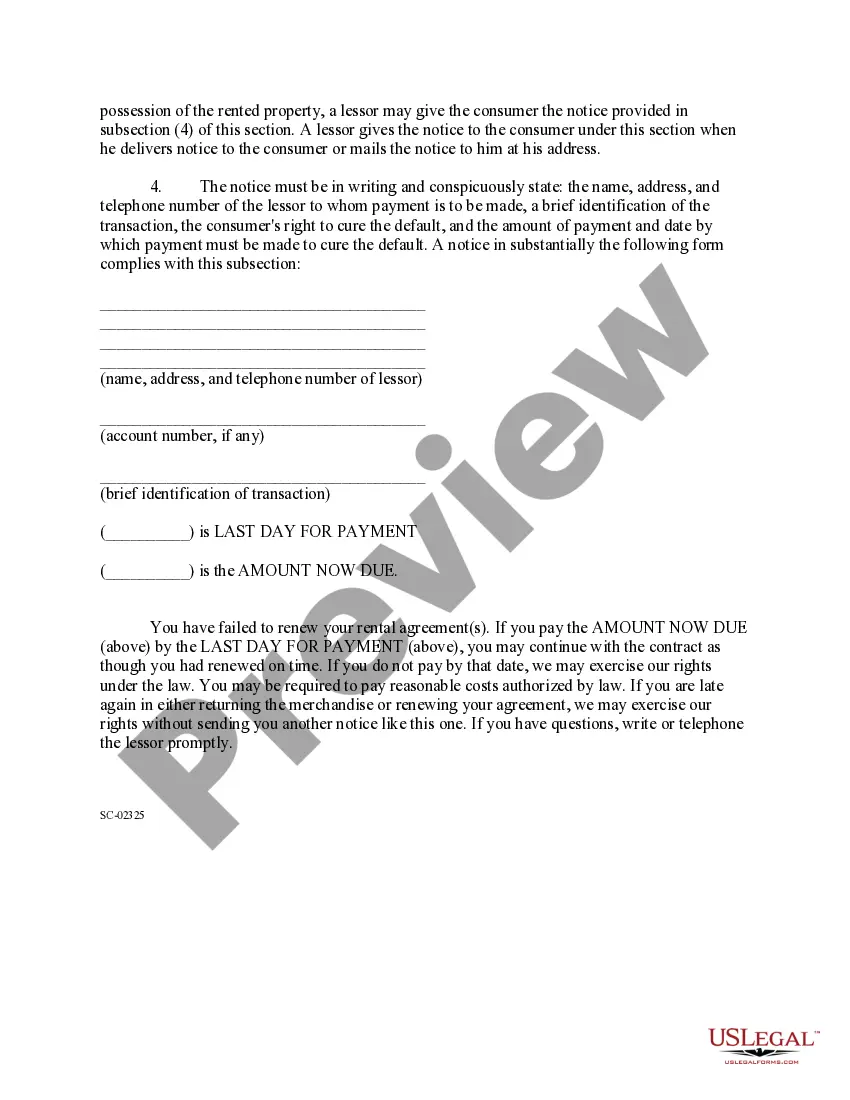

South Carolina Notice of Consumer's Right to Cure Default

Description Notice Of Right To Cure

How to fill out Right To Cure Default Letter?

The work with documents isn't the most simple job, especially for those who almost never work with legal paperwork. That's why we recommend making use of correct South Carolina Notice of Consumer's Right to Cure Default samples made by skilled lawyers. It gives you the ability to eliminate difficulties when in court or handling formal institutions. Find the files you need on our website for high-quality forms and exact descriptions.

If you’re a user with a US Legal Forms subscription, simply log in your account. Once you are in, the Download button will immediately appear on the template web page. After accessing the sample, it will be saved in the My Forms menu.

Customers without an active subscription can easily get an account. Make use of this short step-by-step guide to get the South Carolina Notice of Consumer's Right to Cure Default:

- Make certain that the document you found is eligible for use in the state it’s required in.

- Verify the document. Use the Preview option or read its description (if available).

- Buy Now if this template is the thing you need or go back to the Search field to get a different one.

- Select a suitable subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your file in a wanted format.

After finishing these easy actions, it is possible to complete the form in an appropriate editor. Recheck filled in data and consider asking an attorney to review your South Carolina Notice of Consumer's Right to Cure Default for correctness. With US Legal Forms, everything becomes much simpler. Try it out now!

Notice Of Default Sample Form popularity

Notice To Cure Letter Other Form Names

Notice To Cure Construction Template FAQ

5 Common Repo Questions Answered A: The repo man isn't legally allowed to enter locked and secured private property such as a garage to take away your vehicle. But they can repossess your car, without a court order, if it's sitting in your driveway, outside your home, or in a public space.

Under South Carolina law (S.C. Code § 15-3-530), the statute of limitations for most types of consumer and business debt is three (3) years. As an article from the U.S. Federal Trade Commission (FTC) explains, the statute of limitations typically begins ticking once a debtor fails to make payments on the debt.

South Carolina law allows a lender to sell a repossessed car if the borrower is unable to reclaim it. If the borrower has paid 60 percent or more of the loan, the borrower can force the lender to sell the repossessed car within 90 days.

If they take your car, then the lender will send you a Notice of Sale with what they plan to do with the car. By law, the lender must send a Notice of Sale or disposition. To redeem your car and stop the sale you might have to pay all of the late payments. You are usually given 10-14 days to do this.

If you don't take any action within the 15 days, the lender must offer the goods for sale. The lender can't sell, or offer to sell, the goods before the 15 days are up. You can reinstate or settle the agreement at any time before the lender sells, or agrees to sell, the goods.

If you stop paying, the lender can reclaim the property. It may choose to sue and get a judgment against you, but it's not required as long as the repossession is peaceful.

To eliminate or correct a violation or defect. For example, a landlord's cure or quit notice gives the tenant a set amount of time to correct, or cure, a lease violation or face an eviction lawsuit. contracts.

The Right to Cure Defined. The legal right to cure is essentially a principle found in contract law that allows one party in a contract, who has defaulted under a contract provision, to remedy their default by taking steps to ensure compliance or otherwise, cure the default.State Laws and Consumer Loans.