Rhode Island Payroll Specialist Agreement - Self-Employed Independent Contractor

Description

How to fill out Rhode Island Payroll Specialist Agreement - Self-Employed Independent Contractor?

You are able to spend hours on-line trying to find the lawful document design that meets the federal and state requirements you want. US Legal Forms supplies 1000s of lawful kinds which are examined by professionals. You can actually download or produce the Rhode Island Payroll Specialist Agreement - Self-Employed Independent Contractor from the services.

If you have a US Legal Forms account, you can log in and then click the Acquire option. Afterward, you can comprehensive, edit, produce, or indicator the Rhode Island Payroll Specialist Agreement - Self-Employed Independent Contractor. Each and every lawful document design you purchase is your own property permanently. To have yet another copy of any bought form, go to the My Forms tab and then click the corresponding option.

If you use the US Legal Forms web site for the first time, adhere to the straightforward instructions listed below:

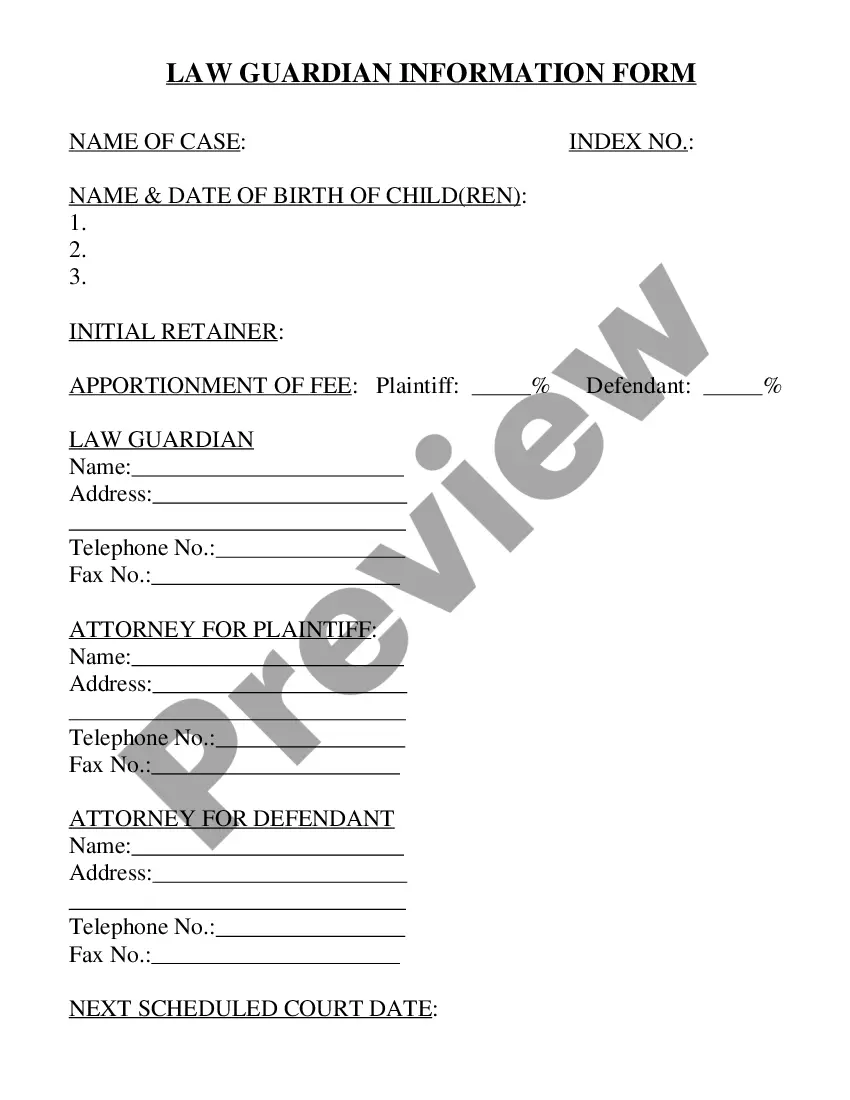

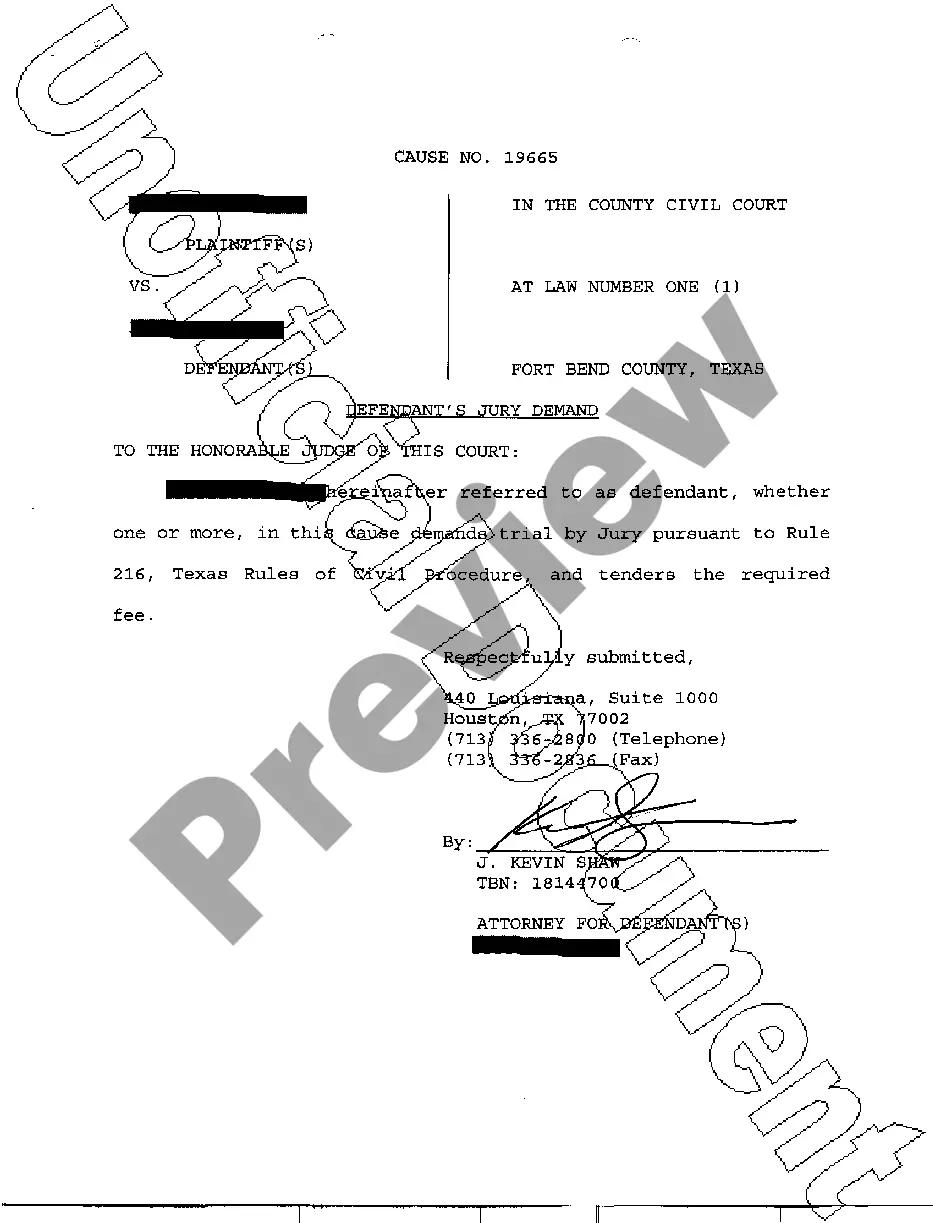

- Very first, make certain you have selected the proper document design for your state/area of your choosing. See the form description to ensure you have picked out the proper form. If accessible, make use of the Review option to search from the document design also.

- If you wish to discover yet another edition of your form, make use of the Search industry to obtain the design that meets your requirements and requirements.

- After you have identified the design you desire, click Get now to continue.

- Pick the pricing program you desire, type in your credentials, and register for an account on US Legal Forms.

- Full the deal. You may use your bank card or PayPal account to purchase the lawful form.

- Pick the file format of your document and download it to your system.

- Make changes to your document if required. You are able to comprehensive, edit and indicator and produce Rhode Island Payroll Specialist Agreement - Self-Employed Independent Contractor.

Acquire and produce 1000s of document web templates making use of the US Legal Forms web site, that offers the greatest collection of lawful kinds. Use skilled and status-specific web templates to take on your company or specific needs.

Form popularity

FAQ

This means that if you hire 1099 workers, you don't need to pay payroll taxes on their behalf. You also aren't required to provide them standard employee benefits, such as PTO and sick leave, or contribute to their health insurance coverage or retirement plan.

Employees in South Africa are entitled to certain minimum employment benefits, while independent contractors are not. Subject to some exclusions, all employees are entitled to a number of statutory minimum entitlements and basic conditions of employment.

The main pieces of employment legislation, chief among which are the Labour Relations Act 66 of 1995 (LRA) the Basic Conditions of Employment Act 75 of 1997 (BCEA) and the Employment Equity Act 55 of 1998 (EEA), apply to employees and not independent contractors.

Often Independent Contractors are completely unaware that they are not Employees as defined in South African labour legislation and therefore unprotected by labour legislation.

Payroll refers to the tasks an employer must execute to ensure employees are paid accurately and on time. An independent contractor is not an employee; therefore, he's not paid through the payroll.

Payroll refers to the tasks an employer must execute to ensure employees are paid accurately and on time. An independent contractor is not an employee; therefore, he's not paid through the payroll.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

How to Pay 1099 Contractors in PayrollAdd the contractor by going to Payroll > 1099 Contractors > Add Contractor.Enter the 1099 Type and their FEIN or Social Security/Individual Taxpayer ID number.If you have Patriot's Accounting software, be sure the Pay this contractor in payroll box is checked on their record.More items...

How is an independent contractor paid?Obtain the independent contractor's Form W-9, Request for Taxpayer Identification Number and Certification.Provide compensation for work performed.Remit backup withholding payments to the IRS, if necessary.Complete Form 1099-NEC, Nonemployee Compensation.

Independent contractors are not classified as employees by the Internal Revenue Service (IRS), so instead of being paid through your payroll system, they're paid separately as a business expense.