Rhode Island Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest is a legal document used in the state of Rhode Island to outline specific provisions related to the conversion of an overriding royalty interest into a working interest for parties involved in oil and gas exploration and production. This document is crucial for individuals or companies seeking to exercise their rights and convert their interest in an oil and gas project. The Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest typically contains the following information: 1. Identifying Details: The document begins by providing necessary information such as the names and contact details of the parties involved, including the operator, the overriding royalty interest owner, and the working interest owner. 2. Description of the Agreement: The document outlines the existing agreement or lease that governs the relationship between the parties. It mentions the specific provisions that pertain to the conversion of overriding royalty interests to working interests. 3. Notice of Payout: This section highlights the threshold or condition that triggers the payout provision. It identifies the point at which the operator is required to notify the overriding royalty interest owner of the opportunity to convert. 4. Election to Convert: This section outlines the overriding royalty interest owner's election to convert their interest to a working interest. It specifies the date by which the election must be made and the manner in which it should be communicated. 5. Terms and Conditions: This part outlines the terms and conditions associated with the conversion, such as the allocation of costs, the percentage interest the overriding royalty interest owner will receive as a working interest, and any other considerations or adjustments. 6. Signatures and Notarization: The document concludes with signatures from all parties involved, acknowledging their agreement to the terms and conditions outlined in the Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest. It's important to note that there might not be different types of Rhode Island Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest. However, the content and terms within the document may vary depending on the specific agreement or lease in place, as well as the negotiation between the parties involved.

Rhode Island Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest

Description

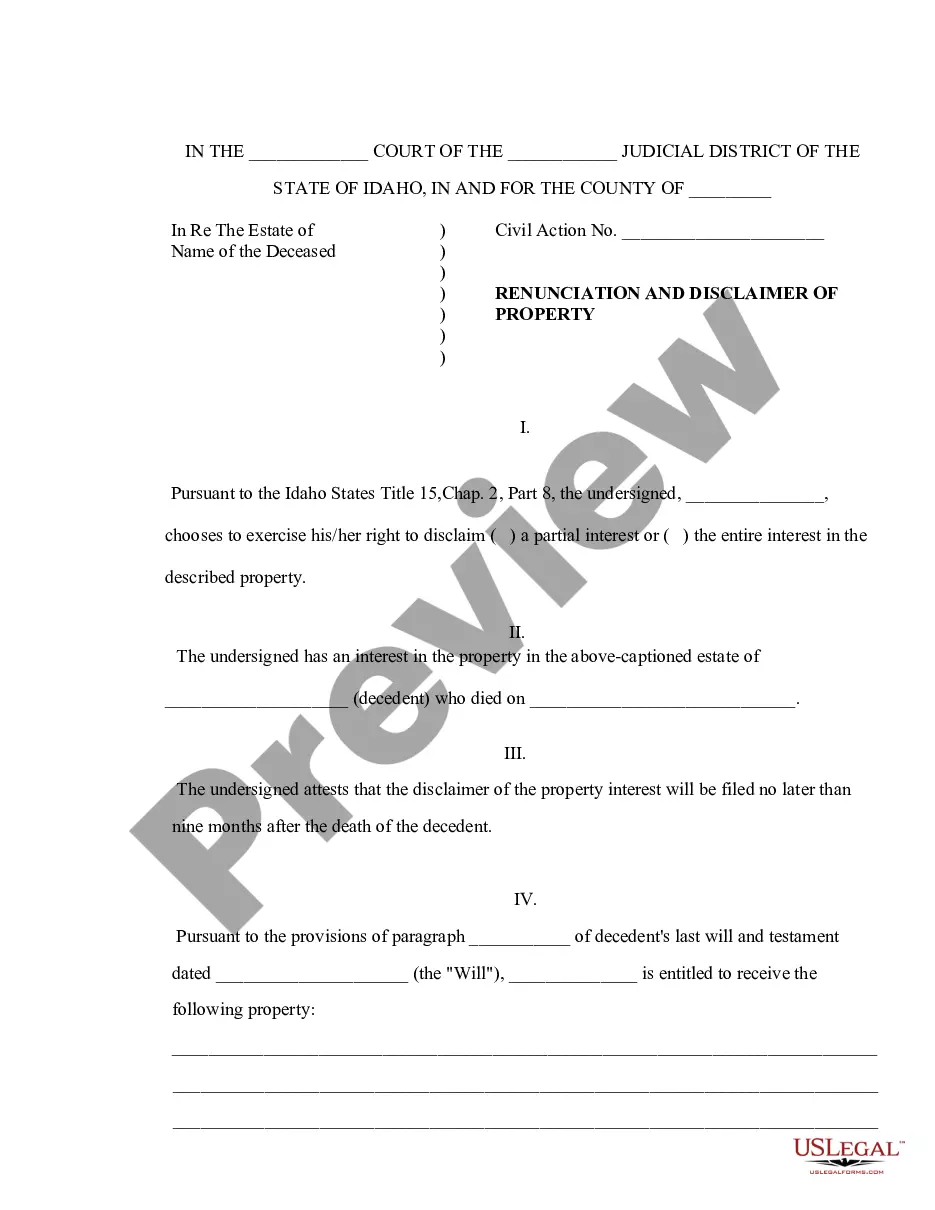

How to fill out Rhode Island Notice Of Payout, Election To Convert Interest To Party With Right To Convert An Overriding Royalty Interest To A Working Interest?

Are you currently inside a place in which you will need files for sometimes company or personal purposes nearly every day? There are tons of legitimate document layouts accessible on the Internet, but discovering ones you can rely isn`t straightforward. US Legal Forms provides a large number of form layouts, much like the Rhode Island Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest, that are published to satisfy state and federal demands.

In case you are presently acquainted with US Legal Forms website and also have a free account, basically log in. Next, you can download the Rhode Island Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest design.

If you do not have an accounts and wish to begin to use US Legal Forms, abide by these steps:

- Discover the form you will need and make sure it is for the correct metropolis/county.

- Take advantage of the Review key to examine the form.

- Read the explanation to ensure that you have chosen the right form.

- In the event the form isn`t what you`re trying to find, use the Lookup field to find the form that fits your needs and demands.

- If you get the correct form, just click Acquire now.

- Pick the costs strategy you want, complete the specified information to produce your account, and pay for the transaction using your PayPal or Visa or Mastercard.

- Select a convenient file file format and download your backup.

Get all of the document layouts you may have bought in the My Forms food list. You may get a extra backup of Rhode Island Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest whenever, if possible. Just click the necessary form to download or produce the document design.

Use US Legal Forms, probably the most extensive selection of legitimate types, in order to save time and prevent mistakes. The service provides professionally manufactured legitimate document layouts that can be used for an array of purposes. Produce a free account on US Legal Forms and initiate creating your way of life easier.

Form popularity

FAQ

Several things determine what the ORRI value is, including: Mineral interest location. One in a shale basin with high production is worth more. Producing oil and gas wells. Wells currently producing are valued more. ... Production reserves and levels. ... Prices.

As a mineral rights value rule of thumb, the 3X cash flow method is often used. To calculate mineral rights value, multiply the 12-month trailing cash flow by 3. For a property with royalty rights, a 5X multiple provides a more accurate valuation (stout.com).

How Do Overriding Royalty Interest Payments Work? The value of an overriding royalty interest is simple to calculate since it is a percent of the working interest lease. The ORRI value is based on production on the acreage leased by the working interest.

The value of non-producing minerals is usually determined by a price per net acre multiplier. This represents how much of the land is owned, and how much of that acreage is valuable.

Overriding Royalty Interest Conveyance means an assignment, in form and substance acceptable to Lender, pursuant to which Borrower grants in favor of Lender an overriding royalty interest equal to six and one-fourth percent (6.25%) of Hydrocarbons produced, saved and sold or used off the premises of the relevant Lease, ...

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

The ORRI lease holder's proportional share is based on the WI revenues after the royalty mineral owner receives their share. The RI holder's share of the working interest is typically 12.5?25 percent of the mineral reserves' revenue under the WI.

You may have noticed on your check stubs an ?owner interest? or ?net revenue interest? or a ?decimal interest?. The operator will then multiply your interest by the quantity of oil and gas produced and the current price to determine your oil and gas royalty payments.