South Carolina Statement of Earnings for Workers' Compensation

Description

How to fill out South Carolina Statement Of Earnings For Workers' Compensation?

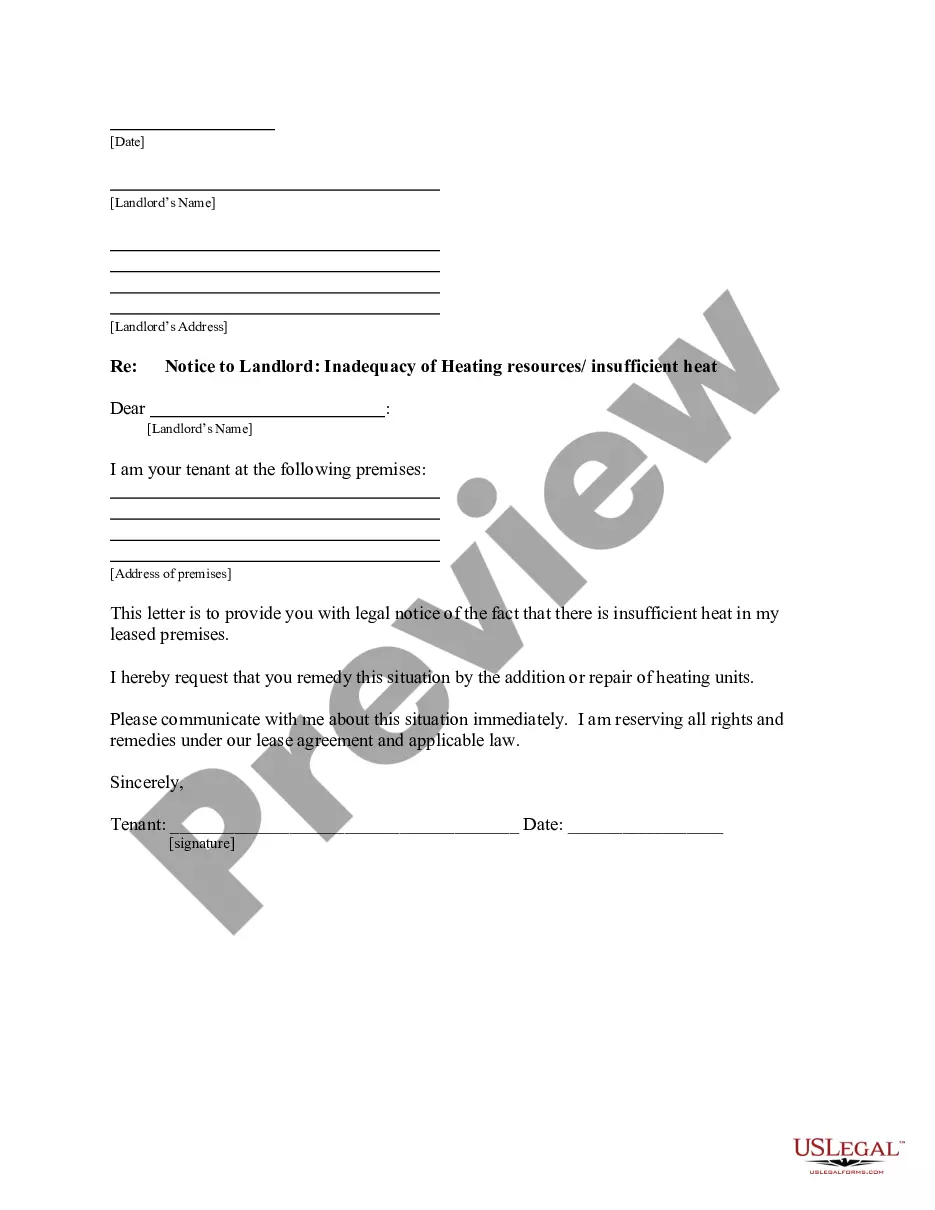

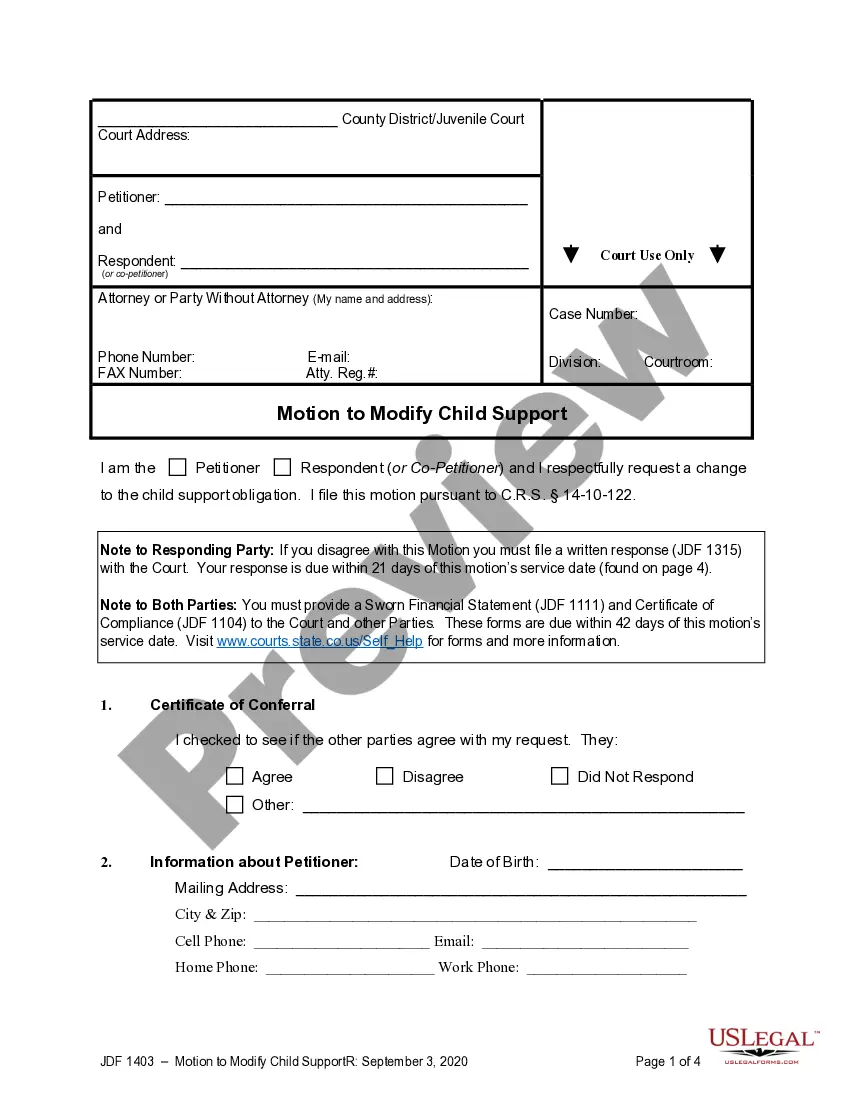

The work with papers isn't the most easy job, especially for those who almost never work with legal paperwork. That's why we recommend utilizing correct South Carolina Statement of Earnings for Workers' Compensation samples created by professional attorneys. It gives you the ability to prevent difficulties when in court or dealing with official institutions. Find the templates you want on our website for high-quality forms and correct descriptions.

If you’re a user with a US Legal Forms subscription, just log in your account. When you are in, the Download button will immediately appear on the template webpage. After getting the sample, it will be saved in the My Forms menu.

Customers with no a subscription can easily create an account. Follow this short step-by-step help guide to get the South Carolina Statement of Earnings for Workers' Compensation:

- Be sure that file you found is eligible for use in the state it is needed in.

- Verify the document. Utilize the Preview feature or read its description (if available).

- Click Buy Now if this sample is what you need or return to the Search field to get another one.

- Choose a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your file in a preferred format.

After doing these easy steps, you are able to fill out the form in a preferred editor. Recheck filled in info and consider asking a lawyer to examine your South Carolina Statement of Earnings for Workers' Compensation for correctness. With US Legal Forms, everything gets much easier. Test it now!

Form popularity

FAQ

A workers' compensation insurance policy is based on payroll, regardless of whether the employee is full-time, part-time, temporary or seasonal. Begin with the gross payroll for each employee. Tips for Calculating Payroll: Gross payroll for each employee can be rounded to the nearest $1,000.

Gross wages include salaries, commissions, bonuses, vacation, holiday pay, sick pay, overtime base wages, the market value of gifts, all substitutes for money earned or paid during the policy period including meals and lodging in lieu of wages, automobile allowances, and some pension play payments explained below.

Workers' Compensation Insurance premiums are based on your company's business and industry, the type of work performed by each employee, claims history and your company payroll. Employee Classification Rate.For $100 of taxable wages paid to that employee, the employer is charged $0.15 for Workers' Comp Insurance.

A workers' compensation insurance policy is based on payroll, regardless of whether the employee is full-time, part-time, temporary or seasonal. Begin with the gross payroll for each employee.

For workers' compensation purposes, payroll or remuneration means money or substitutes for money. Your premium calculations include the following as remuneration: Wages or salaries including retroactive wages or salaries. Total cash received by employees for commissions and draws against commissions.

A workers' compensation certificate of insurance is proof that a business carries workers' comp coverage. It can sometimes be referred to by other names, including COI, insurance certificate, certificate of insurance form, subcontractor certificate of insurance, or proof of insurance.

Workers Compensation Calculator Most often, benefits are calculated and paid based on the average weekly wage. This is calculated by multiplying the employee's daily wage by the number of days worked in a full year. That number is then divided by 52 weeks to get the average weekly wage.

Calculating California Workers' Compensation Benefits In California, if you are injured on the job, you are entitled to receive two-thirds of your pretax gross wage.This is not required by law in California, but it makes up the salary difference so that you receive your entire income if you were injured on the job.

Workers' Comp Payroll DefinitionWages or salaries including retroactive wages or salaries. Total cash received by employees for commissions and draws against commissions. Bonuses including stock bonus plans. Extra pay for overtime work-see next section for exceptions.