Rhode Island Borrower Security Agreement is a legal document that outlines the terms and conditions of securing credit facilities extended to borrowers in Rhode Island. It establishes the rights and responsibilities of both the borrower and the lender, ensuring the lender's protection in case of default or non-payment. In this agreement, the borrower pledges certain assets or collateral as security for the credit facility. The agreement includes detailed information about the borrower, such as their name, address, and contact details. It also outlines the lender's details, including their name, address, and contact information. The agreement specifies the amount of credit facility being extended to the borrower and the terms of repayment, including interest rates and any applicable fees. One of the key components of the Rhode Island Borrower Security Agreement is the identification and description of the collateral being pledged as security for the credit facility. This may include real estate, equipment, inventory, accounts receivable, or any other tangible or intangible asset that holds value. The agreement defines the rights of the lender to seize and sell the collateral in the event of default. Moreover, the agreement includes provisions regarding the maintenance and insurance of the collateral during the term of the credit facility. It may require the borrower to keep the collateral in good condition and adequately insured to protect the lender's interest. Additionally, the Rhode Island Borrower Security Agreement outlines the events that would constitute a default, such as failure to make payments, breach of other loan covenants, or any other violation of the agreement's terms. In such cases, the lender may have the right to accelerate the debt, demand immediate repayment, or exercise their rights over the pledged collateral. It is important to note that there can be different types of Rhode Island Borrower Security Agreement regarding the extension of credit facilities. Some variations may include agreements specific to mortgages, automotive loans, business loans, or personal loans. Each agreement may have its own distinct provisions tailored to the nature of the credit facility. In conclusion, the Rhode Island Borrower Security Agreement is a crucial legal document that protects the interests of both lenders and borrowers in credit transactions. It defines the terms of the credit facility, the collateral pledged, and the consequences of default. Whether it is a mortgage, business loan, or personal loan, the agreement ensures that both parties understand their rights and obligations, providing a framework for a secure credit transaction.

Rhode Island Borrower Security Agreement regarding the extension of credit facilities

Description

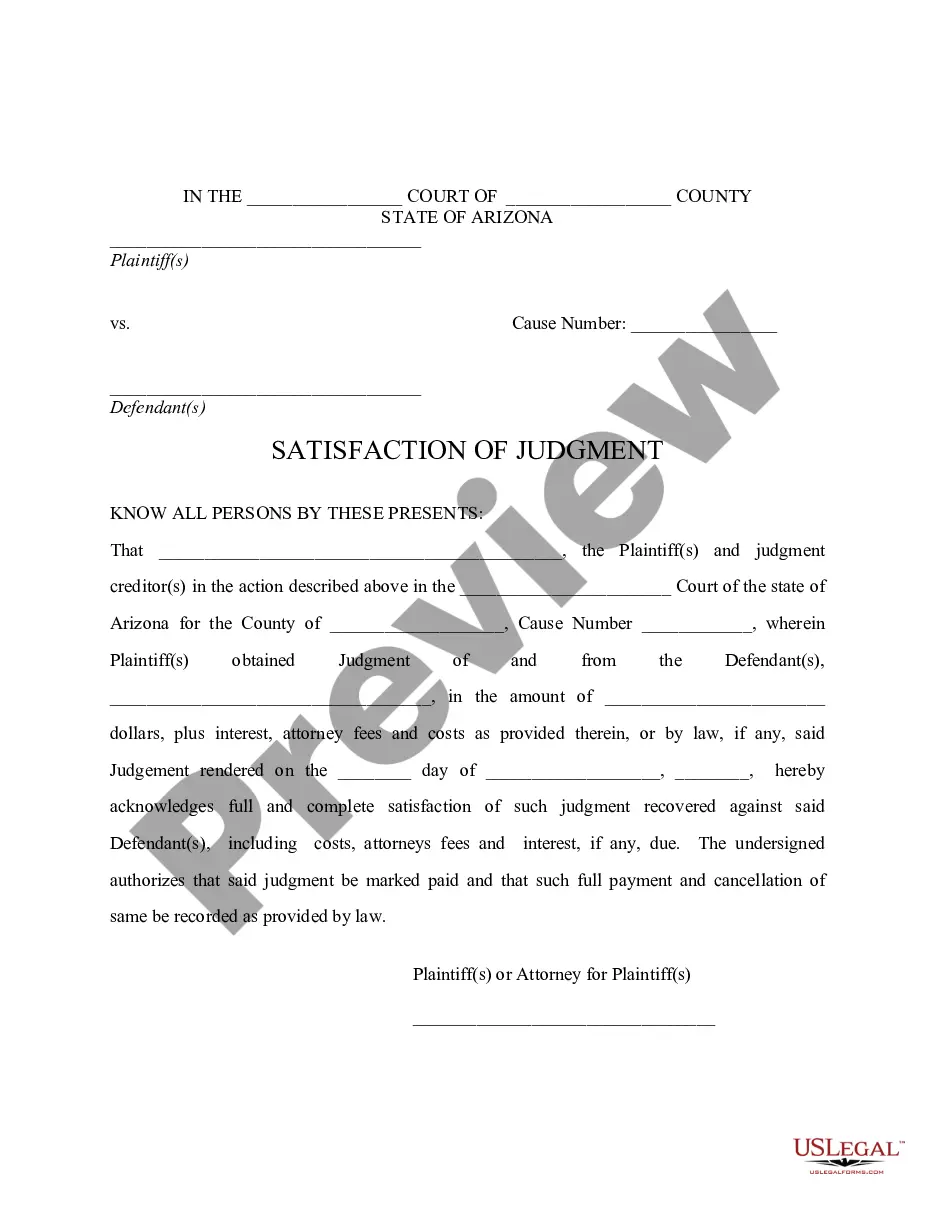

How to fill out Rhode Island Borrower Security Agreement Regarding The Extension Of Credit Facilities?

US Legal Forms - among the greatest libraries of lawful types in the USA - gives a wide range of lawful file themes it is possible to acquire or produce. Making use of the web site, you can get a large number of types for organization and person uses, sorted by categories, says, or search phrases.You will find the most recent variations of types like the Rhode Island Borrower Security Agreement regarding the extension of credit facilities within minutes.

If you currently have a monthly subscription, log in and acquire Rhode Island Borrower Security Agreement regarding the extension of credit facilities from the US Legal Forms catalogue. The Download key can look on each develop you look at. You have accessibility to all previously downloaded types in the My Forms tab of your bank account.

If you would like use US Legal Forms initially, listed below are straightforward directions to get you began:

- Ensure you have picked out the best develop for your personal city/state. Click on the Review key to analyze the form`s information. Browse the develop description to ensure that you have selected the correct develop.

- If the develop doesn`t match your specifications, use the Search discipline at the top of the monitor to get the the one that does.

- In case you are pleased with the form, verify your selection by simply clicking the Acquire now key. Then, opt for the rates program you like and supply your accreditations to register on an bank account.

- Procedure the deal. Use your bank card or PayPal bank account to complete the deal.

- Find the format and acquire the form on the system.

- Make changes. Complete, modify and produce and signal the downloaded Rhode Island Borrower Security Agreement regarding the extension of credit facilities.

Every single web template you added to your money lacks an expiration time and it is your own eternally. So, if you want to acquire or produce yet another duplicate, just go to the My Forms area and click on in the develop you require.

Obtain access to the Rhode Island Borrower Security Agreement regarding the extension of credit facilities with US Legal Forms, by far the most considerable catalogue of lawful file themes. Use a large number of specialist and express-specific themes that meet up with your organization or person needs and specifications.

Form popularity

FAQ

Ing to the Consumer Financial Protection Bureau (CFPB), a creditor is ?any person who offers or extends credit creating a debt or to whom a debt is owed.? A financial institution, individual or nonprofit could all be examples of creditors, so long as they lend money to another party.

A loan extension agreement is a mutual agreement between a lender and borrower that extends the maturity date on a borrower's loan. Most commonly used when a borrower falls behind on payments, a loan extension agreement can restructure the loan payment schedule to get the borrower back on track.

A creditor is an entity that extends credit, such as a bank or an individual, while a debtor is the entity that borrows money. There are two types of creditors: personal and real creditors, and two types of loans: secured and unsecured.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

Extension of Credit means the right to defer payment of debt or to incur debt and defer its payment offered or granted primarily for personal, family, or household purposes.

In most cases, a creditor is a financial institution that gives money to customers in the form of loans and credit cards with the expectation that the borrower will pay back the amount. A creditor could also be an individual who lends money to a friend or family member.

What to include in your loan agreement? The amount of the loan, also known as the principal amount. The date of the creation of the loan agreement. The name, address, and contact information of the borrower. The name, address, and contact information of the lender.

A creditor is an individual or institution that extends credit to another party to borrow money usually by a loan agreement or contract.