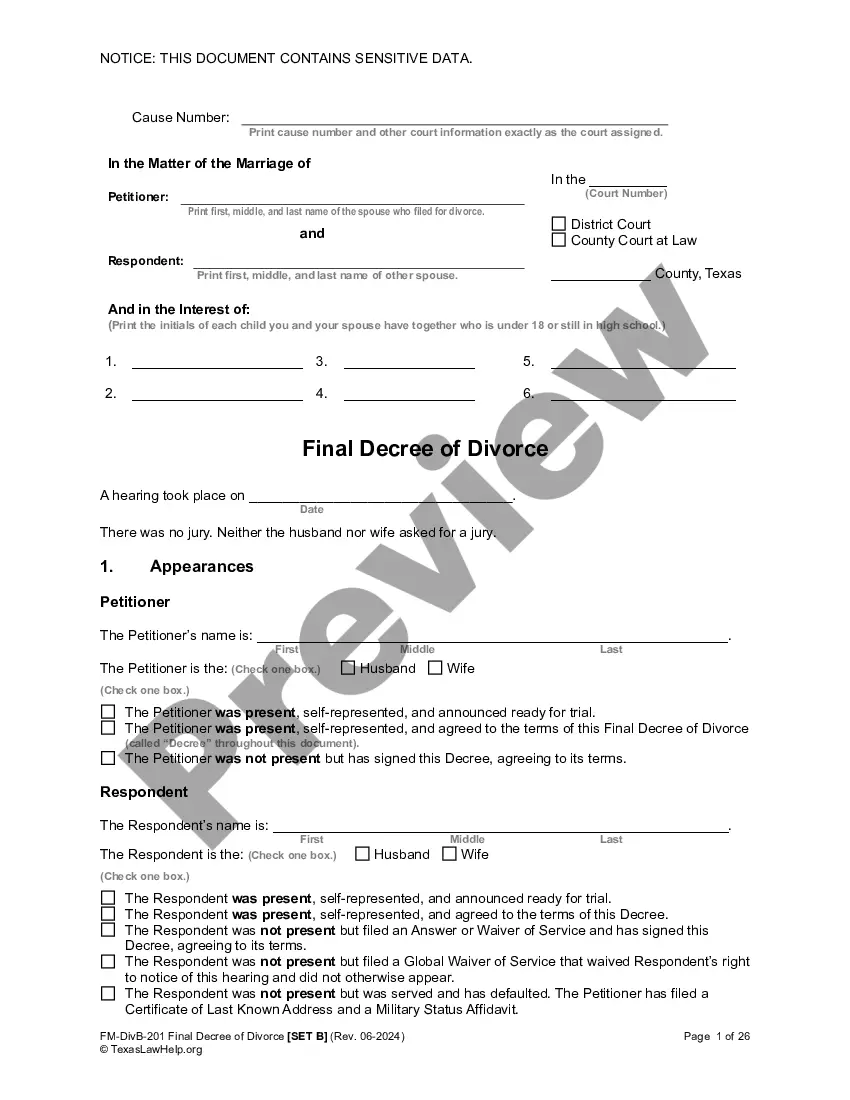

The ?Pooling and Servicing Agreement? is the legal document that contains the responsibilities and rights of the servicer, the trustee, and others over a pool of mortgage loans.

Confirmed successor in interest means a successor in interest once a servicer has confirmed the successor in interest's identity and ownership interest in a property that secures a mortgage loan subject to this subpart. § 1024.31 Definitions. | Consumer Financial Protection Bureau Consumer Financial Protection Bureau (.gov) ? regulations Consumer Financial Protection Bureau (.gov) ? regulations