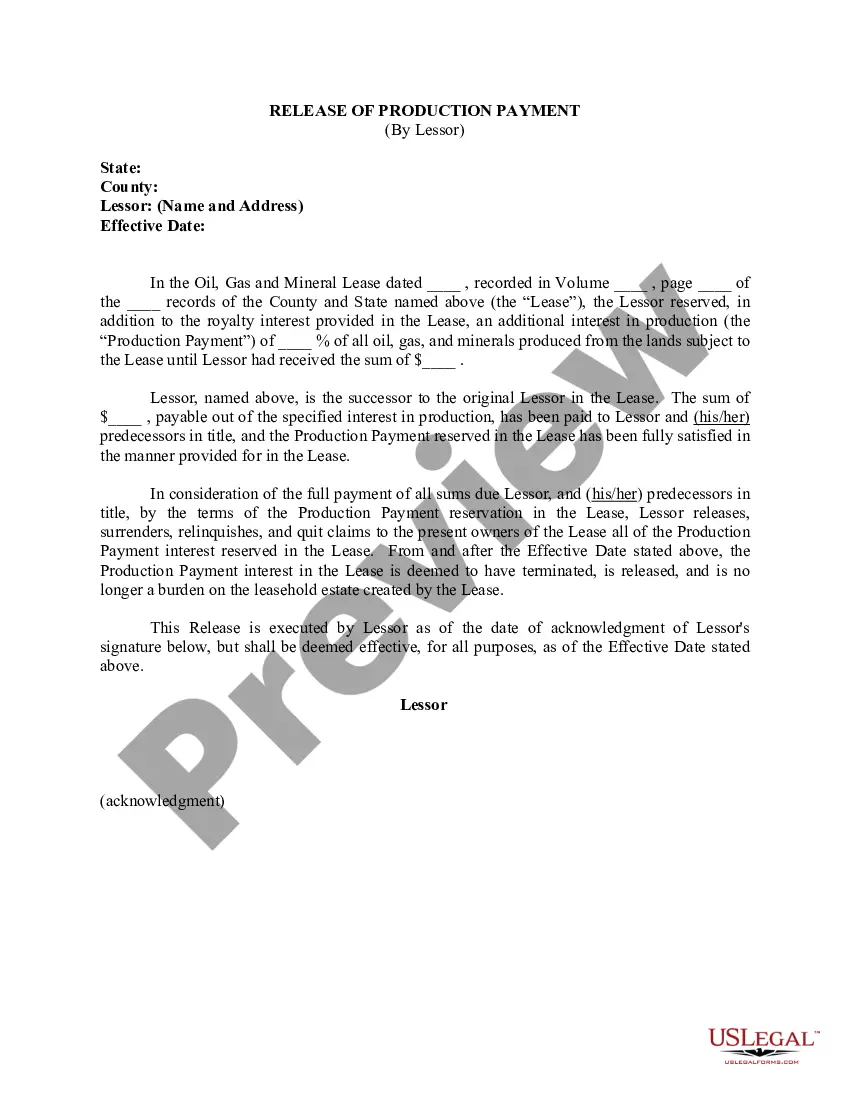

This form of release is used when Lessor releases, relinquishes, and quit claims to the present owners of the Lease all of a Production Payment interest. From and after the Effective Date, the Production Payment interest in the Lease is deemed to have terminated and is no longer a burden on the leasehold estate created by the Lease.

Rhode Island Release of Production Payment by Lessor

Description

How to fill out Release Of Production Payment By Lessor?

If you have to comprehensive, download, or printing authorized record templates, use US Legal Forms, the greatest selection of authorized varieties, that can be found online. Use the site`s easy and handy look for to find the files you will need. Numerous templates for company and personal functions are categorized by classes and states, or key phrases. Use US Legal Forms to find the Rhode Island Release of Production Payment by Lessor in just a handful of mouse clicks.

If you are presently a US Legal Forms buyer, log in to your bank account and then click the Down load switch to have the Rhode Island Release of Production Payment by Lessor. You may also accessibility varieties you in the past delivered electronically within the My Forms tab of your respective bank account.

Should you use US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Make sure you have selected the shape for the right area/region.

- Step 2. Utilize the Review solution to look through the form`s content material. Never forget about to learn the information.

- Step 3. If you are not satisfied with all the type, make use of the Search field towards the top of the display screen to locate other models in the authorized type web template.

- Step 4. After you have located the shape you will need, go through the Buy now switch. Opt for the rates plan you choose and add your accreditations to register on an bank account.

- Step 5. Process the financial transaction. You should use your credit card or PayPal bank account to complete the financial transaction.

- Step 6. Choose the formatting in the authorized type and download it on your system.

- Step 7. Total, edit and printing or sign the Rhode Island Release of Production Payment by Lessor.

Each authorized record web template you get is the one you have permanently. You have acces to every single type you delivered electronically with your acccount. Go through the My Forms segment and select a type to printing or download yet again.

Compete and download, and printing the Rhode Island Release of Production Payment by Lessor with US Legal Forms. There are thousands of specialist and state-particular varieties you can utilize for your personal company or personal requires.