Rhode Island Terms for Private Placement of Series Seed Preferred Stock: An Overview Private placement of Series Seed Preferred Stock is a common method used by startup companies to raise capital. These offerings enable companies to attract investment from private investors, providing them with preferential rights and potentially higher returns compared to common stockholders. In Rhode Island, there are certain terms and regulations governing such private placements, ensuring transparency and protection for both investors and issuers. Let's delve into the details of these terms and explore any potential variations that exist. 1. Rhode Island Private Placement of Series Seed Preferred Stock Definition: Rhode Island Securities Act governs the offering of securities, including private placements of Series Seed Preferred Stock. These offerings involve the issuance of preferred stock to a limited number of private investors, generally accredited and sophisticated individuals. 2. Regulatory Compliance: The offering must comply with the Rhode Island Securities Act, which mandates the registration or qualification of securities unless an exemption applies. Exemptions may include a limited number of purchasers, non-public offerings, and certain investment contracts. 3. Investor Accreditation: Many private placements require investors to be "accredited" under SEC guidelines, indicating they meet certain financial thresholds or possess sufficient knowledge and experience in financial and business matters. This requirement aims to protect investors from investing in high-risk opportunities without adequate financial means or knowledge. 4. Due Diligence: Before investing, both the issuer and investor undertake a due diligence process. The issuer discloses comprehensive information about the company's financials, business model, products, and the terms of the preferred stock. Conversely, investors scrutinize these details to assess the risks and evaluate potential returns. 5. Preferred Stock Terms: The Rhode Island Terms for Private Placement of Series Seed Preferred Stock include provisions specifying the rights and privileges of preferred stockholders. These may include preferences in dividend distributions, liquidation preferences, conversion rights into common stock, anti-dilution protection, participation rights, voting rights, and redemption rights. 6. Conversion Rights: Series Seed Preferred Stock may carry conversion rights, allowing investors to convert their preferred shares into common shares at a predetermined conversion price. This conversion typically occurs upon certain triggering events, such as an initial public offering or a sale of the company. 7. Liquidation Preferences: Series Seed Preferred Stockholders often possess liquidation preferences, ensuring they are paid a specific amount before holders of common stock in the event of a liquidation or acquisition. This provision protects the investors' interests and potentially guarantees a return on investment. Variations: It's important to note that specific variations may exist in Rhode Island regarding the Terms for Private Placement of Series Seed Preferred Stock. These variations may arise due to factors such as the company's industry, growth stage, investor preferences, or negotiations between the parties involved. Companies and investors should consult legal counsel to ensure compliance with Rhode Island regulations while tailoring the terms to meet their specific requirements. In conclusion, the Rhode Island Terms for Private Placement of Series Seed Preferred Stock provides a framework for startups and private investors to conduct investment transactions while complying with securities regulations. These terms establish investor protections, define the rights of preferred stockholders, and facilitate the growth of companies through capital infusion.

Rhode Island Terms for Private Placement of Series Seed Preferred Stock

Description

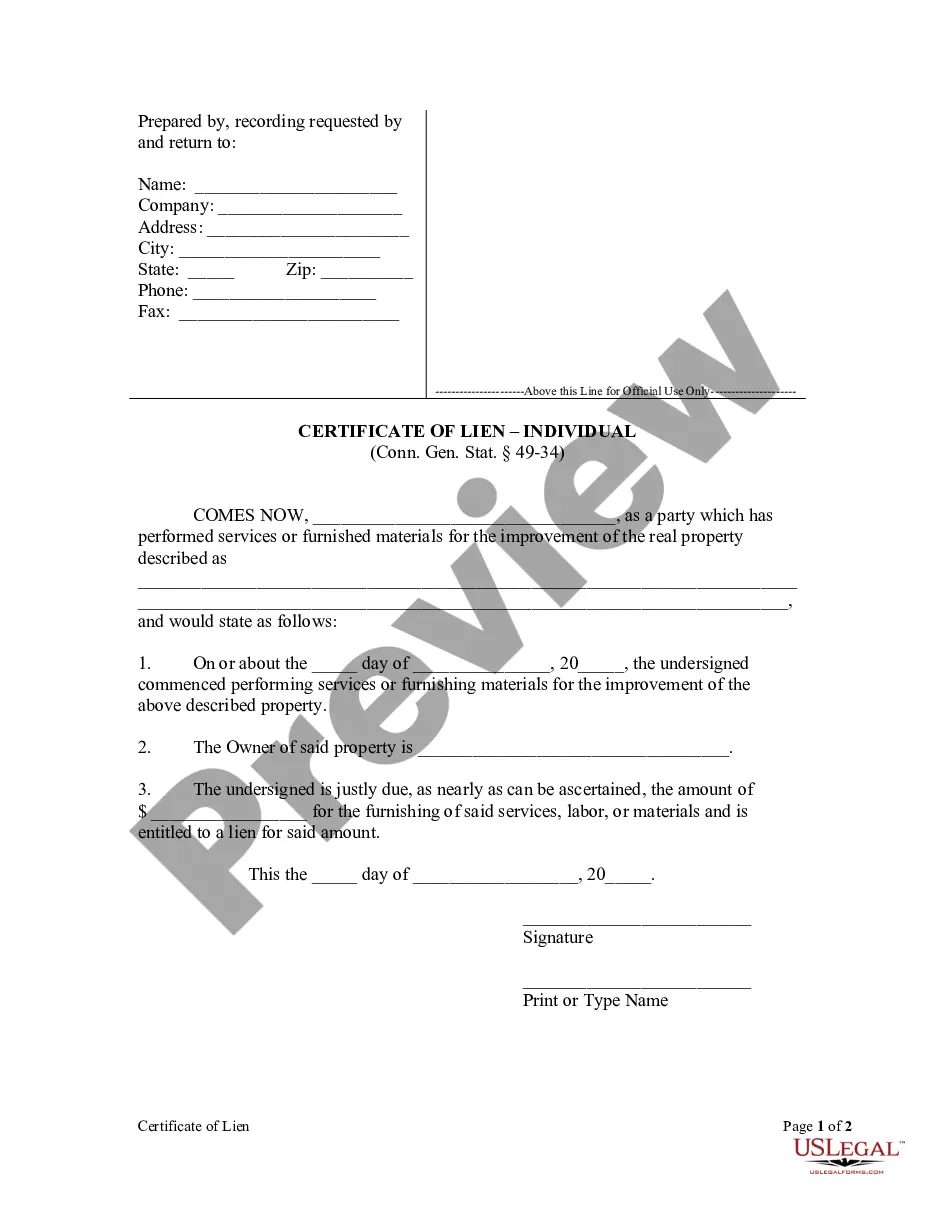

How to fill out Rhode Island Terms For Private Placement Of Series Seed Preferred Stock?

It is possible to invest hrs online looking for the lawful file design which fits the state and federal demands you will need. US Legal Forms offers a large number of lawful forms which are analyzed by professionals. It is possible to obtain or produce the Rhode Island Terms for Private Placement of Series Seed Preferred Stock from your support.

If you already possess a US Legal Forms accounts, it is possible to log in and click on the Obtain option. Next, it is possible to total, change, produce, or signal the Rhode Island Terms for Private Placement of Series Seed Preferred Stock. Every lawful file design you acquire is yours forever. To have another version associated with a acquired kind, check out the My Forms tab and click on the related option.

If you use the US Legal Forms website initially, keep to the easy guidelines beneath:

- Initial, make certain you have selected the best file design to the county/town that you pick. Browse the kind explanation to make sure you have picked out the proper kind. If offered, make use of the Preview option to look from the file design as well.

- If you want to find another variation from the kind, make use of the Look for industry to get the design that suits you and demands.

- Once you have found the design you want, just click Get now to continue.

- Choose the costs strategy you want, type in your references, and register for a merchant account on US Legal Forms.

- Complete the deal. You can use your charge card or PayPal accounts to pay for the lawful kind.

- Choose the structure from the file and obtain it to the product.

- Make changes to the file if possible. It is possible to total, change and signal and produce Rhode Island Terms for Private Placement of Series Seed Preferred Stock.

Obtain and produce a large number of file layouts making use of the US Legal Forms web site, that offers the largest selection of lawful forms. Use expert and condition-distinct layouts to deal with your business or personal requires.