Rhode Island Last Will and Testament with All Property to Trust called a Pour Over Will

Description Last Will Trust

How to fill out Rhode Island Last Will And Testament With All Property To Trust Called A Pour Over Will?

The work with documents isn't the most uncomplicated process, especially for people who rarely deal with legal paperwork. That's why we advise utilizing accurate Rhode Island Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will samples created by professional lawyers. It allows you to prevent difficulties when in court or handling formal organizations. Find the files you want on our website for high-quality forms and exact information.

If you’re a user with a US Legal Forms subscription, just log in your account. Once you are in, the Download button will immediately appear on the file web page. After getting the sample, it’ll be stored in the My Forms menu.

Customers without an active subscription can quickly get an account. Make use of this short step-by-step guide to get your Rhode Island Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will:

- Ensure that the document you found is eligible for use in the state it’s needed in.

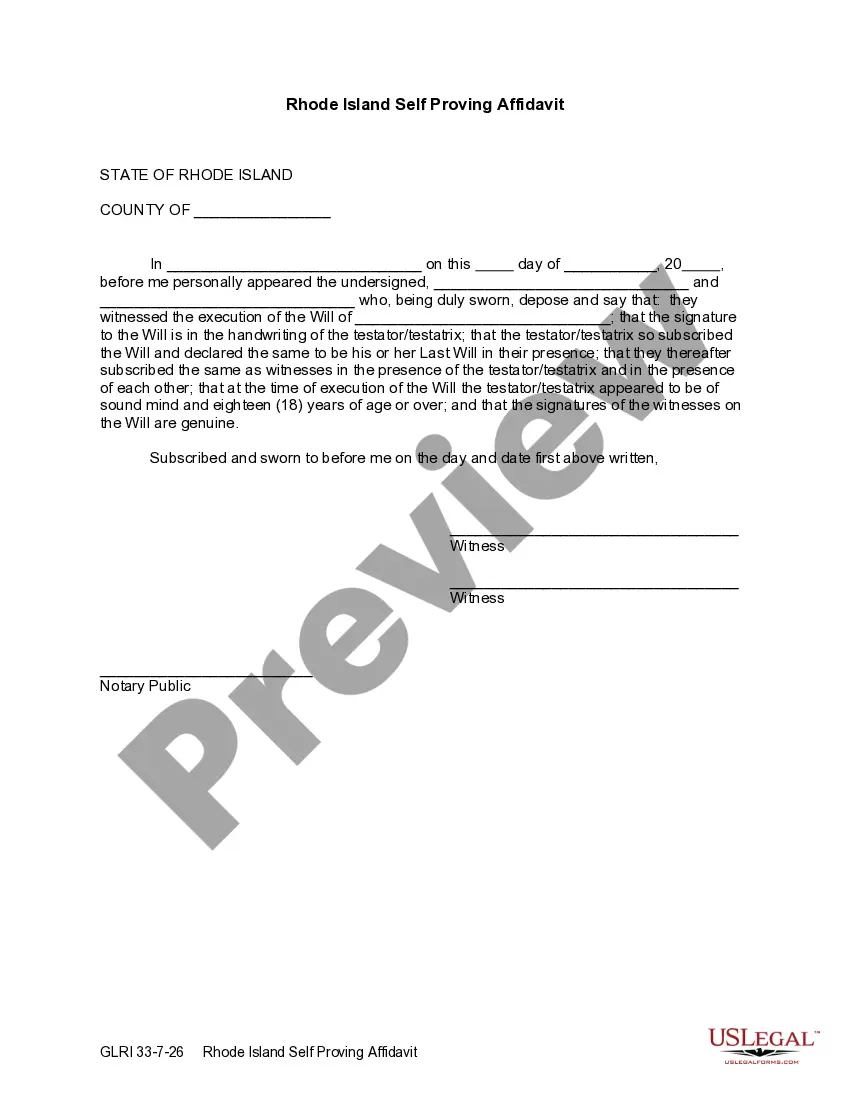

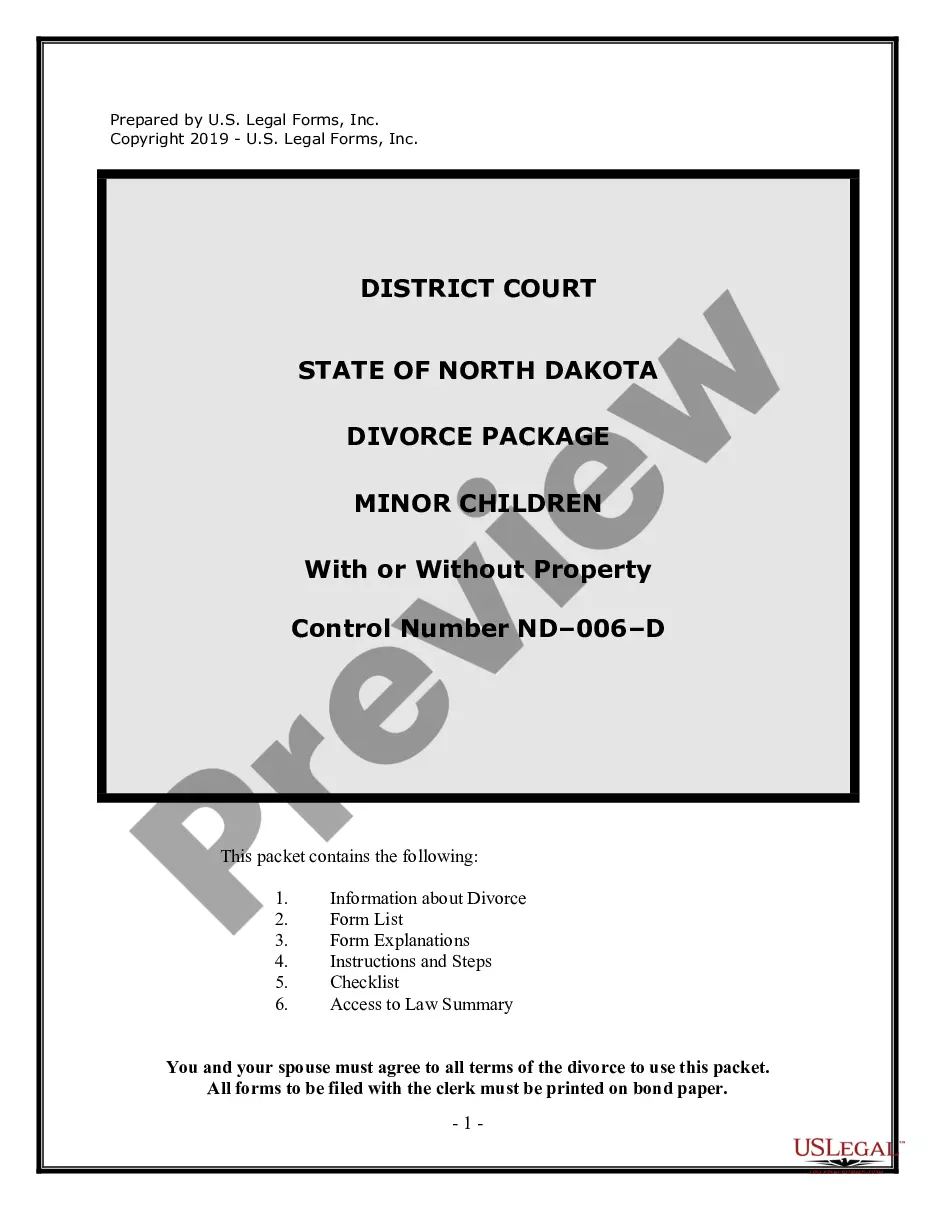

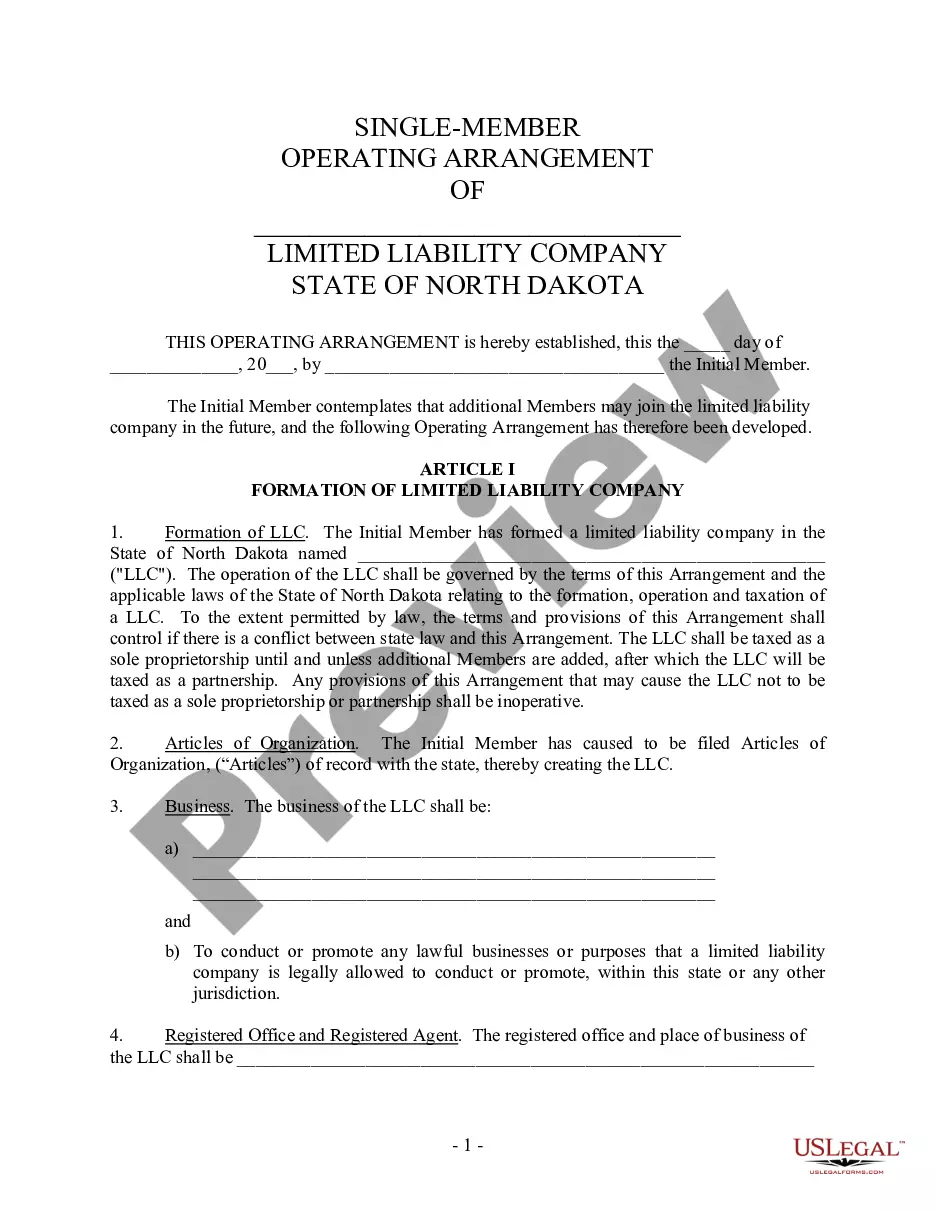

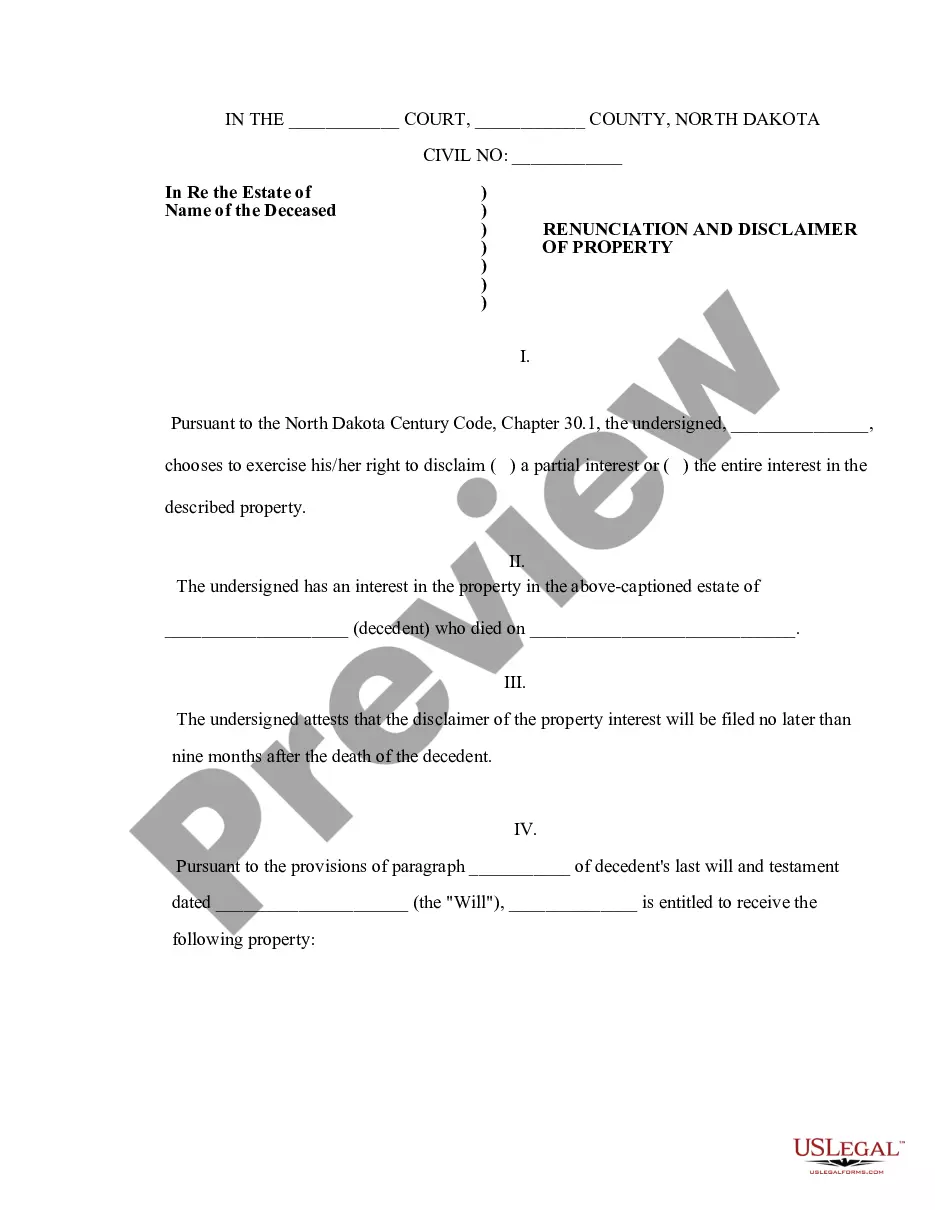

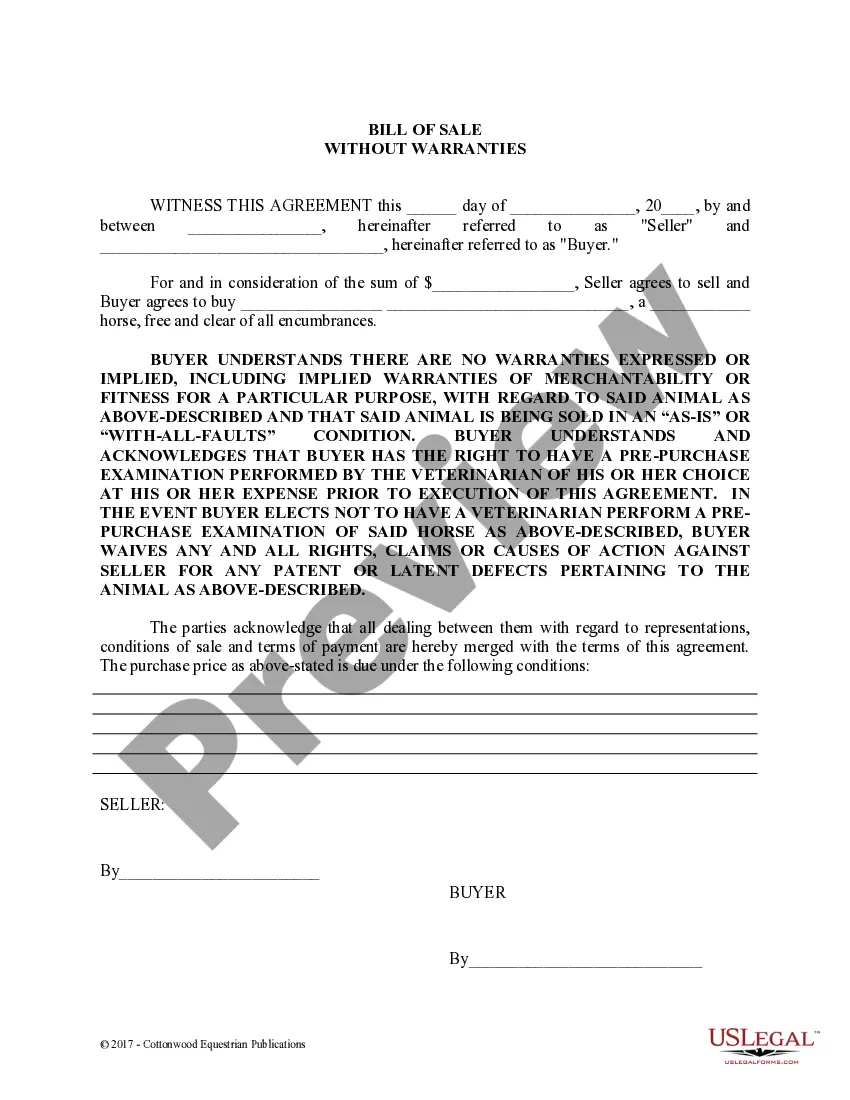

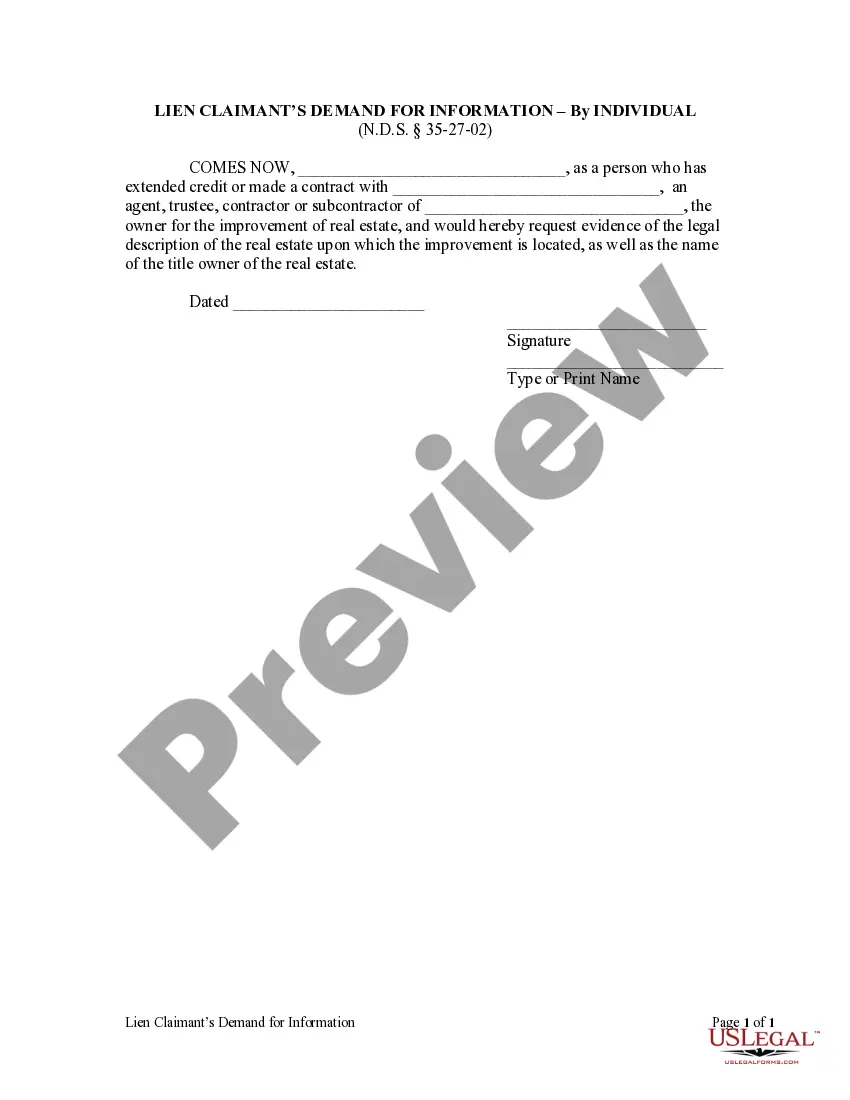

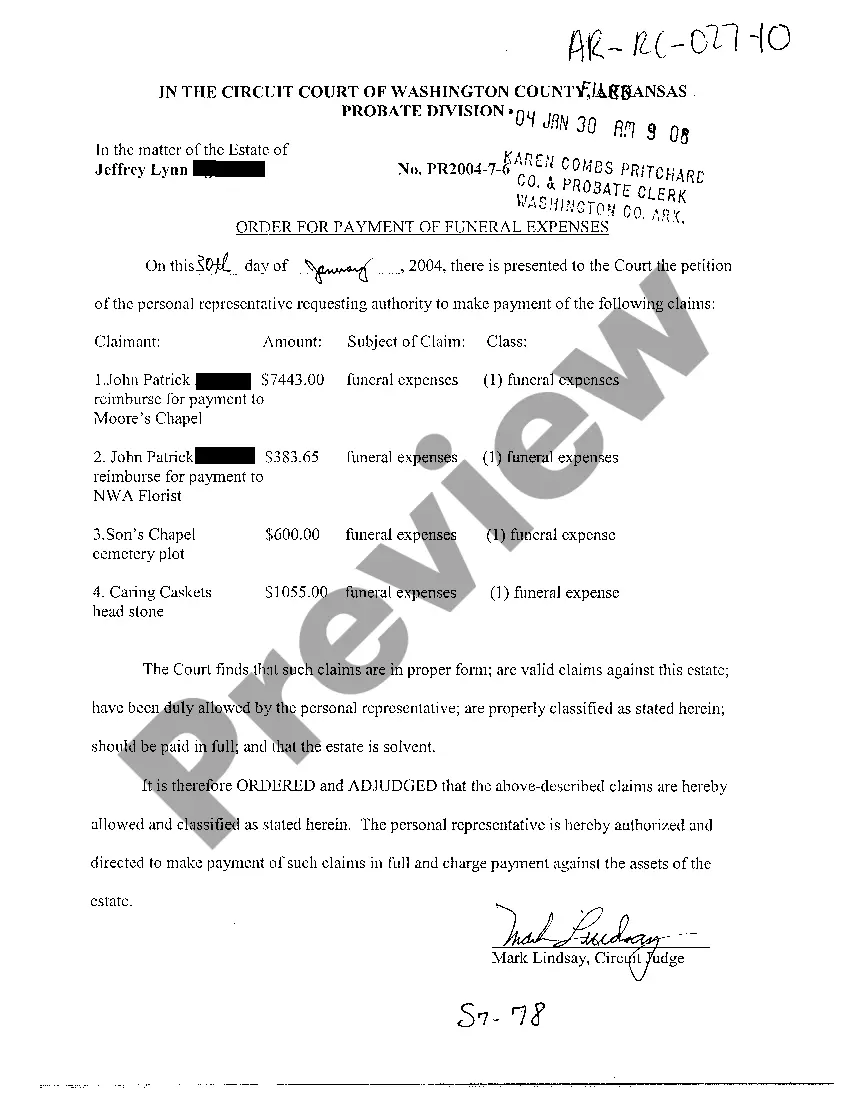

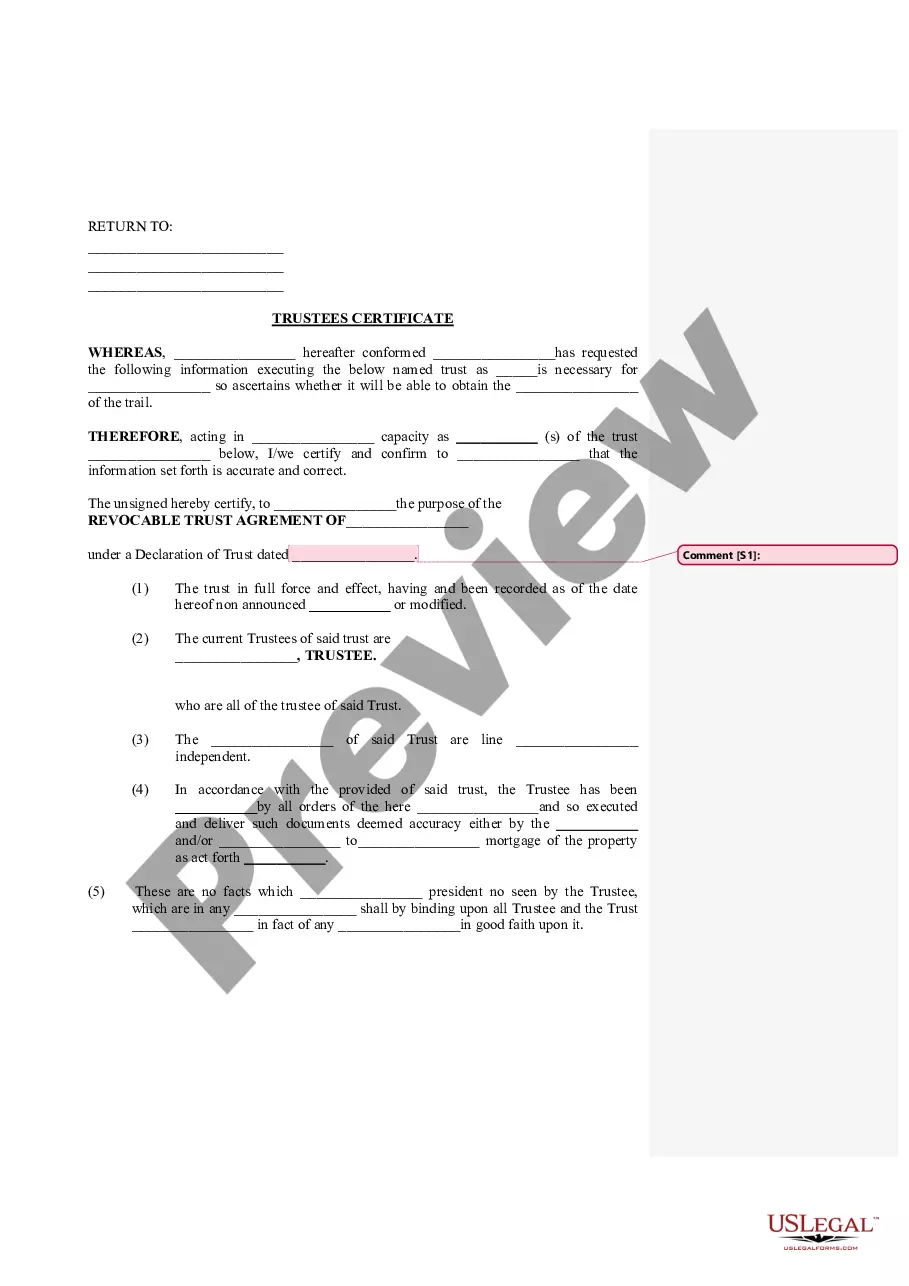

- Verify the document. Use the Preview option or read its description (if readily available).

- Click Buy Now if this sample is what you need or return to the Search field to get a different one.

- Choose a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a preferred format.

After completing these simple actions, you are able to complete the sample in an appropriate editor. Check the filled in data and consider asking a legal professional to review your Rhode Island Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will for correctness. With US Legal Forms, everything gets much easier. Test it now!

Rhode Island Last Will Testament Form Form popularity

Rhode Island Last Will Testament Other Form Names

FAQ

Sure you can write your own revocable living trust. In fact, you can do it better than a lot of the attorneys. First you have to ascertain that you really want a trust.This is true whether you are preparing a revocable living trust, corporate bylaws, LLC documents, or any other legal documents.

This should include the titles and deeds to real property, bank account information, investment accounts, stock certificates, life insurance policies, and other assets you will be using to fund the trust. Having this information available will make it easier to prepare your trust distribution provisions.

An estate plan that includes a trust costs $1,000 to $3,000, versus $300 or less for a simple will. What a living-trust promoter may not tell you: You don't need a trust to protect assets from probate. You can arrange for most of your valuable assets to go to your heirs outside of probate.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

A Living Trust is a document that allows individual(s), or 'Grantor', to place their assets to the benefit of someone else at their death or incapacitation. Unlike a Will, a Trust does not go through the probate process with the court.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.