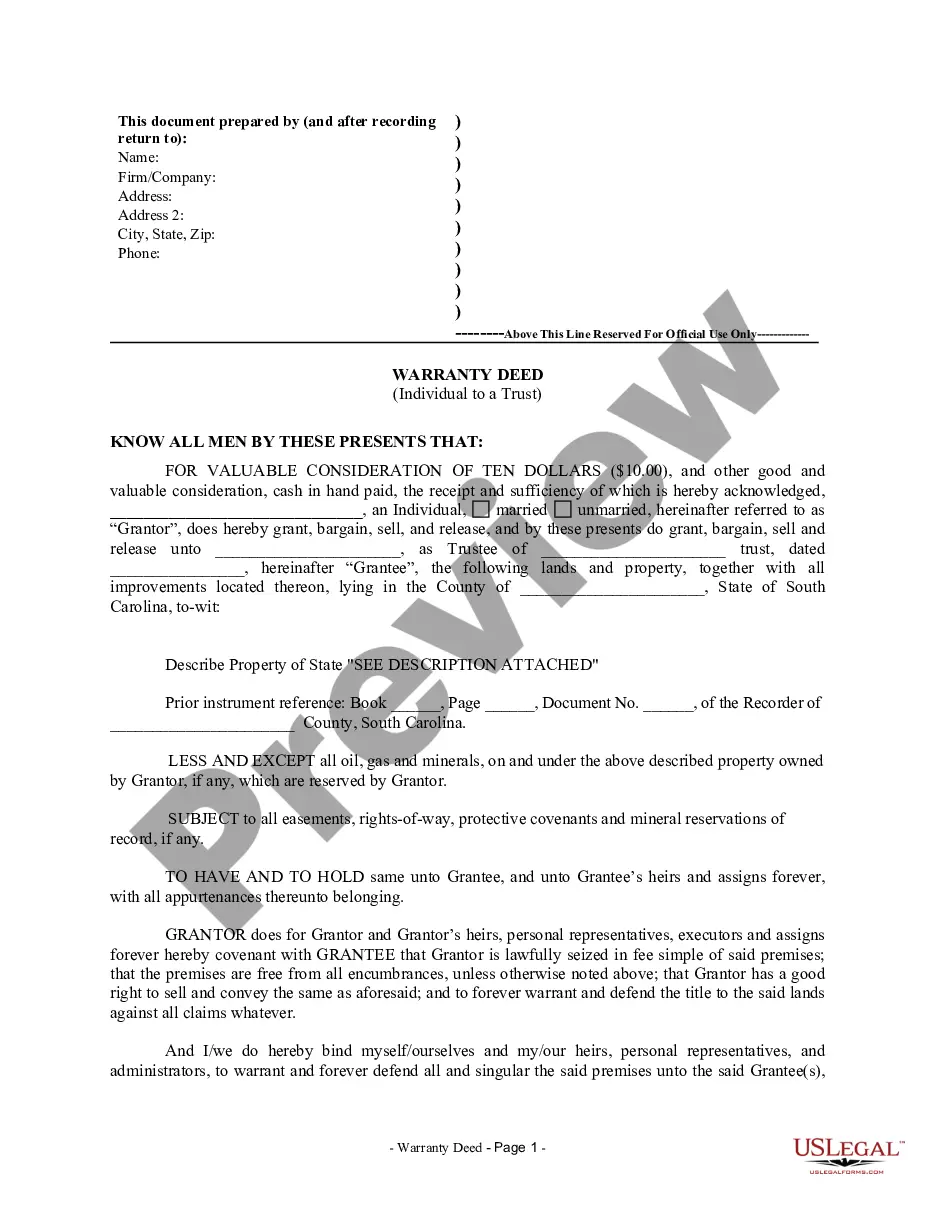

South Carolina Warranty Deed from Individual to a Trust

Description Warranty Deed South Carolina

How to fill out South Carolina Warranty Deed From Individual To A Trust?

The work with documents isn't the most simple job, especially for people who almost never deal with legal paperwork. That's why we advise using correct South Carolina Warranty Deed from Individual to a Trust templates made by professional attorneys. It allows you to eliminate troubles when in court or dealing with formal institutions. Find the files you require on our website for high-quality forms and accurate descriptions.

If you’re a user with a US Legal Forms subscription, simply log in your account. When you’re in, the Download button will immediately appear on the template page. Right after downloading the sample, it will be saved in the My Forms menu.

Users without a subscription can easily create an account. Look at this simple step-by-step help guide to get your South Carolina Warranty Deed from Individual to a Trust:

- Make certain that file you found is eligible for use in the state it’s required in.

- Confirm the document. Use the Preview option or read its description (if offered).

- Buy Now if this template is the thing you need or go back to the Search field to get a different one.

- Select a convenient subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your document in a preferred format.

Right after finishing these straightforward actions, you can complete the form in a preferred editor. Recheck filled in information and consider asking a legal professional to review your South Carolina Warranty Deed from Individual to a Trust for correctness. With US Legal Forms, everything becomes much simpler. Test it now!

South Carolina Warranty Deed Form popularity

South Carolina Trust Other Form Names

FAQ

A warranty deed protects property owners from future claims that someone else actually owns a portion (or all) of their property, while trustee deeds protect lenders when borrowers default on their mortgage loans.

No. And unless the deed identifies the trust as an owner, then father is the owner of an interest. It is a common mistake to set up a trust and then fail to deed property into the trust. However, you cannot force him to make the changes you are...

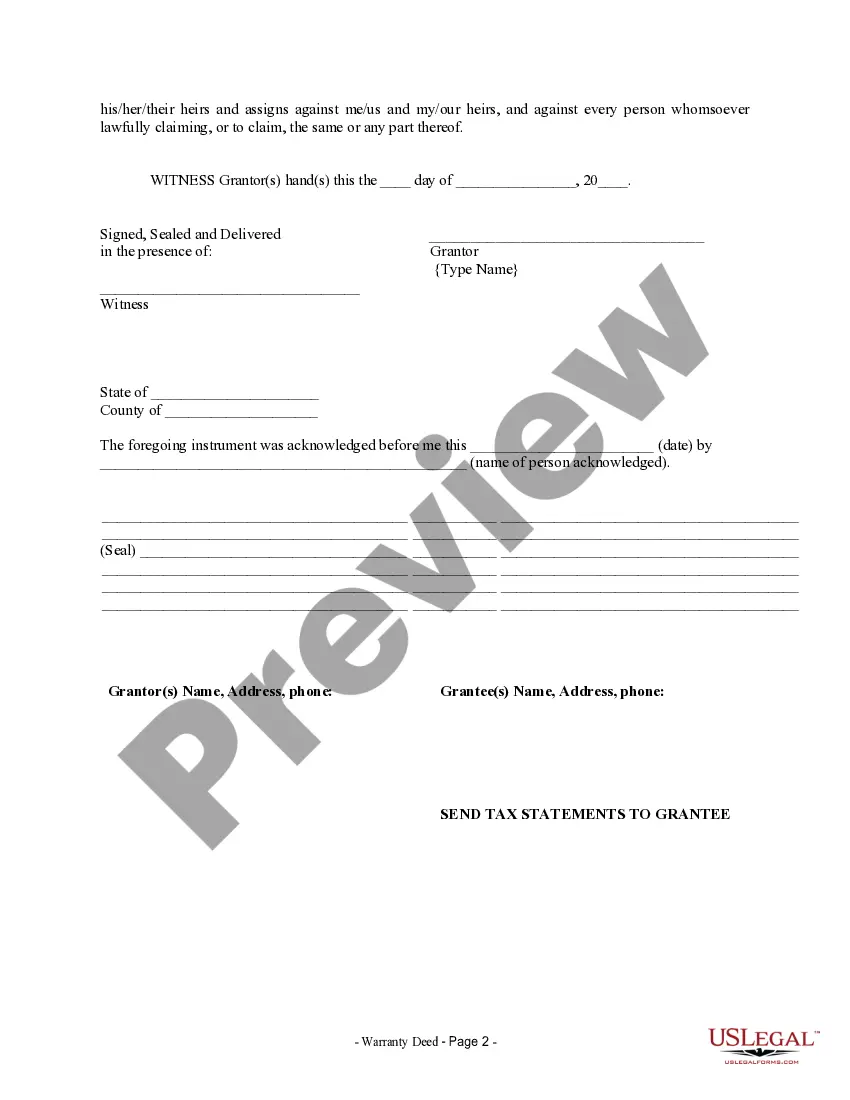

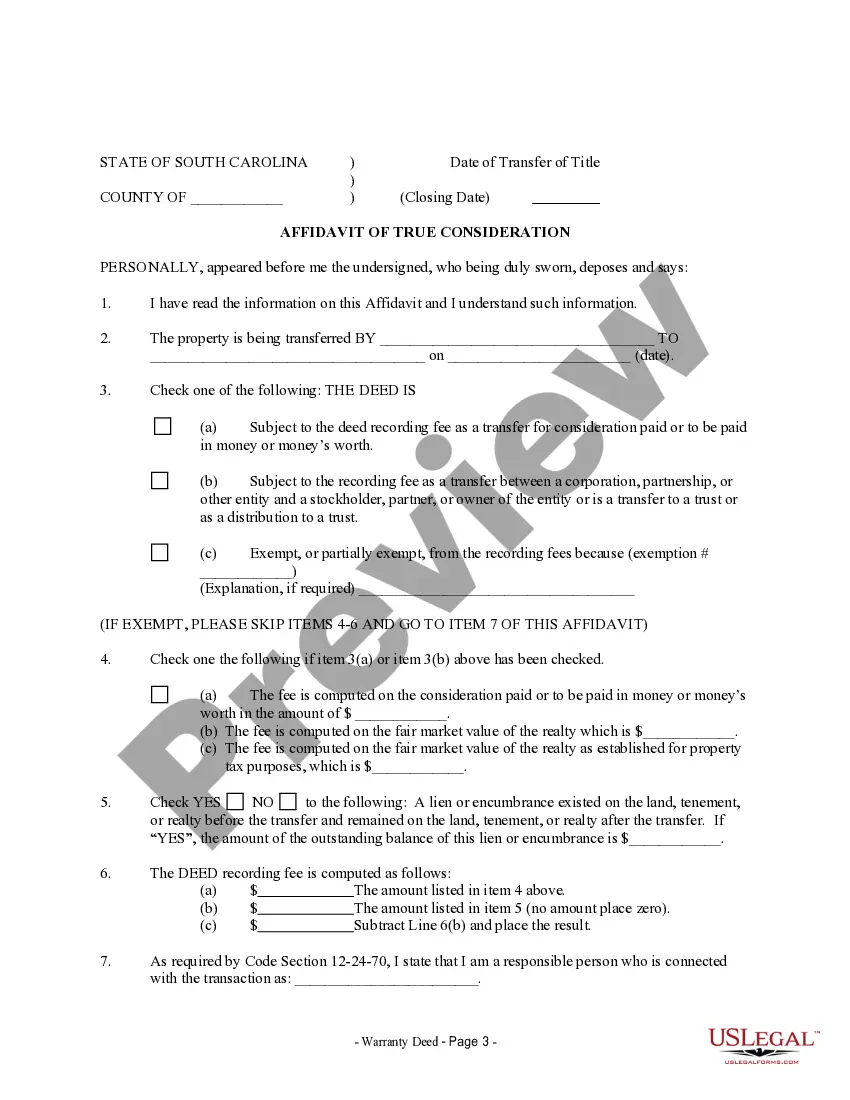

In South Carolina, the grantor must sign the deed in front of two witnesses and in the presence of an individual authorized by the state to administer an oath. Record the completed deed at the local county Recorder's office, along with an Affidavit of True Consideration (S.C. Code Ann.

A trustee deed offers no such warranties about the title.

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

Trustee's deeds convey real estate out of a trust.This type of conveyance is named for the person using the form the trustee who stands in for the beneficiary of the trust and holds title to the property.

The act of transferring a property that is owned by an individual into a trust, will see the trust liable to pay stamp duty on acquisition of the asset. Additionally, the individual who is transferring ownership to the trust, will be liable to pay capital gains tax on the disposal of the asset.

The mortgage company usually prepares this deed as part of the loan package and delivers it to the title company for you to sign at closing. The title company is commonly the trustee to the deed and holds legal title to the property until the loan gets fully repaid.