Rhode Island Exhibit C Accounting Procedure Joint Operations

Description

How to fill out Exhibit C Accounting Procedure Joint Operations?

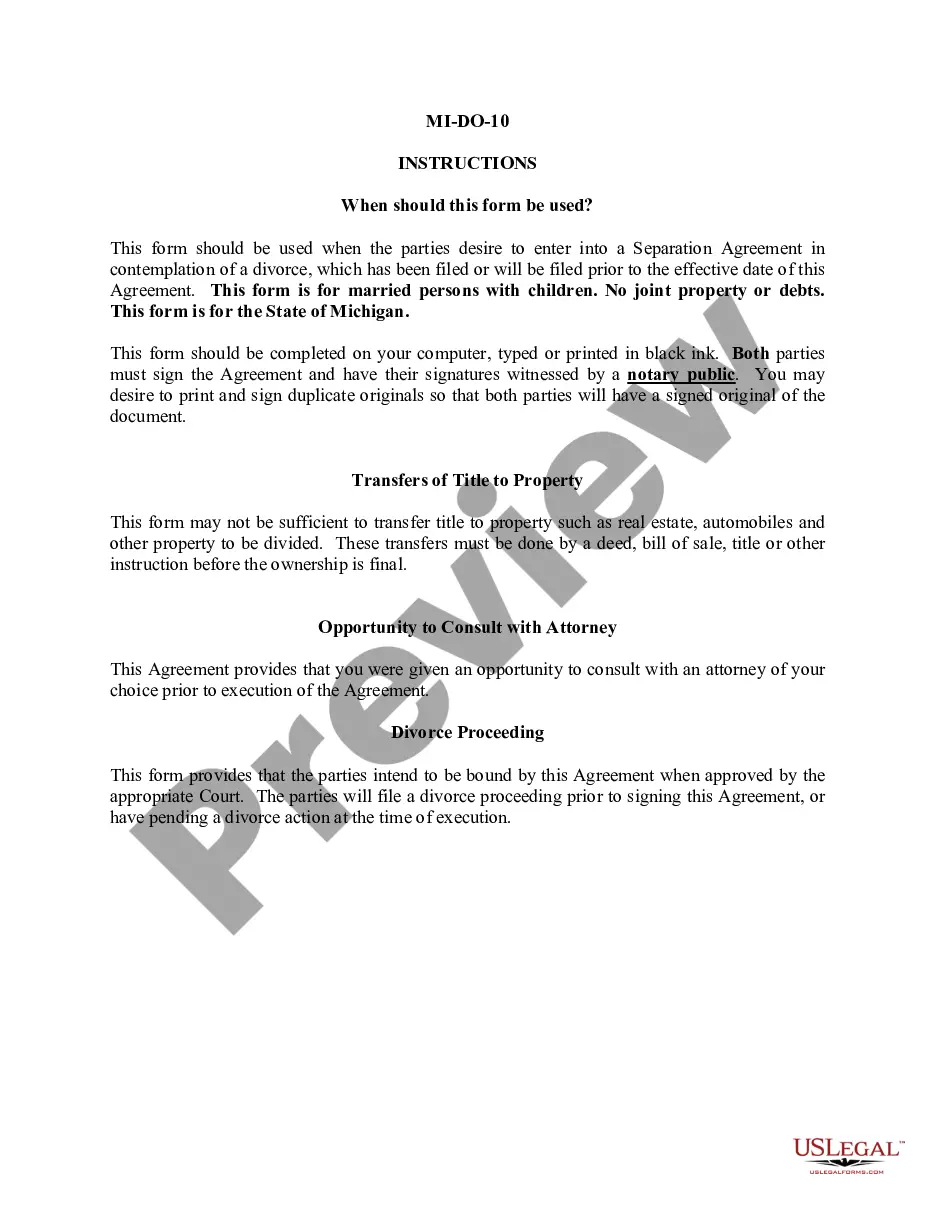

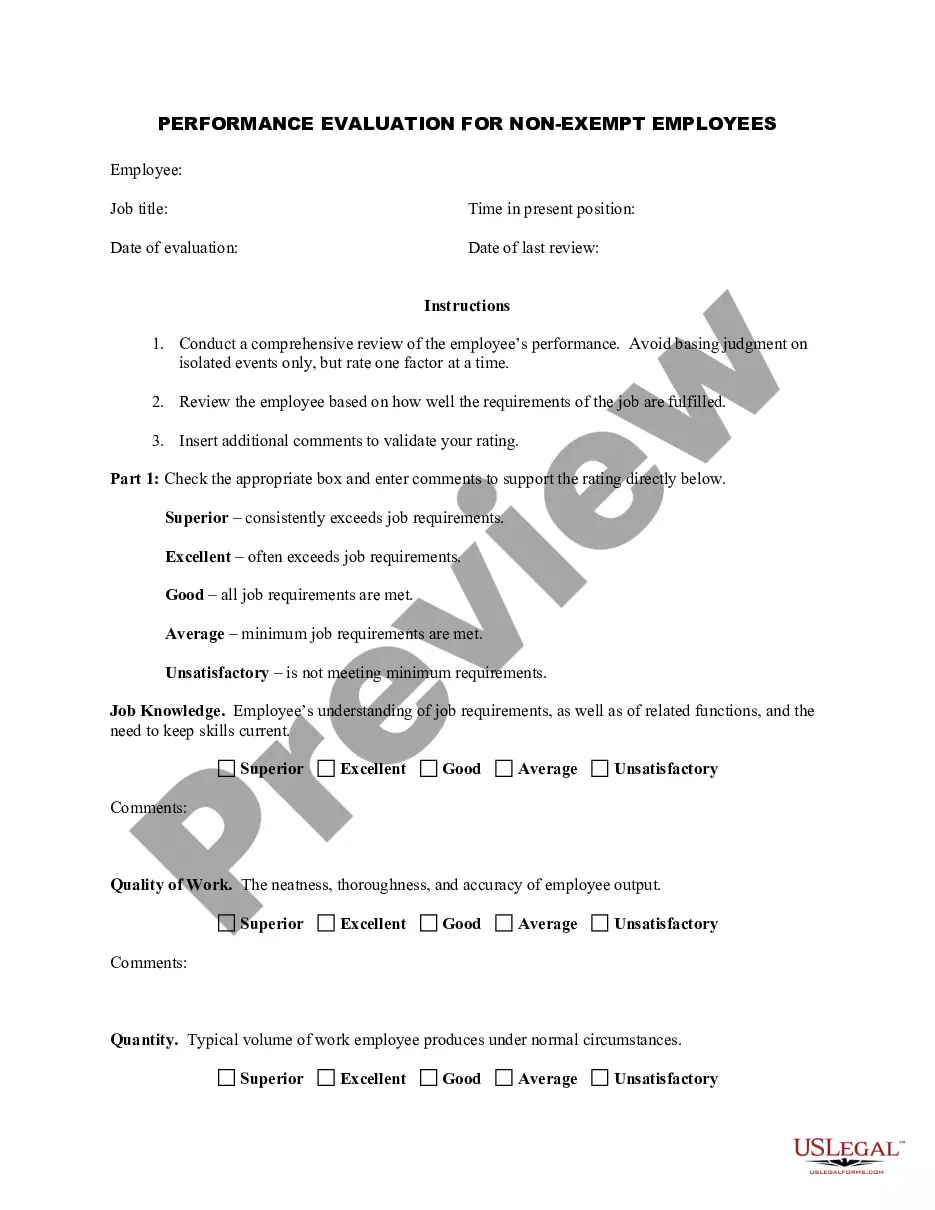

Choosing the best legitimate record web template can be quite a have a problem. Naturally, there are a lot of web templates available on the Internet, but how would you get the legitimate kind you need? Make use of the US Legal Forms site. The service offers a huge number of web templates, including the Rhode Island Exhibit C Accounting Procedure Joint Operations, which you can use for company and private requires. All the types are checked by professionals and meet up with federal and state specifications.

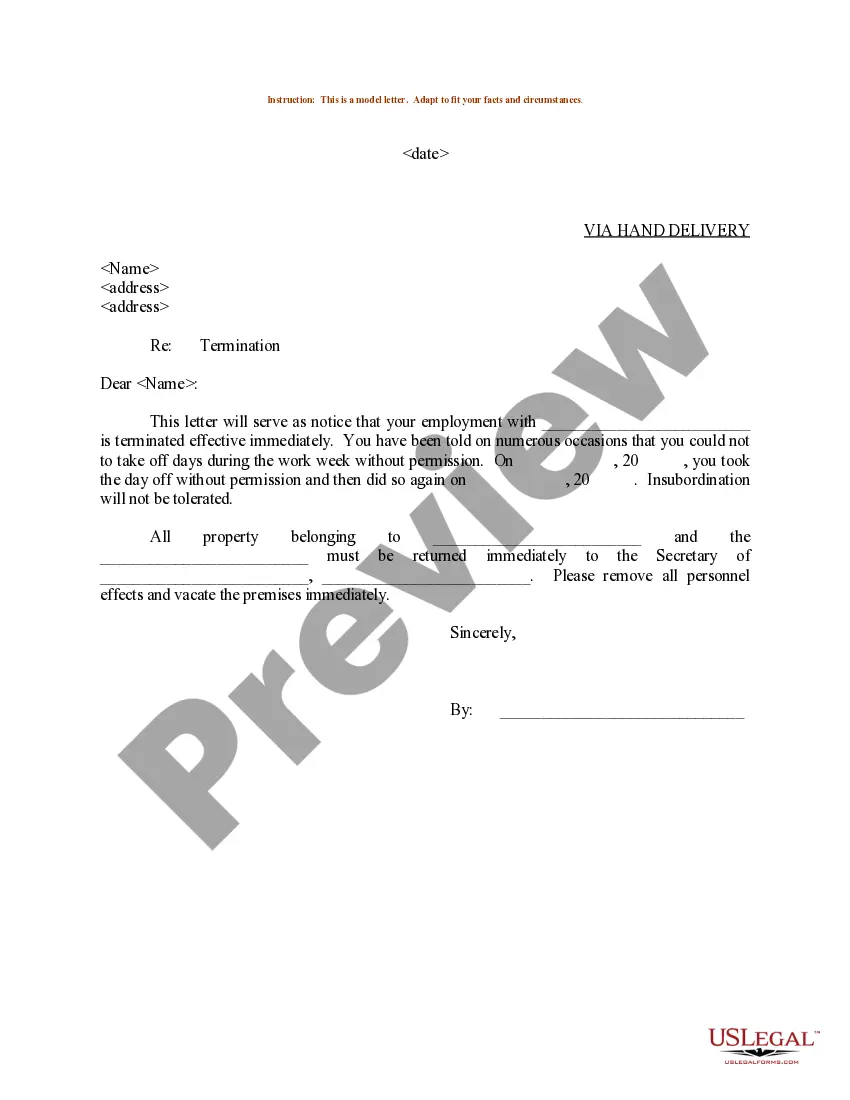

If you are already authorized, log in in your profile and click on the Down load key to find the Rhode Island Exhibit C Accounting Procedure Joint Operations. Make use of your profile to look throughout the legitimate types you have ordered earlier. Proceed to the My Forms tab of your profile and have another backup in the record you need.

If you are a whole new consumer of US Legal Forms, here are simple instructions for you to comply with:

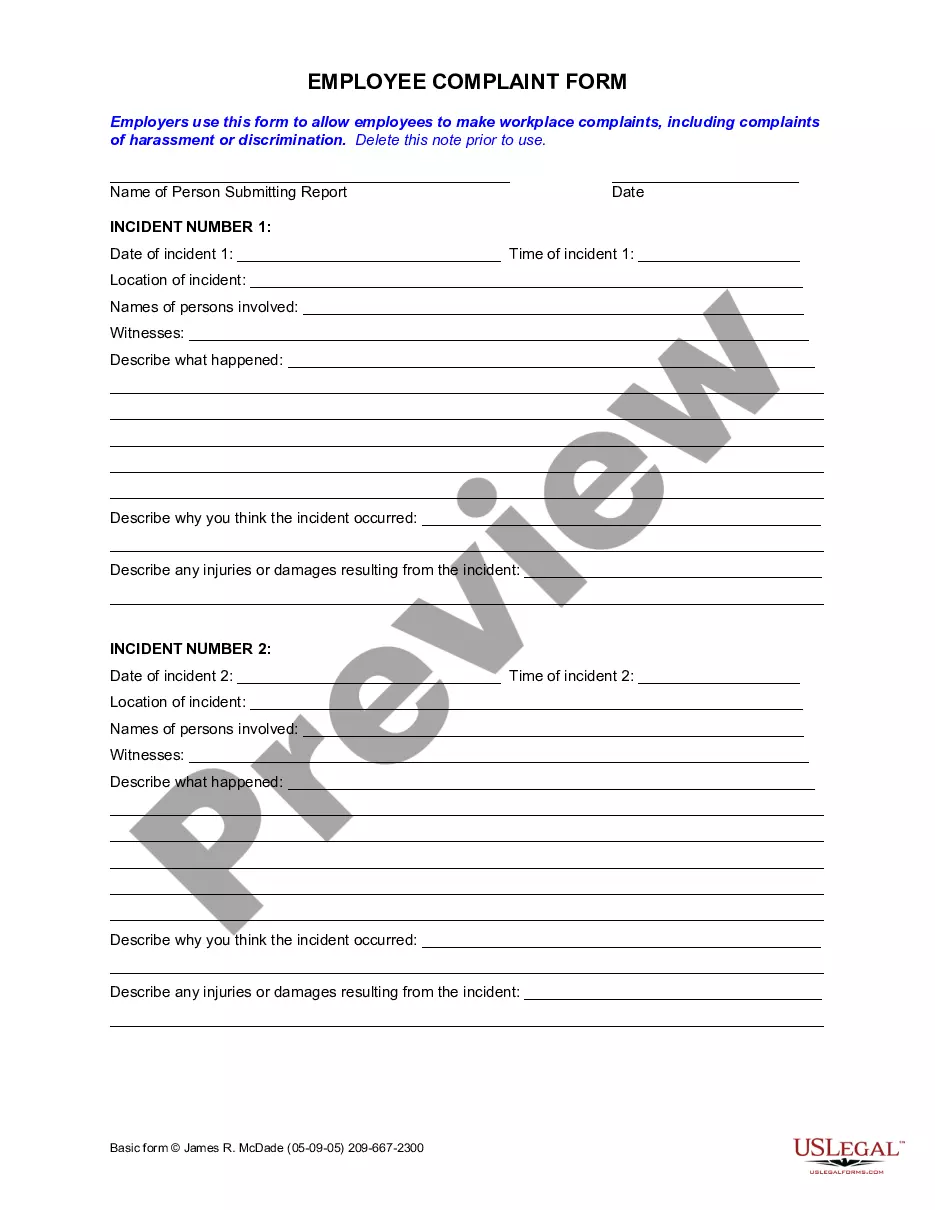

- First, be sure you have chosen the correct kind for your area/area. You can examine the form while using Preview key and read the form information to make certain it is the best for you.

- If the kind will not meet up with your expectations, take advantage of the Seach field to discover the correct kind.

- Once you are certain the form is proper, select the Purchase now key to find the kind.

- Opt for the pricing program you desire and enter in the necessary information. Create your profile and purchase your order using your PayPal profile or charge card.

- Opt for the data file file format and acquire the legitimate record web template in your system.

- Comprehensive, change and produce and signal the obtained Rhode Island Exhibit C Accounting Procedure Joint Operations.

US Legal Forms is the greatest catalogue of legitimate types that you can find numerous record web templates. Make use of the service to acquire skillfully-produced paperwork that comply with status specifications.

Form popularity

FAQ

Any gambling winnings are subject to federal income tax. If you win more than $5,000 on a wager, and the payout is at least 300 times the amount of your bet, the IRS requires the payer to withhold 24% for income taxes. Any gambling losses can offset your gambling winning as long as you meet certain criteria.

In Rhode Island, you'll have a 5.99% state tax, and after all taxes roughly $45,320,340 would be withheld from the lump sum payout, leaving the winner (if they're a single-filer) with about $431,374,705, USA Mega reports.

Some states do not levy income tax or tax lottery winnings, they include: Alaska. California. Delaware. Florida. Nevada. New Hampshire. South Dakota. Tennessee.

The RI-1040 Resident booklet contains returns and instructions for filing the 2022 Rhode Island Resident Individual Income Tax Return. Read the in- structions in this booklet carefully. For your convenience we have provided ?line by line instructions? which will aid you in completing your return. 2022 instructions for filing ri-1040 - RI Division of Taxation ri.gov ? sites ? files ? xkgbur541 ? files ri.gov ? sites ? files ? xkgbur541 ? files

Effective July 1, 1989, winnings and prizes received from the Rhode Island Lottery are taxable under the provisions of the Rhode Island personal income tax (R.I. Gen. Laws § 44-30-1 et seq., as amended) and are includable in the income of both residents and nonresidents alike.

Withholding Tax on Gambling Winnings: If a must withhold for federal purposes, RI must withhold federal tax withheld multiplied by the Rhode Island personal income tax withholding rate in effect on the date of the payment. Rhode Island - American Gaming Association americangaming.org ? uploads ? 2019/07 americangaming.org ? uploads ? 2019/07

If you are a Rhode Island resident and you are required to file a federal return, you must also file a Rhode Island return. Even if you are not required to file a federal return, you may still have to file a Rhode Island return if your income exceeds the amount of your personal exemption. What are Rhode Island's Filing Requirements? - TaxSlayer Support taxslayer.com ? en-us ? articles ? 360015... taxslayer.com ? en-us ? articles ? 360015...

Rhode Island does not allow the use of federal itemized deductions. 2021 instructions for filing ri-1040 - RI Division of Taxation ri.gov ? sites ? files ? xkgbur541 ? files ri.gov ? sites ? files ? xkgbur541 ? files