Rhode Island Assignment of Promissory Note & Liens

Description

How to fill out Assignment Of Promissory Note & Liens?

Are you within a place the place you require papers for either organization or specific reasons nearly every day? There are plenty of legitimate document templates available on the Internet, but finding types you can rely is not effortless. US Legal Forms offers a huge number of form templates, like the Rhode Island Assignment of Promissory Note & Liens, which can be published in order to meet state and federal specifications.

In case you are already informed about US Legal Forms internet site and have a merchant account, simply log in. After that, you can obtain the Rhode Island Assignment of Promissory Note & Liens web template.

Should you not offer an accounts and want to start using US Legal Forms, follow these steps:

- Get the form you will need and make sure it is for your appropriate city/state.

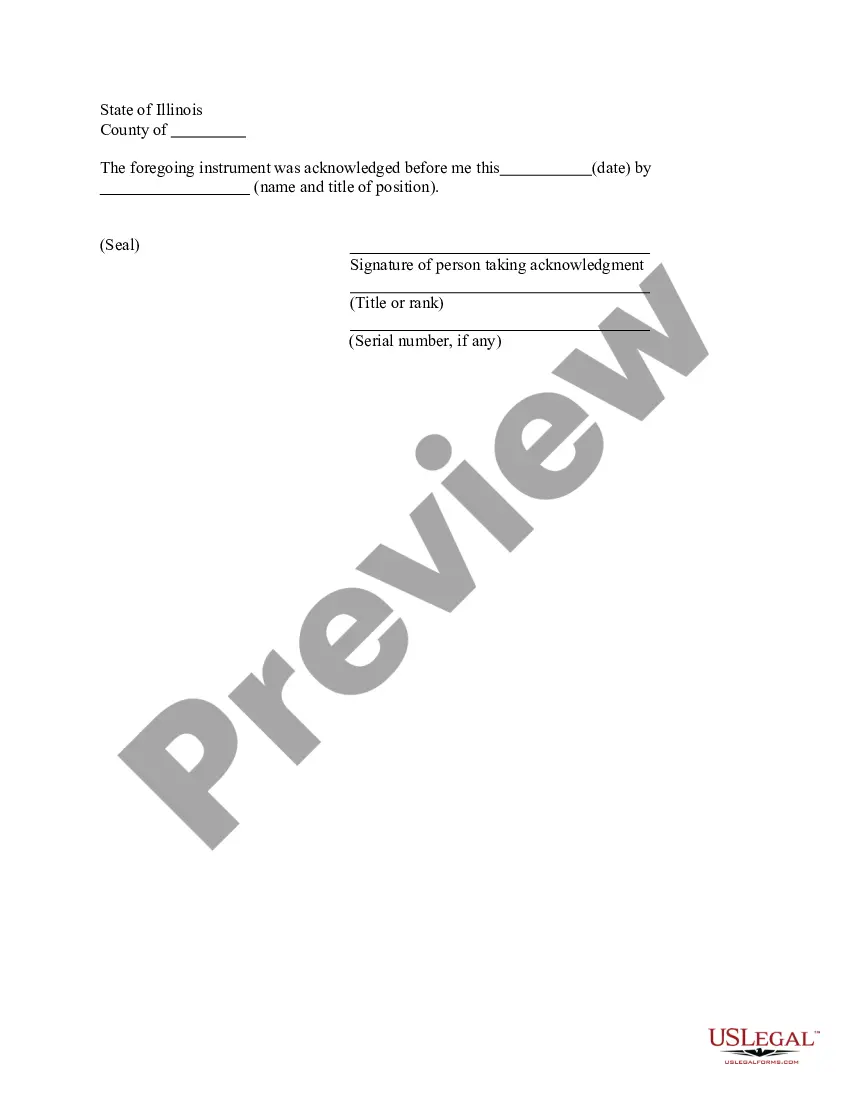

- Make use of the Review switch to examine the form.

- Read the information to ensure that you have chosen the correct form.

- In the event the form is not what you`re seeking, make use of the Search discipline to obtain the form that fits your needs and specifications.

- Once you obtain the appropriate form, just click Buy now.

- Opt for the rates prepare you would like, fill out the desired info to generate your bank account, and pay money for the transaction utilizing your PayPal or credit card.

- Pick a practical document file format and obtain your copy.

Discover all of the document templates you have bought in the My Forms food selection. You can aquire a extra copy of Rhode Island Assignment of Promissory Note & Liens any time, if possible. Just go through the required form to obtain or produce the document web template.

Use US Legal Forms, one of the most substantial assortment of legitimate varieties, to save lots of efforts and steer clear of mistakes. The assistance offers expertly manufactured legitimate document templates which can be used for a selection of reasons. Produce a merchant account on US Legal Forms and commence creating your way of life easier.

Form popularity

FAQ

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

A promissory note typically contains all the terms involved, such as the principal debt amount, interest rate, maturity date, payment schedule, the date and place of issuance, and the issuer's signature.

Before a promissory note can be canceled, the lender must agree to the terms of canceling it. A well-drafted and detailed promissory note can help the parties involved avoid future disputes, misunderstandings, and confusion. When canceling the promissory note, the process is referred to as a release of the note.

A promissory note could become invalid if: It isn't signed by both parties. The note violates laws. One party tries to change the terms of the agreement without notifying the other party.

An unconditional promise to pay a certain amount of money to a named party or the holder of the note, or to deposit that money as such persons direct. A promissory note must be in writing and signed by the maker of the promise.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

To be legally enforceable, a promissory note must meet multiple legal conditions. Moreover, it must contain both an offer of agreement and an acceptance of agreement. All contracts state the type of services or goods rendered and indicate how much they cost.

When you are applying for a loan to purchase a home, the lender may require you to sign a promissory note and a mortgage or a deed of trust. In the event that your loan is sold to another party, these documents will be transferred to the new owner with an assignment and an endorsement.