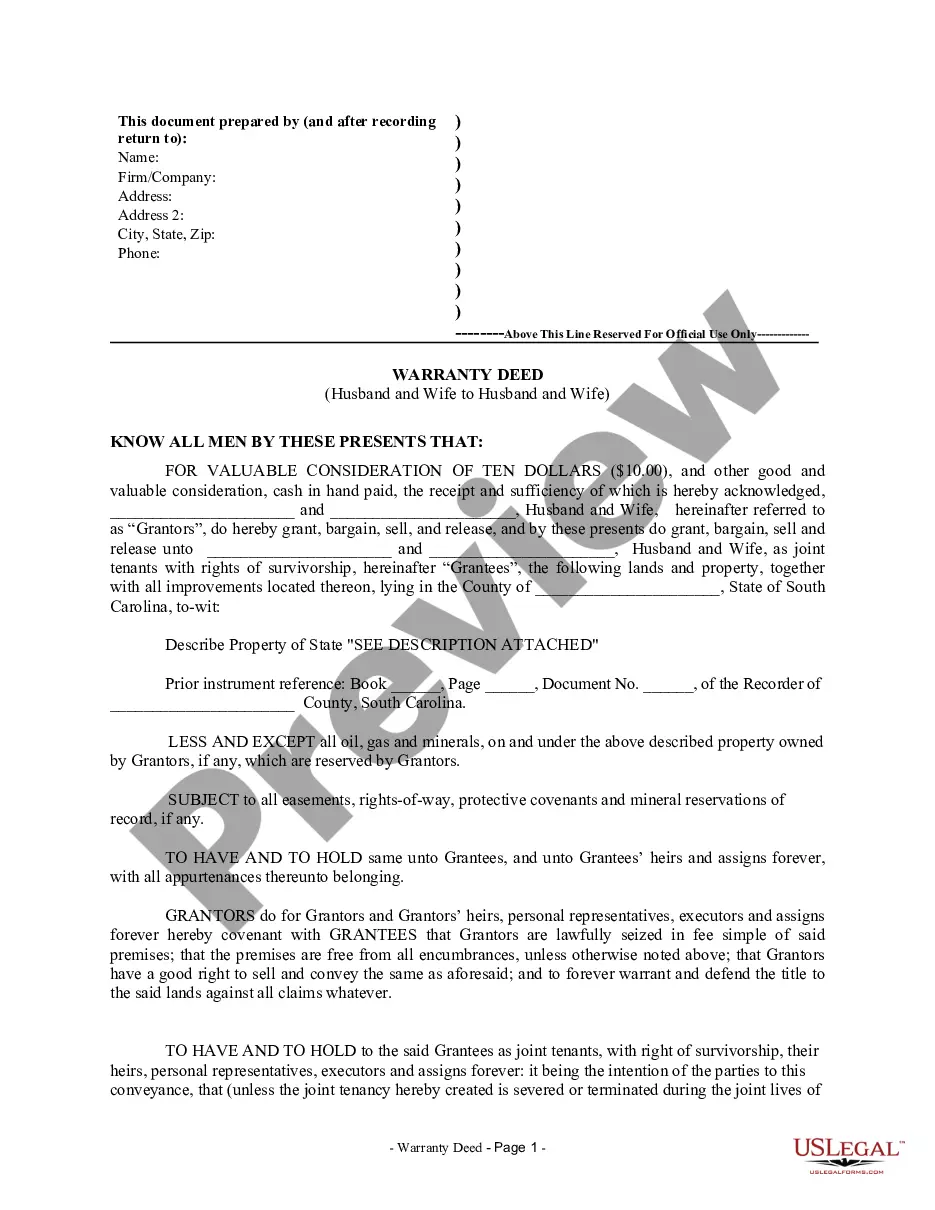

South Carolina Warranty Deed from Husband and Wife to Husband and Wife

Description

How to fill out South Carolina Warranty Deed From Husband And Wife To Husband And Wife?

Creating papers isn't the most simple job, especially for those who rarely deal with legal papers. That's why we advise making use of accurate South Carolina Warranty Deed from Husband and Wife to Husband and Wife samples made by professional lawyers. It gives you the ability to stay away from troubles when in court or working with official institutions. Find the files you need on our website for high-quality forms and exact descriptions.

If you’re a user with a US Legal Forms subscription, just log in your account. Once you are in, the Download button will automatically appear on the template web page. After accessing the sample, it’ll be stored in the My Forms menu.

Users with no an active subscription can quickly create an account. Utilize this simple step-by-step guide to get your South Carolina Warranty Deed from Husband and Wife to Husband and Wife:

- Make sure that the form you found is eligible for use in the state it’s necessary in.

- Confirm the file. Make use of the Preview option or read its description (if offered).

- Buy Now if this sample is the thing you need or use the Search field to find another one.

- Choose a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a required format.

Right after doing these simple steps, it is possible to complete the sample in an appropriate editor. Recheck completed information and consider requesting a legal representative to review your South Carolina Warranty Deed from Husband and Wife to Husband and Wife for correctness. With US Legal Forms, everything gets much easier. Test it now!

Form popularity

FAQ

In South Carolina, the grantor must sign the deed in front of two witnesses and in the presence of an individual authorized by the state to administer an oath. Record the completed deed at the local county Recorder's office, along with an Affidavit of True Consideration (S.C. Code Ann.

Property taxes are collected on a semi-annual basis. South Carolina charges a deed recordation tax on real estate of $2.60 per thousand for the State Deed Stamps plus $1.10 per thousand for the County Deed Stamps, for a total of $3.70 per thousand of the sales price. Deed stamps in most cases are paid by your seller.

Usually the SELLER pays 100% of this cost, but it is possible that it may have been negotiated that you only pay 50% or the BUYER pays all. ATTORNEY FEES for the SELLER will usually range between $250 and $1000, but it could be more. It is prudent to ask in advance what the fee will be.

If the consideration is $100,000, the transfer tax is $370, and paid directly to the County Register of Deeds by the closing attorney. Transfer taxes are paid at the recording of the deed only, but property taxes are paid every year by the owner of the property.

An original, wet signed document. Signature of the Party of the First Part. Two witnesses to the signature. A South Carolina Probate or Acknowledgement. A property description to include a recorded plat reference or metes and bounds description.

What Should I Know About Quitclaim Deeds in South Carolina? You are buying the least amount of protection of any deed. A quitclaim deed conveys whatever interest the grantor currently has in the property if any. The grantor only remises, releases and quitclaims his or her interest in the property to the grantee.

The South Carolina deed recording fee is imposed for the privilege of recording a deed, and is based on the transfer of real property from one person or business entity to another. The fee is generally imposed on the grantor of the real property, although the grantee may be secondarily liable for the fee.