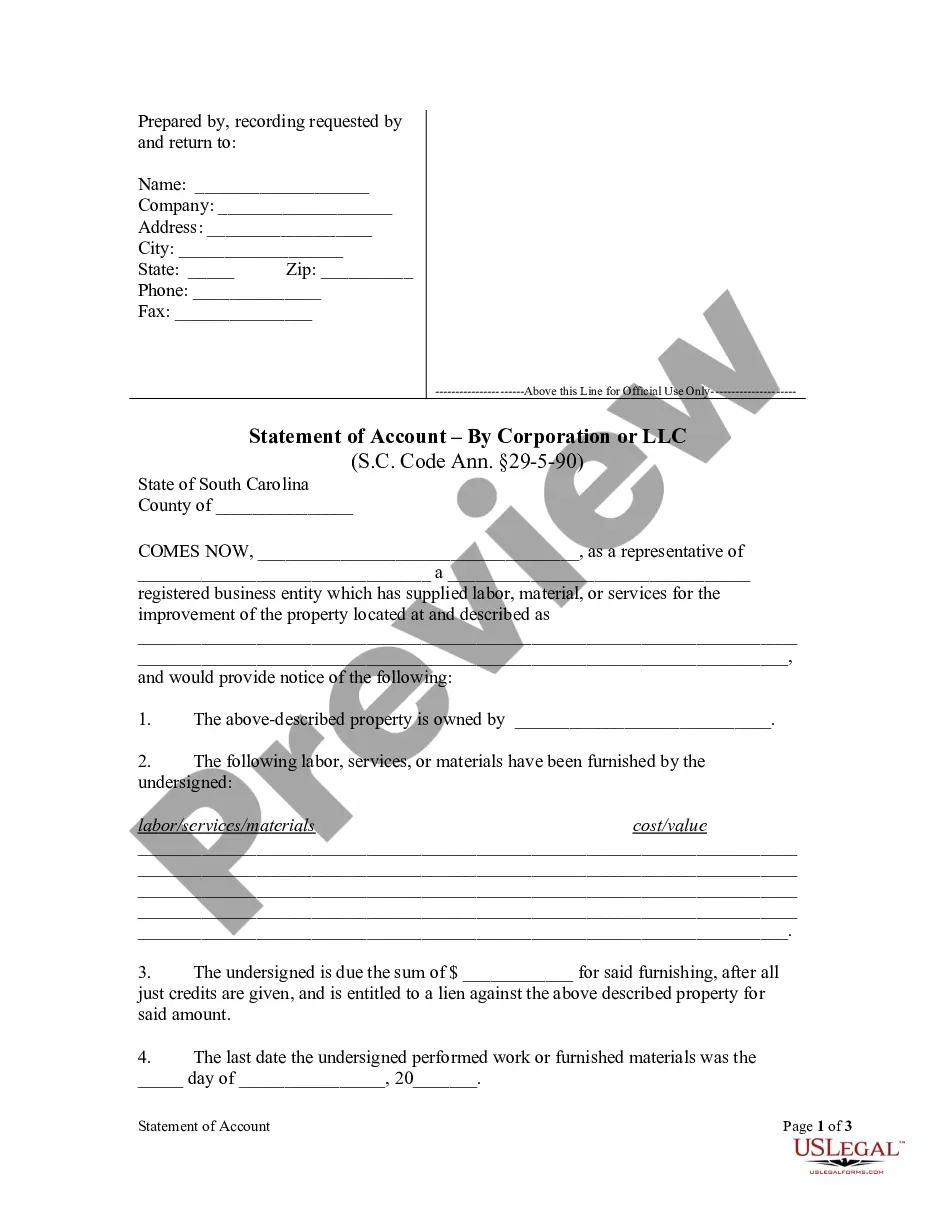

Statement of Account by Corporation

Note: This summary is not

intended to be an all inclusive discussion of South Carolina's construction

or mechanic's lien laws, but does include basic provisions.

What is a construction or mechanic's lien?

Every State permits

a person who supplies labor or materials for a construction project to

claim a lien against the improved property. While some states differ

in their definition of improvements and some states limit lien claims to

buildings or structures, most permit the filing of a document with the

local court that puts parties interested in the property on notice that

the party asserting the lien has a claim. States differ widely in

the method and time within which a party may act on their lien. Also

varying widely are the requirements of written notices between property

owners, contractors, subcontractors and laborers, and in some cases lending

institutions. As a general rule, these statutes serve to prevent

unpleasant surprises by compelling parties who wish to assert their legal

rights to put all parties who might be interested in the property on notice

of a claim or the possibility of a claim. This by no means constitutes

a complete discussion of construction lien law and should not be interpreted

as such. Parties seeking to know more about construction laws in

their State should always consult their State statutes directly.

Who can claim a lien in this State?

A person to whom a debt is

due for labor performed or furnished or for materials furnished and actually

used in the erection, alteration, or repair of a building or structure

upon real estate or the boring and equipping of wells, by virtue of an

agreement with, or by consent of, the owner of the building or structure,

or a person having authority from, or rightfully acting for, the owner

in procuring or furnishing the labor or materials shall have a lien upon

the building or structure and upon the interest of the owner of the building

or structure in the lot of land upon which it is situated to secure the

payment of the debt due to him.

How long does a party have to claim a lien?

Such a lien shall be

dissolved unless the person desiring to avail himself thereof, within

ninety days after he ceases to labor on or furnish labor or materials

for such building or structure, serves upon the owner or, in the event

the owner cannot be found, upon the person in possession and files in the

office of the register of deeds or clerk of court of the county in which

the building or structure is situated a statement of a just and true account

of the amount due him, with all just credits given, together with a description

of the property intended to be covered by the lien sufficiently accurate

for identification, with the name of the owner of the property, if known,

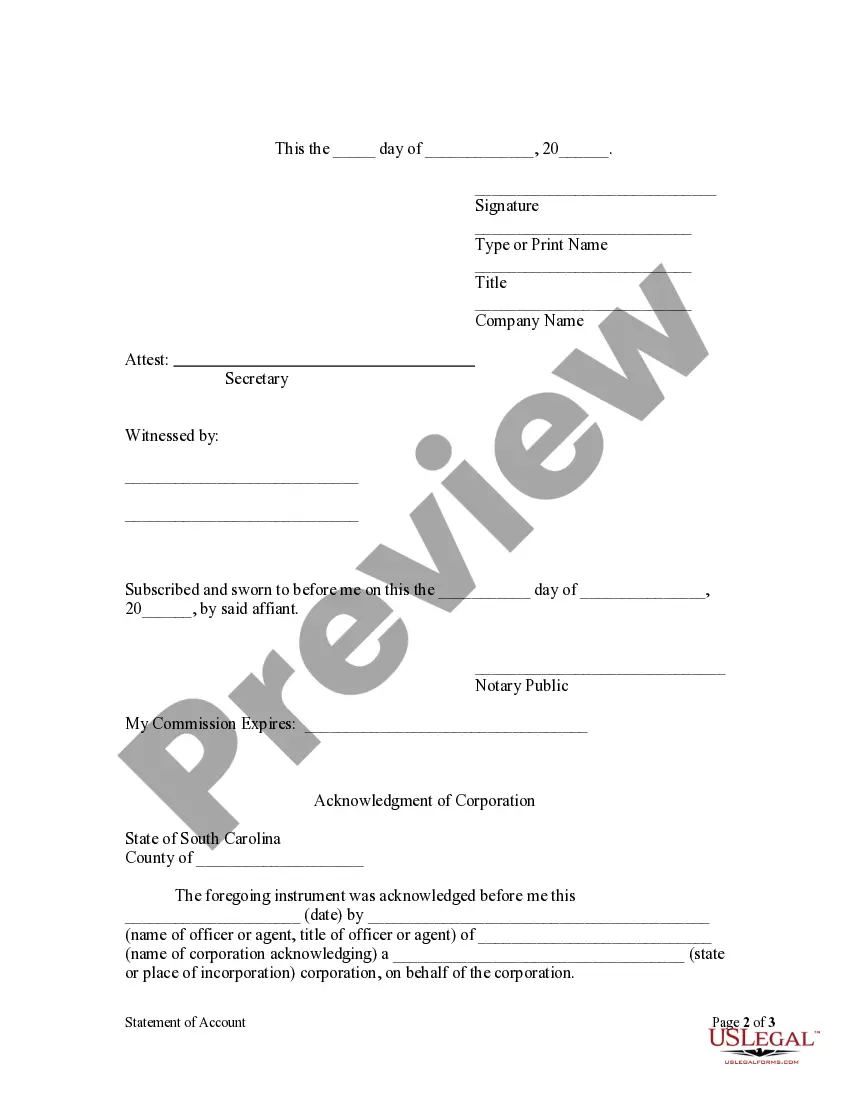

which certificate shall be subscribed and sworn to by the person claiming

the lien or by someone in his behalf and shall be recorded in a book kept

for the purpose by the register or clerk who shall be entitled to the same

fees therefor as for recording mortgages of equal length.

How long is a lien good for?

Unless a suit for enforcing

the lien is commenced, and notice of pendency of the action is filed, within

six months after the person desiring to avail himself thereof ceases to

labor on or furnish labor or material for such building or structures,

the lien shall be dissolved/

Does this State require or provide for a notice

from subcontractors and laborers to property owners?

Yes. South Carolina

law allows for a party to file with the Clerk of Court or Register of deeds

a Notice of Commencement when work begins. Any party who provides

labor or materials and was employed by someone other than the owner is

required to furnish a notice to that effect to the owner. Finally,

a lien claimant must provide the property owner with a copy of a filed

Statement of Account.

Does this State require or provide for a notice

from the property owner to the contractor, subcontractor, or laborers?

South Carolina law does

provide that a property owner may furnish a notice to contractors, subcontractors,

and other parties that the owner will not be responsible for the cost of

improvements on the property. (Please see below.)

Does this State require a notice prior to starting

work, or after work has been completed?

Any person entering

into a direct agreement with, or with the consent of, an owner for the

improvement of real property may file with the Clerk of Court or Register

of Deeds in the county or counties where the real property is situated a

Notice of Project Commencement. The notice must be filed within fifteen

days of the commencement of work and must be accompanied by a filing fee

of fifteen dollars to be deposited in that county's general fund.

Does this State permit a person with an interest

in property to deny responsibility for improvements?

Yes. The owner

of any such building or structure in the process of erection or being altered

or repaired, other than the person by whom or in whose behalf a contract

for labor or materials has been made, may prevent the attaching of any

lien for labor thereon not at the time performed or materials not then

furnished by giving notice, in writing, to the person performing or furnishing

such labor or furnishing such materials that he will not be responsible

therefor.

Is a notice attesting to the satisfaction of a

lien provided for or required?

No. South Carolina

statutes do not provide for or require that a lien holder who has been

paid produce or file a notice to that effect.

Does this State permit the use of a bond to release

a lien?

Yes.

At any time after service and filing of the statement required under SECTION

29-5-90 the owner or any other person having an interest in or lien upon

the property involved may secure the discharge of such property from such

lien by filing in the office of the clerk of court or register of deeds where

such lien is filed his written undertaking, in an amount equal to one and

one-third times the amount claimed in such statement, secured by the pledge

of United States or State of South Carolina securities, by cash or by a

surety bond executed by a surety company licensed to do business in this

State, and upon the filing of such undertaking so secured the lien shall

be discharged and the cash, securities or surety bond deposited shall take

the place of the property upon which the lien existed and shall be subject

to the lien.