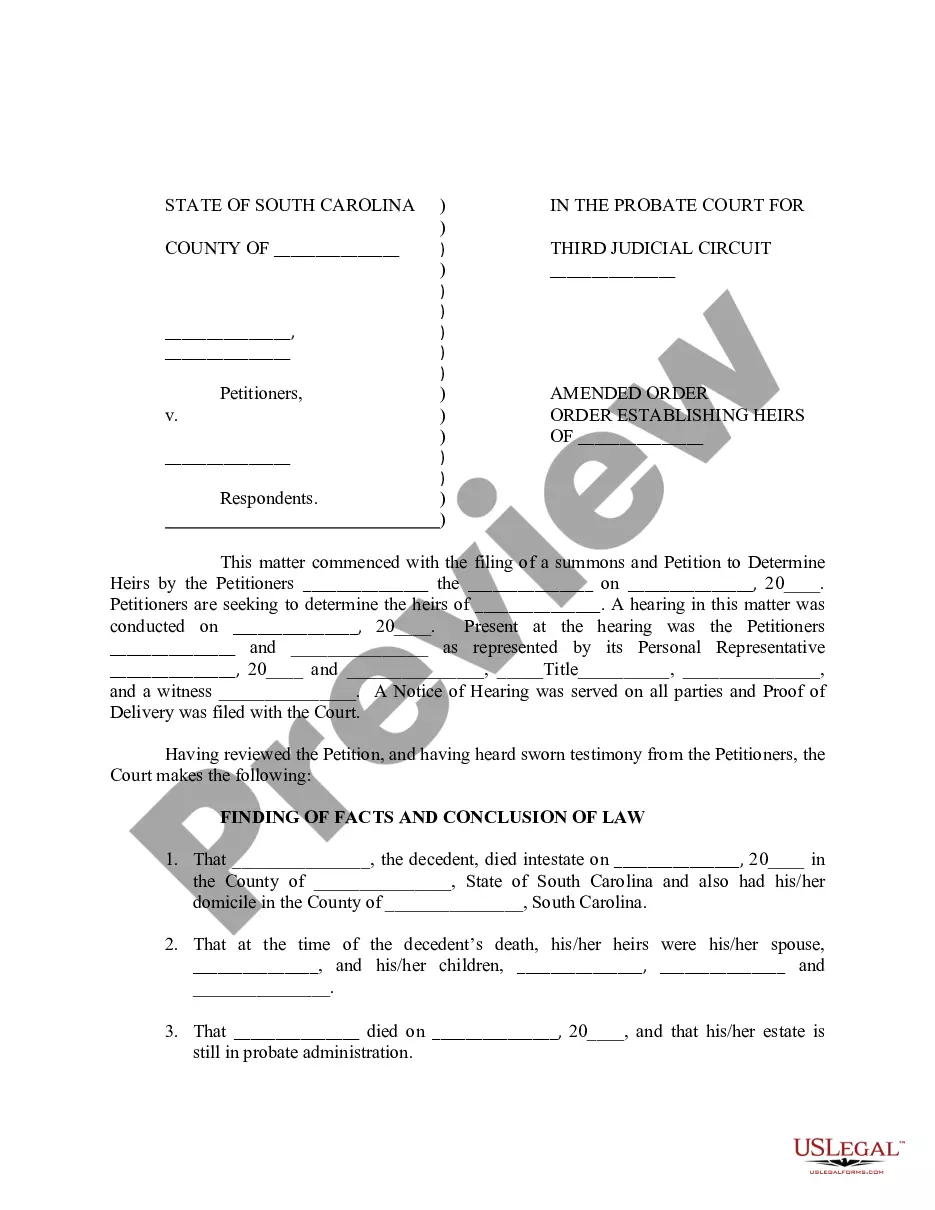

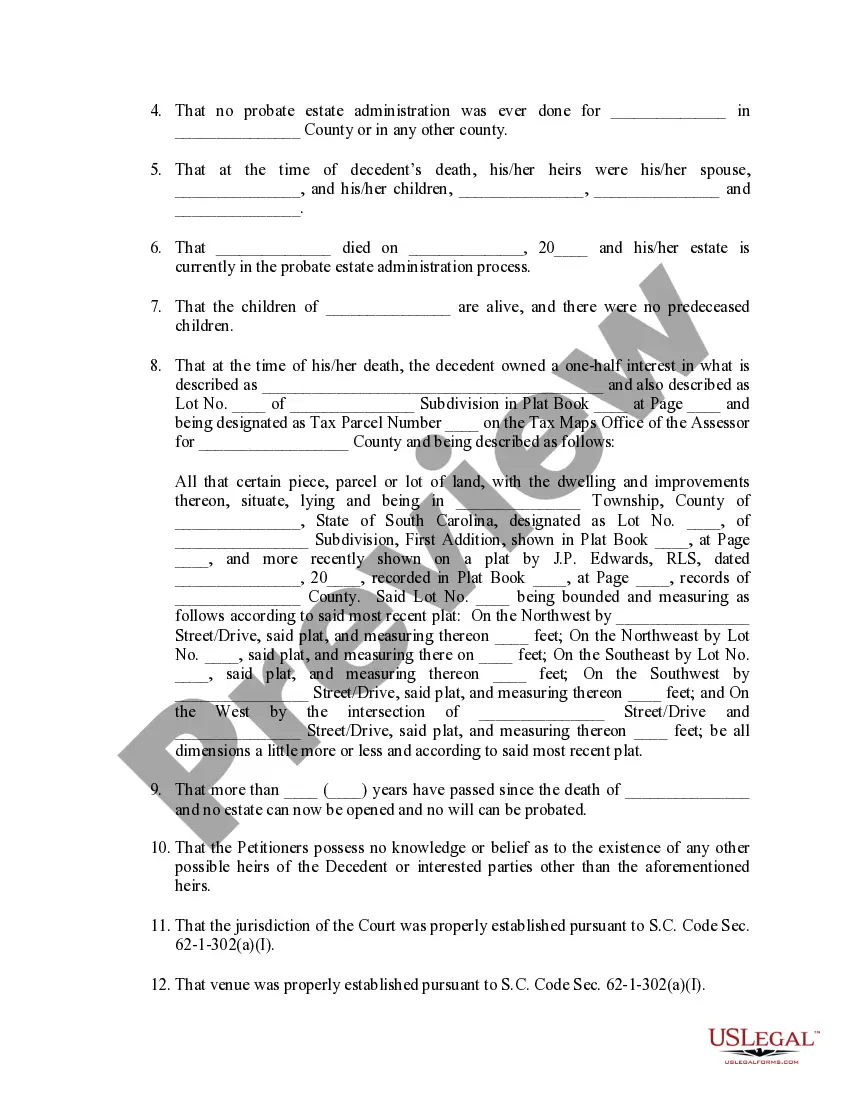

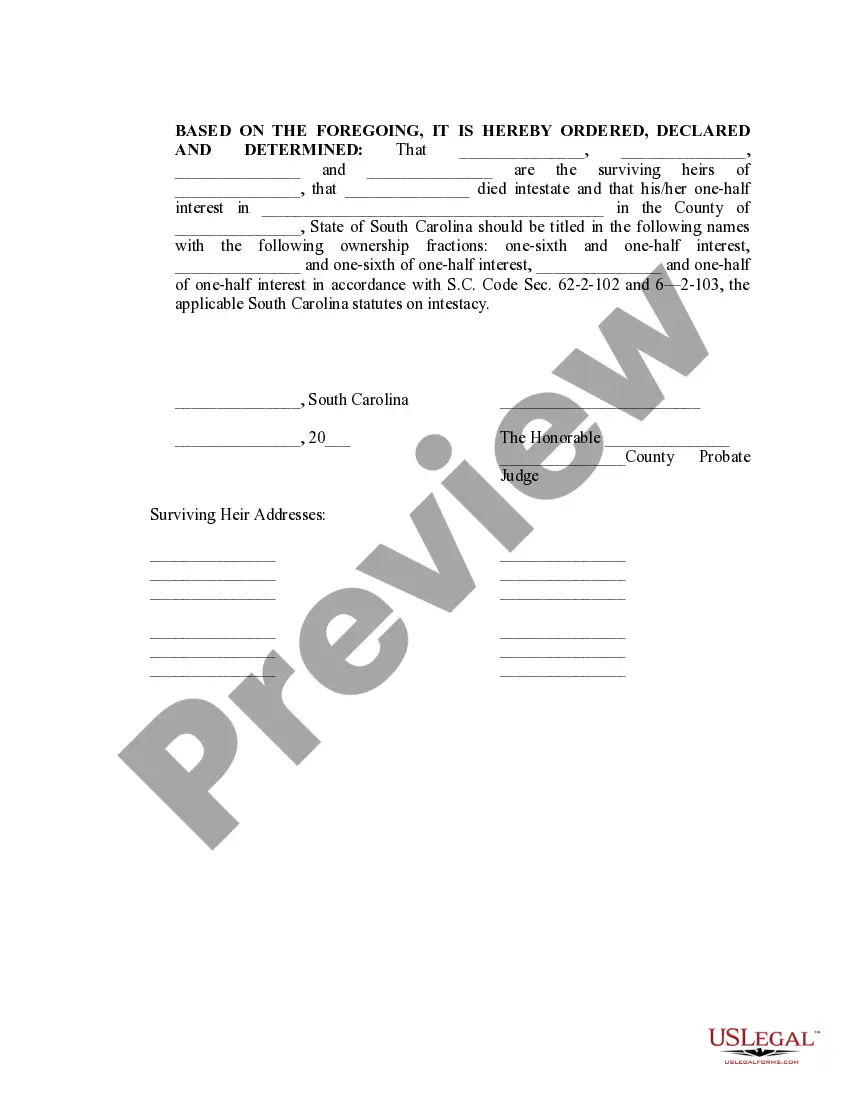

South Carolina Amended Order Establishing Heirs

Description

How to fill out South Carolina Amended Order Establishing Heirs?

The work with papers isn't the most easy process, especially for those who rarely work with legal paperwork. That's why we advise using accurate South Carolina Amended Order Establishing Heirs samples made by professional attorneys. It allows you to prevent problems when in court or handling official institutions. Find the templates you want on our site for top-quality forms and exact information.

If you’re a user having a US Legal Forms subscription, simply log in your account. When you’re in, the Download button will immediately appear on the file page. Right after accessing the sample, it’ll be saved in the My Forms menu.

Customers with no an active subscription can easily get an account. Utilize this brief step-by-step help guide to get the South Carolina Amended Order Establishing Heirs:

- Be sure that the sample you found is eligible for use in the state it is needed in.

- Verify the document. Make use of the Preview feature or read its description (if offered).

- Click Buy Now if this file is what you need or return to the Search field to get another one.

- Select a suitable subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a required format.

Right after doing these simple actions, you are able to complete the form in an appropriate editor. Recheck completed info and consider asking an attorney to examine your South Carolina Amended Order Establishing Heirs for correctness. With US Legal Forms, everything becomes much simpler. Try it out now!

Form popularity

FAQ

In most cases, a deceased person's heirs-at-law are determined by the intestacy laws of the state in which she lived at the time of her death. But the intestacy laws of another state might apply if she owned real estate or tangible personal property there.

An heir is a person who is legally entitled to collect an inheritance, when a deceased person did not formalize a last will and testament. Generally speaking, heirs who inherit the property are children, descendants or other close relatives of the decedent.

As an heir, you are entitled to a copy of the Will, whether you are named as a beneficiary or not. If there is a probate estate, then you should receive a copy of the Will. If you do not, you can always get it from the court. If there is no probate estate, then the Will is not going to do anything.

Heirs who inherit property are typically children, descendants, or other close relatives of the decedent. Spouses typically are not legally considered to be heirs, as they are instead entitled to properties via marital or community property laws.

Quitclaim Deed. A quitclaim deed transfers an owner's interest in real property whatever that interest may be to the buyer. Forced Sale. Tax Sale. Suit to Quiet Title. Transfer by Agreement.