Rhode Island Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest

Description

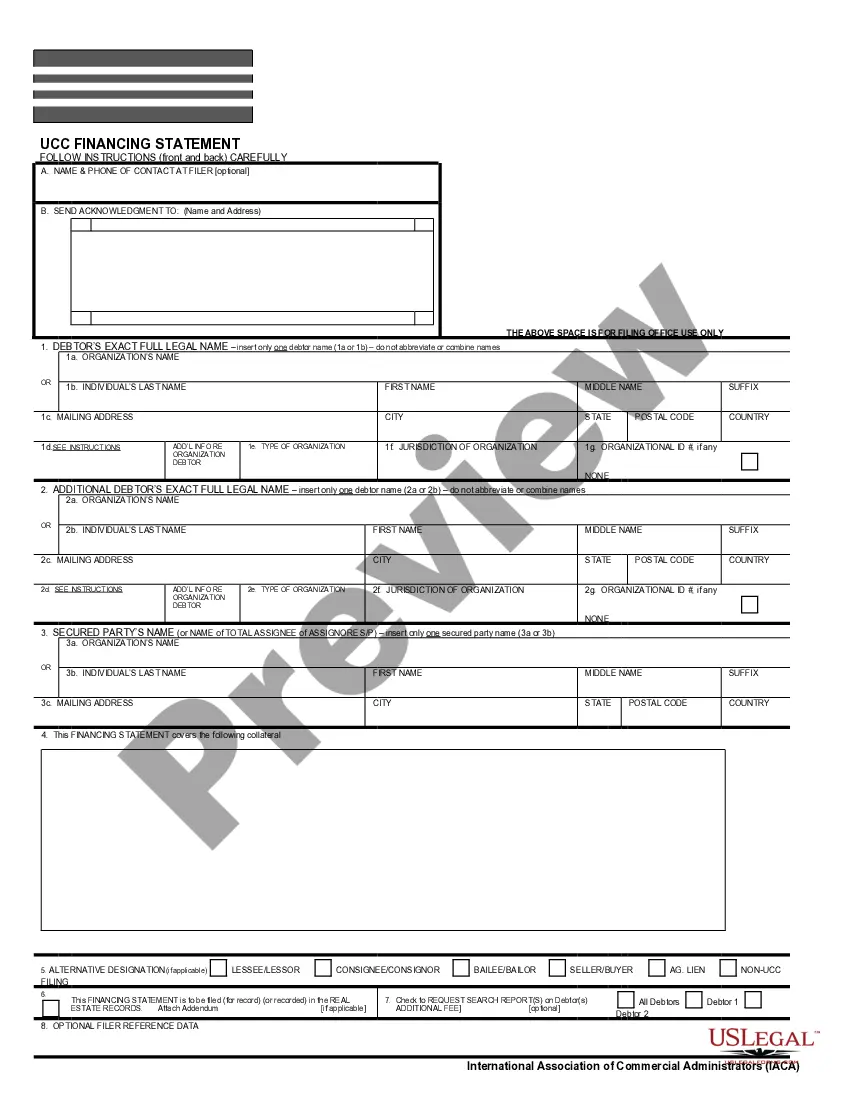

How to fill out Mineral Deed With Grantor Reserving Nonparticipating Royalty Interest?

US Legal Forms - one of the greatest libraries of lawful types in America - delivers a wide array of lawful file web templates you can down load or printing. Using the site, you will get a huge number of types for enterprise and specific functions, sorted by categories, says, or key phrases.You can find the most recent versions of types such as the Rhode Island Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest within minutes.

If you already have a monthly subscription, log in and down load Rhode Island Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest from the US Legal Forms collection. The Obtain button can look on each and every form you see. You get access to all previously saved types in the My Forms tab of your respective accounts.

In order to use US Legal Forms the very first time, allow me to share simple recommendations to obtain started:

- Make sure you have selected the best form for the town/region. Go through the Preview button to check the form`s information. Browse the form outline to actually have chosen the proper form.

- In the event the form doesn`t match your specifications, use the Search field towards the top of the monitor to get the one which does.

- When you are pleased with the shape, validate your selection by clicking on the Purchase now button. Then, select the rates strategy you favor and offer your credentials to sign up to have an accounts.

- Method the deal. Utilize your charge card or PayPal accounts to perform the deal.

- Pick the format and down load the shape in your product.

- Make adjustments. Complete, edit and printing and sign the saved Rhode Island Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest.

Every single design you included with your account lacks an expiration date and it is yours forever. So, if you want to down load or printing an additional copy, just go to the My Forms segment and click around the form you will need.

Gain access to the Rhode Island Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest with US Legal Forms, by far the most considerable collection of lawful file web templates. Use a huge number of skilled and express-specific web templates that fulfill your company or specific needs and specifications.

Form popularity

FAQ

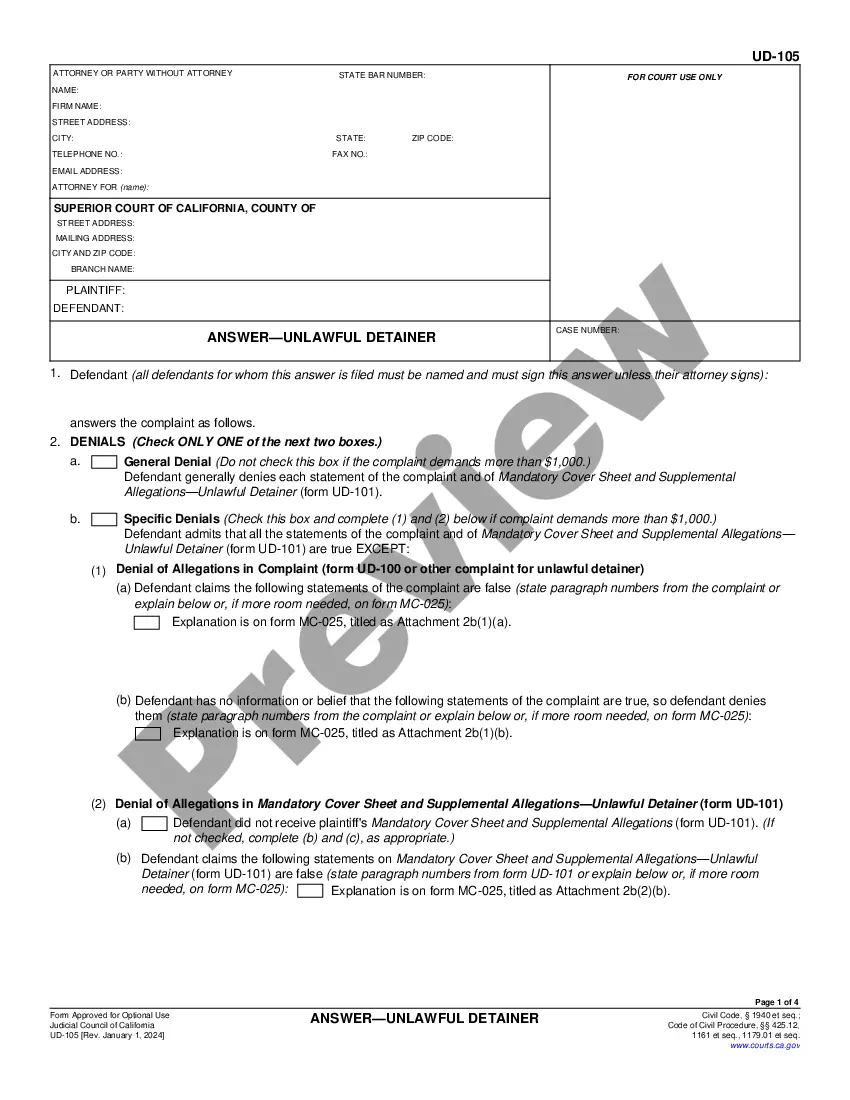

A quick overview of the differences between mineral rights and royalty interests shows a mineral interest is a real property interest obtained by severing the minerals from the surface and a royalty interest grants an owner a portion of the production revenue generated.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

A quick overview of the differences between mineral rights and royalty interests shows a mineral interest is a real property interest obtained by severing the minerals from the surface and a royalty interest grants an owner a portion of the production revenue generated.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain ?royalty interest? it is expensefree, bearing no operational costs of production.

Typically, NPRIs are created by an express grant or reservation in a deed and are entirely different from a ?leasehold? royalty. The holder of a NPRI has no power to negotiate or execute an oil and gas lease and has no power to enter upon the land to extract the hydrocarbons.

In contrast to a royalty interest, a working interest refers to an investment in an oil and gas operation where the investor does bear some costs for exploration, drilling and production. An investor holding a royalty interest bears only the cost of the initial investment and isn't liable for ongoing operating costs.

Unlike mineral owners, non-participating royalties do not have executive rights in lease negotiations, leasing incentives, or rental payments. They just receive the actual production proceeds.