This non-employee director option agreement grants the optionee (the non-employee director) a non-qualified stock option under the company's non-employee director stock option plan. The option allows optionee to purchase shares of the company's common stock up to the number of shares listed in the agreement.

Rhode Island Non Employee Director Stock Option Agreement

Description

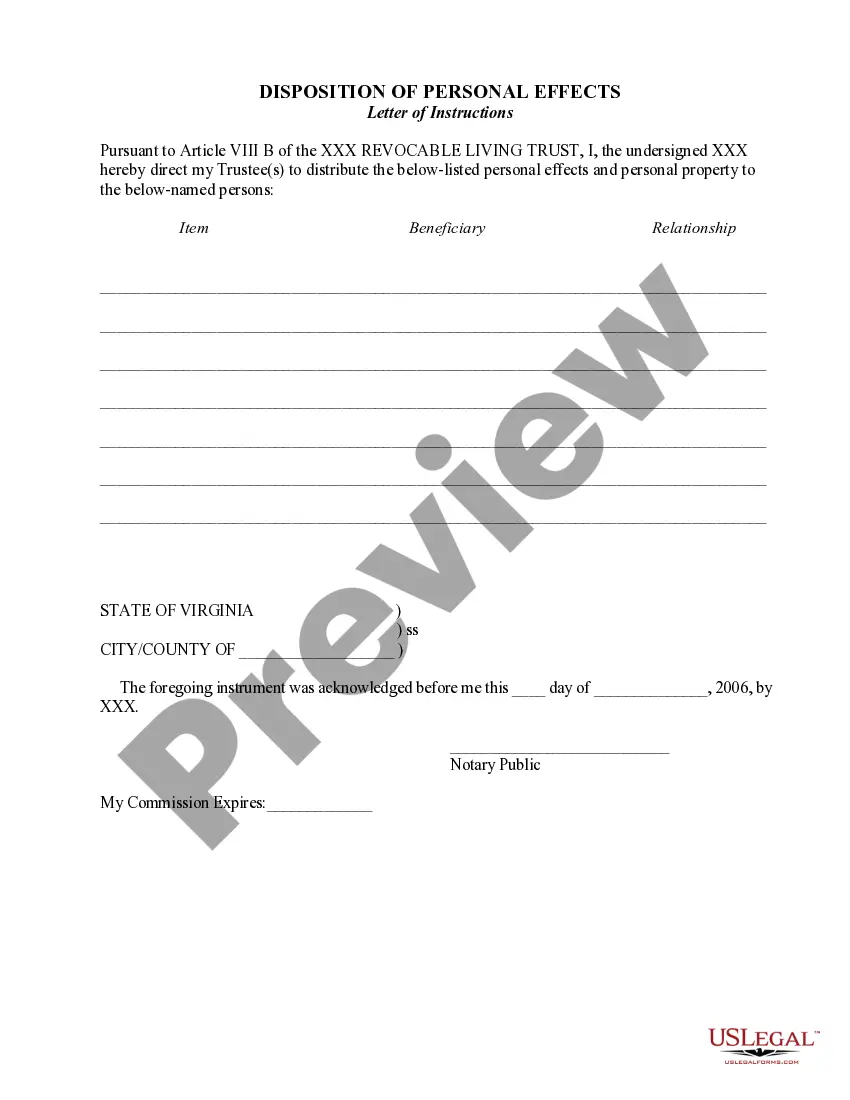

How to fill out Non Employee Director Stock Option Agreement?

If you need to complete, obtain, or print out legal papers themes, use US Legal Forms, the greatest variety of legal kinds, that can be found online. Make use of the site`s easy and hassle-free research to find the files you require. Different themes for enterprise and individual reasons are categorized by groups and suggests, or keywords. Use US Legal Forms to find the Rhode Island Non Employee Director Stock Option Agreement in a number of mouse clicks.

When you are already a US Legal Forms consumer, log in to your accounts and then click the Download key to get the Rhode Island Non Employee Director Stock Option Agreement. Also you can entry kinds you in the past delivered electronically in the My Forms tab of your accounts.

If you work with US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have chosen the shape to the appropriate area/nation.

- Step 2. Use the Review solution to examine the form`s articles. Do not neglect to see the description.

- Step 3. When you are unhappy with all the kind, utilize the Research field on top of the screen to get other types from the legal kind design.

- Step 4. After you have discovered the shape you require, click on the Acquire now key. Select the rates prepare you favor and add your accreditations to sign up for an accounts.

- Step 5. Approach the purchase. You can utilize your charge card or PayPal accounts to perform the purchase.

- Step 6. Pick the formatting from the legal kind and obtain it on the gadget.

- Step 7. Comprehensive, modify and print out or sign the Rhode Island Non Employee Director Stock Option Agreement.

Each legal papers design you get is your own property forever. You might have acces to every kind you delivered electronically with your acccount. Go through the My Forms area and choose a kind to print out or obtain once more.

Compete and obtain, and print out the Rhode Island Non Employee Director Stock Option Agreement with US Legal Forms. There are millions of specialist and status-certain kinds you can utilize for the enterprise or individual requirements.

Form popularity

FAQ

Stock options are a form of equity compensation that allows an employee to buy a specific number of shares at a pre-set price. Many startups, private companies, and corporations will include them as part of a compensation plan for prospective employees.

NSOs. NSOs can be offered to anyone affiliated with your company, including independent contractors, investors and directors. If an employee disqualifies themselves from the terms of an ISO, their stock options are then treated as an NSO.

A share option is a contract issued to an employee (or another stakeholder) giving them the right to purchase shares in a company at a later date for a predetermined strike price.

There are two main types of ESO: Incentive stock options (ISOs), also known as statutory or qualified options, are generally only offered to key employees and top management. ... Non-qualified stock options (NSOs) can be granted to employees at all levels of a company, as well as to board members and consultants.

Employee stock options are offered by companies to their employees as equity compensation plans. These grants come in the form of regular call options and give an employee the right to buy the company's stock at a specified price for a finite period of time.

Stock options are a financial investment where an employee can purchase shares in a company at a preset time and price. Instead of giving away shares directly, employers give their employees the option to acquire a certain number of shares at a discounted rate.

Qualified stock options, also known as incentive stock options, can only be granted to employees. Non-qualified stock options can be granted to employees, directors, contractors and others. This gives you greater flexibility to recognize the contributions of non-employees.

Allotment of ESOP Grant: Grant means the issue of stocks to the employees. It means informing the employee that he is eligible for ESOP. ... Vest: Vest means the right of the employees to apply for the shares granted to them. ... Exercise: The exercise period is where the employees can exercise the option of buying the shares.