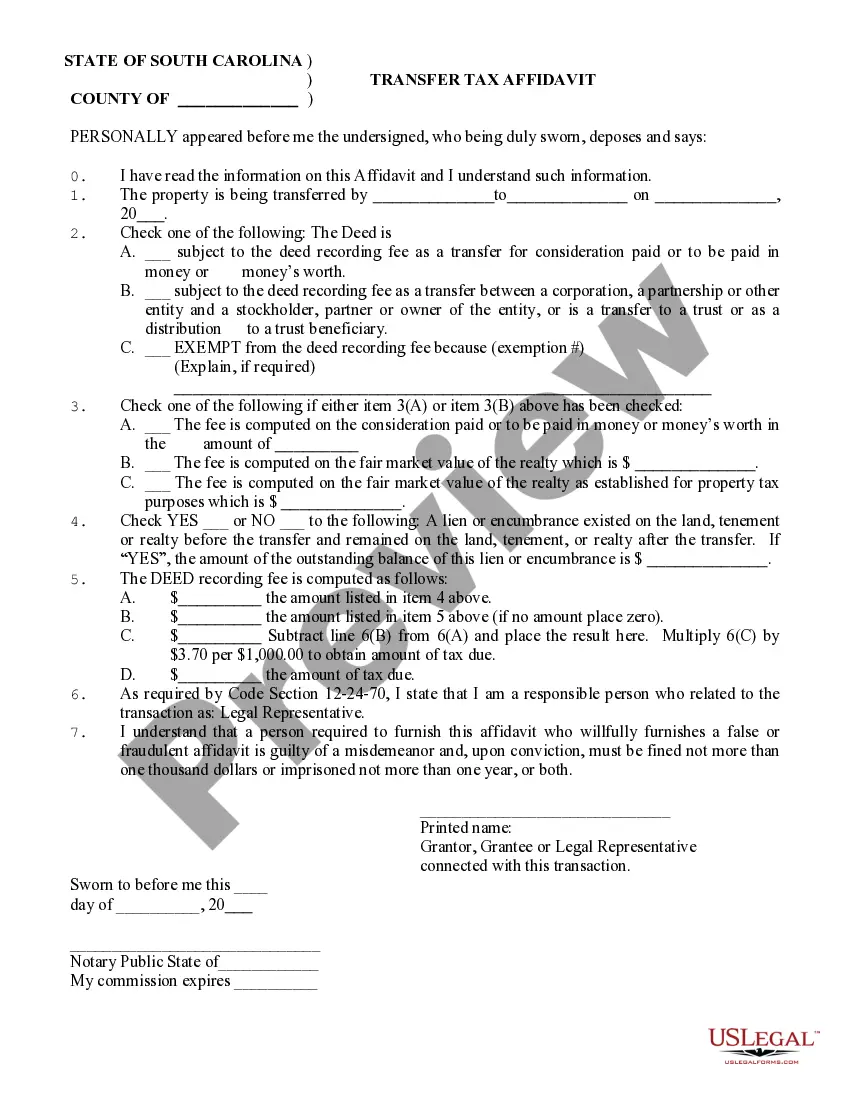

The South Carolina Transfer Tax Affidavit is a document used to certify that the transfer of real estate is exempt from the South Carolina real estate transfer tax. It is typically signed by the buyer and seller, and is sometimes referred to as the South Carolina Real Estate Transfer Tax Exemption Affidavit. The two main types of South Carolina Transfer Tax Affidavit are the (1) South Carolina Real Estate Transfer Tax Exemption Affidavit and the (2) South Carolina Real Estate Transfer Tax Affidavit for Exempt Transactions. The South Carolina Real Estate Transfer Tax Exemption Affidavit is used to certify that the transfer of real estate is exempt from the South Carolina real estate transfer tax due to the exemption being claimed. This exemption may be due to a transfer between spouses, a transfer from a parent to a child, or a transfer to an entity exempt from taxation. The South Carolina Real Estate Transfer Tax Affidavit for Exempt Transactions is used to certify that the real estate transfer is exempt from the South Carolina real estate transfer tax. This exemption may be due to the transfer being made in a will, a trust, or a foreclosure. Both of these South Carolina Transfer Tax Affidavit forms must be completed and signed in order to be valid.

South Carolina Transfer Tax Affidavit

Description

Key Concepts & Definitions

Transfer Tax Affidavit is a legal document required during the process of transferring property ownership in the United States. This affidavit confirms that all relevant taxes associated with the transfer have been accounted for or exempted. It is crucial for ensuring compliance with state and local tax laws.

Step-by-Step Guide

- Identify the applicable state or local authority where the property is located, as transfer tax regulations can vary.

- Obtain the correct form for a Transfer Tax Affidavit, which is typically provided by the state or county's official website or at the local offices.

- Complete the affidavit with accurate information about the property, the transfer, and the parties involved.

- Calculate the applicable transfer taxes, if any, based on the property's sale price or assessed value.

- Submit the completed affidavit along with any necessary payment for the transfer taxes to the relevant authority before or at the time of property transfer.

- Keep a copy of the affidavit and any receipts for your records.

Risk Analysis

Failing to accurately complete a Transfer Tax Affidavit can lead to legal complications, including fines and penalties. Incorrect or incomplete affidavits may delay the property transfer process or result in the imposition of liens against the property. It is essential to ensure all provided information is accurate to the best of one's knowledge.

Best Practices

- Double-check all information: Verify all data entered on the Transfer Tax Affidavit for accuracy.

- Understand local tax laws: Each jurisdiction may have different rules and exemptions for transfer taxes, so it's critical to understand local requirements thoroughly.

- Seek professional help: Consider consulting with a legal or tax professional to navigate the complexities of transfer taxes effectively.

Common Mistakes & How to Avoid Them

- Underestimating Tax Rates: Always verify current tax rates and exemption clauses to prevent miscalculations.

- Omitting Necessary Details: Complete all required fields in the affidavit to avoid processing delays or legal issues.

- Late Filing: Submit the affidavit according to the deadlines set by the respective local or state authority.

FAQ

- Who needs to file a Transfer Tax Affidavit? Anyone involved in the property transfer, such as the buyer or seller, depending on local laws.

- Can transfer taxes be avoided? In some cases, transfers between family members or other special circumstances might be exempt. However, an affidavit may still need to be filed to document the exemption.

- Where can I find the correct form? Typically, the necessary forms are available on the state or county's official website or at local government offices.

How to fill out South Carolina Transfer Tax Affidavit?

US Legal Forms is the most easy and affordable way to find appropriate legal templates. It’s the most extensive web-based library of business and personal legal paperwork drafted and verified by legal professionals. Here, you can find printable and fillable blanks that comply with federal and local regulations - just like your South Carolina Transfer Tax Affidavit.

Getting your template requires only a few simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the form on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a properly drafted South Carolina Transfer Tax Affidavit if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to ensure you’ve found the one corresponding to your needs, or find another one using the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and select the subscription plan you prefer most.

- Create an account with our service, log in, and purchase your subscription using PayPal or you credit card.

- Decide on the preferred file format for your South Carolina Transfer Tax Affidavit and save it on your device with the appropriate button.

After you save a template, you can reaccess it whenever you want - just find it in your profile, re-download it for printing and manual completion or upload it to an online editor to fill it out and sign more effectively.

Take advantage of US Legal Forms, your trustworthy assistant in obtaining the corresponding formal paperwork. Try it out!

Form popularity

FAQ

Unlike other types of insurance that turn into recurring annual expenses, title insurance is a one-time cost that stays in effect until you sell your property. In South Carolina, buyers are typically on the hook for all title-related fees, including title insurance.

In South Carolina, the formula for the transfer tax, mostly referred to as deed stamps, is $1.85 per $500 of consideration; this is the combined amount for city, county and state taxes. If the consideration is $100,000, the transfer tax is $370, and paid directly to the County Register of Deeds by the closing attorney.

The prior owner conveying the property is primarily responsible for payment, and the new owner is secondarily responsible. The deed-recording fee rate is $1.85 for each $500.00 of the real estate's value.

SECTION 12-24-70. Affidavits. (A)(1) The clerk of court or register of deeds shall require an affidavit showing the value of the realty to be filed with a deed. The affidavit required by this section must be signed by a responsible person connected with the transaction, and the affidavit must state that connection.

The deed recording fee is one dollar and eighty-five cents for each five hundred dollars, or fractional part of five hundred dollars, of the realty's ?value? as determined by S.C. Code § 2-24-30.

It is customary for the seller of the property to pay all real estate transfer taxes in South Carolina. The transfer taxes are usually due at the time of closing, alongside other fees such as appraisal fees or agent fees.

In South Carolina, the formula for the transfer tax, mostly referred to as deed stamps, is $1.85 per $500 of consideration; this is the combined amount for city, county and state taxes. If the consideration is $100,000, the transfer tax is $370, and paid directly to the County Register of Deeds by the closing attorney.