Rhode Island Accredited Investor Representation Letter is a legal document that provides evidence to financial institutions or investment firms that an individual or entity meets the criteria to be considered an accredited investor in the state of Rhode Island. This letter is crucial for investors looking to participate in certain investment opportunities that are available exclusively to accredited investors. To qualify as an accredited investor in Rhode Island, individuals or entities must meet certain criteria set by the Securities and Exchange Commission (SEC), which include having a high net worth, having a certain level of annual income, or being an entity with assets exceeding a specific threshold. The Rhode Island Accredited Investor Representation Letter typically includes detailed information about the investor's financial position, such as their net worth, income, or assets, along with supporting documents such as bank statements, tax returns, or balance sheets. This documentation is necessary to verify the investor's eligibility to take part in private placement offerings, hedge funds, venture capital investments, or other opportunities restricted to accredited investors. There are different types of Rhode Island Accredited Investor Representation Letters based on the different categories of accredited investors. These may include: 1. Individual Accredited Investor Letters: This type of letter is intended for individual investors who meet the SEC's criteria, such as having a net worth of over $1 million (excluding the value of their primary residence) or having an annual income of at least $200,000 (or $300,000 jointly with a spouse) for the past two years with an expectation to continue at the same level. 2. Entity Accredited Investor Letters: Entities such as corporations, limited liability companies (LCS), partnerships, or trusts can also be accredited investors. The representation letter for these entities would include relevant financial statements, disclosing their assets and liabilities, income, and ownership structure, to demonstrate their eligibility. 3. Private Fund Accredited Investor Letters: This category refers to investors who participate in private funds, including hedge funds, private equity funds, or venture capital funds. The representation letter for private fund investors could include additional information, such as past investment experience, risk tolerance, and specific investment objectives. In conclusion, the Rhode Island Accredited Investor Representation Letter is a crucial document that verifies an individual or entity's eligibility to participate in exclusive investment opportunities. By providing comprehensive financial information, investors can effectively demonstrate their accredited status and gain access to diverse investment options.

Rhode Island Accredited Investor Representation Letter

Description

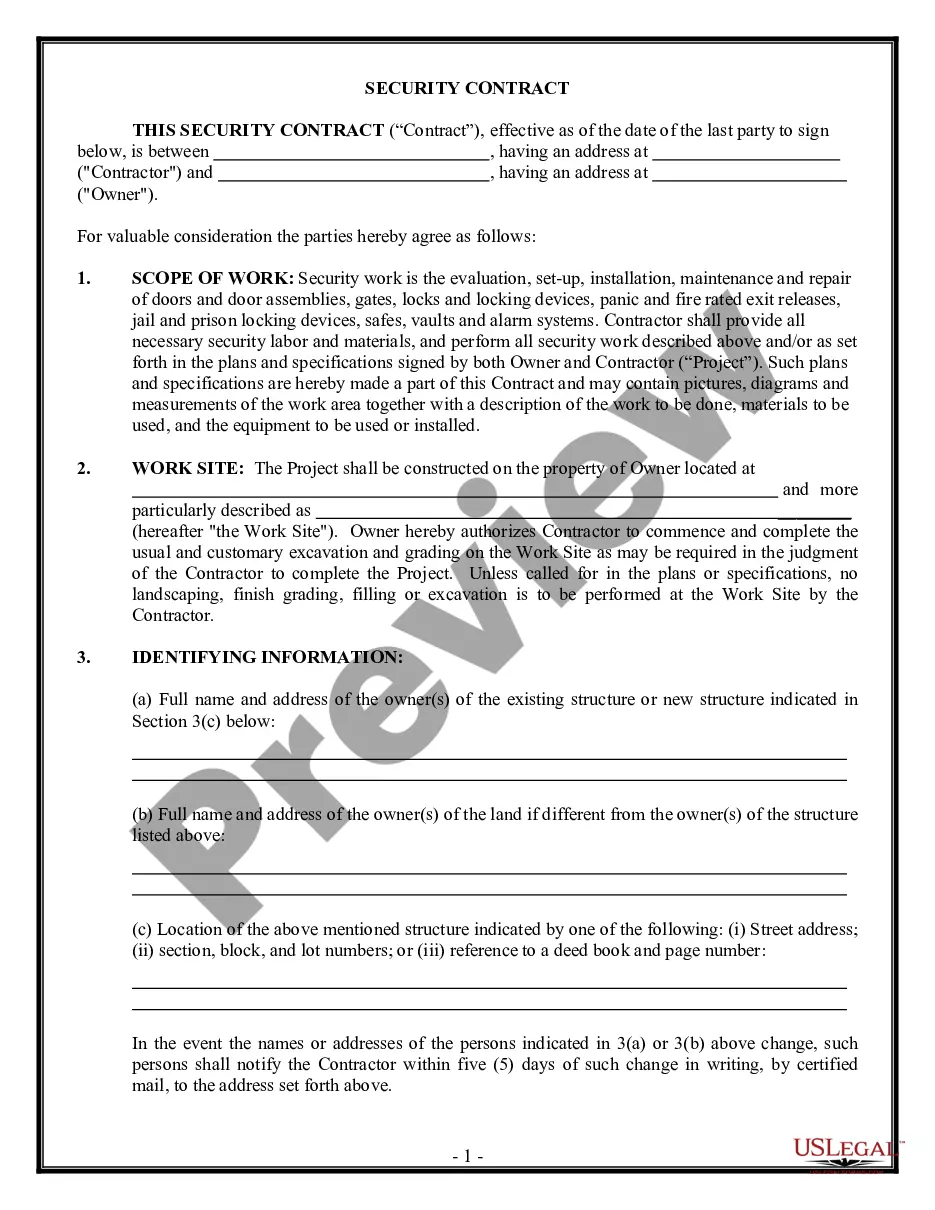

How to fill out Rhode Island Accredited Investor Representation Letter?

You are able to devote several hours online trying to find the legal record design that fits the federal and state demands you need. US Legal Forms supplies a large number of legal types which are examined by professionals. You can easily acquire or print the Rhode Island Accredited Investor Representation Letter from our services.

If you currently have a US Legal Forms account, you may log in and click the Download switch. Following that, you may full, revise, print, or sign the Rhode Island Accredited Investor Representation Letter. Every legal record design you purchase is the one you have permanently. To have yet another copy associated with a purchased form, visit the My Forms tab and click the corresponding switch.

If you work with the US Legal Forms website initially, stick to the simple directions listed below:

- Very first, ensure that you have chosen the best record design to the area/metropolis that you pick. See the form outline to make sure you have picked out the correct form. If readily available, make use of the Review switch to check throughout the record design as well.

- If you wish to locate yet another version in the form, make use of the Look for discipline to discover the design that meets your requirements and demands.

- When you have identified the design you would like, simply click Get now to move forward.

- Choose the costs program you would like, type in your credentials, and sign up for your account on US Legal Forms.

- Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal form.

- Choose the formatting in the record and acquire it to your device.

- Make adjustments to your record if required. You are able to full, revise and sign and print Rhode Island Accredited Investor Representation Letter.

Download and print a large number of record layouts utilizing the US Legal Forms site, which provides the most important selection of legal types. Use specialist and condition-particular layouts to deal with your small business or person requires.