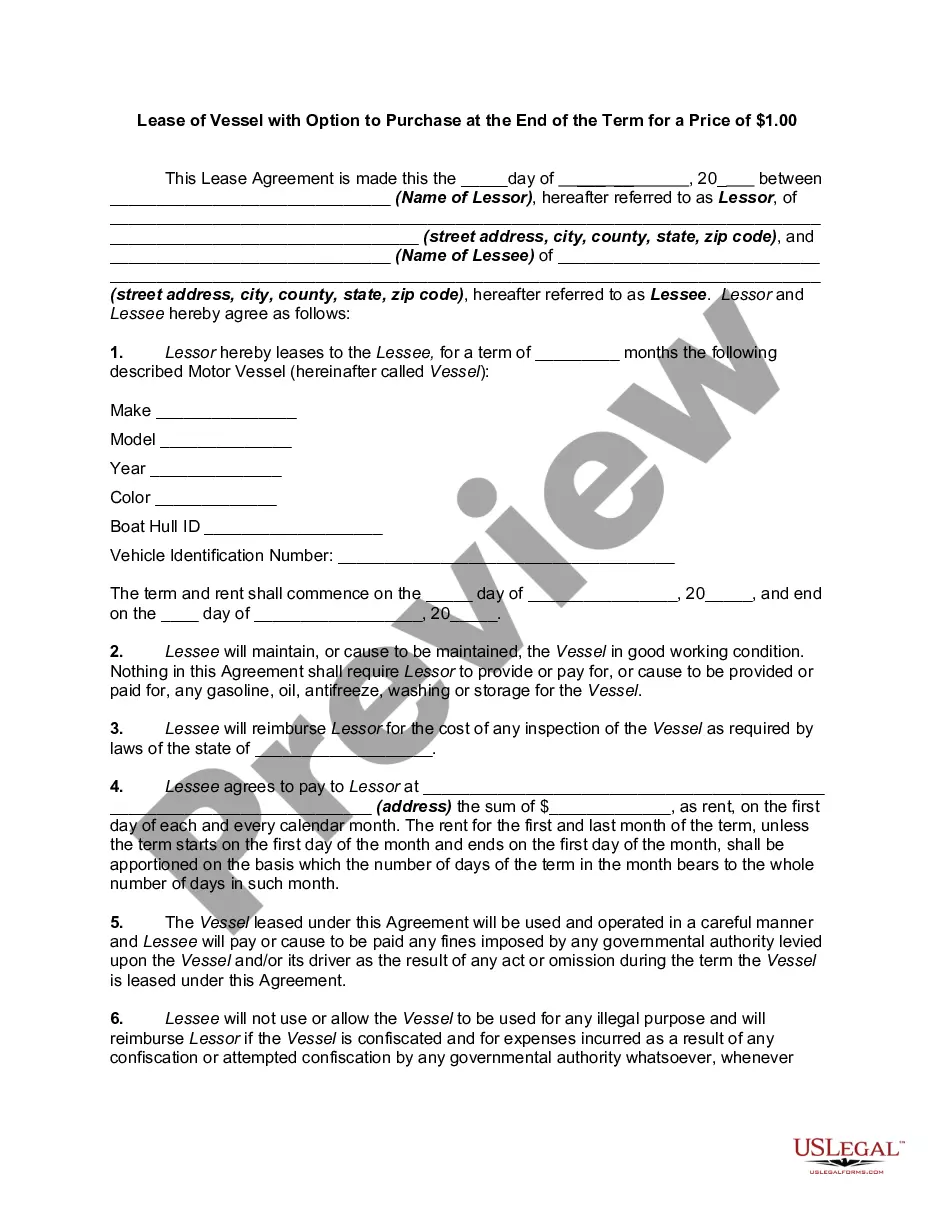

It is not uncommon to encounter a situation where a mineral owner owns all the mineral estate in a tract of land, but the royalty interest in that tract has been divided and conveyed to a number of parties; i.e., the royalty ownership is not common in the entire tract. If a lease is granted by the mineral owner on the entire tract, and the lessee intends to develop the entire tract as a producing unit, the royalty owners may desire to enter into an agreement providing for all royalty owners in the tract to participate in production royalty, regardless of where the well is actually located on the tract. This form of agreement accomplishes this objective.

Rhode Island Commingling and Entirety Agreement by Royalty Owners Where the Royalty Ownership Is Not Common

Description

How to fill out Commingling And Entirety Agreement By Royalty Owners Where The Royalty Ownership Is Not Common?

Are you currently within a place where you will need papers for possibly organization or person reasons virtually every working day? There are a lot of authorized document themes accessible on the Internet, but locating kinds you can trust isn`t straightforward. US Legal Forms delivers a large number of type themes, just like the Rhode Island Commingling and Entirety Agreement by Royalty Owners Where the Royalty Ownership Is Not Common, that happen to be created in order to meet federal and state specifications.

Should you be already familiar with US Legal Forms site and also have your account, merely log in. Following that, you can download the Rhode Island Commingling and Entirety Agreement by Royalty Owners Where the Royalty Ownership Is Not Common template.

If you do not have an accounts and wish to start using US Legal Forms, follow these steps:

- Get the type you require and ensure it is to the correct metropolis/region.

- Make use of the Review option to check the form.

- See the outline to actually have selected the appropriate type.

- In case the type isn`t what you`re searching for, use the Look for discipline to discover the type that meets your requirements and specifications.

- Once you obtain the correct type, simply click Purchase now.

- Pick the prices strategy you desire, fill out the specified info to generate your account, and purchase the transaction utilizing your PayPal or bank card.

- Choose a handy document structure and download your backup.

Get every one of the document themes you possess purchased in the My Forms food selection. You can obtain a further backup of Rhode Island Commingling and Entirety Agreement by Royalty Owners Where the Royalty Ownership Is Not Common at any time, if possible. Just click the essential type to download or print out the document template.

Use US Legal Forms, by far the most substantial selection of authorized kinds, to save lots of efforts and stay away from mistakes. The assistance delivers expertly manufactured authorized document themes which you can use for a selection of reasons. Produce your account on US Legal Forms and start making your way of life easier.

Form popularity

FAQ

A royalty interest is a property interest that entitles the owner to receive a share of the production revenue. An individual or company that owns a royalty interest does not have to pay for any of the operational costs required to produce the resource, but they still own a portion of the revenue produced.

In such a circumstance, the Payor may elect to file what is known as an Interpleader action to determine the proper owner (or might be encouraged to do so). In an Interpleader, the stakeholder sues the parties who are asserting conflicting claims to the royalties due and deposits the royalties into the court.

Parties in Royalties Accounting The person who creates or owns the asset and provides the right of using such an asset to the third party is known as the lessor or the landlord. Furthermore, lessor receives consideration from the third party for using the rights to use his asset.

A quick overview of the differences between mineral rights and royalty interests shows a mineral interest is a real property interest obtained by severing the minerals from the surface and a royalty interest grants an owner a portion of the production revenue generated.

Royalties are generated by many types of assets, including musical compositions, oil wells, gold mines, books, movies and TV shows. As passive income, royalties are taxed at lower rates than wages and salaries. Investors can invest in royalty income through auction sites and royalty income trusts.

A royalty is an amount paid by a third party to an owner of a product or patent for the use of that product or patent. The terms of royalty payments are laid out in a licensing agreement.