South Carolina Loan Modification Agreement

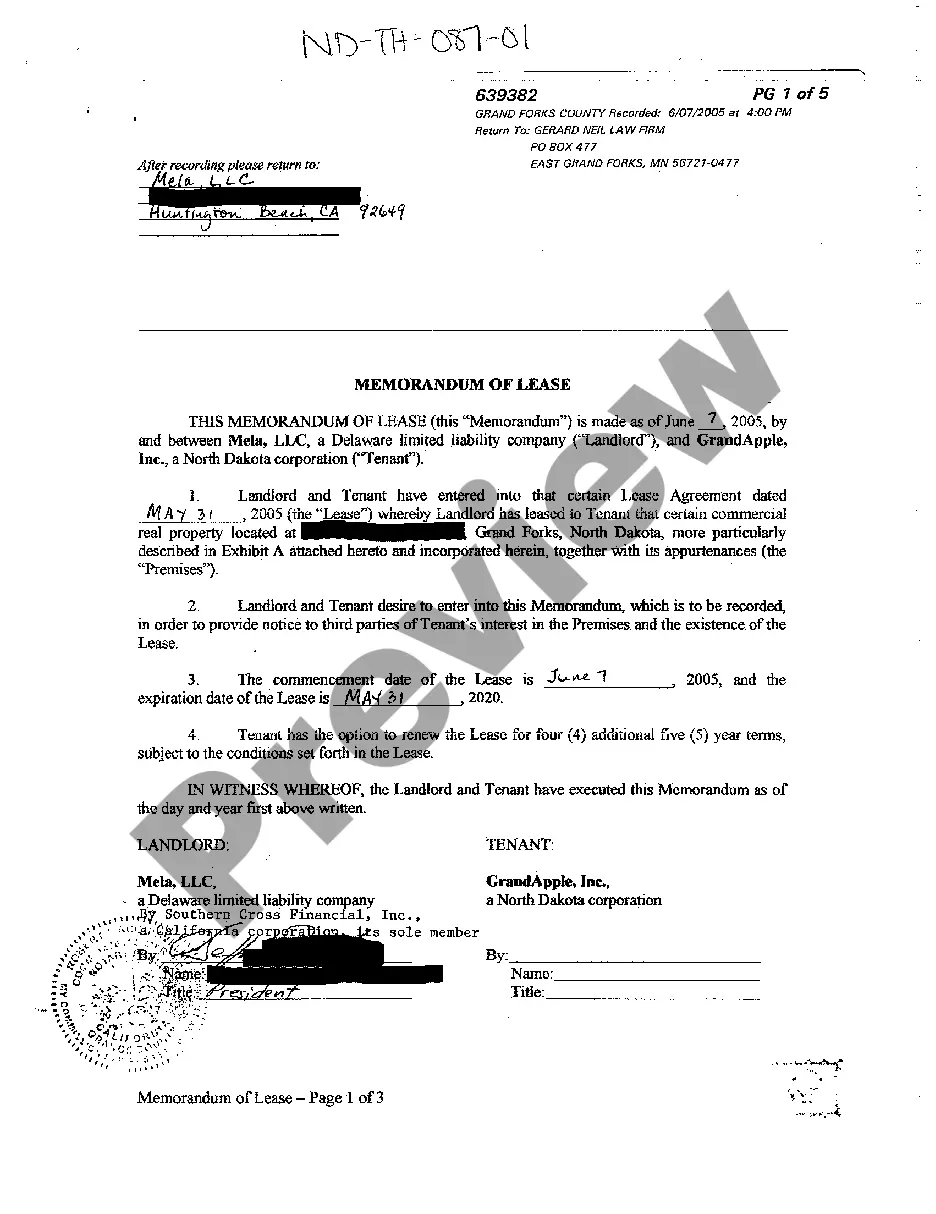

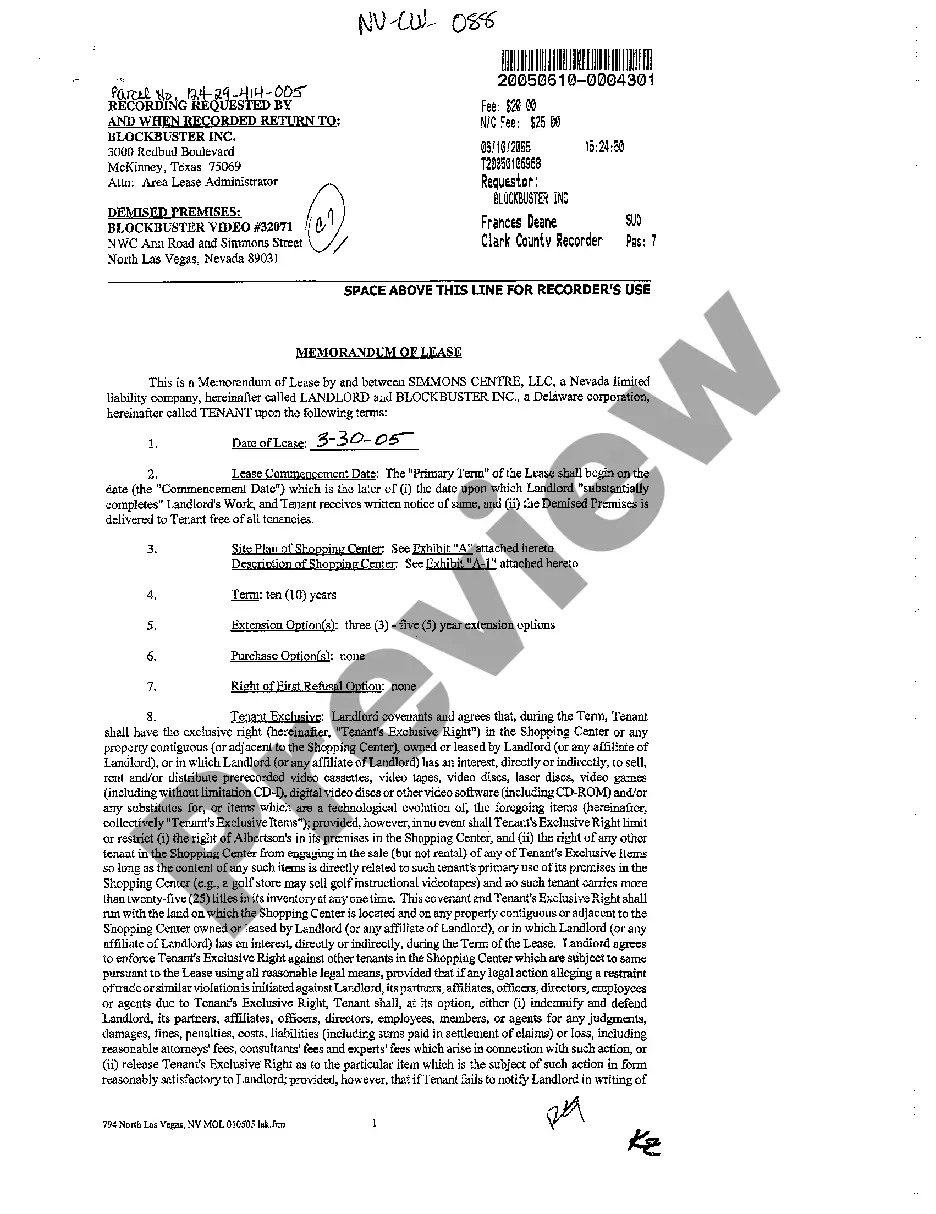

Description Loan Modification Agreement Form

How to fill out South Carolina Loan Modification Agreement?

The work with papers isn't the most uncomplicated job, especially for those who rarely deal with legal paperwork. That's why we advise using correct South Carolina Loan Modification Agreement templates created by professional lawyers. It gives you the ability to prevent troubles when in court or handling formal organizations. Find the samples you need on our website for high-quality forms and correct descriptions.

If you’re a user having a US Legal Forms subscription, just log in your account. Once you are in, the Download button will immediately appear on the template webpage. Soon after downloading the sample, it’ll be saved in the My Forms menu.

Users with no an active subscription can easily create an account. Follow this brief step-by-step guide to get your South Carolina Loan Modification Agreement:

- Make sure that the sample you found is eligible for use in the state it is required in.

- Confirm the file. Utilize the Preview feature or read its description (if readily available).

- Buy Now if this sample is what you need or use the Search field to get another one.

- Choose a convenient subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a required format.

After completing these straightforward actions, you can complete the sample in your favorite editor. Recheck filled in data and consider asking a legal professional to examine your South Carolina Loan Modification Agreement for correctness. With US Legal Forms, everything gets easier. Try it out now!

Form popularity

FAQ

Be at least one regular mortgage payment behind or show that missing a payment is imminent. Provide evidence of significant financial hardship, for reasons such as:

Yes, probably. In California, a law called the Homeowner Bill of Rights (HBOR) generally gives borrowers the right to appeal a modification denial. Under HBOR, in most cases, if the servicer denies a borrower's application to modify a first lien loan, the borrower can appeal.

You should contact the lender's loss and mitigation department to discuss the reason of you loan modification rejection. Possible reasons for a modification rejection include insufficient income, high debt-to-income ratio, missing documents, or delinquent credit history.

Some of the most common types of hardship are: job loss, pay reduction, underemployment, declining business revenue, death of a coborrower, illness, injury, and divorce.

A lender may agree to a loan modification during a settlement procedure or in the case of a potential foreclosure.A loan modification agreement is a long-term solution. A loan modification may involve a reduced interest rate, a longer period to repay, a different type of loan, or any combination of these.