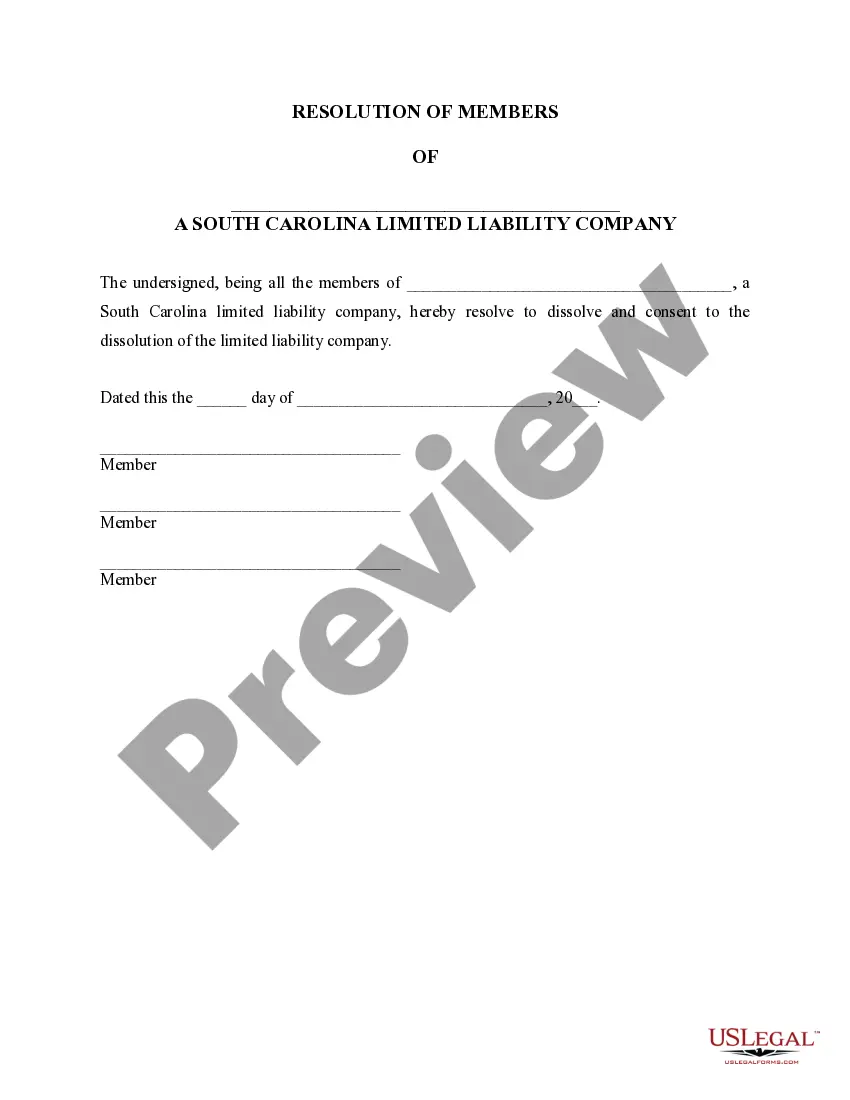

South Carolina Dissolution Package to Dissolve Limited Liability Company LLC

Description

How to fill out South Carolina Dissolution Package To Dissolve Limited Liability Company LLC?

The work with papers isn't the most straightforward process, especially for people who rarely work with legal papers. That's why we recommend making use of correct South Carolina Dissolution Package to Dissolve Limited Liability Company LLC templates made by professional lawyers. It allows you to eliminate difficulties when in court or working with official organizations. Find the documents you want on our site for high-quality forms and accurate explanations.

If you’re a user with a US Legal Forms subscription, simply log in your account. As soon as you’re in, the Download button will immediately appear on the file web page. After downloading the sample, it’ll be saved in the My Forms menu.

Users without an activated subscription can quickly create an account. Follow this brief step-by-step help guide to get the South Carolina Dissolution Package to Dissolve Limited Liability Company LLC:

- Be sure that the document you found is eligible for use in the state it’s required in.

- Confirm the document. Make use of the Preview feature or read its description (if offered).

- Click Buy Now if this file is what you need or go back to the Search field to find a different one.

- Select a convenient subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a required format.

Right after finishing these easy steps, you are able to complete the sample in a preferred editor. Check the completed details and consider asking an attorney to review your South Carolina Dissolution Package to Dissolve Limited Liability Company LLC for correctness. With US Legal Forms, everything becomes much easier. Try it out now!

Form popularity

FAQ

If you are a member of a limited liability company and wish to leave the membership voluntarily, you cannot simply walk away. There are procedures to follow that include methods of notification of the remaining membership, how assets are handled, and what the provisions of withdrawal are for each LLC.

Step 1: Corporation or LLC action. Step 2: Filing the Certificate of Dissolution with the state. Step 3: Filing federal, state, and local tax forms. Step 4: Notifying creditors your business is ending. Step 5: Settling creditors' claims.

Unlike most other states, South Carolina's LLC Act provides no explicit, statutory method for voluntary dissolution, such as unanimous member consent or a majority member vote, if your operating agreement does not contain provisions for dissolution.

There is no fee to file the California dissolution forms. To speed up the process, you can pay for expedited service and preclearance.

Unless dissolved, your California LLC will continue to be liable for state fees, it will continue to be open to incurring more debts, it will continue to own the assets under its name, and you won't be able to sell those assets as your own.

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

Method 1: You can voluntarily dissolve your LLC. This requires a majority vote from all members or a certain percentage of votes as required per your operating agreement. With the required votes, you can move forward with the dissolution.

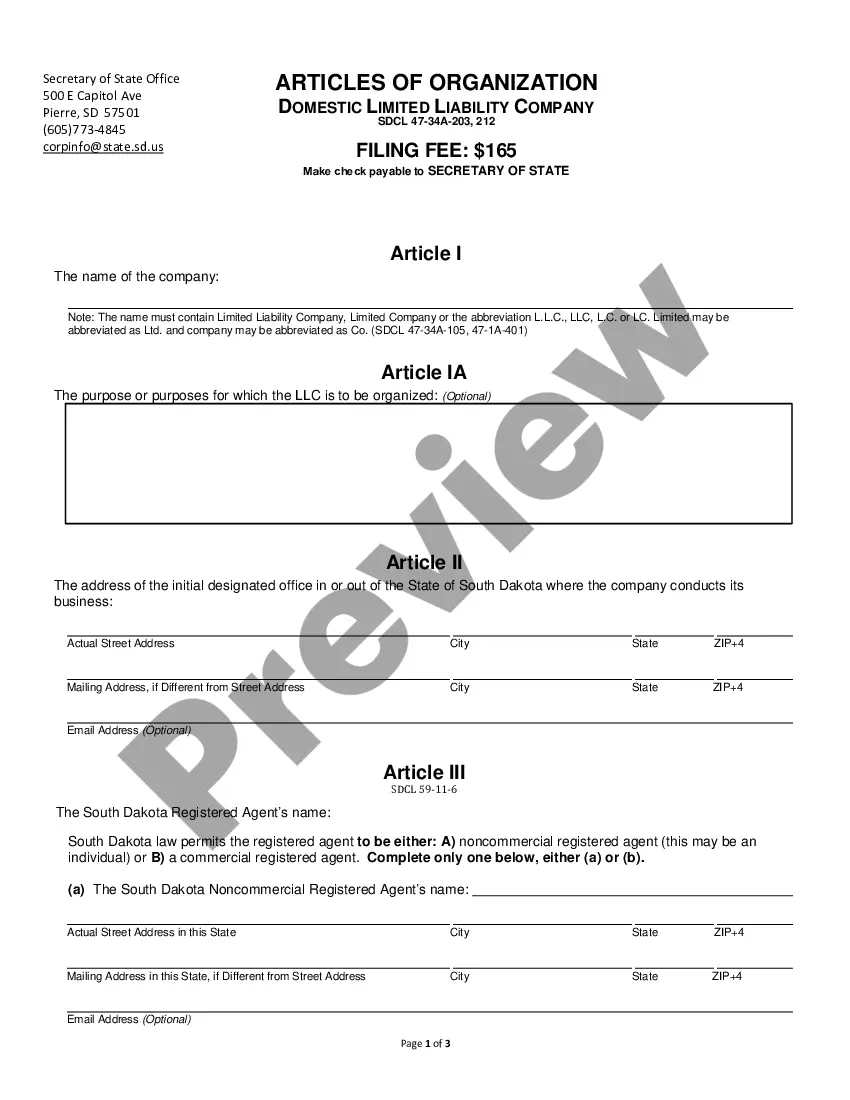

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.