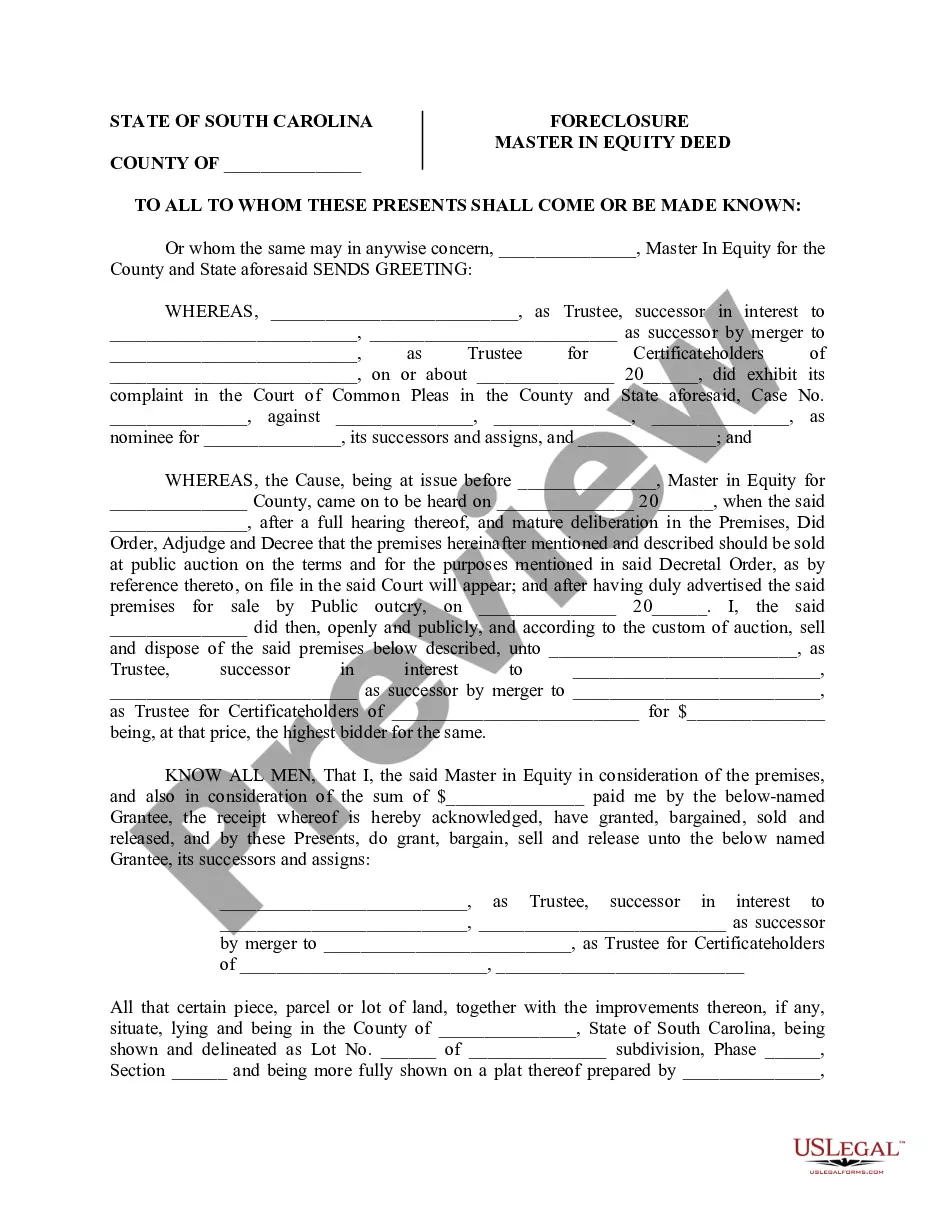

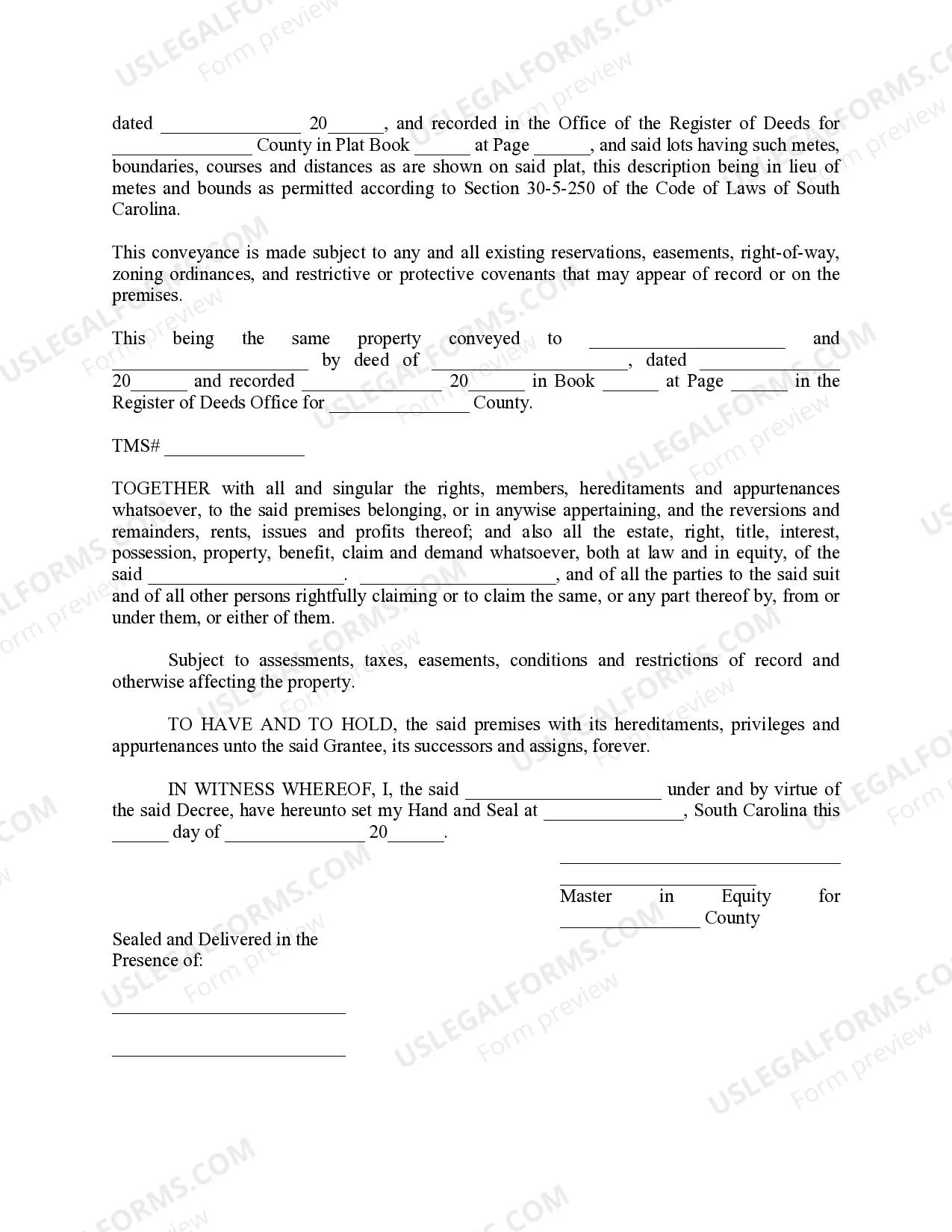

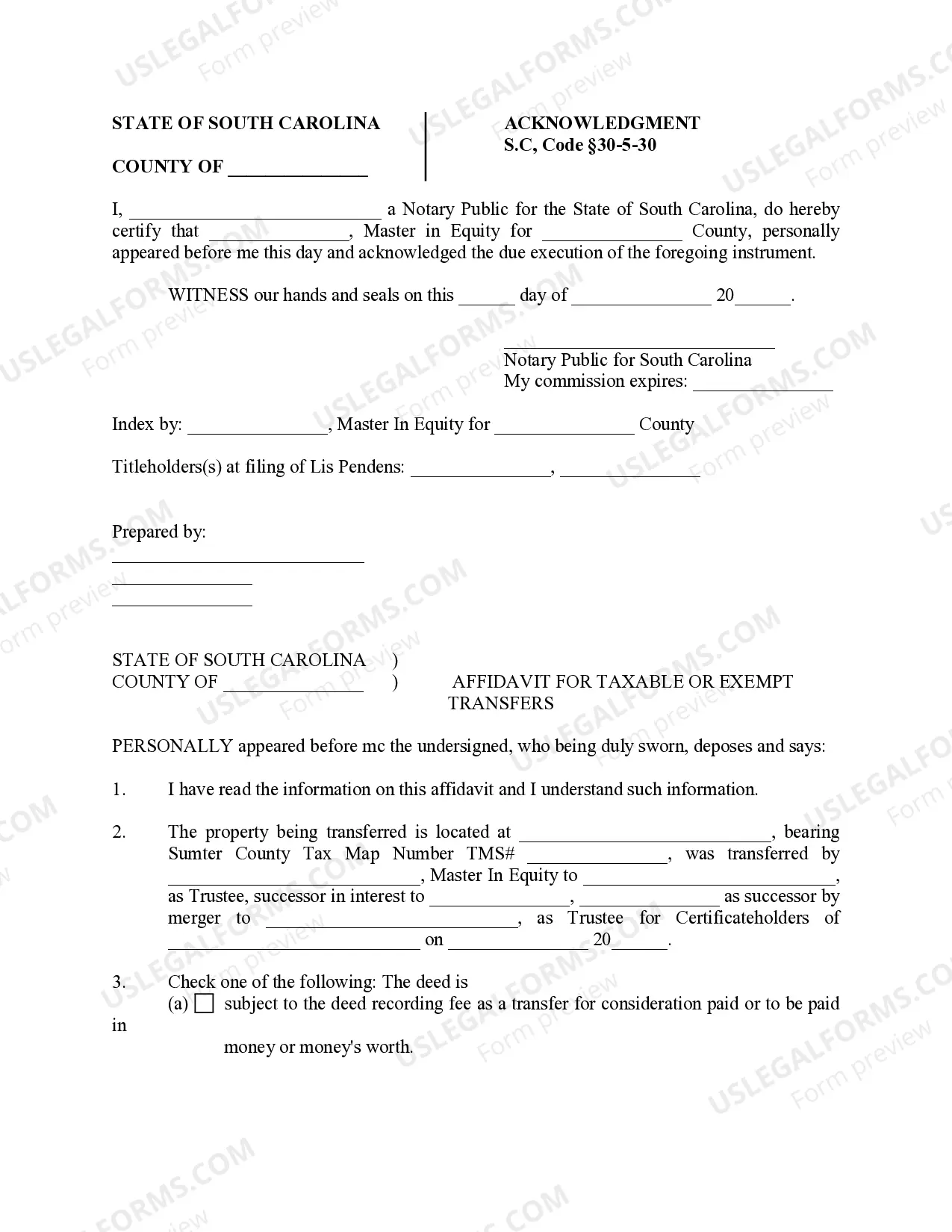

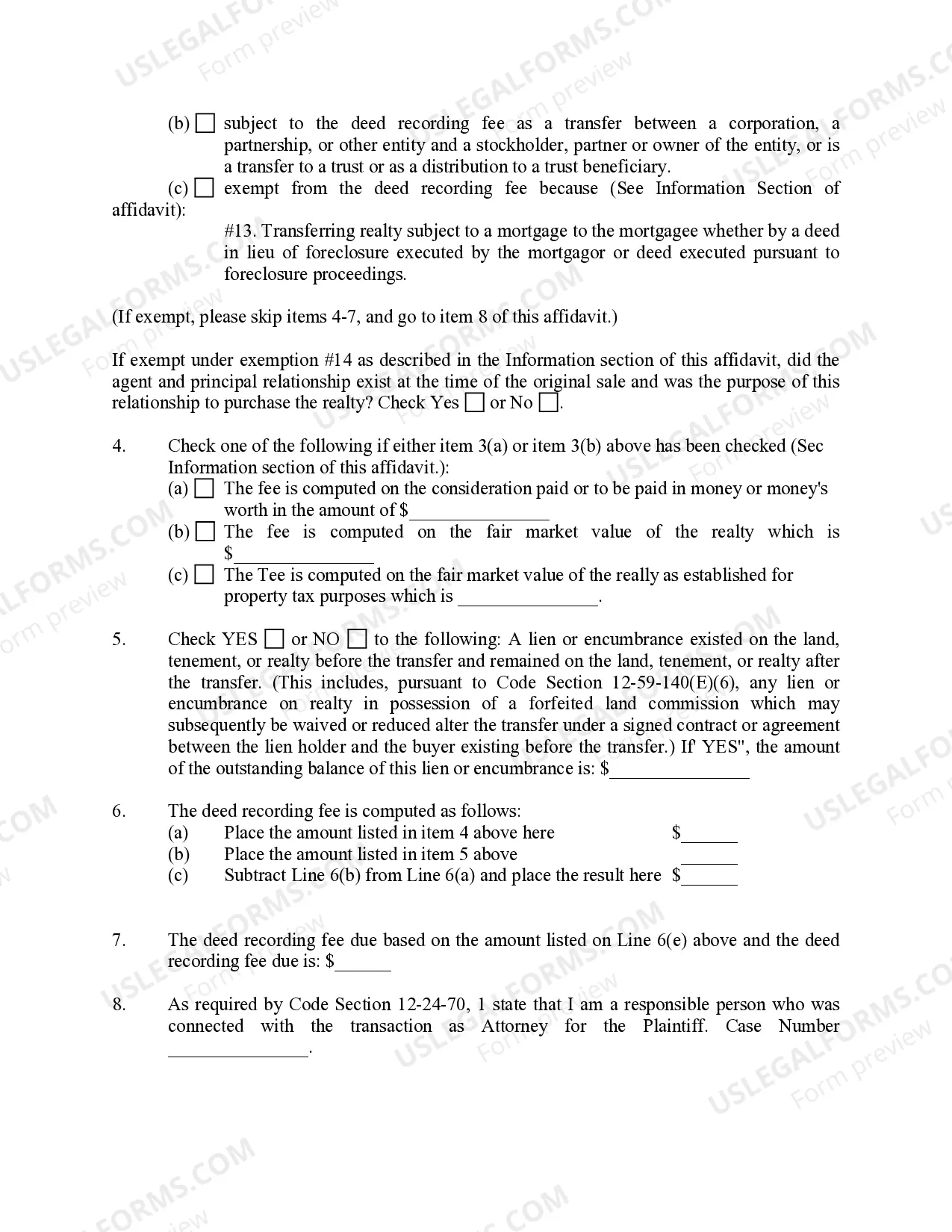

South Carolina Foreclosure Master in Equity Deed

Description Foreclosure Equity Sc

asking the court to sell the property to satisfy the debt.

Without a jury. A Master-in-Equity typically handles cases involving real

estate, such as foreclosures, partitions, and contracts. However, a Masterin-Equity may hear any matter referred to him or her by the Circuit Court. A real estate foreclosure is the legal action the lender files with the court

asking the court to sell the property to satisfy the debt.

How to fill out South Carolina Foreclosure Master In Equity Deed?

The work with papers isn't the most simple task, especially for those who almost never work with legal paperwork. That's why we advise making use of correct South Carolina Foreclosure Master in Equity Deed templates made by professional attorneys. It gives you the ability to eliminate problems when in court or handling official institutions. Find the samples you need on our site for top-quality forms and accurate explanations.

If you’re a user having a US Legal Forms subscription, simply log in your account. When you’re in, the Download button will immediately appear on the template page. Soon after downloading the sample, it will be saved in the My Forms menu.

Customers with no an activated subscription can easily create an account. Look at this short step-by-step help guide to get the South Carolina Foreclosure Master in Equity Deed:

- Make certain that the document you found is eligible for use in the state it is needed in.

- Verify the file. Make use of the Preview option or read its description (if offered).

- Click Buy Now if this sample is the thing you need or utilize the Search field to get another one.

- Choose a convenient subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a required format.

After doing these straightforward steps, you are able to fill out the sample in your favorite editor. Recheck filled in info and consider asking a lawyer to examine your South Carolina Foreclosure Master in Equity Deed for correctness. With US Legal Forms, everything becomes much easier. Try it now!

Sc Foreclosure Form popularity

Sc Foreclosure Equity Other Form Names

FAQ

State Statutory Redemption Laws Many states reduce the redemption period if the property has been abandoned, while borrowers may waive their redemption rights in many states. States that allow for statutory redemption include California, Illinois, Florida, and Texas.

In South Carolina, the lender must sue the borrower and prove the lender is entitled to foreclose. The homeowner (defendant) has the right to defend the foreclosure by conducting discovery, raising defenses, and filing counterclaims (that is, suing the lender under various causes of action).

In foreclosure cases, some states give borrowers a 'right to redemption'. Essentially, redemption is the ability of a borrower to buy back a property that has been foreclosed upon even after the foreclosure sale has already been completed.However, there is no right to redemption in South Carolina.

Foreclosures in South Carolina are judicial, which means a court handles the process. The lender must file a lawsuit to foreclose the home. In some other states, though, foreclosures are nonjudicial, which means they're usually carried out with little, if any, court involvement.

If you think that your next mortgage payment may be late, or if you are already behind with your payments, the most important thing you can do to help prevent foreclosure is contact SC Housing immediately. If you make an arrangement to pay your SC Housing mortgage, please call us toll-free at 800.476.

More specifically, it's a legal process by which the owner forfeits all rights to the property. If the owner can't pay off the outstanding debt, or sell the property via short sale, the property then goes to a foreclosure auction. If the property doesn't sell there, the lending institution takes possession of it.

The Master-in-Equity is a judge who has the power to decide certain cases without a jury. A Master-in-Equity typically handles cases involving real estate, such as foreclosures, partitions, and contracts. However, a Master- in-Equity may hear any matter referred to him or her by the Circuit Court. See S.C. Code Ann.