Rhode Island Clauses Relating to Venture IPO: A Detailed Description In the realm of venture capital and initial public offerings (IPOs), Rhode Island has enforced specific clauses to protect both investors and the interests of local businesses. These clauses aim to regulate the IPO process, addressing important aspects such as disclosures, registration requirements, and accountability. Below, we describe the various types of Rhode Island Clauses Relating to Venture IPO: 1. Disclosure Clause: The disclosure clause is a fundamental aspect of Rhode Island's venture IPO clauses. It mandates that companies seeking to go public must provide comprehensive and accurate information about their financial status, business operations, and future prospects. This clause is crucial in ensuring that potential investors have access to transparent and reliable information before making investment decisions. 2. Registration Requirement Clause: Rhode Island's registration requirement clause necessitates that companies intending to conduct an IPO must register with the appropriate regulatory authorities, such as the Rhode Island Department of Business Regulation. The registration process serves as a key mechanism to monitor and supervise IPOs, ensuring compliance with relevant laws and regulations. 3. Anti-Fraud Clause: To safeguard investors, Rhode Island incorporates an anti-fraud clause in its venture IPO regulations. This clause prohibits any fraudulent or misleading activities during the IPO phase, imposing penalties for individuals or entities engaging in such practices. With this clause, Rhode Island aims to enhance investor confidence and maintain the integrity of the IPO market. 4. Due Diligence Clause: Rhode Island's due diligence clause emphasizes the need for thorough research and investigation by both companies and investors before engaging in an IPO. It encourages potential investors to review the company's prospectus, financial statements, and other relevant documents carefully. Moreover, this clause reminds companies of their responsibility to conduct due diligence on any assertions made in their offering materials to avoid misrepresentation. 5. Transparency Clause: The transparency clause in Rhode Island's venture IPO regulations focuses on ensuring that investors are informed and aware of any changes or material events occurring before, during, or after an IPO. Companies are required to promptly disclose any significant developments that could impact their financial position, operations, or prospects. This clause encourages a high level of transparency and fosters trust between companies and investors. 6. Promoter's Clause (Optional): Some Rhode Island IPO clauses may include a promoter's clause, which outlines the responsibilities, obligations, and limitations of the promoters involved in the IPO process. This clause aims to regulate the behavior of promoters, minimizing conflicts of interest and protecting the rights of investors. By implementing these clauses, Rhode Island seeks to create a favorable environment for venture IPOs, promoting fair practices, transparency, and investor protection. Investors can confidently explore new investment opportunities, while companies benefit from a streamlined and regulated IPO process.

Rhode Island Clauses Relating to Venture IPO

Description

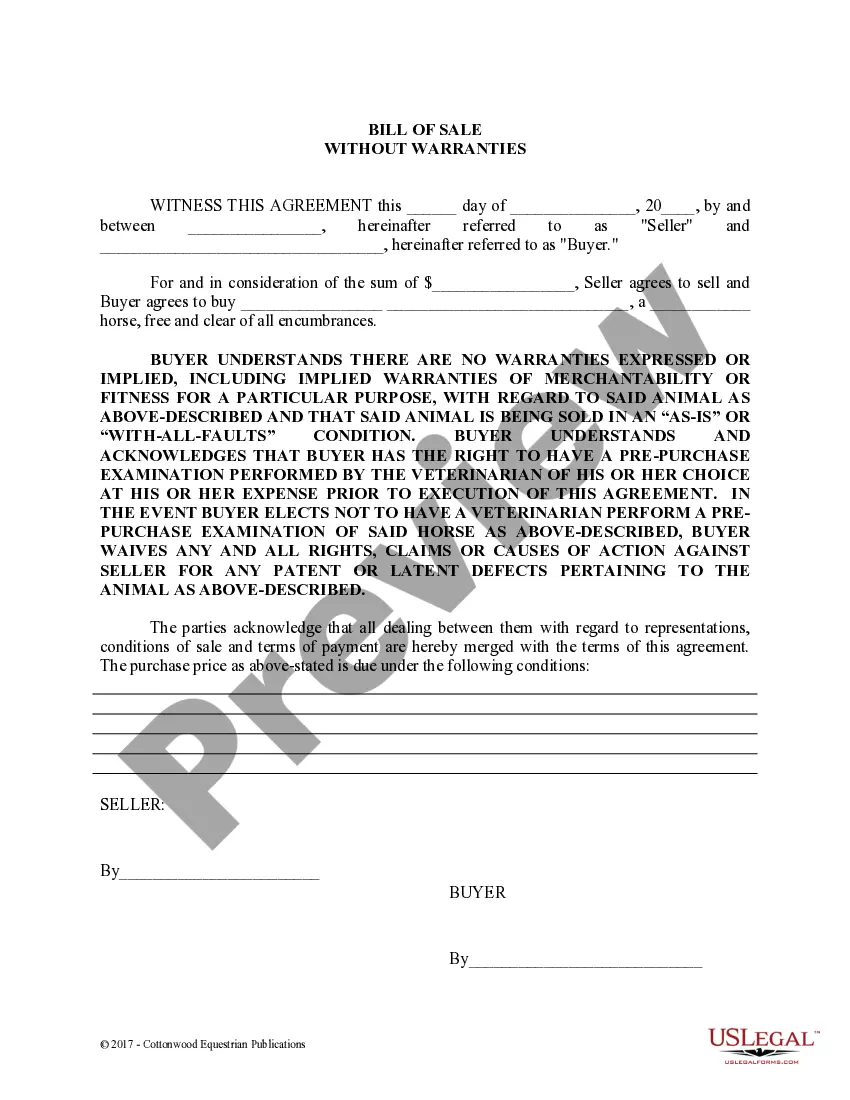

How to fill out Rhode Island Clauses Relating To Venture IPO?

Are you presently in the position that you will need papers for possibly business or individual reasons almost every working day? There are a variety of legal papers templates available online, but getting ones you can rely is not simple. US Legal Forms provides thousands of type templates, like the Rhode Island Clauses Relating to Venture IPO, that are published to meet state and federal requirements.

Should you be currently acquainted with US Legal Forms internet site and possess your account, merely log in. After that, you may acquire the Rhode Island Clauses Relating to Venture IPO format.

Should you not offer an profile and would like to begin using US Legal Forms, adopt these measures:

- Get the type you want and ensure it is for that right city/region.

- Utilize the Review option to examine the shape.

- Browse the explanation to actually have selected the appropriate type.

- When the type is not what you are looking for, make use of the Search industry to discover the type that meets your needs and requirements.

- When you find the right type, simply click Acquire now.

- Select the pricing strategy you would like, complete the required information and facts to create your account, and buy the transaction using your PayPal or Visa or Mastercard.

- Select a hassle-free paper structure and acquire your version.

Find each of the papers templates you might have purchased in the My Forms food selection. You can aquire a more version of Rhode Island Clauses Relating to Venture IPO any time, if possible. Just select the required type to acquire or printing the papers format.

Use US Legal Forms, one of the most considerable collection of legal varieties, in order to save time as well as steer clear of faults. The assistance provides expertly created legal papers templates that you can use for a selection of reasons. Make your account on US Legal Forms and begin generating your daily life easier.