Rhode Island Discounts, Credits & Tubular: Rhode Island Discounts, Credits & Tubular refer to various money-saving programs, incentives, and promotions available to residents and businesses in the state of Rhode Island. These programs aim to provide financial relief, stimulate economic growth, and encourage sustainable practices. Here are some key components of Rhode Island Discounts, Credits & Tubular: 1. Energy Efficiency Programs: Rhode Island offers numerous energy efficiency programs to residents and businesses, including discounted rates on energy-efficient appliances, rebates on energy-efficient upgrades, and tax credits for renewable energy installations like solar panels or geothermal systems. 2. Tax Relief & Credits: Rhode Island provides various tax relief measures and credits to eligible individuals and businesses. These include property tax relief programs for seniors or disabled citizens, historic preservation tax credits for property owners who restore historically significant buildings, and film tax credits to attract movie productions to the state. 3. Local Business Discounts: Rhode Island encourages residents to support local businesses by offering discounts and incentives. Some cities or towns may provide discount cards or loyalty programs that grant exclusive deals, promotions, or special events in participating local stores, restaurants, or attractions. 4. Educational Credits: Rhode Island offers several educational credits to help lessen the burden of education-related expenses. Residents may be eligible for tax credits or deductions for higher education tuition, student loan interest, or contributions to a College Board Saver account, which is a tax-advantaged college savings plan. 5. Transportation Discounts: Residents of Rhode Island can avail themselves of various transportation discounts. The state offers discounted fares for seniors or disabled individuals on public transportation services like buses and trains. Additionally, some cities may have bike-sharing programs or carpooling incentives, promoting eco-friendly and cost-effective commuting options. 6. Tourism and Cultural Discounts: To encourage tourism and promote the state's cultural heritage, Rhode Island provides discounts or free admission to its museums, historical sites, and parks. These savings may be available to residents or visitors, allowing them to explore the state's rich history, natural beauty, and vibrant arts scene at a lower cost. By actively participating in these Rhode Island Discounts, Credits & Tubular, individuals and businesses can enjoy financial benefits, support local communities, conserve energy resources, and contribute to the state's overall growth and development. Make sure to visit official Rhode Island government websites or contact relevant authorities to gather accurate and up-to-date information on these programs as eligibility criteria and offerings may vary over time.

Rhode Island Discounts, Credits & Tubulars

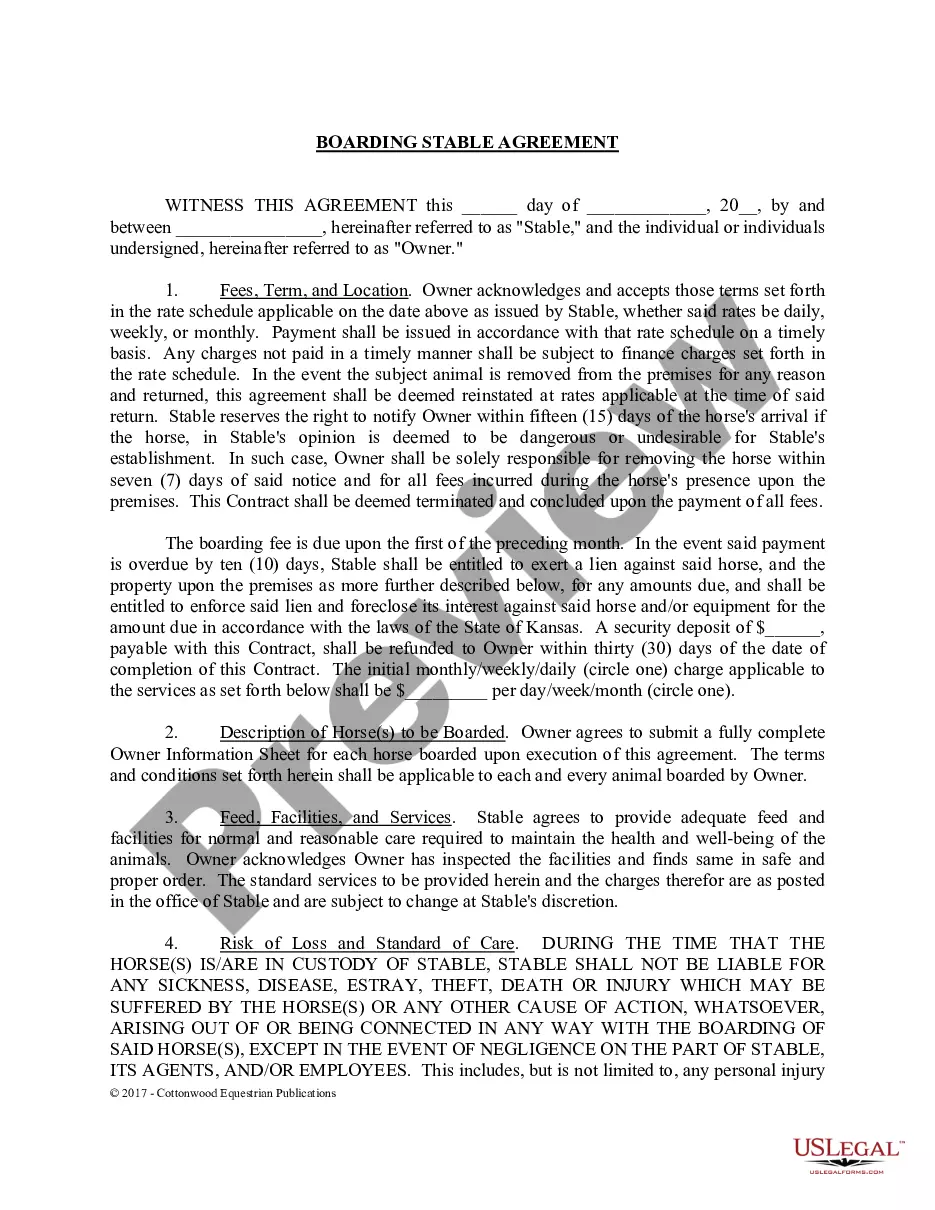

Description

How to fill out Rhode Island Discounts, Credits & Tubulars?

US Legal Forms - one of several largest libraries of authorized types in the USA - gives an array of authorized file templates it is possible to acquire or printing. Utilizing the internet site, you will get thousands of types for organization and person reasons, sorted by classes, says, or search phrases.You can find the most up-to-date models of types like the Rhode Island Discounts, Credits & Tubulars within minutes.

If you have a registration, log in and acquire Rhode Island Discounts, Credits & Tubulars from the US Legal Forms library. The Acquire switch will show up on each and every form you perspective. You gain access to all previously saved types from the My Forms tab of your bank account.

If you would like use US Legal Forms the very first time, here are easy guidelines to help you started out:

- Be sure to have selected the right form for your personal area/county. Go through the Review switch to review the form`s articles. Browse the form explanation to ensure that you have selected the appropriate form.

- In case the form does not suit your requirements, take advantage of the Look for discipline near the top of the screen to obtain the one that does.

- Should you be happy with the shape, validate your option by clicking the Acquire now switch. Then, select the prices program you prefer and provide your credentials to sign up on an bank account.

- Procedure the deal. Make use of credit card or PayPal bank account to finish the deal.

- Select the formatting and acquire the shape on your own product.

- Make alterations. Load, revise and printing and sign the saved Rhode Island Discounts, Credits & Tubulars.

Each design you included with your bank account does not have an expiry particular date and it is your own property eternally. So, if you want to acquire or printing yet another copy, just visit the My Forms area and then click about the form you require.

Get access to the Rhode Island Discounts, Credits & Tubulars with US Legal Forms, the most considerable library of authorized file templates. Use thousands of expert and state-certain templates that meet up with your organization or person requires and requirements.