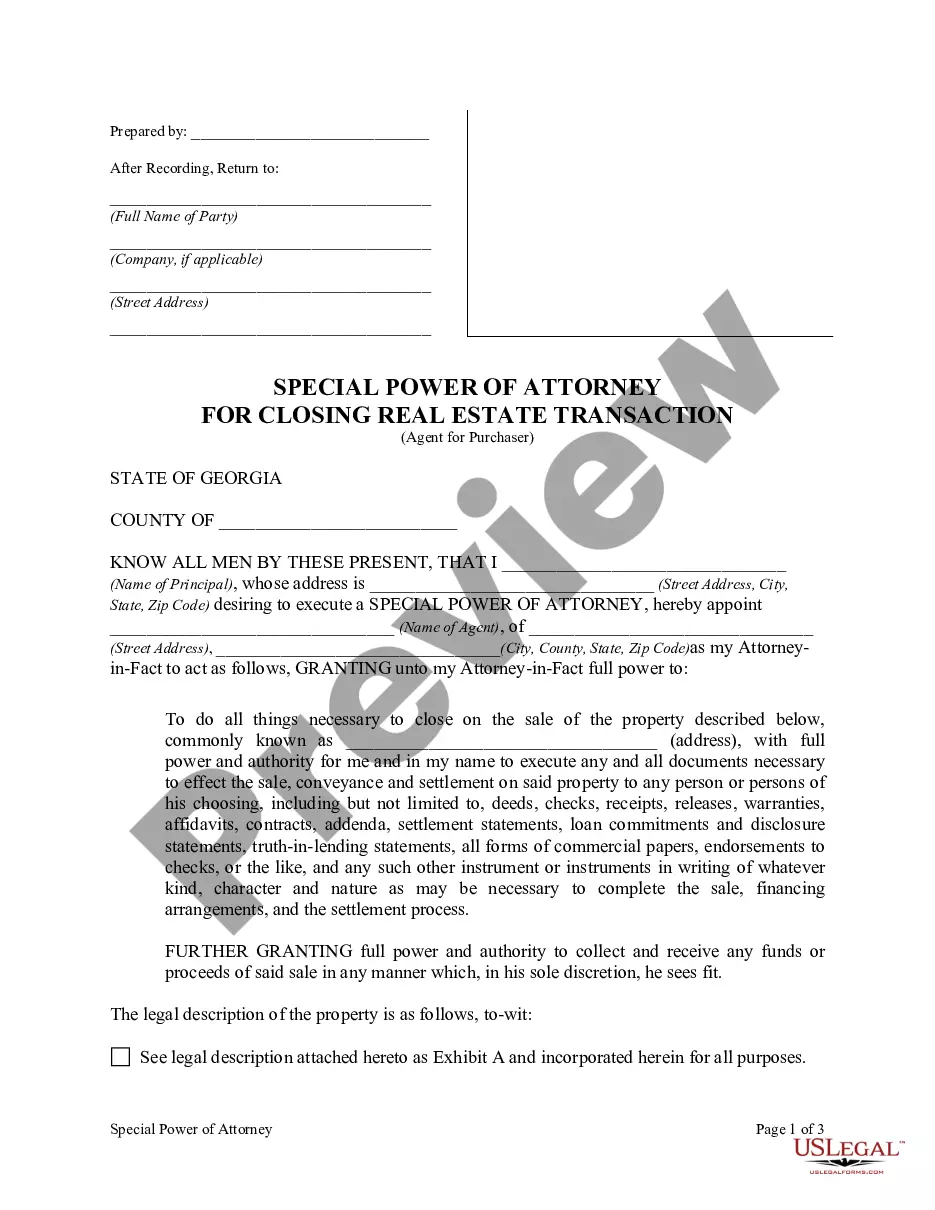

Rhode Island Escrow Agreement is a legally binding contract that outlines the terms and conditions for the establishment and management of an escrow account between Cowling Ban corporation, Cowling Bank, and Northern Bank of Commerce. This agreement ensures the safekeeping and proper distribution of funds or assets held in escrow until certain obligations or conditions are met. Under the Rhode Island Escrow Agreement, Cowling Ban corporation acts as the depositor, Cowling Bank serves as the escrow agent, and Northern Bank of Commerce is designated as the beneficiary or interested party. The agreement sets forth the roles, responsibilities, and rights of each party involved, thereby providing a clear framework for escrow management. The escrow agreement typically includes clauses regarding the specific purpose of the escrow, such as real estate transactions, mergers and acquisitions, or loan agreements. It also outlines the duration of the escrow, specifying start and end dates, as well as any termination conditions. Moreover, the Rhode Island escrow agreement details the conditions and requirements for the release or disbursement of funds or assets from the escrow account. These conditions may consist of the completion of certain milestones, the receipt of necessary approvals, or the fulfillment of contractual obligations. In the case of Cowling Ban corporation, Cowling Bank, and Northern Bank of Commerce, there may be variations or different types of Rhode Island Escrow Agreements tailored to specific transactions or business arrangements. Some potential variations may include: 1. Real Estate Escrow Agreement: This type of agreement is utilized when Cowling Ban corporation, Cowling Bank, and Northern Bank of Commerce are involved in a real estate transaction, such as the purchase or sale of property. The agreement would outline the specific conditions under which funds or assets held in escrow would be released. 2. Acquisition Escrow Agreement: In the event of a merger or acquisition involving Cowling Ban corporation, Cowling Bank, and Northern Bank of Commerce, an acquisition escrow agreement may be established. This agreement would govern the handling of funds or assets during the transaction, ensuring proper distribution upon meeting specific conditions. 3. Loan Escrow Agreement: If Cowling Ban corporation, Cowling Bank, and Northern Bank of Commerce are entering into a loan agreement, a loan escrow agreement may be created. This agreement would detail the terms for the escrow arrangement, including the disbursement of funds upon the borrower fulfilling certain requirements, such as providing collateral or meeting predetermined milestones. It is essential that all Rhode Island Escrow Agreements between Cowling Ban corporation, Cowling Bank, and Northern Bank of Commerce be customized to suit the specific circumstances and objectives of the parties involved. These agreements provide a legally enforceable framework, ensuring transparency, security, and effective management of escrow funds or assets.

Rhode Island Escrow Agreement between Cowlitz Bancorporation, Cowlitz Bank and Northern Bank of Commerce

Description

How to fill out Rhode Island Escrow Agreement Between Cowlitz Bancorporation, Cowlitz Bank And Northern Bank Of Commerce?

US Legal Forms - one of many most significant libraries of legitimate forms in America - gives a wide array of legitimate record web templates you are able to down load or print out. Making use of the website, you can get a large number of forms for business and specific functions, sorted by types, states, or search phrases.You can get the newest versions of forms like the Rhode Island Escrow Agreement between Cowlitz Bancorporation, Cowlitz Bank and Northern Bank of Commerce in seconds.

If you already have a subscription, log in and down load Rhode Island Escrow Agreement between Cowlitz Bancorporation, Cowlitz Bank and Northern Bank of Commerce through the US Legal Forms catalogue. The Obtain key can look on each and every kind you view. You have access to all formerly saved forms from the My Forms tab of your respective profile.

In order to use US Legal Forms for the first time, listed here are basic recommendations to help you get started out:

- Be sure to have picked the correct kind for the metropolis/county. Select the Preview key to check the form`s information. Browse the kind description to ensure that you have chosen the proper kind.

- If the kind doesn`t satisfy your requirements, utilize the Lookup area towards the top of the display to discover the the one that does.

- In case you are pleased with the form, affirm your selection by clicking on the Buy now key. Then, pick the rates prepare you want and offer your credentials to register for an profile.

- Approach the purchase. Make use of credit card or PayPal profile to finish the purchase.

- Pick the file format and down load the form in your system.

- Make changes. Fill up, modify and print out and indication the saved Rhode Island Escrow Agreement between Cowlitz Bancorporation, Cowlitz Bank and Northern Bank of Commerce.

Each and every web template you put into your bank account does not have an expiry date and is also the one you have permanently. So, if you want to down load or print out an additional copy, just check out the My Forms portion and click on on the kind you need.

Obtain access to the Rhode Island Escrow Agreement between Cowlitz Bancorporation, Cowlitz Bank and Northern Bank of Commerce with US Legal Forms, by far the most substantial catalogue of legitimate record web templates. Use a large number of specialist and state-certain web templates that fulfill your business or specific requirements and requirements.