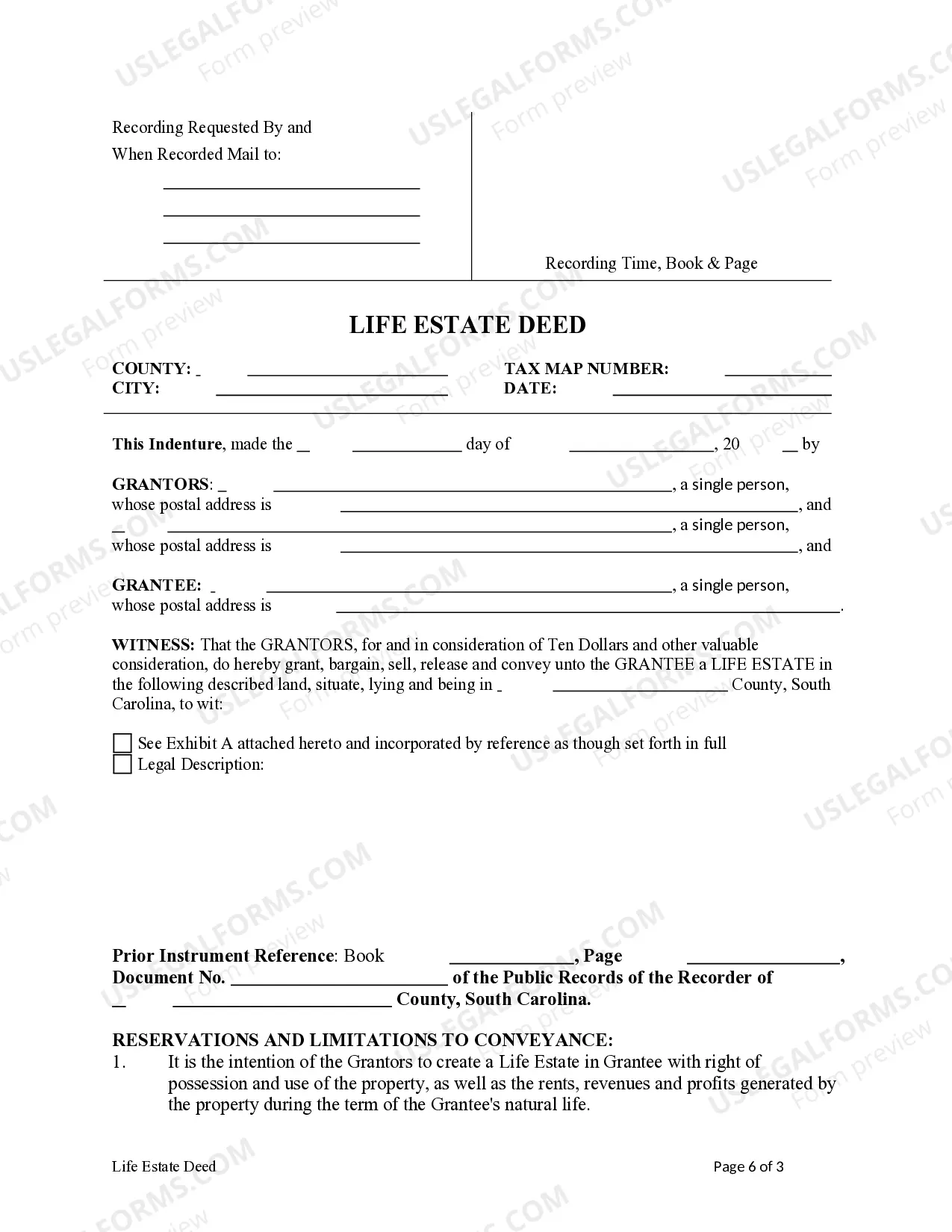

This form is a Life Estate Deed from two Grantors, individuals or husband and wife, to an individual Grantee. Grantors convey and grant to Grantee a life estate in the described property. This deed complies with all state statutory laws.

South Carolina Life Estate Deed from Two Individuals / Husband and Wife to an Individual

Description

How to fill out South Carolina Life Estate Deed From Two Individuals / Husband And Wife To An Individual?

Creating documents isn't the most easy task, especially for those who almost never work with legal papers. That's why we advise utilizing accurate South Carolina Life Estate Deed from Two Individuals / Husband and Wife to an Individual samples created by skilled lawyers. It allows you to stay away from difficulties when in court or handling formal organizations. Find the samples you want on our site for high-quality forms and correct explanations.

If you’re a user with a US Legal Forms subscription, just log in your account. When you’re in, the Download button will immediately appear on the template page. Right after downloading the sample, it’ll be stored in the My Forms menu.

Users without an activated subscription can quickly get an account. Follow this simple step-by-step guide to get the South Carolina Life Estate Deed from Two Individuals / Husband and Wife to an Individual:

- Make certain that file you found is eligible for use in the state it is necessary in.

- Confirm the document. Make use of the Preview option or read its description (if available).

- Click Buy Now if this sample is the thing you need or go back to the Search field to get another one.

- Choose a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a wanted format.

After completing these simple steps, you can complete the form in a preferred editor. Double-check filled in details and consider asking a legal representative to examine your South Carolina Life Estate Deed from Two Individuals / Husband and Wife to an Individual for correctness. With US Legal Forms, everything becomes easier. Test it now!

Form popularity

FAQ

A life estate deed permits the property owner to have full use of their property until their death, at which point the ownership of the property is automatically transferred to the beneficiary.In the right situations, it can be a streamlined and easy way to transfer ownership.

Life Tenant the beneficiary entitled to receive lifetime benefits from a Trust. Remainderman the beneficiary who will receive trust assets after the Life Tenant has died. Right of Occupation a right to live in a property for a specified time, or for the beneficiary's lifetime, but usually subject to conditions.

What happens to a life estate after someone dies? Upon the life tenant's death, the property passes to the remainder owner outside of probate.They can sell the property or move into and claim it as their primary residence (homestead). Property taxes will not be reassessed.

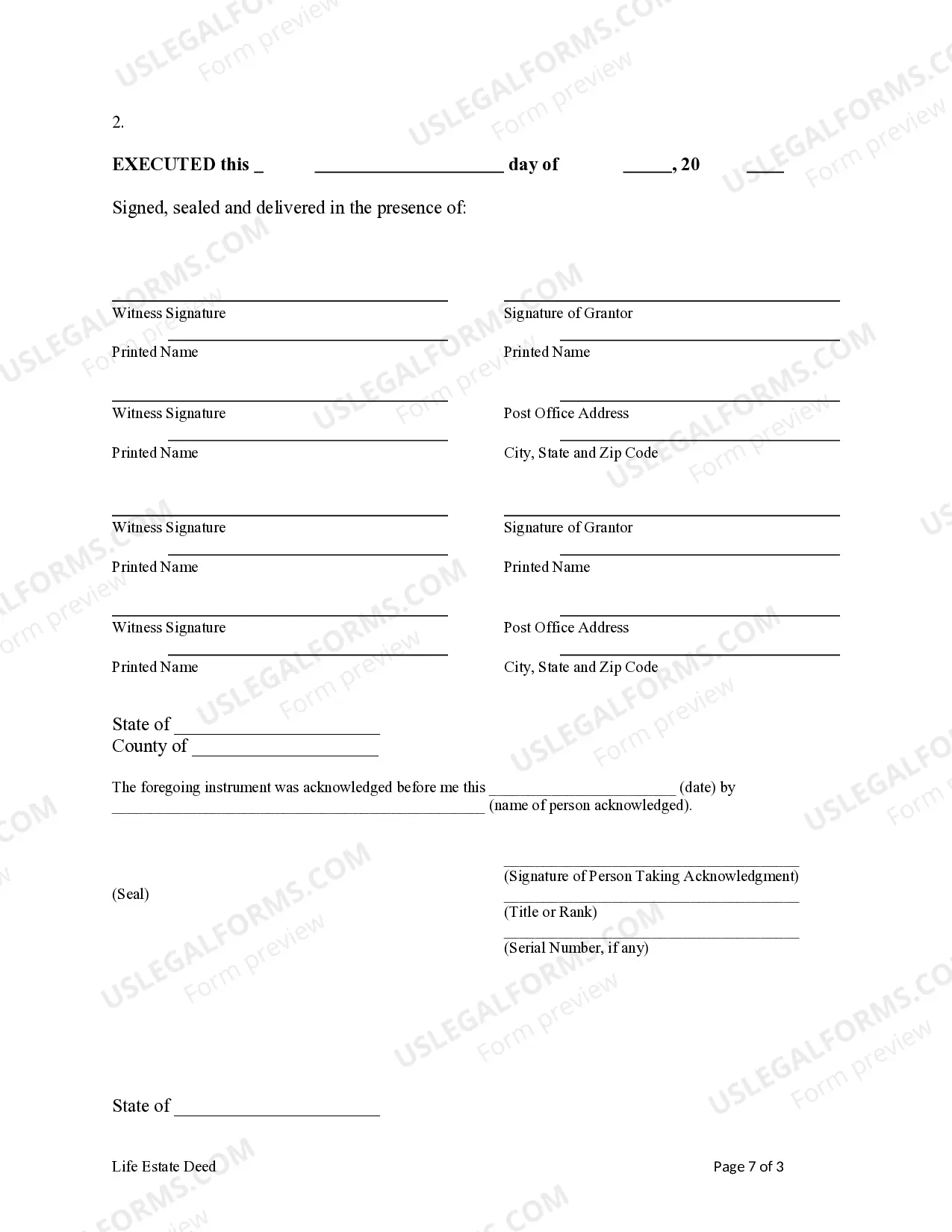

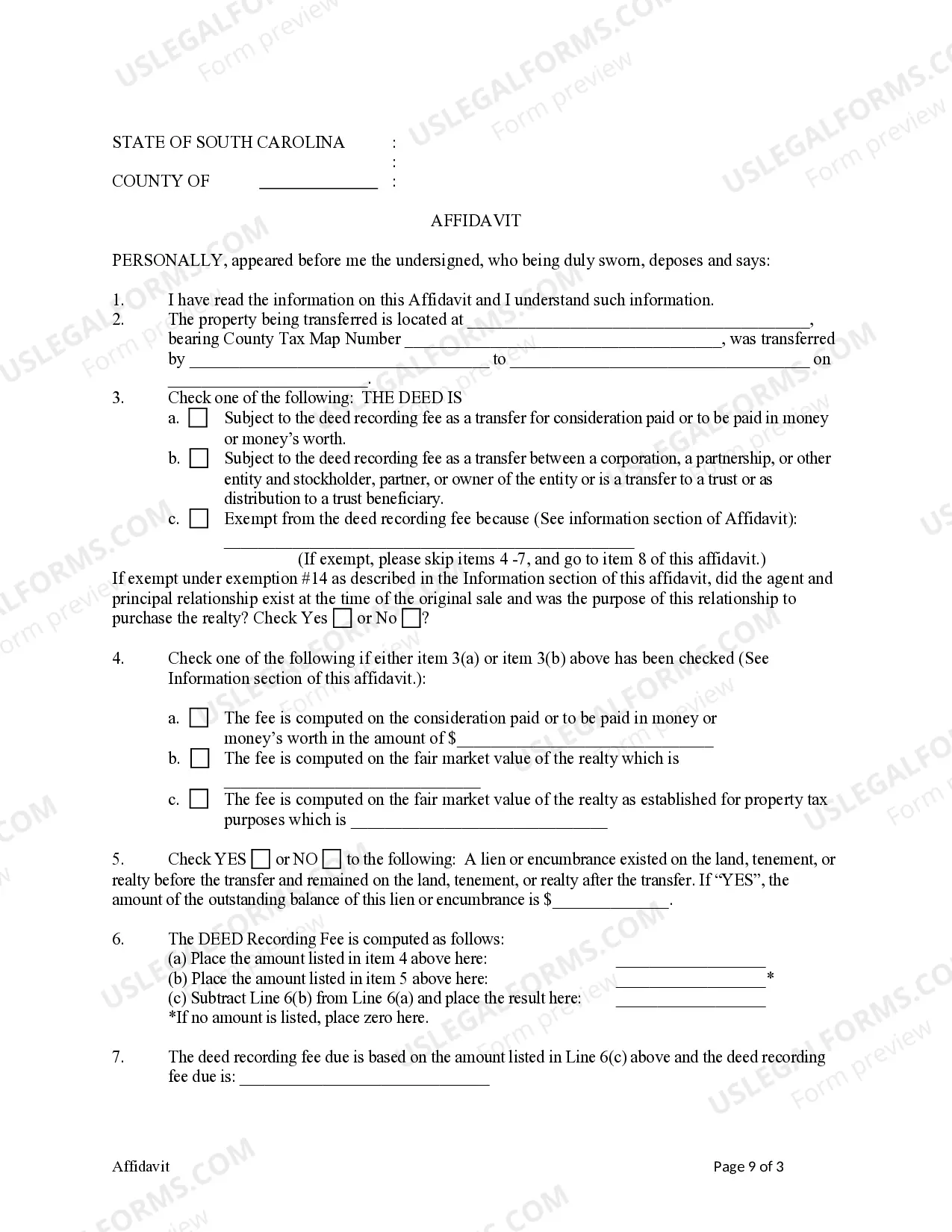

The date the deed was made; The name of the party granting the life estate and their address; The name of the grantee and their address; The address and a legal description of the property that is subject to the life estate;

With a life estate deed, the remainderman's ownership interest vests when the deed is signed and delivered (or recorded in the public record). Accordingly, the children's ownership interest in the property vested upon their father signing the deed and recording it in the public records, or the year 2000.

A life estate deed permits the property owner to have full use of their property until their death, at which point the ownership of the property is automatically transferred to the beneficiary.

Remainderman Rights and Life Estates Typically, the deed will state that the occupant of property is allowed to use it for the duration of their life. Almost all deeds creating a life estate will also name a remaindermanthe person or persons who get the property when the life tenant dies.

Example of creation of a life estate: I grant to my mother, Molly McCree, the right to live in and/or receive rents from my real property, until her death, or I give my daughter, Sadie Hawkins, my real property, subject to a life estate to my mother, Molly McCree. This means a woman's mother, Molly, gets to live in

A person owns property in a life estate only throughout their lifetime. Beneficiaries cannot sell property in a life estate before the beneficiary's death. One benefit of a life estate is that property can pass when the life tenant dies without being part of the tenant's estate.