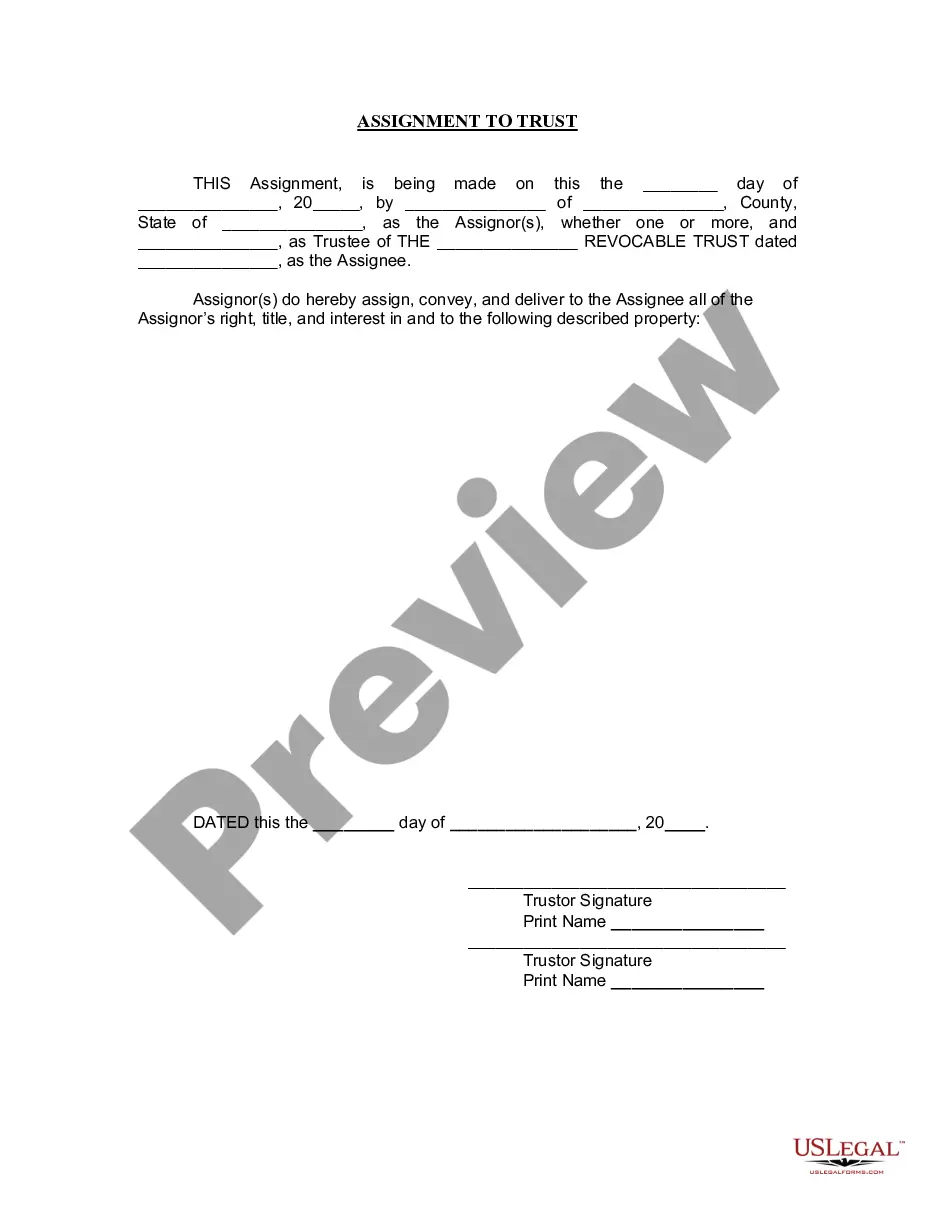

South Carolina Assignment to Living Trust

Description Sc Living Trust Form

How to fill out South Carolina Assignment To Living Trust?

The work with documents isn't the most simple job, especially for people who rarely work with legal paperwork. That's why we advise making use of correct South Carolina Assignment to Living Trust templates created by professional lawyers. It allows you to eliminate difficulties when in court or dealing with official institutions. Find the files you require on our website for high-quality forms and exact explanations.

If you’re a user with a US Legal Forms subscription, simply log in your account. Once you are in, the Download button will automatically appear on the template page. Right after getting the sample, it’ll be saved in the My Forms menu.

Customers with no a subscription can quickly get an account. Follow this brief step-by-step guide to get your South Carolina Assignment to Living Trust:

- Be sure that the sample you found is eligible for use in the state it’s required in.

- Verify the document. Make use of the Preview option or read its description (if available).

- Buy Now if this form is what you need or return to the Search field to get another one.

- Select a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a preferred format.

After doing these easy actions, you can fill out the sample in an appropriate editor. Double-check filled in information and consider asking a lawyer to examine your South Carolina Assignment to Living Trust for correctness. With US Legal Forms, everything becomes much simpler. Test it now!

South Carolina Trust Form Form popularity

Sc Assignment Living Other Form Names

FAQ

Determine the Current Title and Vesting to Your Property. Prepare a Deed. Be Aware of Your Lender and Title Insurance. Prepare a Preliminary Change of Ownership Report. Execute Your Deed. Record Your Deed. Wait for the Deed to be Returned. Keep the Property in the Trust.

Figure out which type of trust is best for you. Take inventory of your property. Choose your trustee. Create the trust document. Sign the trust in front of a notary public. Fund the trust by transferring your assets into it.

As of 2019, attorney fees can range from $1,000 to $2,500 to set up a trust, depending upon the complexity of the document and where you live. You can also hire an online service provider to set up your trust. As of 2019, you can expect to pay about $300 for an online trust.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.

Assuming you decide you want a revocable living trust, how much should you expect to pay? If you are willing to do it yourself, it will cost you about $30 for a book, or $70 for living trust software. If you hire a lawyer to do the job for you, get ready to pay between $1,200 and $2,000.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.