Rhode Island Participation Agreement between Variable Insurance Products Fund, III, Lincoln Life and Annuity Company of New York

Description

How to fill out Participation Agreement Between Variable Insurance Products Fund, III, Lincoln Life And Annuity Company Of New York?

US Legal Forms - one of the most significant libraries of legal varieties in the USA - delivers an array of legal record themes you are able to download or produce. Making use of the website, you may get a huge number of varieties for enterprise and individual purposes, sorted by classes, states, or search phrases.You will discover the most up-to-date versions of varieties just like the Rhode Island Participation Agreement between Variable Insurance Products Fund, III, Lincoln Life and Annuity Company of New York in seconds.

If you already have a monthly subscription, log in and download Rhode Island Participation Agreement between Variable Insurance Products Fund, III, Lincoln Life and Annuity Company of New York through the US Legal Forms local library. The Acquire option will appear on each and every develop you view. You get access to all in the past saved varieties inside the My Forms tab of your account.

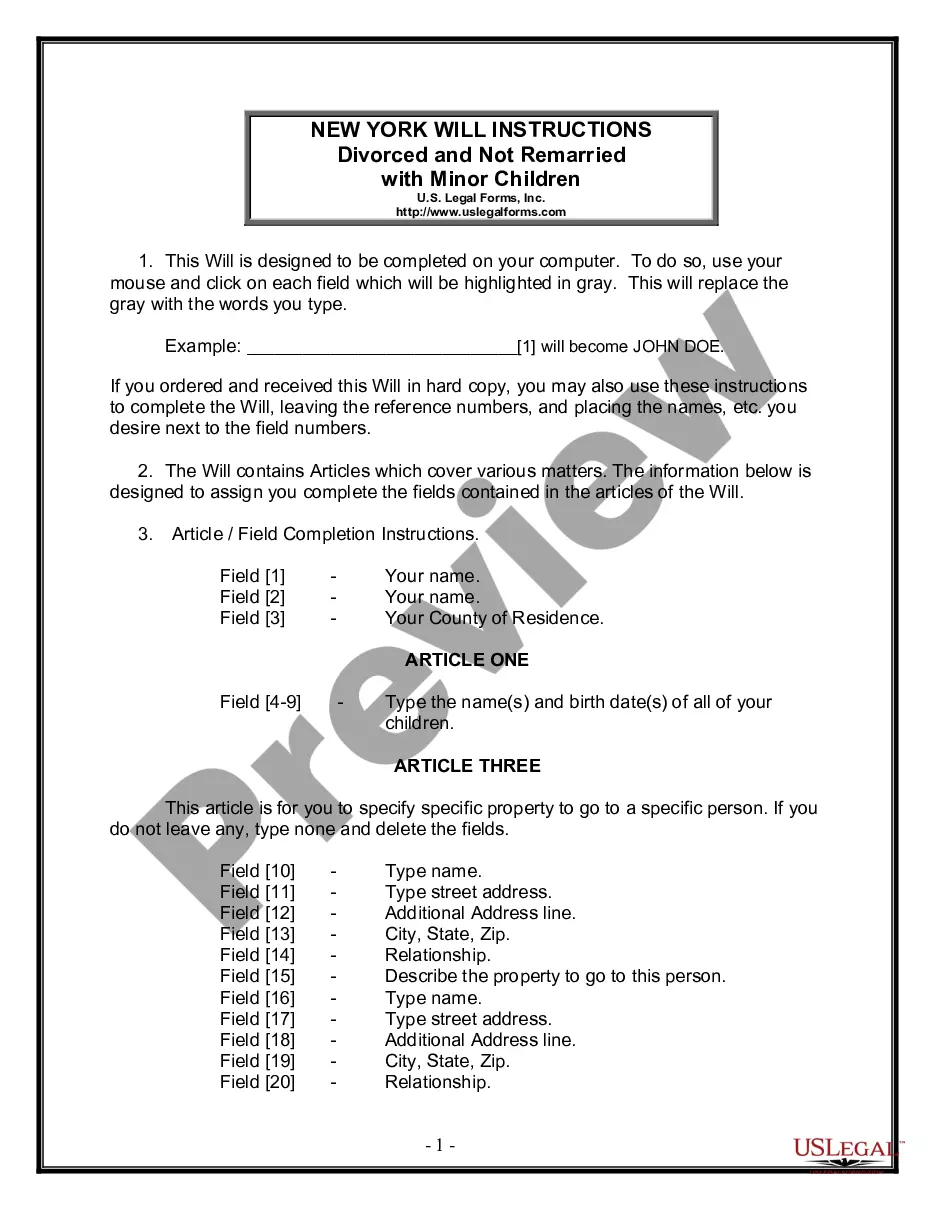

If you want to use US Legal Forms the very first time, listed below are simple instructions to get you started out:

- Ensure you have selected the correct develop to your area/county. Select the Preview option to analyze the form`s content. See the develop information to ensure that you have selected the correct develop.

- When the develop does not satisfy your specifications, make use of the Look for field on top of the display to obtain the one who does.

- In case you are satisfied with the shape, affirm your selection by visiting the Buy now option. Then, pick the rates prepare you favor and offer your qualifications to register to have an account.

- Approach the purchase. Use your bank card or PayPal account to complete the purchase.

- Find the file format and download the shape on your device.

- Make alterations. Complete, revise and produce and indication the saved Rhode Island Participation Agreement between Variable Insurance Products Fund, III, Lincoln Life and Annuity Company of New York.

Every single format you added to your account does not have an expiry time and it is yours forever. So, if you wish to download or produce yet another backup, just check out the My Forms section and click around the develop you require.

Gain access to the Rhode Island Participation Agreement between Variable Insurance Products Fund, III, Lincoln Life and Annuity Company of New York with US Legal Forms, by far the most comprehensive local library of legal record themes. Use a huge number of specialist and express-particular themes that meet your organization or individual requirements and specifications.

Form popularity

FAQ

The separate account is a component of the variable annuity that allows the policyholder to invest their premiums in investment portfolios, which are held separately from the general assets of the insurance company. The investment portfolios are professionally managed and made up of various securities.

There are three main ways to get cash out of your policy. You can borrow against your cash account typically with a low-interest life insurance loan, withdraw the cash (either as a lump sum or in regular payments), or you can surrender your policy.

Lincoln Level Advantage® is a long-term investment product that offers tax-deferred growth, access to a lifetime income stream and death benefit protection.

With the performance trigger strategy, your account is credited a set amount, called a trigger rate, if the index change is positive or flat at the end of the term. If the index return is negative, you can help protect it with a protection level or floor protection.

Variable life insurance is a permanent life insurance policy with an investment component. The policy has a cash-value account with money that is invested, typically in mutual funds. As a permanent life insurance policy, variable life insurance pays a death benefit to your beneficiaries when you die.

A ?separate account? is a separate set of financial statements held by a life insurance company, maintained to report assets and liabilities for specific products that are separated from the insurer's general account.

Variable life insurance is a permanent life insurance product with separate accounts comprised of various instruments and investment funds, such as stocks, bonds, equity funds, money market funds, and bond funds.

Variable life insurance is a permanent life insurance policy combined with a cash-value account invested in bonds or stocks. In contrast, term life insurance lasts for a specific number of years, a variable life insurance policy lasts until the policyholder's death.