Rhode Island Assignment of Overriding Royalty Interest (By Owner of Override)

Description

How to fill out Assignment Of Overriding Royalty Interest (By Owner Of Override)?

If you want to full, obtain, or produce legal document themes, use US Legal Forms, the biggest assortment of legal varieties, which can be found online. Make use of the site`s simple and easy hassle-free lookup to get the files you want. Different themes for business and specific uses are sorted by groups and states, or keywords. Use US Legal Forms to get the Rhode Island Assignment of Overriding Royalty Interest (By Owner of Override) within a few click throughs.

In case you are already a US Legal Forms buyer, log in in your bank account and click the Download key to get the Rhode Island Assignment of Overriding Royalty Interest (By Owner of Override). Also you can gain access to varieties you formerly acquired in the My Forms tab of your bank account.

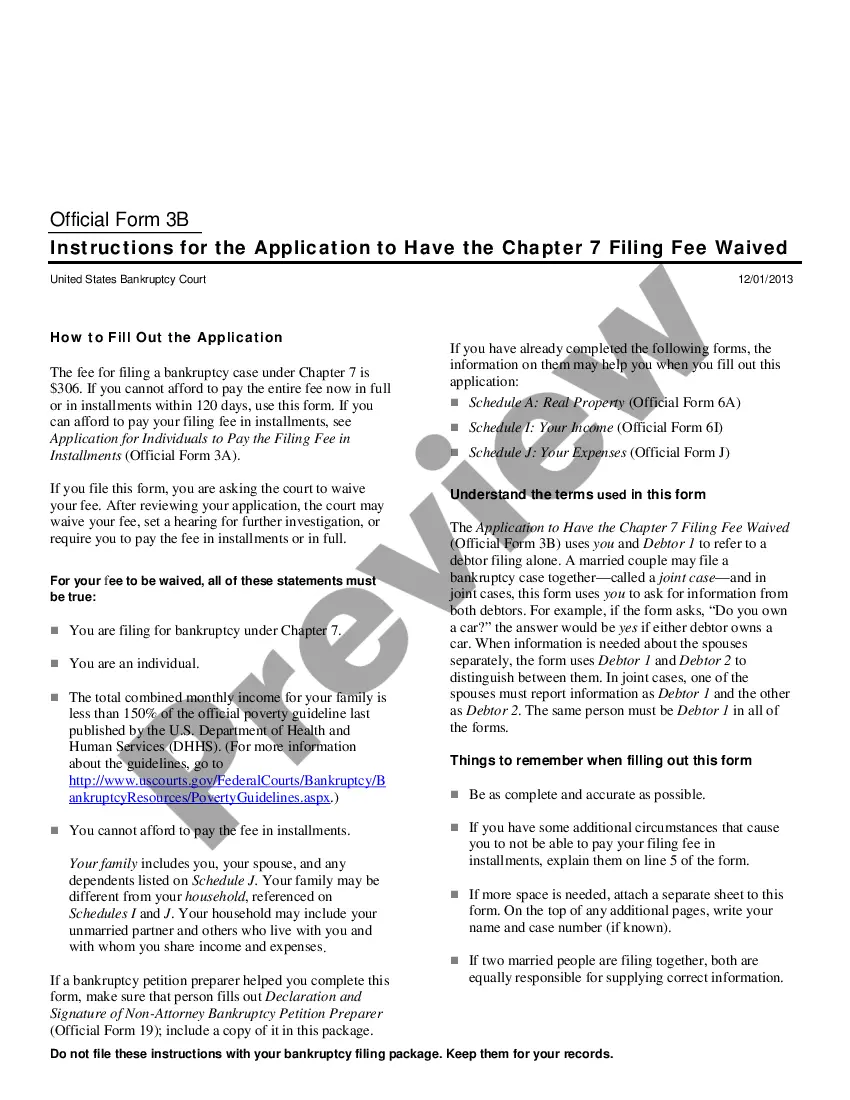

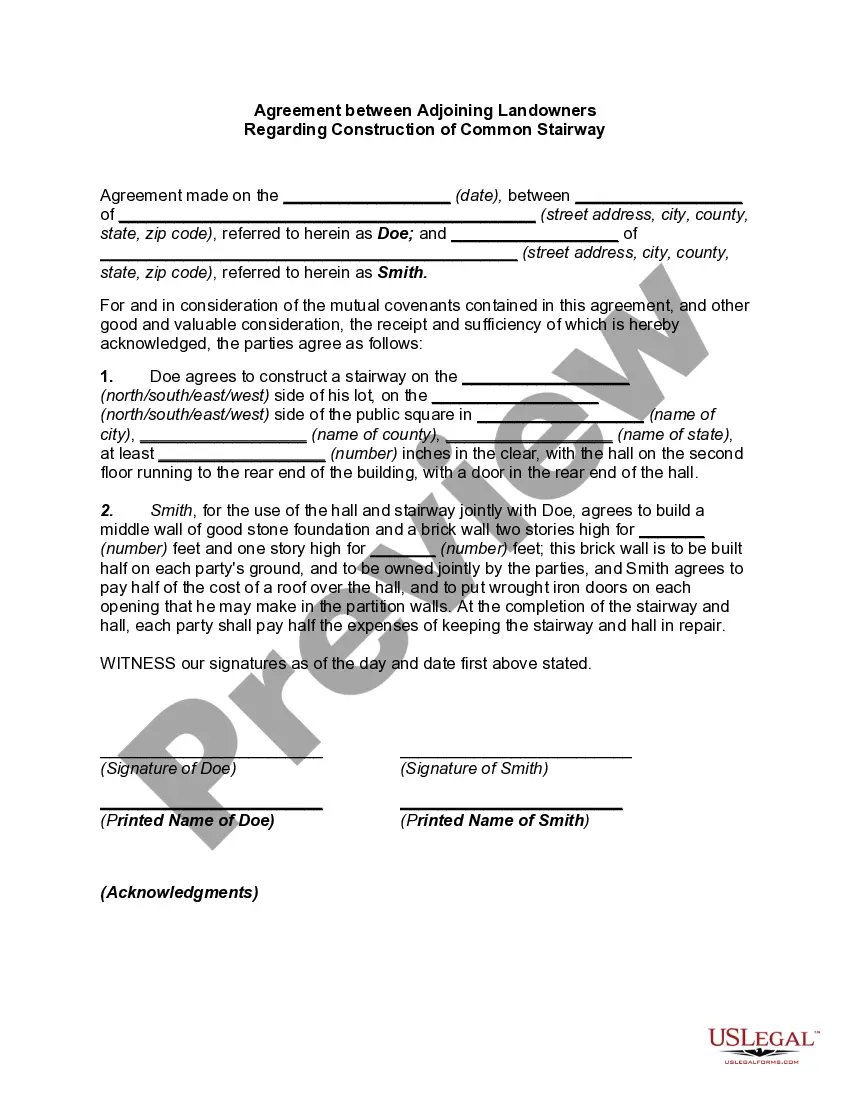

If you use US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the shape for that appropriate city/country.

- Step 2. Take advantage of the Review method to examine the form`s information. Don`t neglect to read the information.

- Step 3. In case you are unhappy using the form, take advantage of the Lookup field towards the top of the monitor to find other variations of the legal form format.

- Step 4. When you have located the shape you want, click on the Get now key. Select the costs strategy you favor and include your qualifications to sign up for an bank account.

- Step 5. Process the transaction. You should use your charge card or PayPal bank account to accomplish the transaction.

- Step 6. Choose the file format of the legal form and obtain it on your own product.

- Step 7. Full, edit and produce or indicator the Rhode Island Assignment of Overriding Royalty Interest (By Owner of Override).

Each legal document format you get is your own forever. You may have acces to each form you acquired in your acccount. Click on the My Forms area and select a form to produce or obtain once again.

Compete and obtain, and produce the Rhode Island Assignment of Overriding Royalty Interest (By Owner of Override) with US Legal Forms. There are thousands of skilled and status-distinct varieties you can use for your personal business or specific needs.

Form popularity

FAQ

Overriding Royalty Interest Conveyance means an assignment, in form and substance acceptable to Lender, pursuant to which Borrower grants in favor of Lender an overriding royalty interest equal to six and one-fourth percent (6.25%) of Hydrocarbons produced, saved and sold or used off the premises of the relevant Lease, ...

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

Several things determine what the ORRI value is, including: Mineral interest location. One in a shale basin with high production is worth more. Producing oil and gas wells. Wells currently producing are valued more. ... Production reserves and levels. ... Prices.

Transfer by deed: You can sell your mineral rights to another person or company by deed. Transfer by will: You can specify who you want to inherit your mineral rights in your will. Transfer by lease: You can lease mineral rights to a third party through a lease agreement.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.