Rhode Island Direction For Payment of Royalty to Trustee by Royalty Owners serves as a guiding document for royalty owners in Rhode Island who wish to establish a system for the proper payment of royalties to a trustee. The process involves ensuring that all parties involved understand their roles and responsibilities in the royalty payment process, maintaining transparency, and adhering to legal and regulatory obligations. Implementing such a direction provides a structured approach that not only benefits the royalty owners but also safeguards the interests of both parties involved. The Rhode Island Direction For Payment of Royalty to Trustee by Royalty Owners primarily includes the following key points: 1. Definitions and Interpretation: This section clarifies any technical terms, abbreviations, or jargon that may arise during the document's implementation. It ensures that all parties share a common understanding of the terminology used throughout. 2. Scope: This section outlines the boundaries and limitations of the direction, defining the specific types of royalties covered, such as oil, gas, mineral, or intellectual property royalties. Depending on the context, variations of the direction might exist, such as Rhode Island Direction For Payment of Royalty to Trustee by Property Owners or Rhode Island Direction For Payment of Royalty to Trustee by Artists. 3. Appointment and Roles: Here, the process of appointing a trustee, who acts as an intermediary, is discussed. The section defines the trustee's responsibilities, such as collecting, managing, and disbursing royalties. It also ensures that the trustee acts in the best interest of the royalty owners while adhering to legal requirements. 4. Obligations and Reporting: This section delves into the specifics of the royalty payment process. It includes details about the frequency of payments, the mode of payment (e.g., direct deposit, check), and any requirements for documentation or reporting. The importance of accurate record-keeping by both the trustee and the royalty owners is emphasized to maintain transparency and accountability. 5. Dispute Resolution: In the event of conflicts or disagreements, this section outlines the mechanisms for resolving disputes. It may include provisions for mediation, arbitration, or alternative dispute resolution methods to ensure a fair and efficient resolution process. 6. Termination: This section specifies the conditions under which the direction may be terminated, either by the trustee or the royalty owners. It details the procedures for the distribution of any remaining royalties and the finalization of the working relationship. By following the Rhode Island Direction For Payment of Royalty to Trustee by Royalty Owners, individuals or businesses involved in royalty payments can streamline their operations, reduce potential conflicts, and ensure fair and timely distribution of royalties. Effective implementation of this direction can provide peace of mind to both the royalty owners and the trustee, fostering a cooperative and productive relationship.

Rhode Island Direction For Payment of Royalty to Trustee by Royalty Owners

Description

How to fill out Rhode Island Direction For Payment Of Royalty To Trustee By Royalty Owners?

US Legal Forms - one of the most significant libraries of legitimate forms in America - provides a wide array of legitimate document templates you are able to download or printing. Utilizing the web site, you will get 1000s of forms for company and individual reasons, categorized by types, claims, or keywords.You can find the newest variations of forms like the Rhode Island Direction For Payment of Royalty to Trustee by Royalty Owners within minutes.

If you already possess a membership, log in and download Rhode Island Direction For Payment of Royalty to Trustee by Royalty Owners from the US Legal Forms collection. The Acquire button can look on each and every kind you view. You gain access to all formerly delivered electronically forms within the My Forms tab of your respective profile.

If you wish to use US Legal Forms initially, allow me to share straightforward instructions to obtain started off:

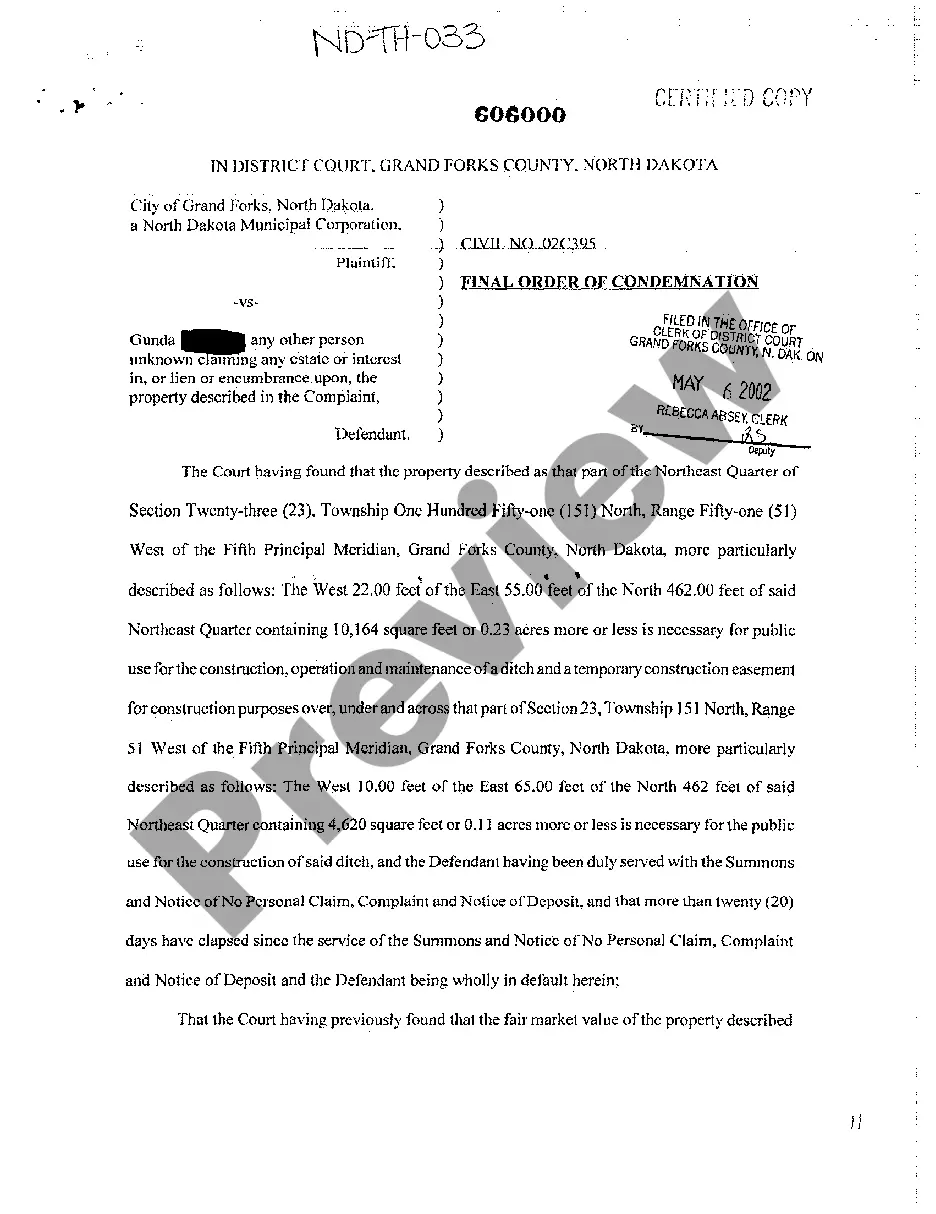

- Be sure to have chosen the proper kind for the area/county. Click the Review button to analyze the form`s content. Browse the kind explanation to actually have selected the proper kind.

- In the event the kind does not satisfy your specifications, utilize the Lookup area towards the top of the screen to discover the the one that does.

- When you are satisfied with the form, validate your selection by clicking the Acquire now button. Then, pick the costs prepare you favor and offer your accreditations to register for an profile.

- Method the financial transaction. Use your bank card or PayPal profile to complete the financial transaction.

- Pick the file format and download the form on your own gadget.

- Make adjustments. Complete, edit and printing and signal the delivered electronically Rhode Island Direction For Payment of Royalty to Trustee by Royalty Owners.

Every template you included with your account lacks an expiry date and is yours forever. So, if you want to download or printing an additional version, just go to the My Forms area and then click in the kind you want.

Get access to the Rhode Island Direction For Payment of Royalty to Trustee by Royalty Owners with US Legal Forms, by far the most extensive collection of legitimate document templates. Use 1000s of skilled and express-certain templates that fulfill your company or individual demands and specifications.