Rhode Island Clauses Relating to Venture Interests

Description

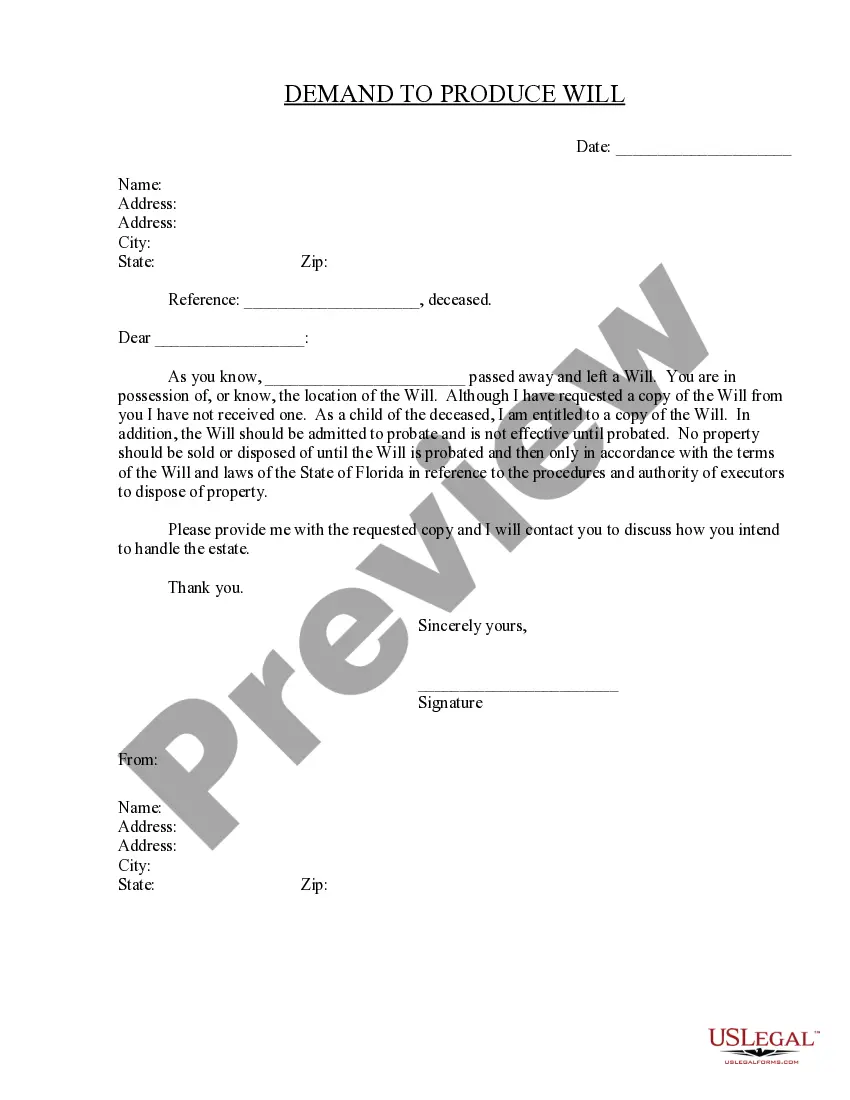

How to fill out Clauses Relating To Venture Interests?

US Legal Forms - one of several greatest libraries of legal kinds in America - offers a wide range of legal file layouts you may obtain or print out. Making use of the web site, you can find thousands of kinds for enterprise and individual reasons, sorted by groups, states, or search phrases.You will find the newest variations of kinds just like the Rhode Island Clauses Relating to Venture Interests within minutes.

If you have a subscription, log in and obtain Rhode Island Clauses Relating to Venture Interests through the US Legal Forms library. The Down load key can look on every single form you perspective. You have accessibility to all in the past delivered electronically kinds within the My Forms tab of your bank account.

If you would like use US Legal Forms initially, allow me to share easy guidelines to help you began:

- Ensure you have picked out the best form to your metropolis/region. Select the Review key to review the form`s content material. Browse the form information to ensure that you have selected the proper form.

- If the form doesn`t suit your specifications, make use of the Search field at the top of the display screen to obtain the the one that does.

- In case you are content with the form, affirm your decision by clicking the Buy now key. Then, choose the costs plan you prefer and give your credentials to register for the bank account.

- Method the purchase. Make use of your charge card or PayPal bank account to accomplish the purchase.

- Pick the formatting and obtain the form in your system.

- Make modifications. Load, edit and print out and indicator the delivered electronically Rhode Island Clauses Relating to Venture Interests.

Every format you included with your bank account does not have an expiration particular date and is also the one you have eternally. So, if you wish to obtain or print out yet another duplicate, just go to the My Forms area and click on on the form you need.

Obtain access to the Rhode Island Clauses Relating to Venture Interests with US Legal Forms, the most comprehensive library of legal file layouts. Use thousands of professional and express-specific layouts that fulfill your small business or individual requirements and specifications.

Form popularity

FAQ

Welcome to OSP! Ocean State ProcuresTM (?OSP?) is the State of Rhode Island's eProcurement system currently in use for vendor registration, solicitations, and awards.

Colony of Rhode Island and Providence PlantationsFlag SealCapitalProvidence, NewportLanguagesEnglish, Narragansett, MassachusettGovernmentSelf-governing colony (1636?1651; 1653?1776) Proprietary colony (1651?1653)25 more rows

(1) The offer is fully responsive to the terms and conditions of the Request; (2) The price offer is determined to be within a competitive range (not to exceed 5% higher than the lowest responsive price offer) for the product or service; (3) The firm making the offer has been certified by the R.I.

In this rule: (1) "Attorney-client privilege" means the protection that applicable law provides for confidential attorney-client communications; (2) "Work-product protection" means the protection that applicable law provides for tangible material (or its intangible equivalent) prepared in anticipation of litigation or ...

For a state that is only 37 miles wide and 48 miles long, it is notable that its shoreline on Narragansett Bay in the Atlantic Ocean runs for 400 miles. Indeed, one of Rhode Island's nicknames is "the Ocean State." The legendary mansions of Newport overlook the ocean at Narragansett Bay.