Rhode Island Self-Employed Independent Contractor Payment Schedule

Description

How to fill out Rhode Island Self-Employed Independent Contractor Payment Schedule?

Discovering the right lawful document web template can be a have difficulties. Of course, there are a lot of themes available on the net, but how can you find the lawful form you want? Use the US Legal Forms website. The service offers a large number of themes, for example the Rhode Island Self-Employed Independent Contractor Payment Schedule, which you can use for organization and personal demands. Every one of the types are checked by experts and satisfy state and federal specifications.

Should you be already signed up, log in to the bank account and then click the Download key to have the Rhode Island Self-Employed Independent Contractor Payment Schedule. Utilize your bank account to look throughout the lawful types you might have bought formerly. Go to the My Forms tab of the bank account and acquire an additional copy in the document you want.

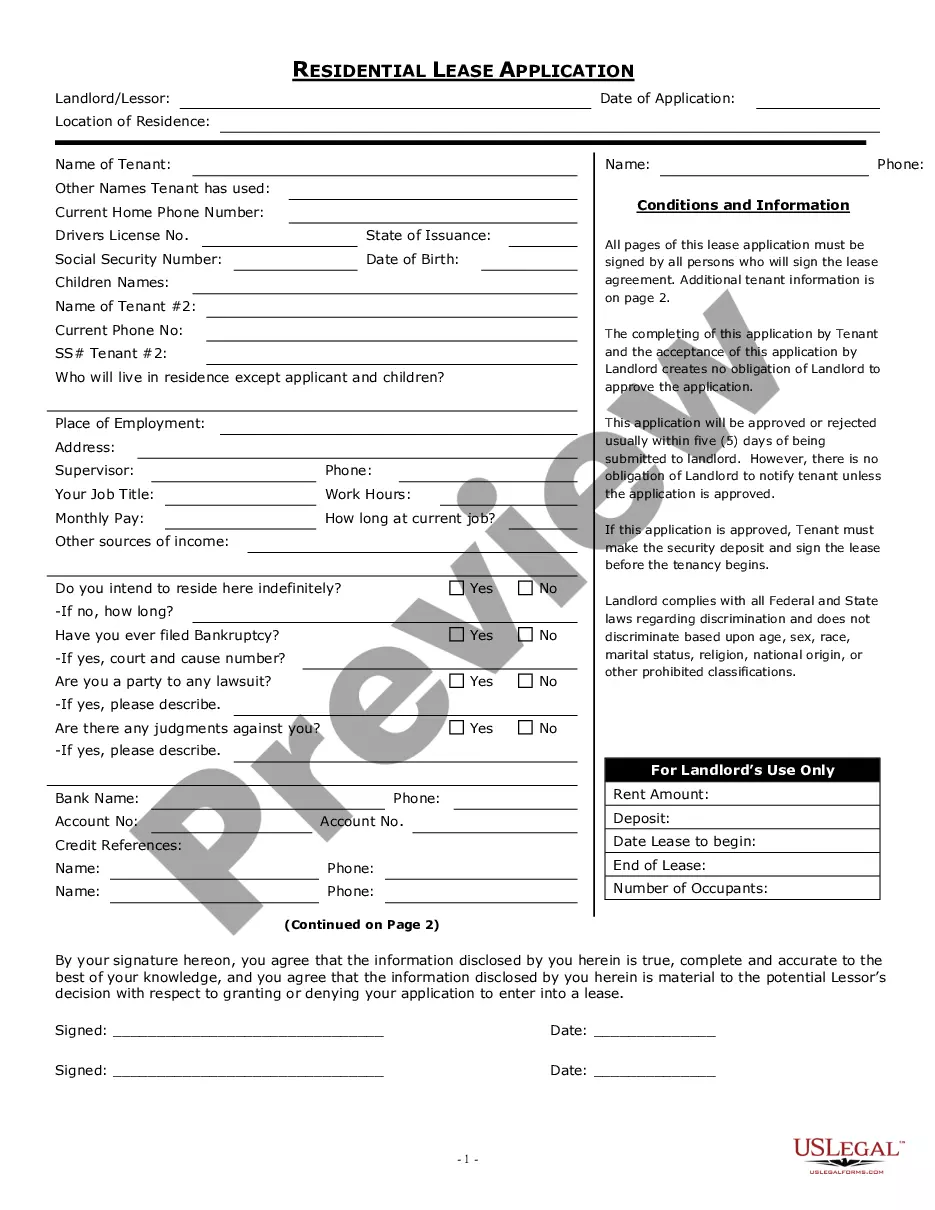

Should you be a fresh consumer of US Legal Forms, here are simple recommendations so that you can follow:

- Initial, be sure you have chosen the proper form to your metropolis/state. It is possible to examine the shape making use of the Review key and study the shape explanation to make certain it is the best for you.

- In case the form is not going to satisfy your expectations, make use of the Seach field to find the proper form.

- When you are positive that the shape would work, click on the Acquire now key to have the form.

- Pick the rates plan you need and enter the necessary details. Design your bank account and purchase the transaction making use of your PayPal bank account or Visa or Mastercard.

- Choose the submit file format and down load the lawful document web template to the product.

- Comprehensive, edit and print and sign the acquired Rhode Island Self-Employed Independent Contractor Payment Schedule.

US Legal Forms may be the largest library of lawful types where you can find different document themes. Use the company to down load professionally-produced documents that follow state specifications.

Form popularity

FAQ

An independent contractor is not eligible for workers' compensation benefits.

Self-employment income is income that arises from the performance of personal services, but which cannot be classified as wages because an employer-employee relationship does not exist between the payer and the payee.

You can now earn up to 150% of your weekly benefit rate and still receive a partial benefit. For example, that means if your weekly benefit amount is $100, you can earn up to $149 working part time. You can also earn up to 50% of your weekly benefit rate before any earnings are subtracted from your benefits.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Unemployment benefits available to gig workers, self-employed, small business owners. CRANSTON, R.I. (WJAR) Jobless benefits during the coronavirus crisis are being extended to those who typically would not qualify for unemployment insurance.

Do independent contractors qualify for unemployment insurance? Yes, with the passing of the CARES Act, independent contractors, gig workers, and self-employed individuals are eligible for unemployment insurance if they are unable to work due to COVID-19.

RI Works - provides temporary cash assistance for low-income and unemployed parents with children. If you and your children need temporary assistance, request an application at one of the DHS offices. You can talk to a DHS representative Monday Friday AM PM by calling 1-855-MY-RIDHS.

Payroll refers to the tasks an employer must execute to ensure employees are paid accurately and on time. An independent contractor is not an employee; therefore, he's not paid through the payroll.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.