This form is used when Lessor releases and discharges Lessee, and all its officers, directors, agents, employees, contractors, and their successors and assigns from any and all claims, demands, or causes of action arising from or growing out of all injuries or damages, if any, of every character, kind, and description sustained by Lessor personally, or to Lessor's property and lands, whether now apparent or known to Lessor, or which may later develop as the result of Lessee's Activities.

Rhode Island Release of Lessor's Claims Against Lessee Arising from Operations

Description

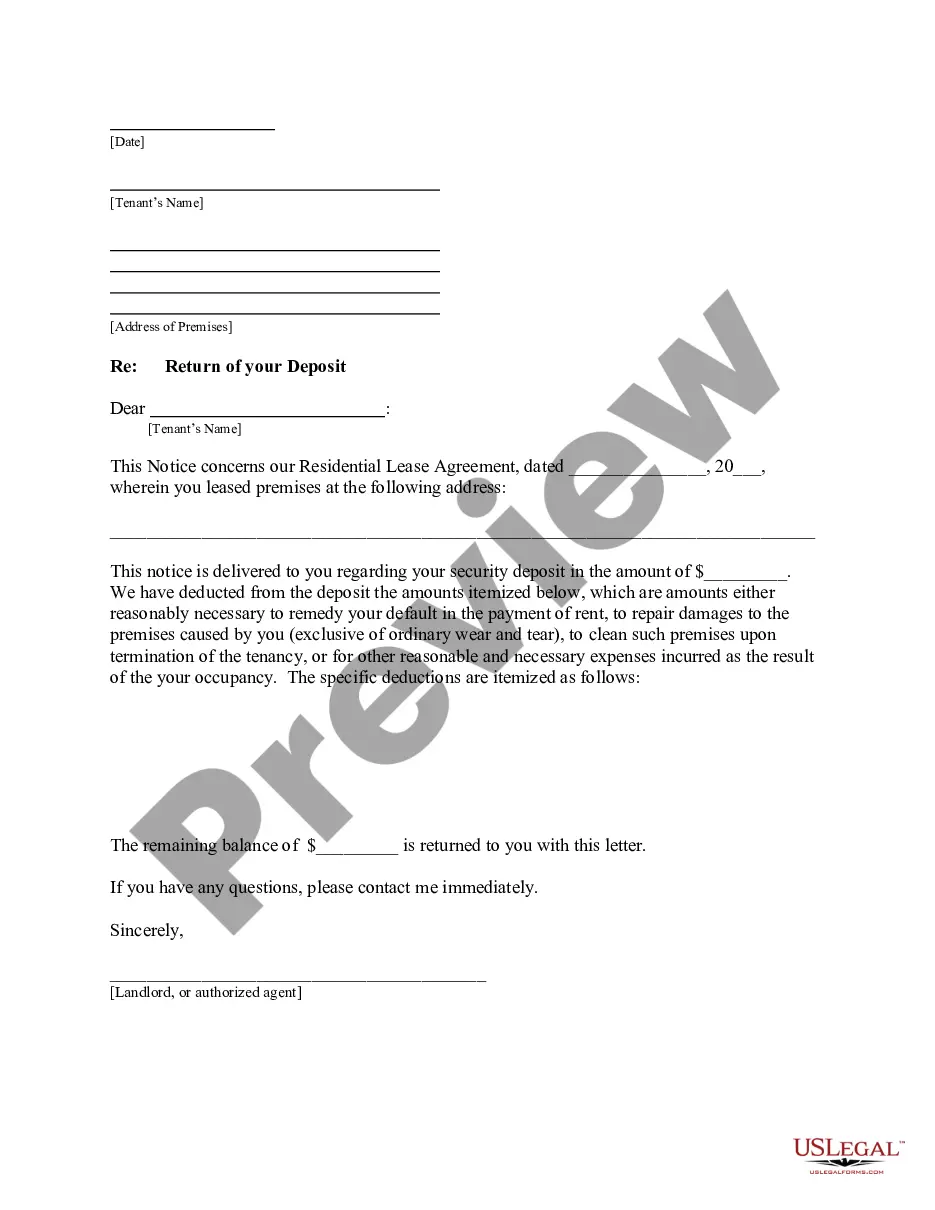

How to fill out Release Of Lessor's Claims Against Lessee Arising From Operations?

Choosing the best authorized file format can be quite a have difficulties. Obviously, there are plenty of templates available online, but how would you find the authorized form you want? Use the US Legal Forms website. The service delivers thousands of templates, for example the Rhode Island Release of Lessor's Claims Against Lessee Arising from Operations, that you can use for business and private needs. All of the varieties are examined by pros and satisfy federal and state demands.

When you are already authorized, log in for your profile and click on the Down load option to get the Rhode Island Release of Lessor's Claims Against Lessee Arising from Operations. Use your profile to search through the authorized varieties you might have acquired previously. Proceed to the My Forms tab of your respective profile and get yet another backup in the file you want.

When you are a new end user of US Legal Forms, listed here are easy instructions that you should stick to:

- Initial, ensure you have selected the proper form to your area/region. You can examine the form using the Review option and browse the form information to guarantee this is the best for you.

- When the form is not going to satisfy your requirements, use the Seach field to discover the correct form.

- When you are sure that the form would work, click the Buy now option to get the form.

- Pick the prices prepare you desire and enter in the needed information and facts. Create your profile and pay for the transaction with your PayPal profile or credit card.

- Opt for the file formatting and download the authorized file format for your product.

- Total, edit and printing and signal the attained Rhode Island Release of Lessor's Claims Against Lessee Arising from Operations.

US Legal Forms is definitely the greatest library of authorized varieties in which you can find a variety of file templates. Use the company to download skillfully-made documents that stick to express demands.

Form popularity

FAQ

The lessor will recognize lease revenue on a straight-line basis and account for any differences in cash received using a deferred rent receivable or a deposit liability account. The balance sheet will continue to display the operating lease assets separately, along with the associated accumulated depreciation. ASC 842 Guide to Operating Lease Journal Entries With NetLessor netgain.tech ? asc-842-operating-lease-journ... netgain.tech ? asc-842-operating-lease-journ...

Initial direct costs - these are the incremental costs of obtaining a lease that would not have been incurred if the lease had not been obtained. These might include costs such as finder's fees, commissions to agents for establishing the lease and up-front fees.

Under an operating lease, the lessor recognizes and depreciates the leased asset in its balance sheet. For the lessee, the lease payments are considered an operating cost on its income statement.

Operating Lease Accounting can be done by considering that the lessor owns the property and the lessee only uses it for a fixed time. The lessee records rental payments as expenses in the books of accounts. In contrast, the lessor records the property as an asset and depreciates it over its useful life.

By capitalizing an operating lease, a financial analyst is essentially treating the lease as debt. Both the lease and the asset acquired under the lease will appear on the balance sheet. The firm must adjust depreciation expenses to account for the asset and interest expenses to account for the debt.