Rhode Island Qualified Investor Certification Application

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status, take Investor statements regarding information, and waiver of claims."

How to fill out Qualified Investor Certification Application?

Are you presently inside a placement where you will need papers for either enterprise or person purposes nearly every day? There are a variety of lawful papers templates available on the net, but discovering kinds you can depend on isn`t easy. US Legal Forms gives thousands of form templates, much like the Rhode Island Qualified Investor Certification Application, which are composed in order to meet federal and state specifications.

When you are previously familiar with US Legal Forms website and have an account, simply log in. Afterward, it is possible to down load the Rhode Island Qualified Investor Certification Application design.

If you do not offer an account and wish to begin to use US Legal Forms, adopt these measures:

- Get the form you want and ensure it is to the correct city/county.

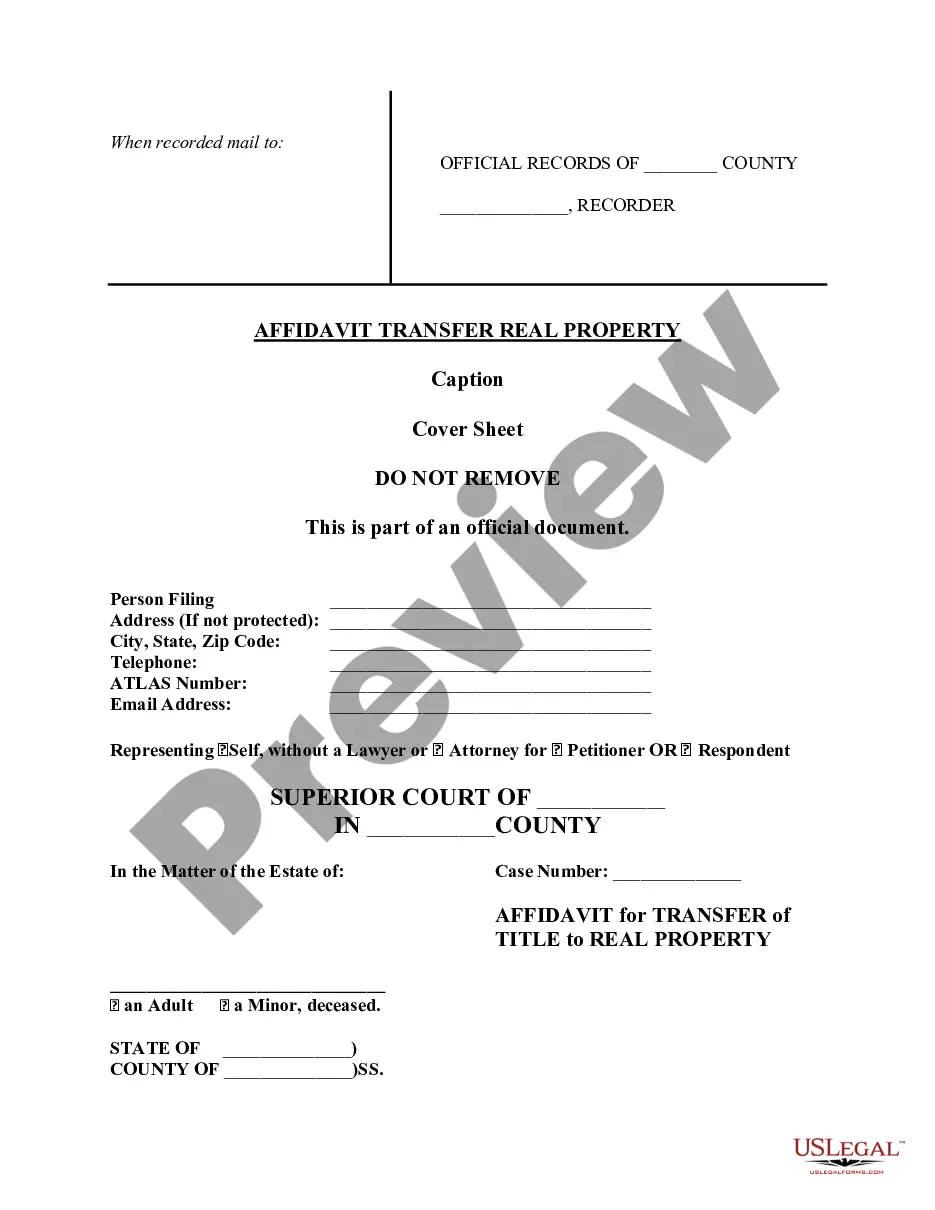

- Make use of the Review button to review the form.

- Look at the explanation to ensure that you have selected the right form.

- In case the form isn`t what you`re searching for, make use of the Lookup industry to find the form that suits you and specifications.

- Whenever you obtain the correct form, just click Get now.

- Choose the rates prepare you desire, complete the desired information and facts to generate your bank account, and buy the order using your PayPal or charge card.

- Select a convenient file structure and down load your duplicate.

Discover each of the papers templates you possess bought in the My Forms menus. You can get a extra duplicate of Rhode Island Qualified Investor Certification Application any time, if required. Just go through the necessary form to down load or print out the papers design.

Use US Legal Forms, probably the most extensive assortment of lawful forms, to save lots of time as well as stay away from mistakes. The assistance gives professionally manufactured lawful papers templates which can be used for a range of purposes. Make an account on US Legal Forms and begin generating your lifestyle a little easier.

Form popularity

FAQ

If you are not a U.S. citizen, you are considered a nonresident of the United States for U.S. tax purposes unless you meet one of two tests. You are a resident of the United States for tax purposes if you meet either the green card test or the substantial presence test for the calendar year (January 1 ? December 31). Determining an Individual's Tax Residency Status - IRS irs.gov ? individuals ? international-taxpayers irs.gov ? individuals ? international-taxpayers

Withholding Tax on Gambling Winnings: If a must withhold for federal purposes, RI must withhold federal tax withheld multiplied by the Rhode Island personal income tax withholding rate in effect on the date of the payment.

A Resident is an individual that is domiciled in Rhode Island or an individual that maintains a place of abode in Rhodes Island spending at least 183 days in the state.

12 months Rhode Island Residency for Tuition Purposes In general, you or your parents must show proof you have lived in the state for 12 months prior to the first day of college. ??? How to Become an RI Resident Correira Brothers Moving ? blog ? how-to-become-rhod... Correira Brothers Moving ? blog ? how-to-become-rhod...

Most states will consider you a resident for tax purposes if you spend 183 days or more in that state. Tax Residency Rules by State - Investopedia Investopedia ? tax-residency-rules-b... Investopedia ? tax-residency-rules-b...

Qualified Jobs Incentive Tax Credit Expand your workforce in Rhode Island or relocate jobs from out of state, and you can receive annual, redeemable tax credits for up to 10 years with the Qualified Jobs Incentive program. Credits can equal up to $7,500 per job per year, depending on the wage level and other criteria.

Part-year resident: A part-year resident is a person who changed legal residence by moving into or out of Rhode Island at any time during the year. Part-year residents will file Form RI-1040NR. Rhode Island State Tax Information - Support taxslayerpro.com ? en-us ? articles ? 3600... taxslayerpro.com ? en-us ? articles ? 3600...

If you are a Rhode Island resident and you are required to file a federal return, you must also file a Rhode Island return. Even if you are not required to file a federal return, you may still have to file a Rhode Island return if your income exceeds the amount of your personal exemption.