Rhode Island Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries

Description

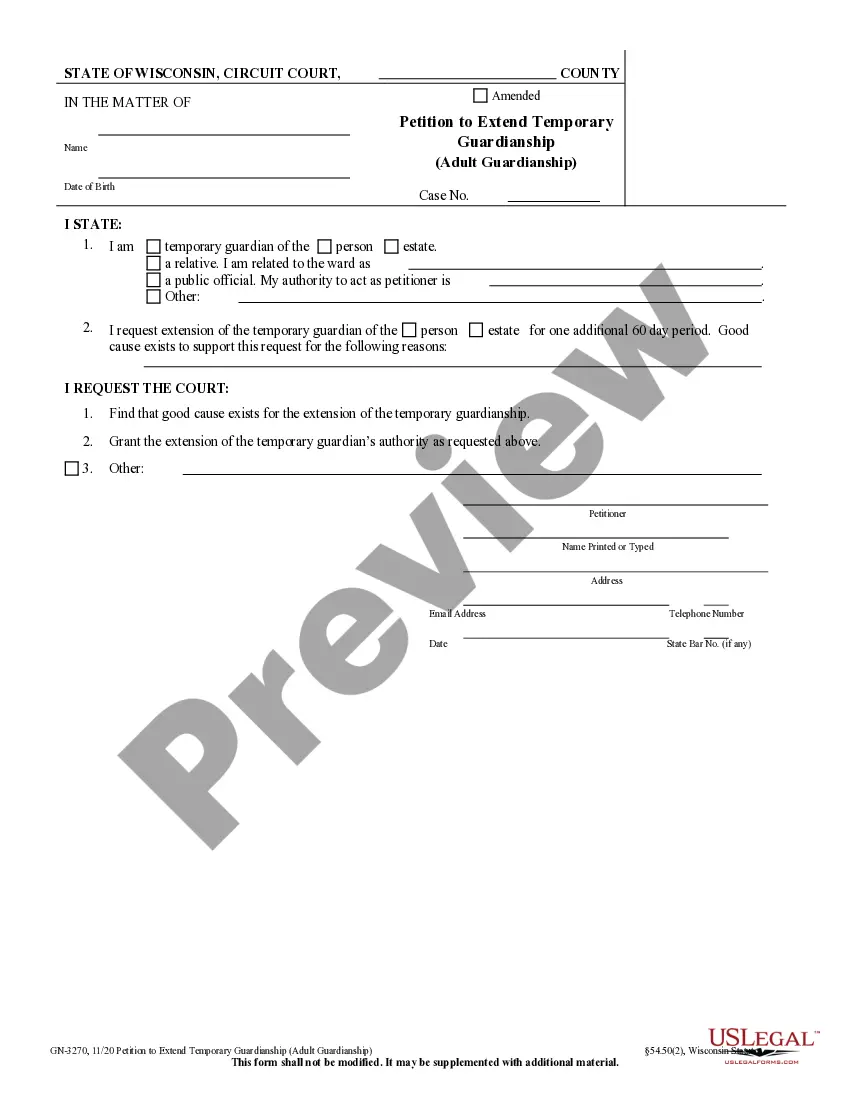

How to fill out Trustee's Deed And Assignment For Distribution By Trustee To Testamentary Trust Beneficiaries?

You may commit several hours on the Internet looking for the authorized record template that suits the federal and state needs you will need. US Legal Forms supplies a huge number of authorized varieties which can be reviewed by experts. You can easily acquire or produce the Rhode Island Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries from your services.

If you currently have a US Legal Forms account, you can log in and click on the Obtain key. Following that, you can comprehensive, modify, produce, or signal the Rhode Island Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries. Every single authorized record template you get is your own eternally. To obtain another copy of any purchased develop, go to the My Forms tab and click on the corresponding key.

If you work with the US Legal Forms web site initially, follow the straightforward directions under:

- Initially, ensure that you have selected the correct record template to the region/area of your choice. Look at the develop outline to ensure you have picked the proper develop. If accessible, utilize the Review key to check with the record template too.

- If you would like discover another variation in the develop, utilize the Lookup field to find the template that meets your needs and needs.

- When you have discovered the template you desire, click Buy now to proceed.

- Choose the costs strategy you desire, type your credentials, and sign up for an account on US Legal Forms.

- Full the financial transaction. You can utilize your charge card or PayPal account to purchase the authorized develop.

- Choose the formatting in the record and acquire it to your gadget.

- Make changes to your record if required. You may comprehensive, modify and signal and produce Rhode Island Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries.

Obtain and produce a huge number of record web templates utilizing the US Legal Forms website, that provides the most important collection of authorized varieties. Use expert and express-distinct web templates to handle your business or personal requires.

Form popularity

FAQ

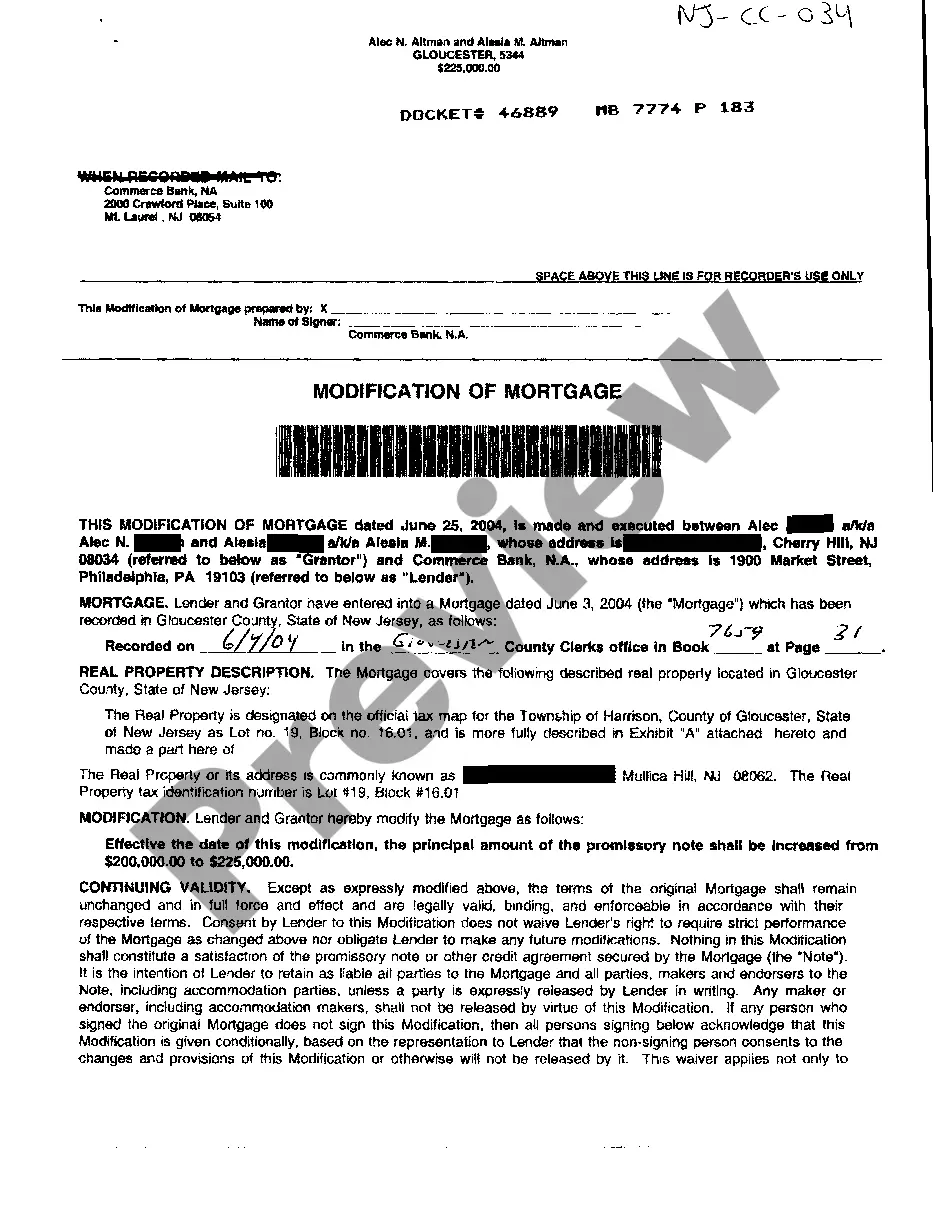

A trustee deed?sometimes called a deed of trust or a trust deed?is a legal document created when someone purchases real estate in a trust deed state, such as California (check your local laws to see what is required in your state). A trust deed is used in place of a mortgage. When is it time to use a trustee deed? | .com ? articles ? when-is-it-time-t... .com ? articles ? when-is-it-time-t...

A deed of trust has a borrower, lender and a ?trustee.? The trustee is a neutral third party that holds the title to a property until the loan is completely paid off by the borrower. In most cases, the trustee is an escrow If you don't repay your loan, the escrow company's attorney must begin the foreclosure process.

If you borrow from a commercial lender, it is most likely that the lender will determine the trustee, which is typically a title company, professional escrow company, or other company in the business of serving as a real estate trustee. Sometimes a real estate broker or an attorney serves in this role.

A Rhode Island deed of trust conveys a property title from a person acquiring real estate financing to a ?trustee? as a means to secure a loan from the financier. Free Rhode Island Deed of Trust Form | PDF | Word - eSign esign.com ? deeds ? deed-of-trust esign.com ? deeds ? deed-of-trust

A deed of trust is a document used in real estate transactions. It represents an agreement between the borrower and a lender to have the property held in trust by a neutral and independent third party until the loan is paid off.

A Deed of Trust is an agreement between a borrower, a lender and a third-party person who's appointed as a Trustee. It's used to secure real estate transactions where money needs to be borrowed in order for property to be purchased.

A grantor can appoint someone a trustee as long as the individual is at least 18 years old and is not likely to become bankrupt or mentally incompetent. Grantors can also be the trustee themselves, as long as the trust is a revocable living trust. This means the trust can be changed during the grantor's lifetime. What Is a Trustee and What Are Their Responsibilities? - SmartAsset smartasset.com ? estate-planning ? trustee smartasset.com ? estate-planning ? trustee

Whether or not the trustee can withhold funds from you depends on the terms of the trust itself. If the trust requires withholding distributions under certain circumstances, such as the beneficiary reaching a specific age, the trustee must follow those stipulations. Can a Trustee Withhold Money From a Beneficiary? mpopc.com ? blog ? trustee-withhold-money-fro... mpopc.com ? blog ? trustee-withhold-money-fro...