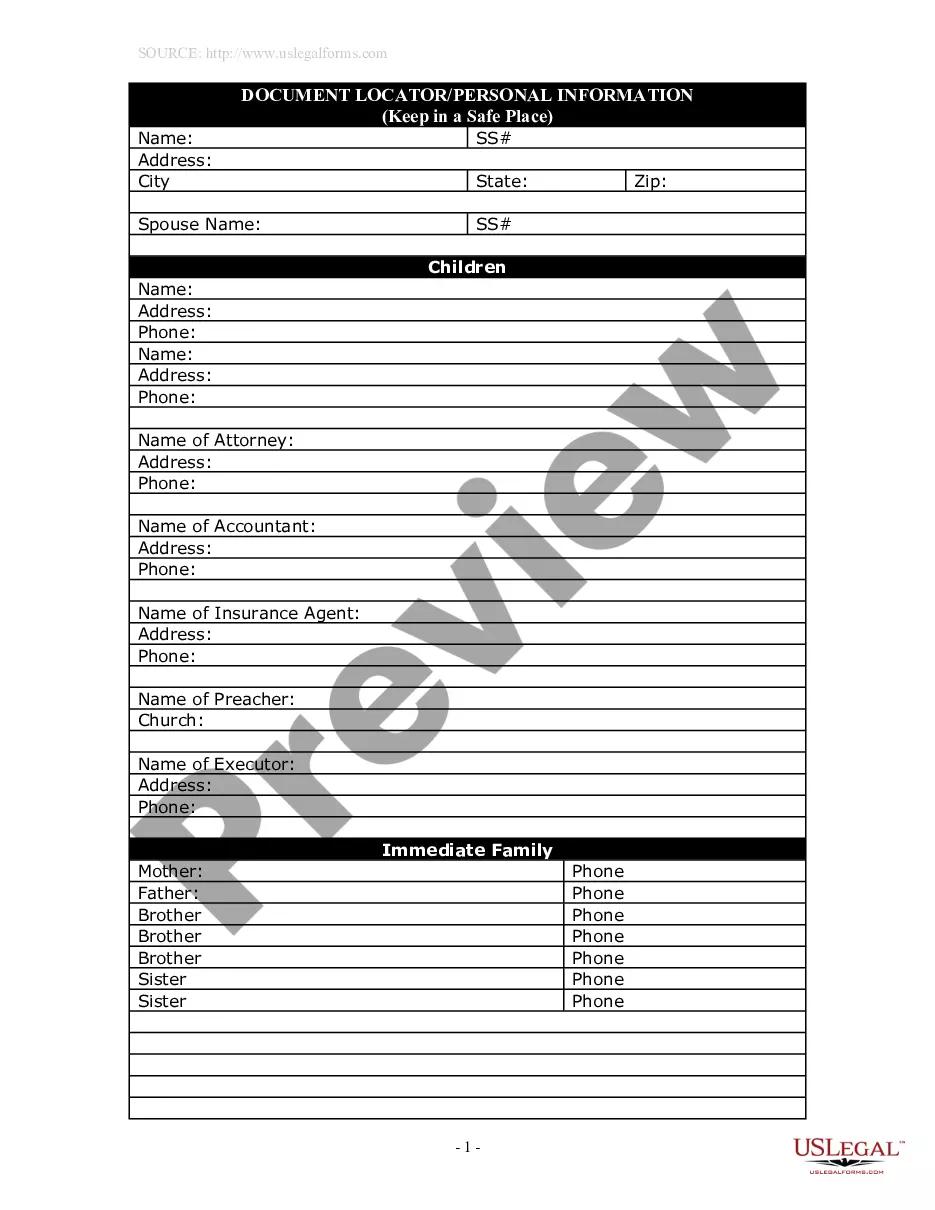

This pamphlet provides an overview on dealing with a lost will of a deceased person. Topics covered include suggestions for locating the will, how to probate a copy of a lost will, and how to prove the contents of a lost will.

Rhode Island USLegal Pamphlet on Lost Wills

Description

How to fill out Rhode Island USLegal Pamphlet On Lost Wills?

Discovering the right legitimate file format could be a have difficulties. Obviously, there are a variety of web templates available on the Internet, but how do you obtain the legitimate form you want? Utilize the US Legal Forms site. The support offers a huge number of web templates, such as the Rhode Island USLegal Pamphlet on Lost Wills, which can be used for enterprise and personal requirements. All the types are checked out by pros and meet up with federal and state demands.

In case you are currently authorized, log in to the bank account and click the Download option to have the Rhode Island USLegal Pamphlet on Lost Wills. Use your bank account to check from the legitimate types you possess bought earlier. Go to the My Forms tab of your bank account and acquire an additional duplicate of the file you want.

In case you are a brand new end user of US Legal Forms, listed here are simple guidelines so that you can adhere to:

- First, make sure you have selected the correct form for the city/county. You can look over the form using the Preview option and read the form information to make sure this is the right one for you.

- In case the form does not meet up with your preferences, take advantage of the Seach industry to find the proper form.

- When you are certain the form is suitable, click the Buy now option to have the form.

- Choose the pricing program you desire and enter the essential details. Design your bank account and purchase your order making use of your PayPal bank account or bank card.

- Select the submit file format and down load the legitimate file format to the device.

- Comprehensive, edit and print and signal the acquired Rhode Island USLegal Pamphlet on Lost Wills.

US Legal Forms will be the largest library of legitimate types where you can discover different file web templates. Utilize the company to down load appropriately-created papers that adhere to state demands.

Form popularity

FAQ

No probate is necessary. Joint tenancy often works well when couples (married or not) acquire real estate, vehicles, bank accounts or other valuable property together. In Rhode Island, each owner, called a joint tenant, must own an equal share. Tenancy by the entirety.

Technically, you only have the legal right to see the Will once the Grant of Probate is issued and it becomes a public document. This means if you were to ask to see the Will before then, the executors could theoretically refuse.

In Rhode Island, you can use a summary probate procedure as long as there's no real estate and probatable property is valued at less than $15,000. Note, Rhode Island doesn't have an Affidavit procedure for small estates.

If you can't find a will, you will usually have to deal with the estate of the person who has died as if they died without leaving a will. For more information, see Who can inherit if there is no will the rules of intestacy.

They're legally bound to follow the wishes in the Will and administer the Estate in a lawful way. If they fail to do so without a valid reason, Beneficiaries can ask the Court to remove them as an Executor.

The best way to avoid probate in Rhode Island is to place the estate in a living trust. With a living trust, the assets will pass to the named beneficiary when the owner dies without going through the probate process.

How does the executor's year work? The executors have a number of duties to both creditors and beneficiaries during the administration of the deceased's estate. Starting from the date of death, the executors have 12 months before they have to start distributing the estate.

Probate in Rhode Island will take at least six months, and the filing of both state and federal tax returns (if required) are due no later than nine months after the estate owner's passing. Of course, the entire process can take much longer to complete for very complex or large estates.

As an Executor, you should ideally wait 10 months from the date of the Grant of Probate before distributing the estate.

If disputes arise the court will hear testimony at a hearing and decide how to settle the disputes. How long does probate take? An estate must be opened for at least six months, because Rhode Island law gives creditors that period of time to file their claims with an estate.