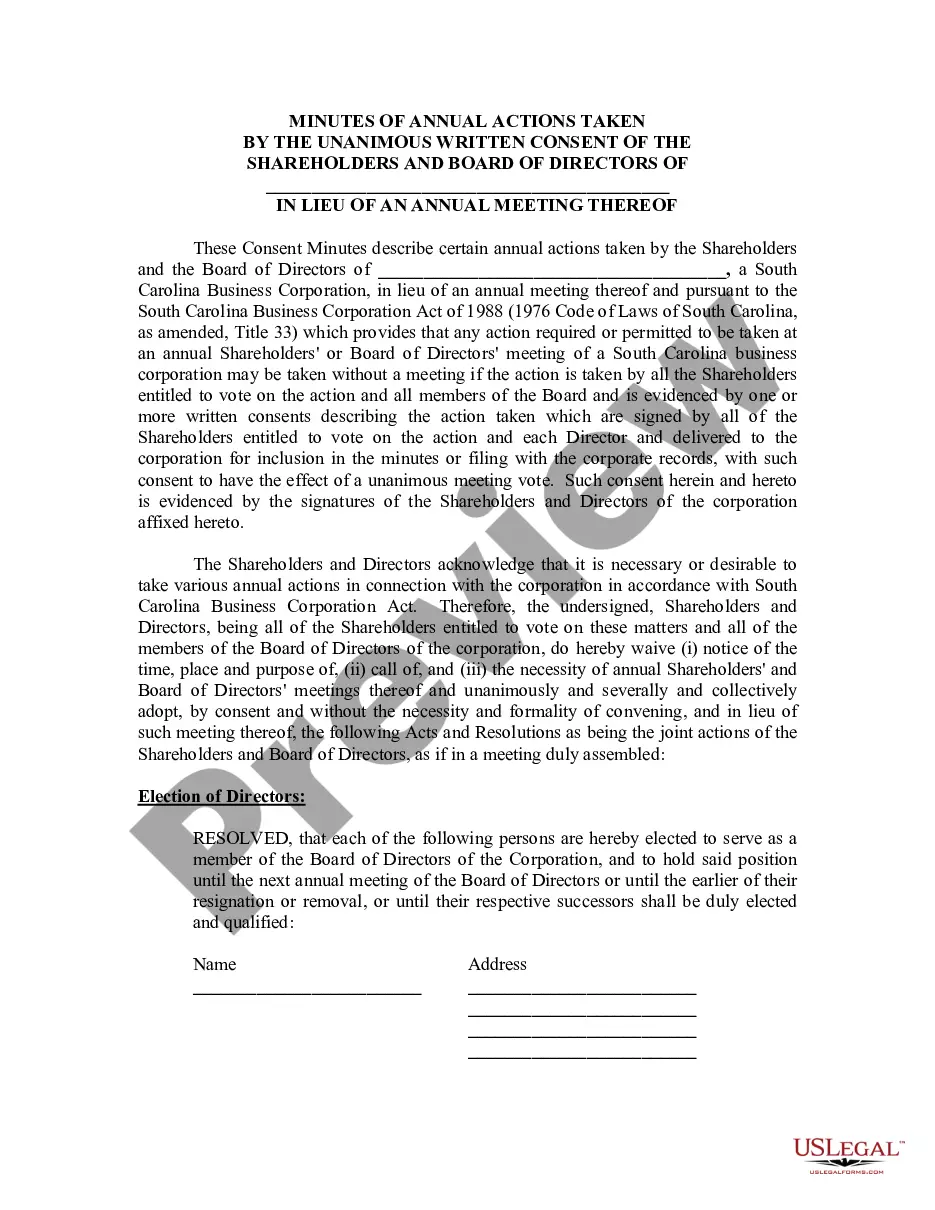

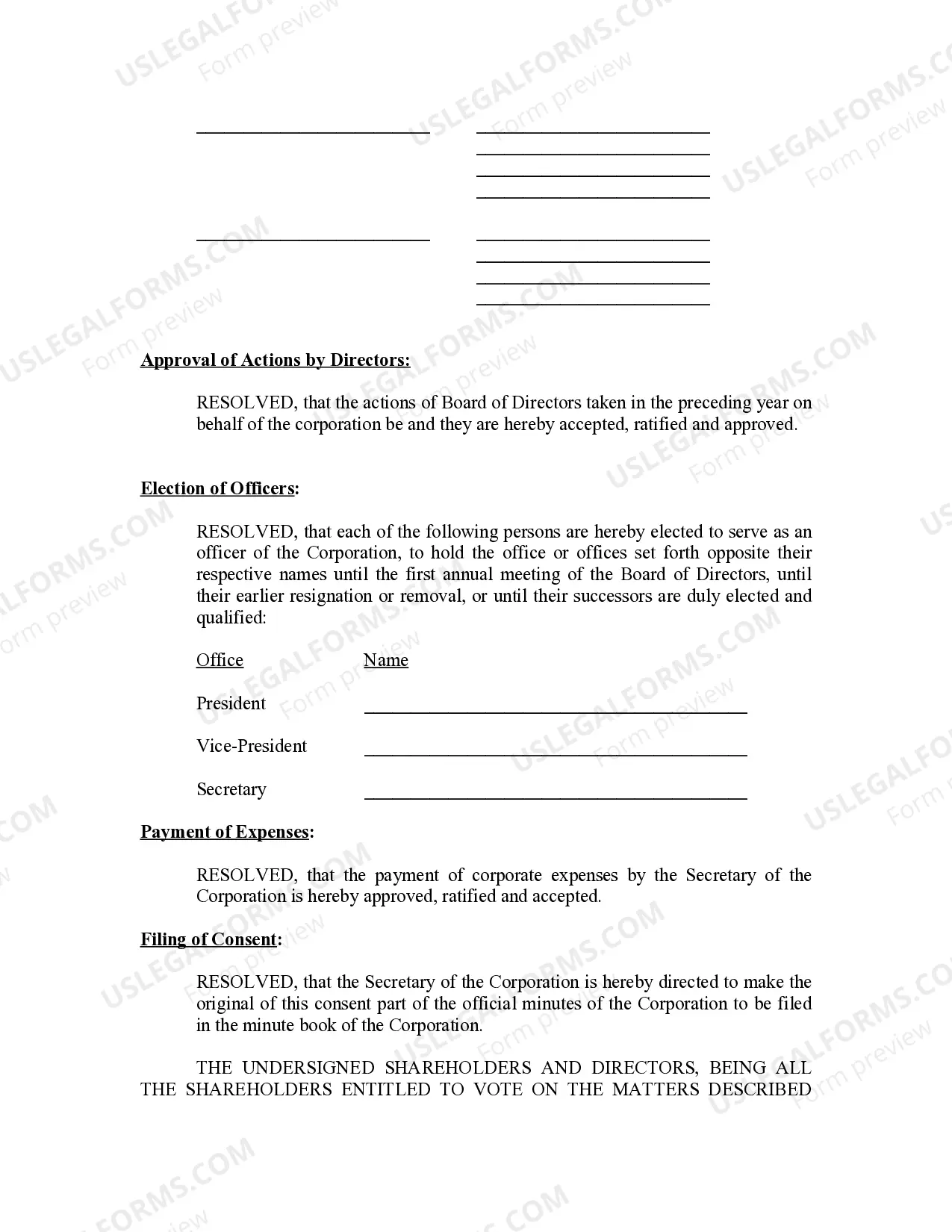

The Annual Minutes form is used to document any changes or other organizational activities of the Corporation during a given year.

South Carolina Annual Minutes

Description

How to fill out South Carolina Annual Minutes?

The work with papers isn't the most uncomplicated process, especially for people who almost never deal with legal paperwork. That's why we recommend making use of accurate Annual Minutes - South Carolina samples made by skilled lawyers. It gives you the ability to eliminate troubles when in court or dealing with formal organizations. Find the files you want on our website for top-quality forms and accurate information.

If you’re a user with a US Legal Forms subscription, just log in your account. Once you are in, the Download button will immediately appear on the file page. Right after accessing the sample, it will be stored in the My Forms menu.

Users without a subscription can quickly create an account. Use this simple step-by-step guide to get your Annual Minutes - South Carolina:

- Ensure that the sample you found is eligible for use in the state it is needed in.

- Verify the document. Use the Preview feature or read its description (if available).

- Buy Now if this file is the thing you need or utilize the Search field to get another one.

- Choose a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a required format.

After completing these easy actions, it is possible to fill out the form in a preferred editor. Recheck filled in info and consider requesting an attorney to examine your Annual Minutes - South Carolina for correctness. With US Legal Forms, everything becomes easier. Try it now!

Form popularity

FAQ

Form CL-1 Initial Annual Report of Corporations must be submitted by both domestic and foreign corporations to the Secretary of State. LLC's filing as a corporation must submit Form CL-1 to SCDOR within 60 days of conducting business in this state.The annual report (Schedule D) is part of the corporate tax return.

Businesses operating in South Carolina will file their annual report along with their tax returns the form itself is essentially a tax return that also renews your business' status in the state. To file, complete your taxes and determine what must be paid.

Aside from that, just about anyone can legally serve as an LLC organizer.The most common options are a member/owner of the LLC, the LLC's registered agent, a lawyer, an accountant, and online business formation services. In our experience, we highly prefer having someone with experience serve as your LLC organizer.

If you are a Limited Liability Company (LLC), professional organization, or other association taxed as a corporation and not exempt under SC Code Section 12-20-110, you must submit a CL-1 and include a $25 payment.

To form an LLC in South Carolina you will need to file the Articles of Organization with the South Carolina Secretary of State, which costs $110. You can apply online or by mail. The Articles of Organization is the legal document that officially creates your South Carolina Limited Liability Company.

If you run an S corporation, you are not required by law to keep meeting minutes. However, they can be a good way to record the progress your company makes toward meeting corporate objectives. Minutes can also be useful as a legal record of corporate activities in the event of a lawsuit or tax audit.

1Hold Shareholders' and Directors' Meetings.2Document Shareholders' and Directors' Corporate Decisions.3Maintain a Separation Between the Corporation and the Owners/Officers/Directors.4Keep Detailed Financial Records.5File a Separate Corporate Income Tax Return.

Form CL-1 Initial Annual Report of Corporations must be submitted by both domestic and foreign corporations to the Secretary of State. LLC's filing as a corporation must submit Form CL-1 to SCDOR within 60 days of conducting business in this state.The annual report (Schedule D) is part of the corporate tax return.