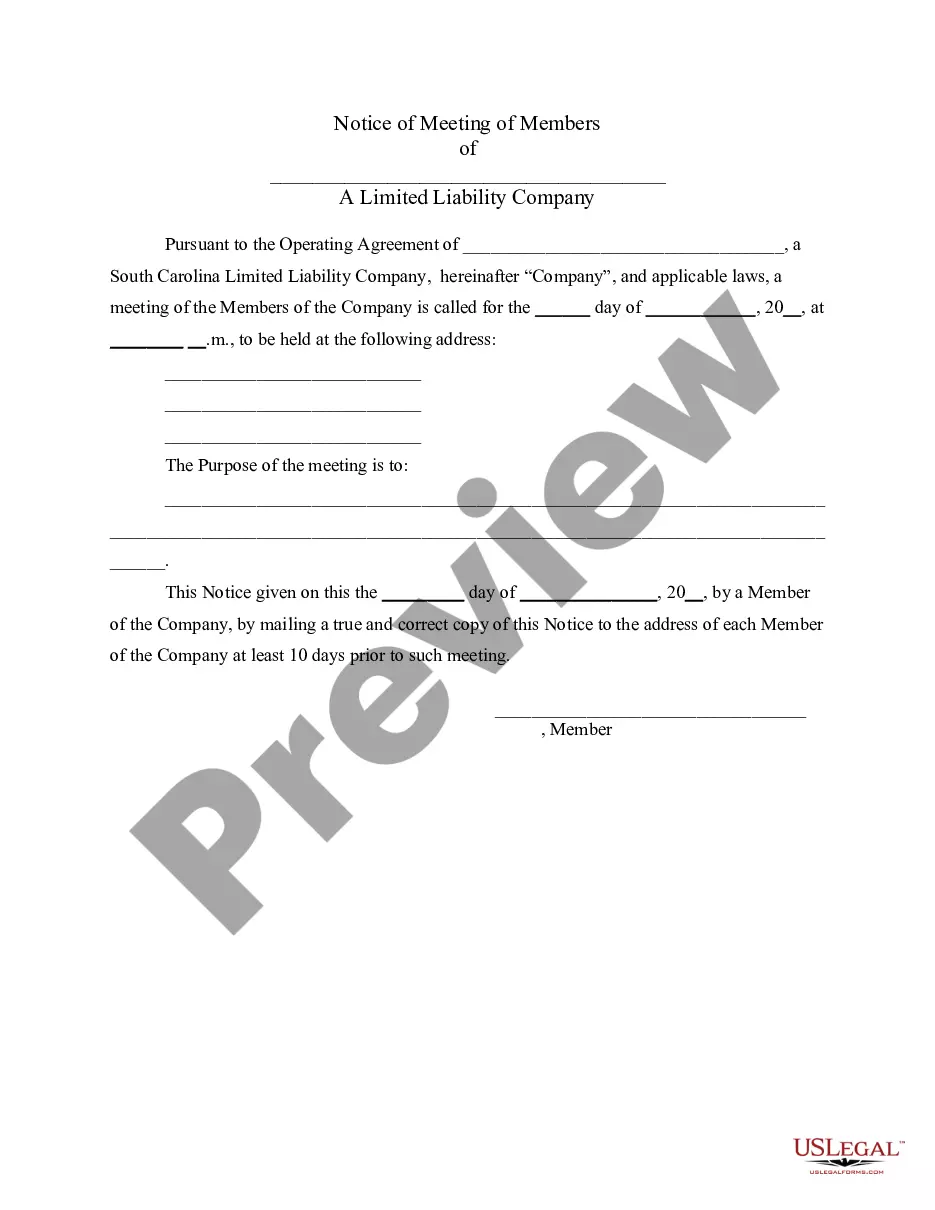

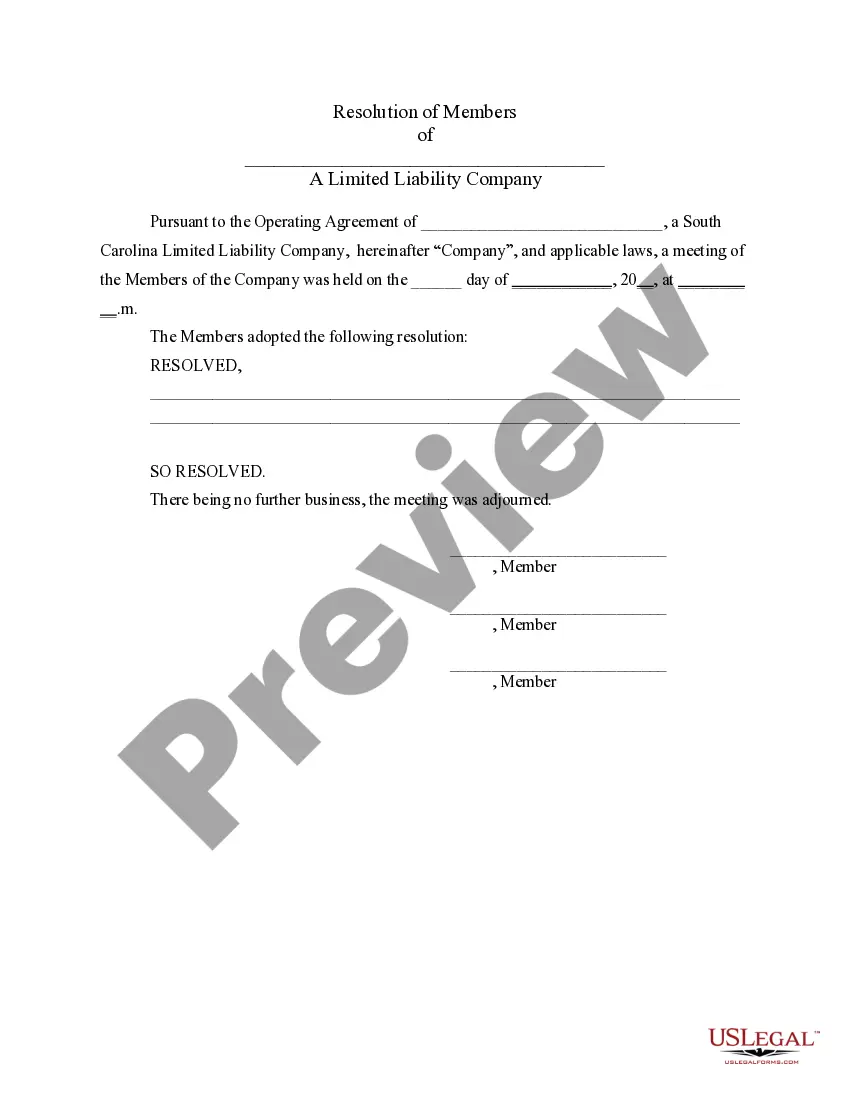

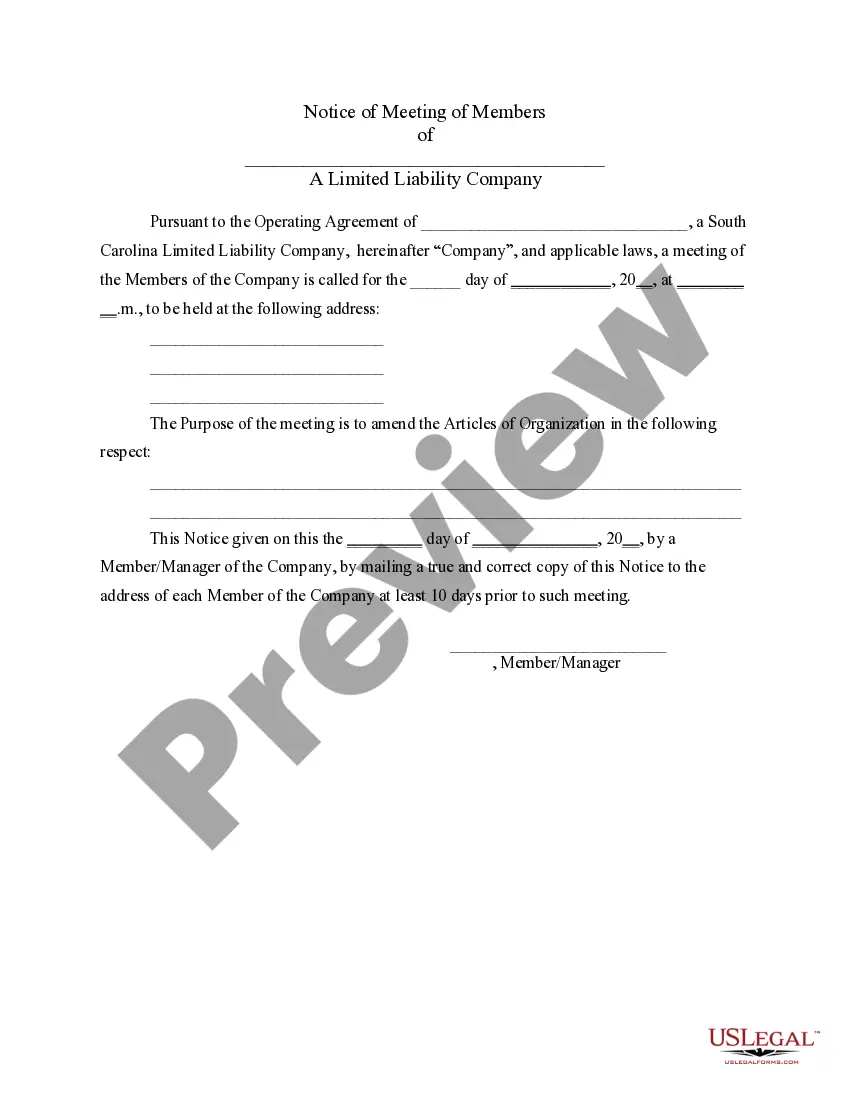

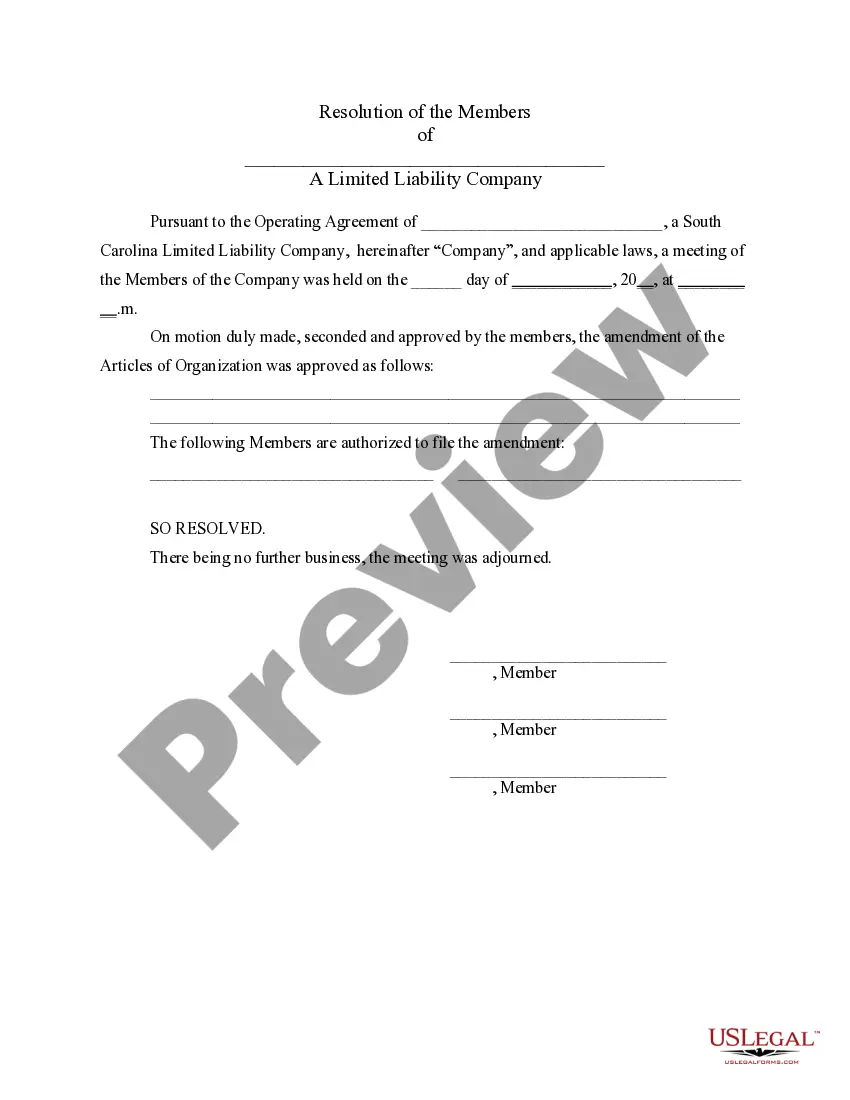

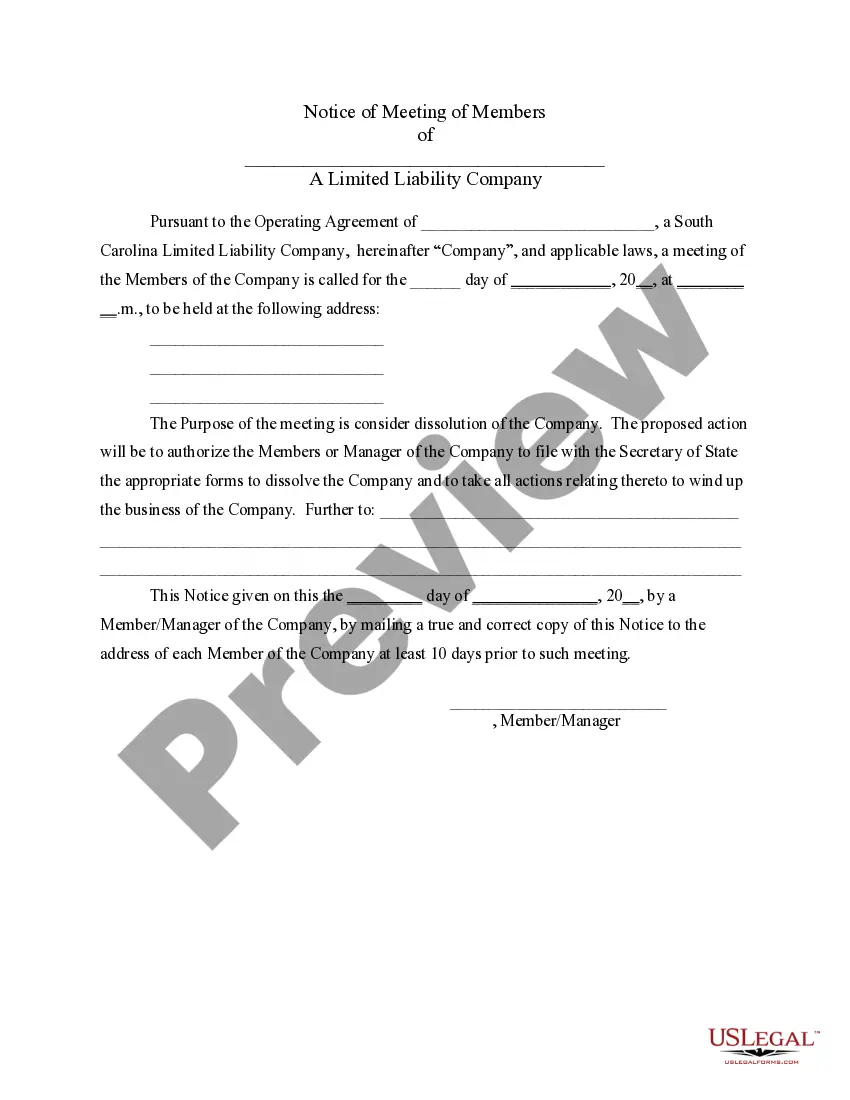

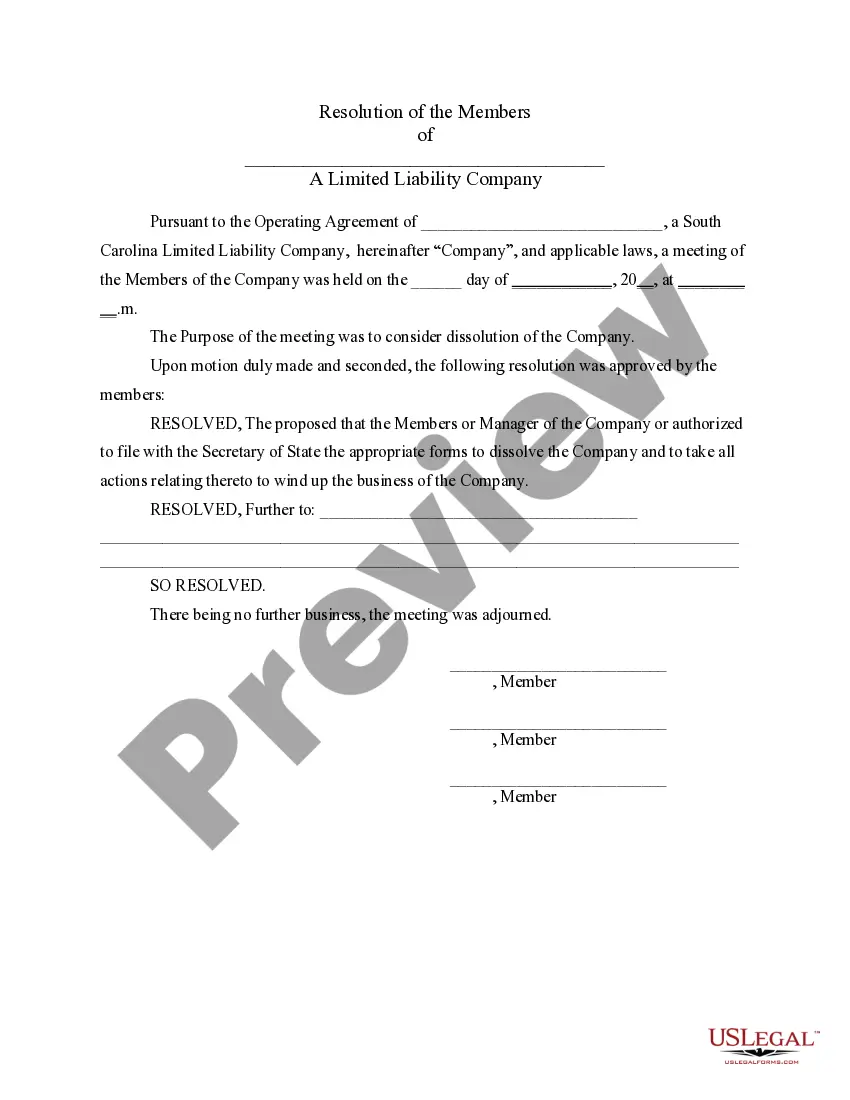

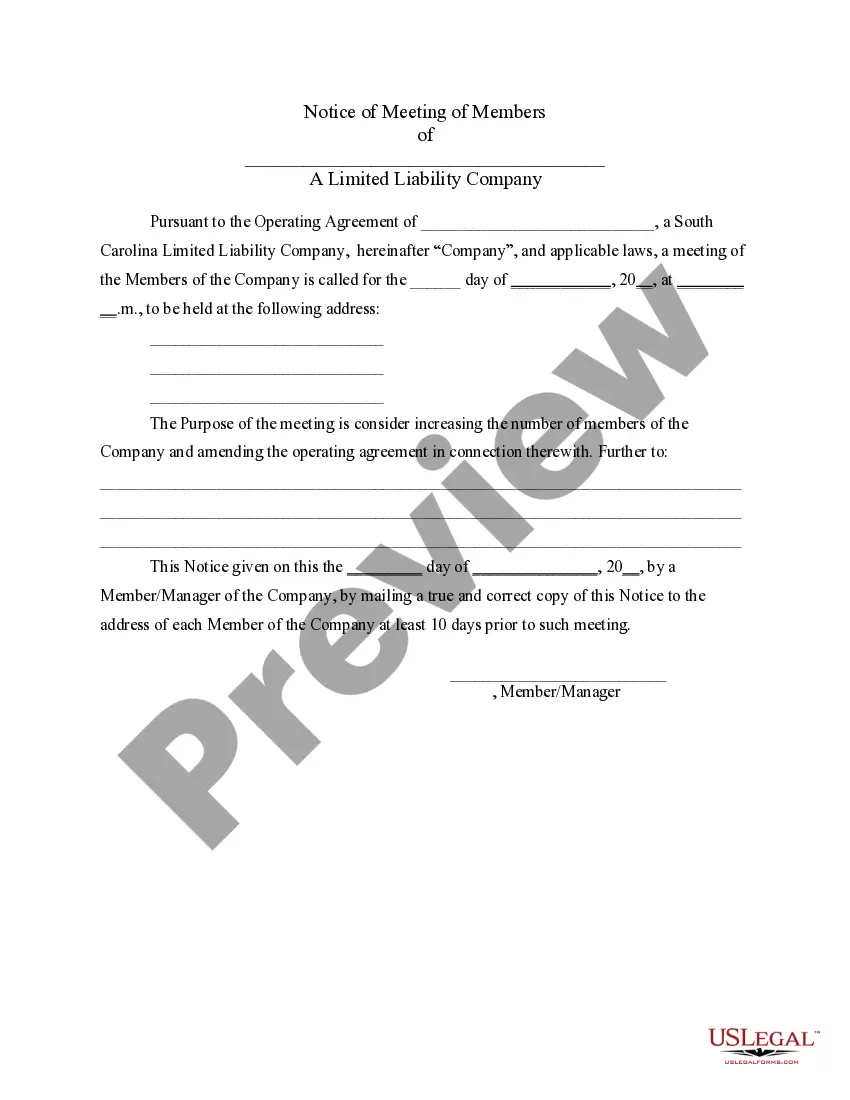

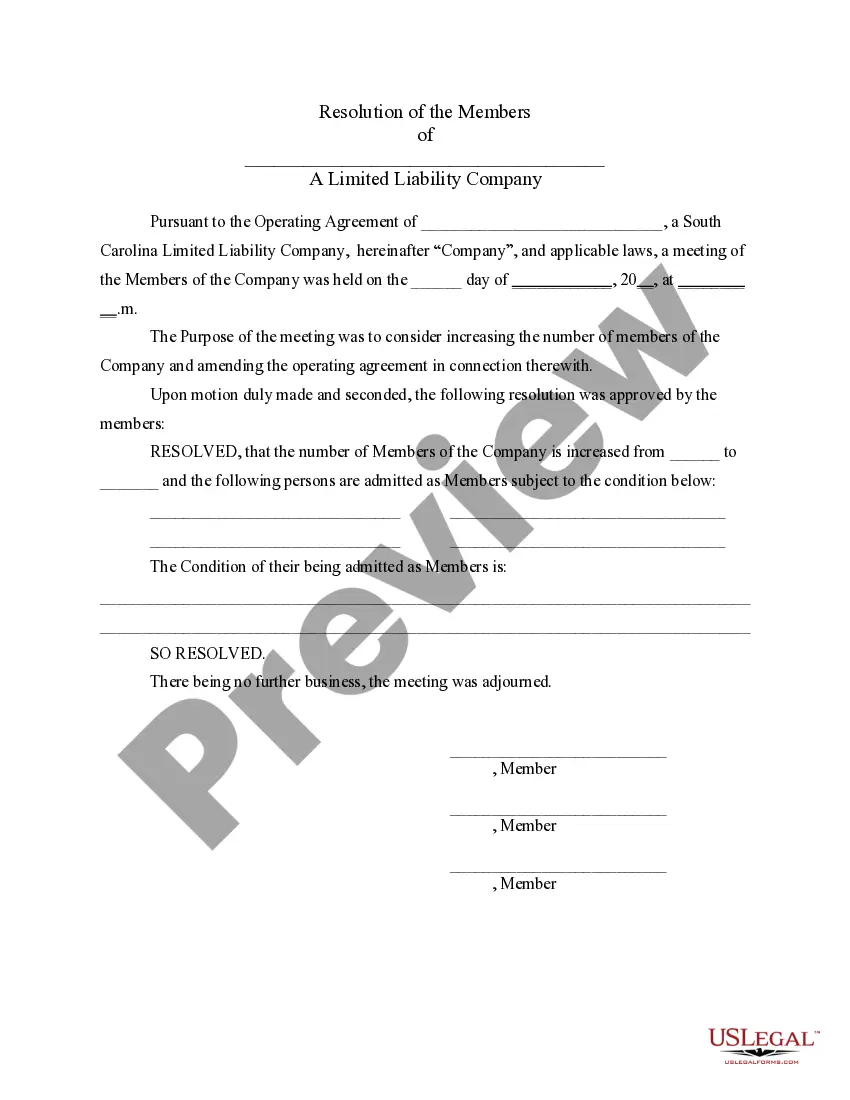

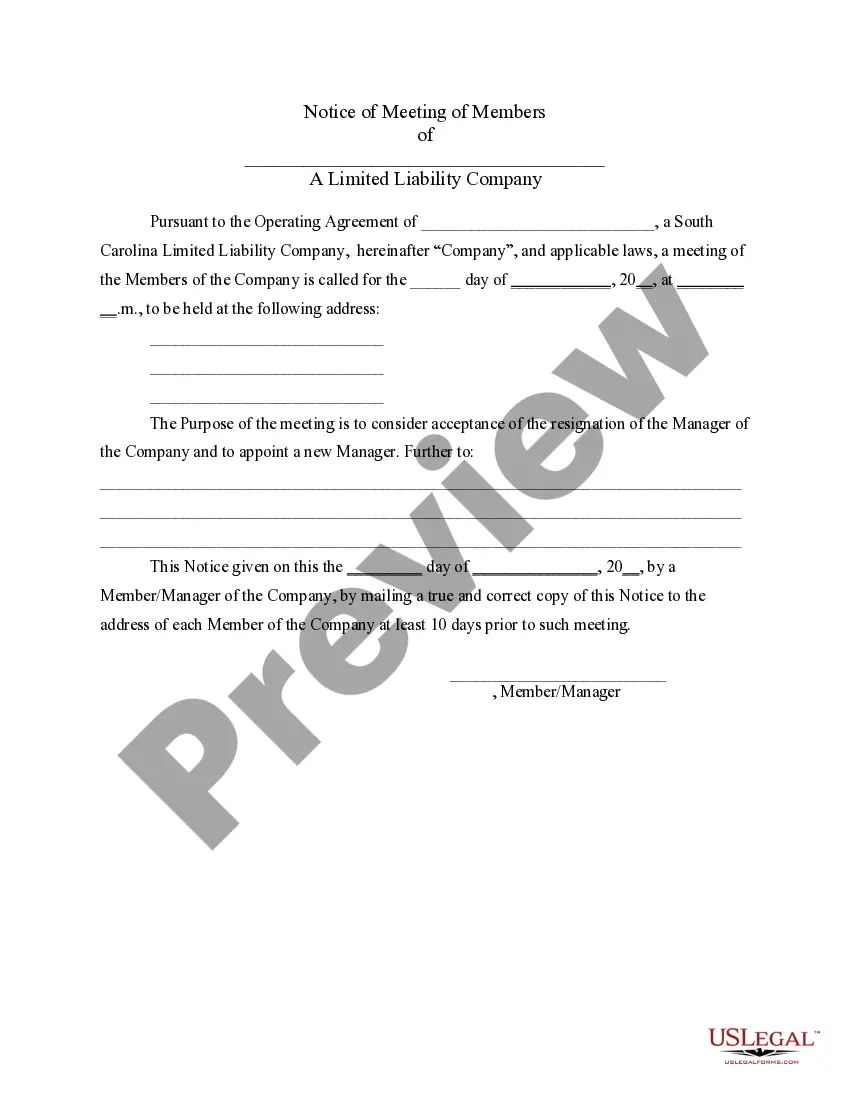

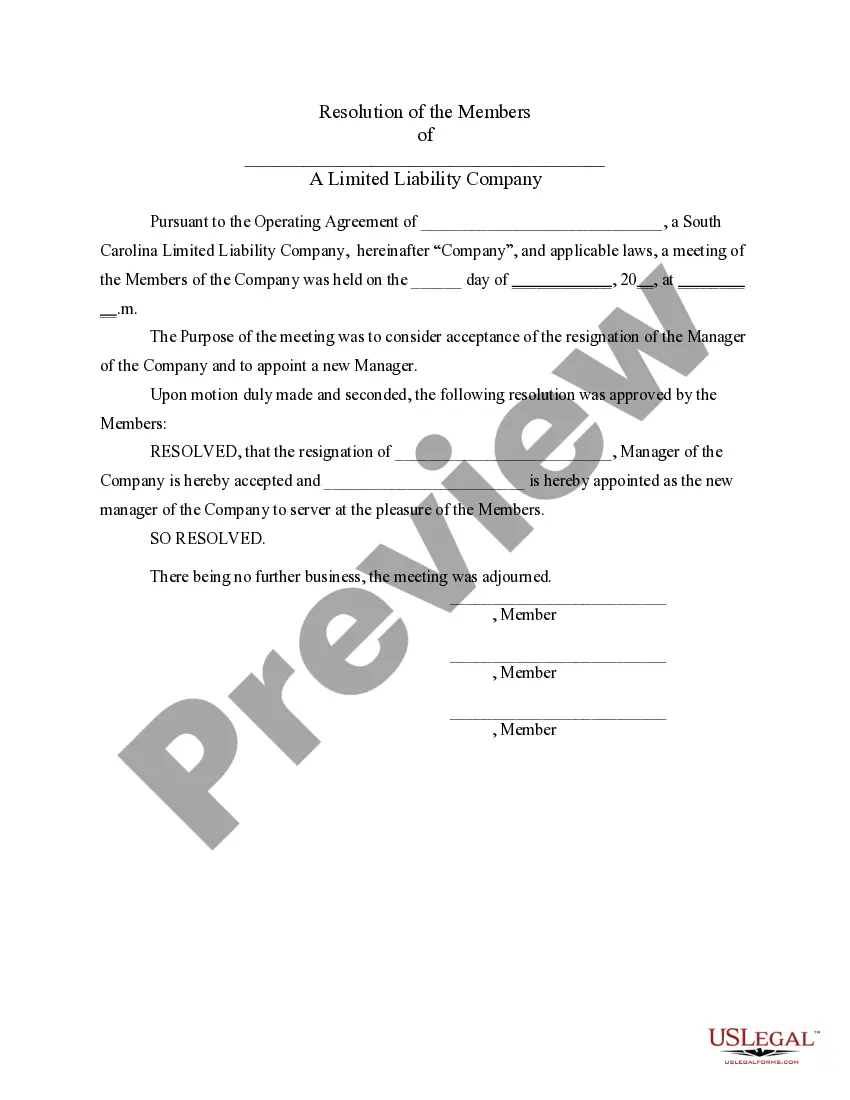

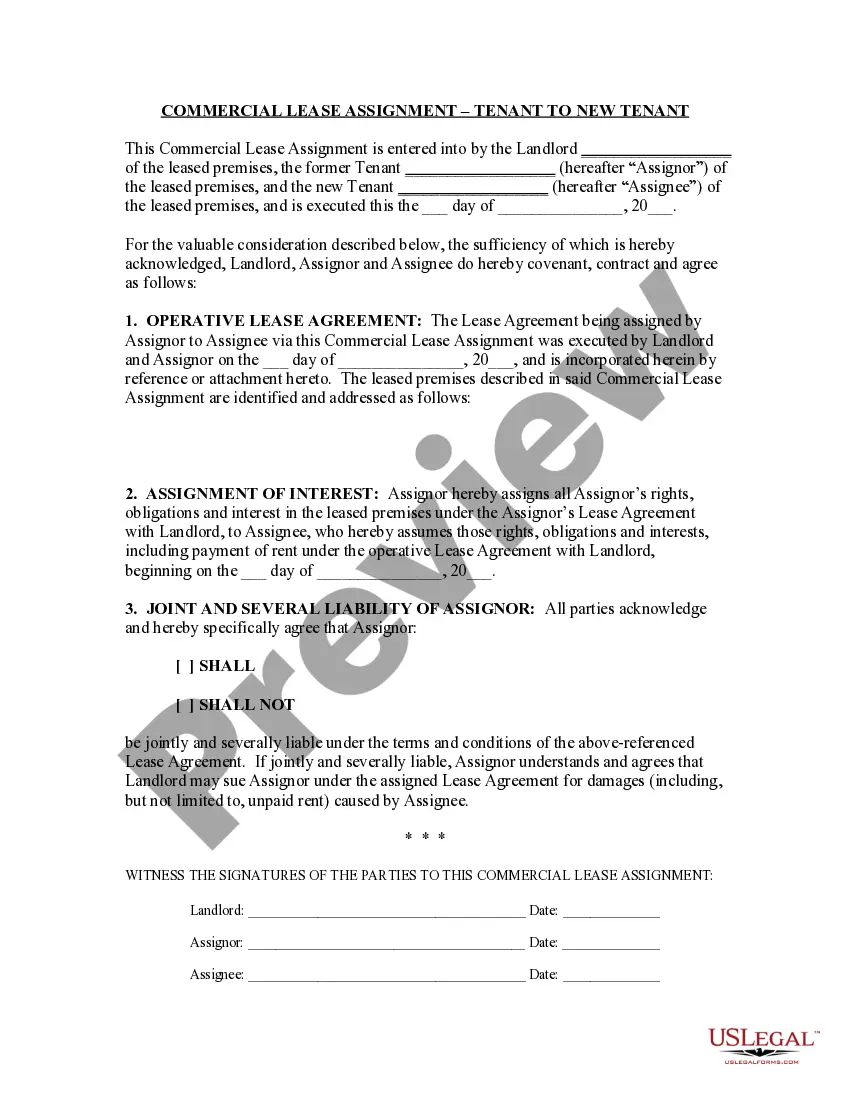

South Carolina LLC Notices, Resolutions and other Operations Forms Package

Description Limited Liability Company Document

How to fill out South Carolina LLC Notices, Resolutions And Other Operations Forms Package?

The work with documents isn't the most straightforward task, especially for people who almost never work with legal papers. That's why we advise making use of accurate South Carolina LLC Notices, Resolutions and other Operations Forms Package templates made by professional lawyers. It gives you the ability to avoid difficulties when in court or working with official organizations. Find the documents you want on our website for top-quality forms and exact information.

If you’re a user with a US Legal Forms subscription, simply log in your account. As soon as you’re in, the Download button will automatically appear on the file webpage. Right after accessing the sample, it will be stored in the My Forms menu.

Users without an activated subscription can easily get an account. Look at this brief step-by-step guide to get the South Carolina LLC Notices, Resolutions and other Operations Forms Package:

- Make sure that the form you found is eligible for use in the state it’s required in.

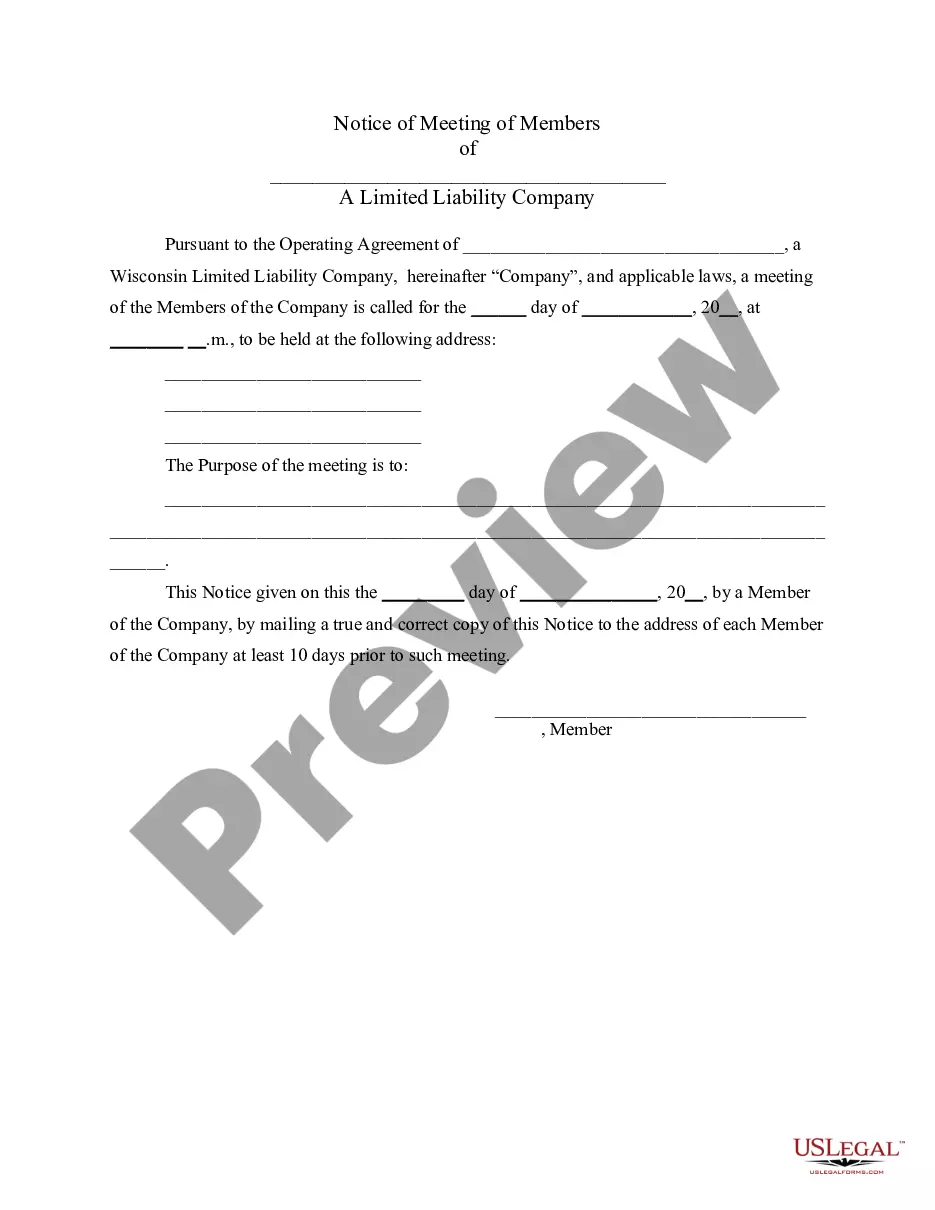

- Verify the file. Use the Preview feature or read its description (if readily available).

- Click Buy Now if this sample is what you need or utilize the Search field to find another one.

- Select a convenient subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a required format.

Right after doing these simple actions, you are able to complete the sample in an appropriate editor. Recheck filled in details and consider requesting a legal representative to examine your South Carolina LLC Notices, Resolutions and other Operations Forms Package for correctness. With US Legal Forms, everything becomes much easier. Test it now!

Limited Liability Company Form Form popularity

Sc Llc Forms Other Form Names

Sc Llc Resolutions FAQ

To file Article of Organization in paper format, file with the South Carolina Secretary of State and pay a fee of $110. Fill out the pdf form online, print and mail 2 copies, the original and either a duplicate original or a conformed copy.

A South Carolina LLC operating agreement is a legal document that is designed to guide the users of any size business in properly creating an agreement that would provide needed protections for any company. This agreement is not required in this State in order to conduct business within the State.

If you are a Limited Liability Company (LLC), professional organization, or other association taxed as a corporation and not exempt under SC Code Section 12-20-110, you must submit a CL-1 and include a $25 payment.

A limited liability company (LLC) is a business structure in the United States whereby the owners are not personally liable for the company's debts or liabilities. Limited liability companies are hybrid entities that combine the characteristics of a corporation with those of a partnership or sole proprietorship. 1feff

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

How much does it cost to form an LLC in South Carolina? The South Carolina Secretary of State charges a $110 fee to file the Articles of Organization. You can reserve your LLC name with the South Carolina Secretary of State for $25.

Businesses operating in South Carolina will file their annual report along with their tax returns the form itself is essentially a tax return that also renews your business' status in the state. To file, complete your taxes and determine what must be paid.

To form an LLC in South Carolina you will need to file the Articles of Organization with the South Carolina Secretary of State, which costs $110. You can apply online or by mail. The Articles of Organization is the legal document that officially creates your South Carolina Limited Liability Company.

Form CL-1 Initial Annual Report of Corporations must be submitted by both domestic and foreign corporations to the Secretary of State. LLC's filing as a corporation must submit Form CL-1 to SCDOR within 60 days of conducting business in this state.The annual report (Schedule D) is part of the corporate tax return.