Rhode Island A Summary of Your Rights Under the Fair Credit Reporting Act — Everything You Need to Know If you're a resident of Rhode Island and want to understand your rights under the Fair Credit Reporting Act (FCRA), you've come to the right place. In this article, we'll provide a detailed description of what Rhode Island A Summary of Your Rights Under the Fair Credit Reporting Act entails, along with key information related to your rights. What is Rhode Island A Summary of Your Rights Under the Fair Credit Reporting Act? Rhode Island A Summary of Your Rights Under the Fair Credit Reporting Act is a document that outlines the rights granted to consumers by the FCRA. This act was established to ensure fairness, accuracy, and privacy of information in the files of consumer reporting agencies (Crash). It empowers consumers to take control of their credit information and rectify any errors or discrepancies. Your Rights Under Rhode Island A Summary of Your Rights Under the Fair Credit Reporting Act: 1. Access to Your Credit Report: You have the right to obtain a free copy of your credit report from each of the three nationwide Crash every 12 months through AnnualCreditReport.com or by contacting them directly. Keywords: Rhode Island, rights, Fair Credit Reporting Act, access, credit report, free copy, nationwide Crash, AnnualCreditReport.com 2. Accuracy and Dispute Process: The FCRA ensures that the information on your credit report is accurate. If you identify any errors, you have the right to dispute them with both the CRA and the information provider. The CRA must investigate the disputed items within 30 days. Keywords: Accuracy, dispute process, errors, credit report, accurate information, dispute, information provider, investigate 3. Consent for Credit Checks: Before a prospective employer runs a background check or a creditor grants credit, they must have your written consent. This protection assures your privacy and control over who accesses your credit information. Keywords: Consent, credit checks, background check, creditor, written consent, privacy, control, credit information 4. Use of Credit Information: The FCRA regulates how consumer information is used. Potential employers or creditors can access your credit report only if they have a legitimate reason, such as evaluating a job application or issuing credit. They must also inform you if adverse action is taken based on the information received. Keywords: Use of credit information, FCRA, regulation, potential employers, creditors, legitimate reason, job application, adverse action 5. Identity Theft and Fraud: If you suspect identity theft or fraud, you can request an extended fraud alert or credit freeze on your credit file. This added protection prevents unauthorized individuals from accessing credit in your name. Keywords: Identity theft, fraud, extended fraud alert, credit freeze, credit file, protection, unauthorized access 6. Credit Monitoring and Reporting: You have the right to receive notices and updates if negative information is added to your credit report. Additionally, you may have access to credit monitoring services that can help you stay informed about changes to your credit profile. Keywords: Credit monitoring, reporting, notices, updates, negative information, credit report, credit profile, informed Different Types of Rhode Island A Summary of Your Rights Under the Fair Credit Reporting Act: There are no specific types of Rhode Island A Summary of Your Rights Under the Fair Credit Reporting Act. However, this summary pertains to all Rhode Island residents who are protected by the FCRA. In conclusion, Rhode Island A Summary of Your Rights Under the Fair Credit Reporting Act ensures that you have the necessary tools to understand, access, and dispute your credit information. By being aware of your rights, you can take control of your financial well-being and protect yourself from fraudulent activities. Stay informed and exercise your rights under the FCRA to secure a healthy credit profile.

Rhode Island A Summary of Your Rights Under the Fair Credit Reporting Act

Description

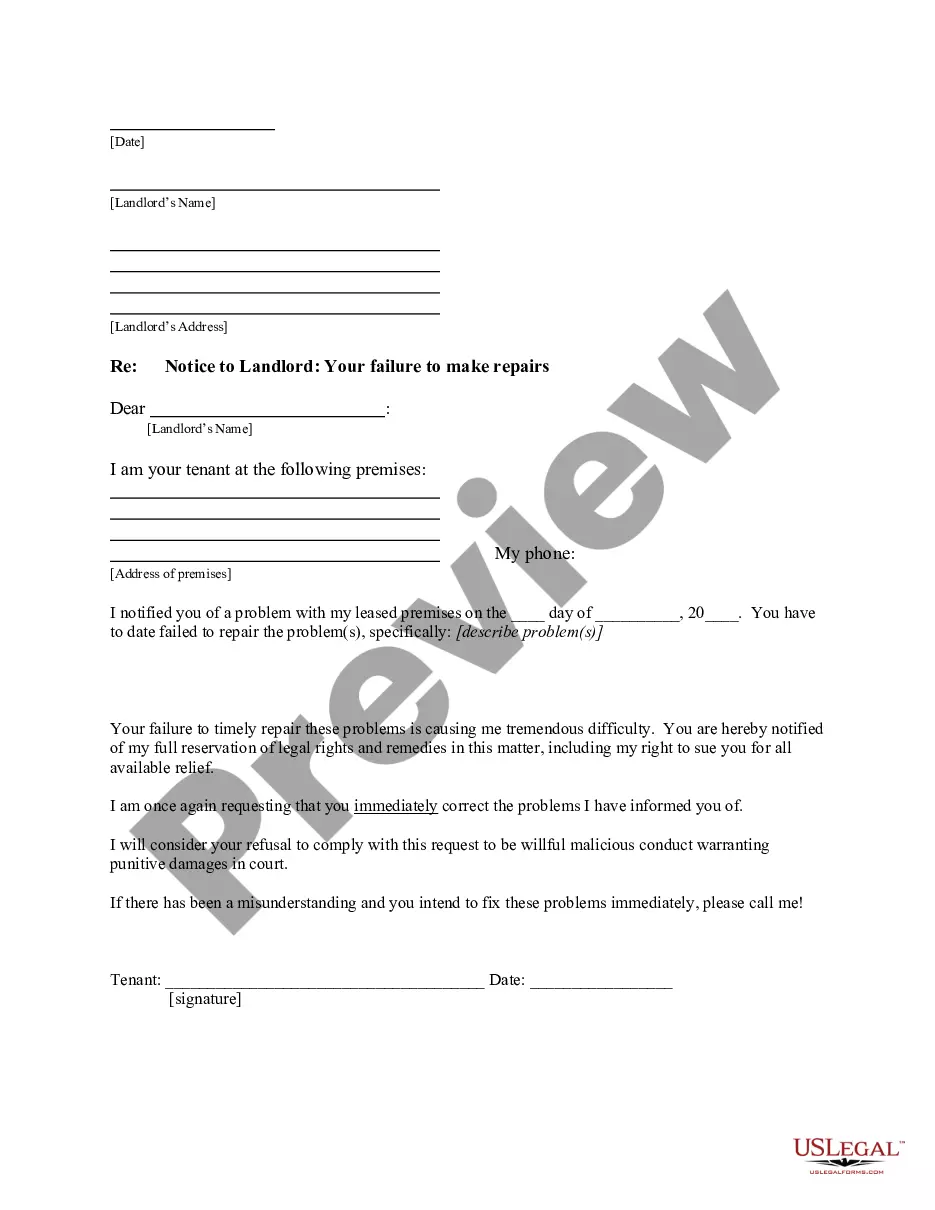

How to fill out Rhode Island A Summary Of Your Rights Under The Fair Credit Reporting Act?

US Legal Forms - one of the largest libraries of lawful varieties in America - offers an array of lawful document templates it is possible to acquire or print. Making use of the web site, you may get thousands of varieties for organization and person purposes, sorted by types, suggests, or search phrases.You will discover the most up-to-date variations of varieties just like the Rhode Island A Summary of Your Rights Under the Fair Credit Reporting Act in seconds.

If you currently have a membership, log in and acquire Rhode Island A Summary of Your Rights Under the Fair Credit Reporting Act through the US Legal Forms library. The Down load button can look on every single form you view. You have accessibility to all earlier acquired varieties from the My Forms tab of your accounts.

If you would like use US Legal Forms for the first time, allow me to share simple instructions to obtain began:

- Ensure you have picked out the best form for your personal area/state. Go through the Preview button to review the form`s articles. Look at the form description to ensure that you have chosen the proper form.

- In case the form doesn`t fit your specifications, take advantage of the Research area near the top of the display screen to discover the the one that does.

- When you are pleased with the shape, validate your option by simply clicking the Purchase now button. Then, pick the prices strategy you favor and provide your qualifications to register for an accounts.

- Approach the transaction. Make use of your charge card or PayPal accounts to perform the transaction.

- Select the file format and acquire the shape on your own product.

- Make modifications. Load, revise and print and indication the acquired Rhode Island A Summary of Your Rights Under the Fair Credit Reporting Act.

Each template you included in your money does not have an expiration particular date and is also yours eternally. So, if you wish to acquire or print an additional copy, just proceed to the My Forms portion and click in the form you need.

Obtain access to the Rhode Island A Summary of Your Rights Under the Fair Credit Reporting Act with US Legal Forms, probably the most comprehensive library of lawful document templates. Use thousands of skilled and condition-distinct templates that fulfill your organization or person needs and specifications.