South Carolina Renunciation And Disclaimer of Property from Will by Testate

Description

How to fill out South Carolina Renunciation And Disclaimer Of Property From Will By Testate?

Creating papers isn't the most uncomplicated task, especially for people who rarely deal with legal paperwork. That's why we advise utilizing correct South Carolina Renunciation And Disclaimer of Property from Will by Testate templates created by skilled lawyers. It allows you to stay away from problems when in court or handling official institutions. Find the templates you require on our site for top-quality forms and correct explanations.

If you’re a user with a US Legal Forms subscription, just log in your account. When you’re in, the Download button will automatically appear on the file webpage. Soon after getting the sample, it’ll be stored in the My Forms menu.

Customers without an active subscription can easily create an account. Make use of this simple step-by-step help guide to get your South Carolina Renunciation And Disclaimer of Property from Will by Testate:

- Make certain that the form you found is eligible for use in the state it’s necessary in.

- Confirm the document. Utilize the Preview option or read its description (if available).

- Click Buy Now if this template is the thing you need or use the Search field to find another one.

- Select a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a required format.

After finishing these straightforward actions, it is possible to complete the sample in a preferred editor. Recheck completed data and consider requesting an attorney to review your South Carolina Renunciation And Disclaimer of Property from Will by Testate for correctness. With US Legal Forms, everything gets much easier. Try it now!

Form popularity

FAQ

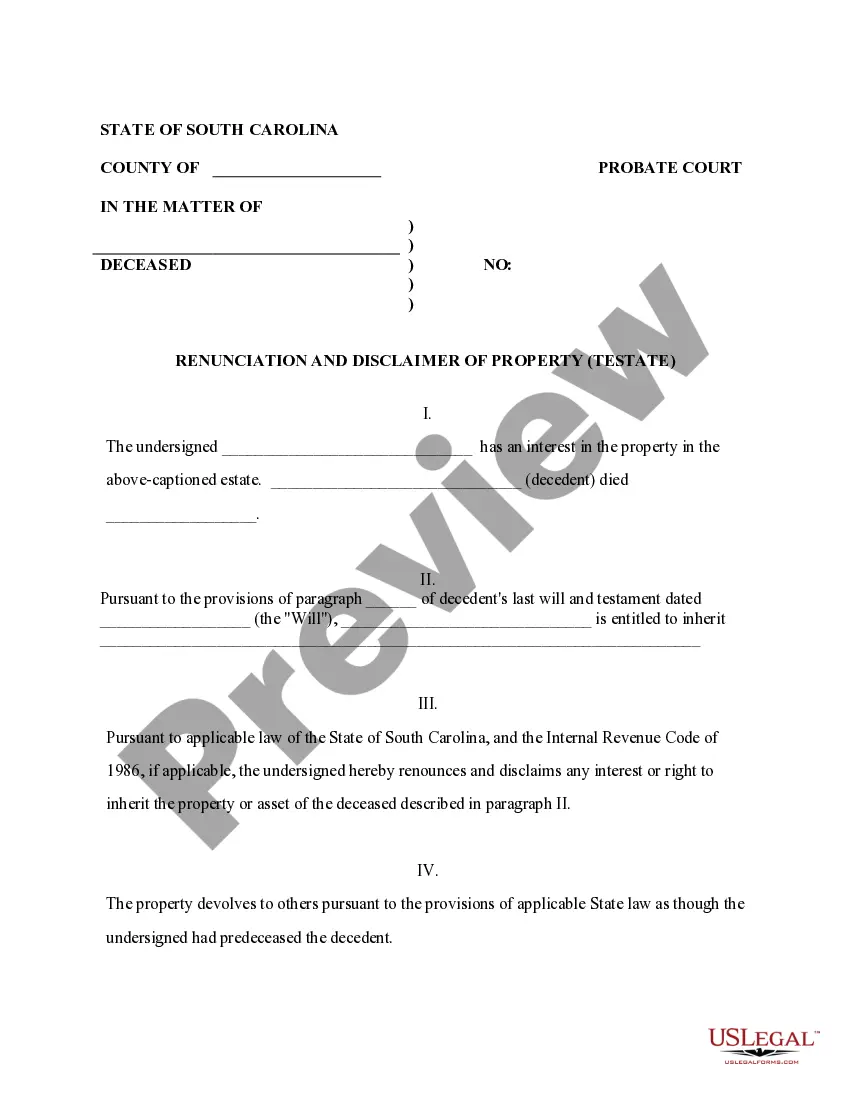

Disclaim, in a legal sense, refers to the renunciation of an interest in, or an acceptance of, inherited assets, such as property, by way of a legal instrument. A person disclaiming an interest, right, or obligation is known as a disclaimant.

What is a Deed of Disclaimer? A Deed of Disclaimer is a document that you can execute if you wish to Disclaim an inheritance due via the Rules of Intestacy and you are not applying for probate. A typical example of this is if a spouse of a deceased would prefer the estate passes to the children.

Disclaiming means that you give up your rights to receive the inheritance. If you choose to do so, whatever assets you were meant to receive would be passed along to the next beneficiary in line. It's not typical for people to disclaim inheritance assets.

A beneficiary of a trust may wish to disclaim their interest in the trust for:Any disclaimer of an interest in a trust by a trust beneficiary must be made to the trustee of that trust. For a disclaimer to be valid, it must be supported by some evidence that the beneficiary is disclaiming their interest.

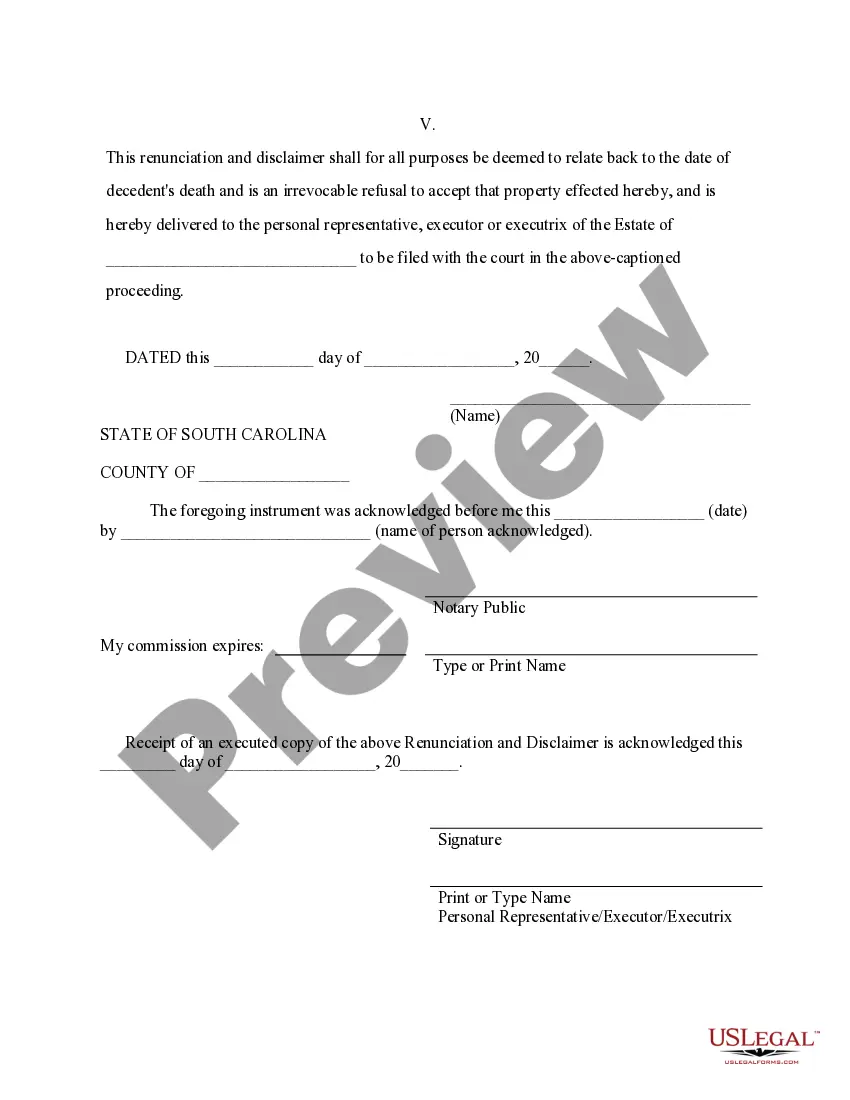

Specifically, the IRS requires that: You make your disclaimer in writing.You disclaim the assets within nine months of the death of the person you inherited them from. (Note: There's an exception for minor beneficiaries; they have until nine months after they reach the age of majority to disclaim.)

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.

Jointly owned property is treated as consisting of a both present and a future interest in the jointly owned property. Thus, a surviving spouse may disclaim the future interest in jointly owned property on the death of their spouse, including assets that were held by the spouses as tenants by the entirety.

In New South Wales, the Registrar General is able record the State of New South Wales as the proprietor of disclaimed land. The land will remain subject to any charges and mortgages despite the change in proprietor.