- US Legal Forms

-

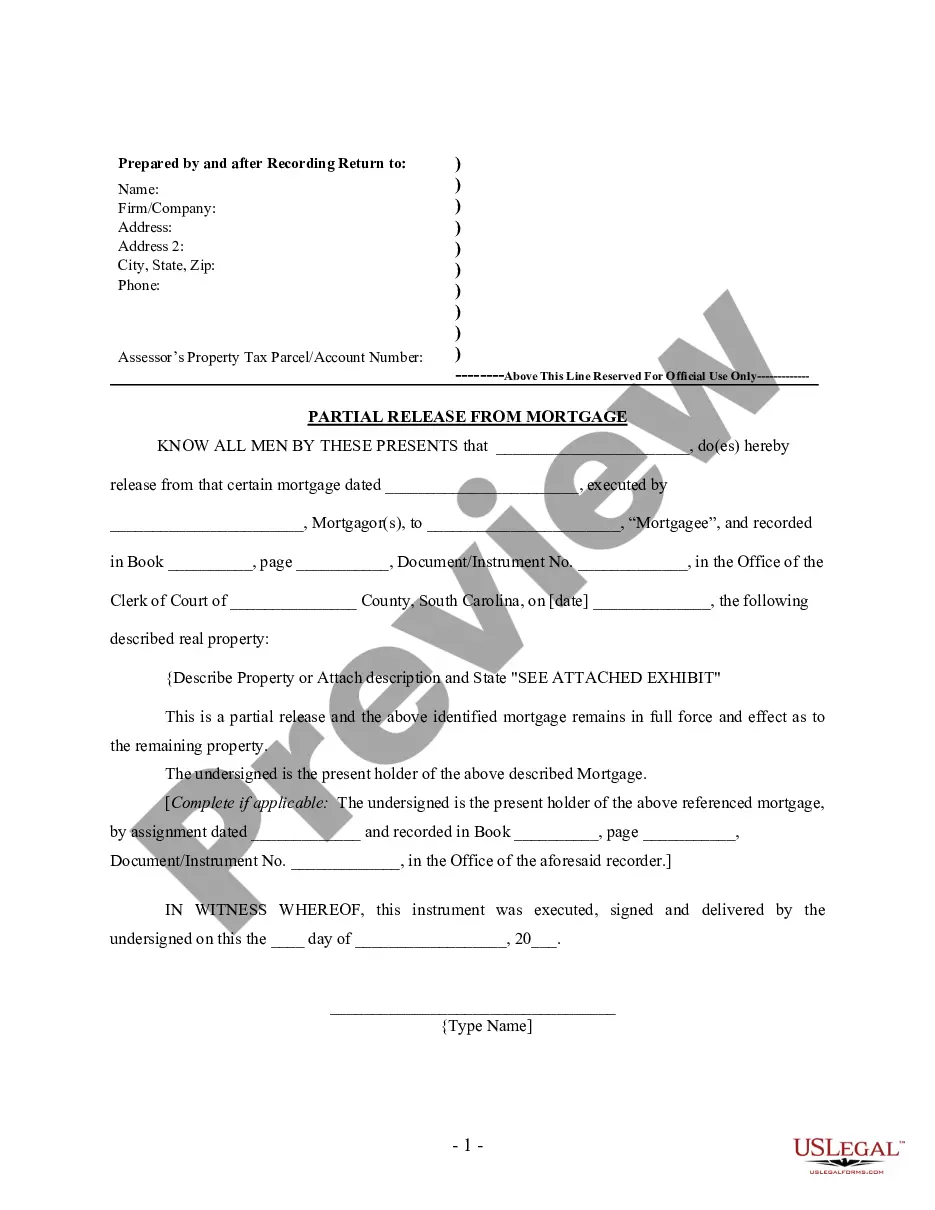

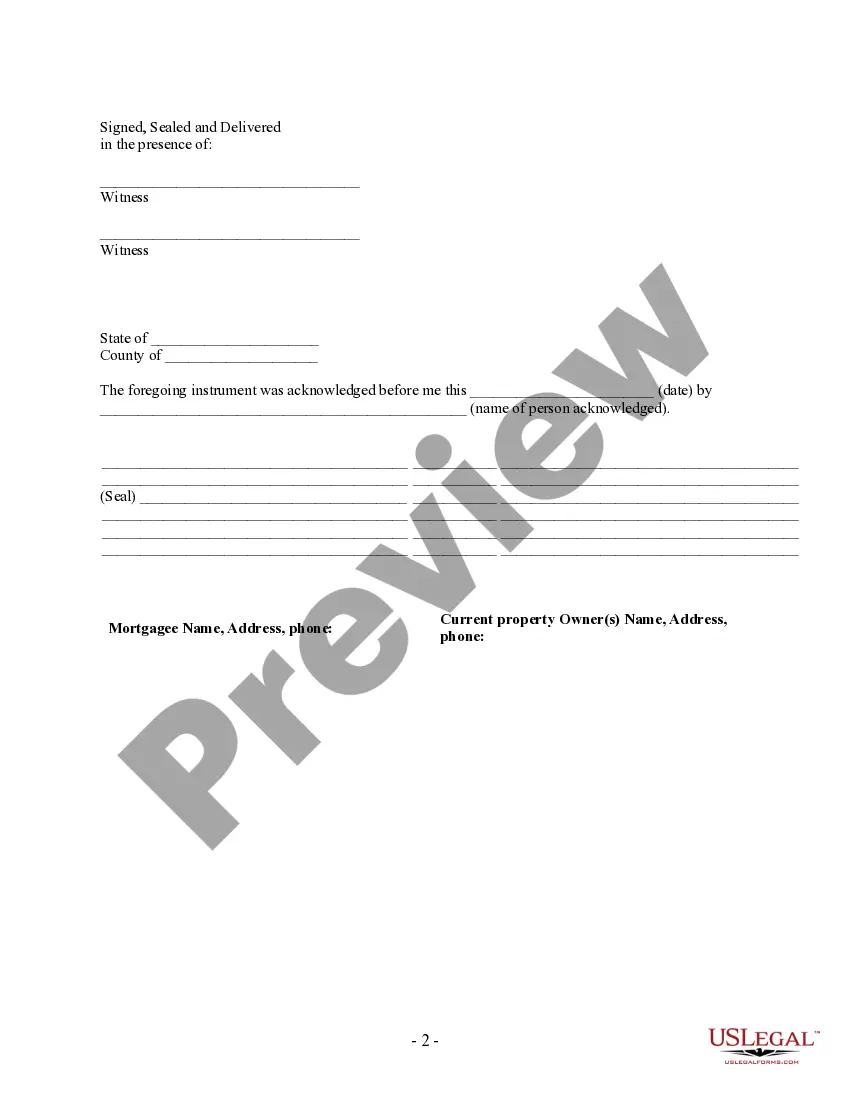

South Carolina Partial Release of Property From Mortgage by Individual...

Partial Release Of Mortgage Template

Description Partial Release Of Mortgage Form

Release Of Mortgage Form Related forms

View Nebraska Effective Financing Statement Addendum

View Nebraska Effective Financing Statement Amended

View Nebraska Attachment to UCC Financing Statement for Statutory Agricultural Liens

View Nebraska UCC1 Financing Statement

View Nebraska UCC1 Financing Statement Addendum

View Nebraska UCC1 Financing Statement Additional Party

Viewed forms

How to fill out South Carolina Partial Release Of Property From Mortgage By Individual Holder?

The work with documents isn't the most uncomplicated process, especially for people who rarely work with legal paperwork. That's why we advise making use of accurate South Carolina Partial Release of Property From Mortgage by Individual Holder samples made by skilled lawyers. It allows you to avoid difficulties when in court or handling official organizations. Find the templates you need on our site for high-quality forms and correct explanations.

If you’re a user with a US Legal Forms subscription, simply log in your account. Once you’re in, the Download button will immediately appear on the template webpage. Soon after accessing the sample, it’ll be stored in the My Forms menu.

Customers without an activated subscription can easily get an account. Look at this simple step-by-step guide to get your South Carolina Partial Release of Property From Mortgage by Individual Holder:

- Be sure that the document you found is eligible for use in the state it’s necessary in.

- Verify the file. Make use of the Preview feature or read its description (if available).

- Click Buy Now if this form is the thing you need or use the Search field to get another one.

- Select a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your file in a preferred format.

Right after finishing these straightforward actions, you are able to complete the sample in an appropriate editor. Recheck completed info and consider requesting a legal representative to review your South Carolina Partial Release of Property From Mortgage by Individual Holder for correctness. With US Legal Forms, everything gets easier. Try it now!

South Carolina Individual Form Rating

South Carolina Mortgage Satisfaction Form Form popularity

FAQ

If you are approved for the partial mortgage release, you will receive notification within two to six weeks.

Which situation would require a partial release? A borrower who wishes to sell a property that is part of a blanket mortgage(multiple properties and one mortgage loan) would need the lender to issue a partial release on the property being sold to release the lien and give the property a clean title.

A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.

Take possession of all the papers. Get an NOC. Get your CIBIL report updated. Get the lien withdrawn. Get an encumbrance certificate.

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.

Partial Release Clause is a provision under which the mortgagee agrees to release certain parcels from the lien of the blanket mortgage upon payment of a certain sum of money by the mortgagor. It's frequently found in tract development construction loans.

A mortgage release usually takes around 90 days to complete, but this could be shorter or longer depending upon your specific situation.

Trusted and secure by over 3 million people of the world’s leading companies

-

No results found.

-

South Carolina

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

District of Columbia

-

Florida

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Louisiana

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

Mississippi

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire

-

New Jersey

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Ohio

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Rhode Island

-

South Dakota

-

Tennessee

-

Texas

-

Utah

-

Vermont

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming

Assignments Generally:

Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rule is that the assignment must be in proper written format and recorded to provide notice of the assignment.

Satisfactions Generally:

Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

South Carolina Law

Assignment:

It is recommended that an assignment be in writing and recorded.

Demand to Satisfy:

Mortgagor must demand satisfaction in writting, by certified mail or other form of delivery with proof of delivery. Mortgagee has 3 months to enter satisfaction of record.

Recording Satisfaction:

In the presence of the officer or his deputy write across the face of the record of the instrument the words, "The debt secured is paid in full and the lien of this instrument is satisfied", or words of like meaning and date the notation and sign it, the signature to be witnessed by the officer or his deputy. Other methods are possible. See code section 29-3-330, below.

Marginal Satisfaction:

Satisfaction may be indicated in the margin of the mortgage document. See code section 29-3-330, below.

Penalty:

If Mortgagee fails to record within the 3 month period following the written request, penalty is a sum of money not exceeding one-half of the amount of the debt secured by the mortgage, or twenty-five thousand dollars, whichever is less, plus actual damages, costs, and attorney's fees in the discretion of the court, to be recovered by action in any court of competent jurisdiction within the State. And on judgment being rendered for the plaintiff in any such action, the presiding judge shall order satisfaction to be entered.

Acknowledgment:

An assignment or satisfaction must contain a proper South Carolina acknowledgment, or other acknowledgment approved by Statute.

South Carolina Statutes

SECTION 29-3-310. Satisfaction shall be entered upon full payment.

Any holder of record of a mortgage who has received full payment or satisfaction or to whom a legal tender has been made of his debts, damages, costs, and charges secured by mortgage of real estate shall, at the request by certified mail or other form of delivery with a proof of delivery of the mortgagor or of his legal representative or any other person being a creditor of the debtor or a purchaser under him or having an interest in any estate bound by the mortgage and on tender of the fees of office for entering satisfaction, within three months after the certified mail, or other form of delivery, with a proof of delivery, request is made, enter satisfaction in the proper office on the mortgage which shall forever thereafter discharge and satisfy the mortgage.

SECTION 29-3-320. Liability for failure to enter satisfaction.

Any holder of record of a mortgage having received such payment, satisfaction, or tender as aforesaid who shall not, by himself or his attorney, within three months after such certified mail, or other form of delivery, with a proof of delivery, request and tender of fees of office, repair to the proper office and enter satisfaction as aforesaid shall forfeit and pay to the person aggrieved a sum of money not exceeding one-half of the amount of the debt secured by the mortgage, or twenty-five thousand dollars, whichever is less, plus actual damages, costs, and attorney's fees in the discretion of the court, to be recovered by action in any court of competent jurisdiction within the State. And on judgment being rendered for the plaintiff in any such action, the presiding judge shall order satisfaction to be entered on the judgment or mortgage aforesaid by the clerk, register, or other proper officer whose duty it shall be, on receiving such order, to record it and to enter satisfaction accordingly.

Notwithstanding any limitations under Sections 37-2-202 and 37-3-202, the holder of record of the mortgage may charge a reasonable fee at the time of the satisfaction not to exceed twenty-five dollars to cover the cost of processing and recording the satisfaction or cancellation. If the mortgagor or his legal representative instructs the holder of record of the mortgage that the mortgagor will be responsible for filing the satisfaction, the holder of the mortgage shall mail or deliver the satisfied mortgage to the mortgagor or his legal representative with no satisfaction fee charged.

SECTION 29-3-330. Methods of entering satisfaction.

Any mortgage, deed of trust, or other written instrument securing the payment of money and being a lien upon real property may be cancelled, discharged, and released by any of the following methods:

(a) The mortgagee or other person being the owner or holder of the mortgage, as appears by the record of the instrument or any assignment of the instrument, or the legal representative or attorney in fact, under a written instrument duly recorded, of the holder of the instrument, may exhibit the instrument to the officer or his deputy who has charge of the recording of the instrument and then in the presence of the officer or his deputy write across the face of the record of the instrument the words, "The debt secured is paid in full and the lien of this instrument is satisfied", or words of like meaning and date the notation and sign it, the signature to be witnessed by the officer or his deputy;

(b) The satisfaction of the mortgage, deed of trust, or other instrument securing the payment of money and being a lien upon real property may be written upon or attached to the original instrument and executed by any person above named in the presence of one or more witnesses, in which event the satisfaction must be recorded across the face of the record of the original instrument; or

(c) In case the original mortgage, deed of trust, or other instrument securing the payment of money and being a lien upon real property has been lost or destroyed it may be satisfied, either by the owner and holder of the instrument in person or his personal representative or duly authorized attorney in fact, by an instrument in writing duly executed in the presence of two witnesses and probated, and in addition the person executing the satisfaction shall make an affidavit that he or the person he represents is at the time of the satisfaction a bona fide owner and holder of the mortgage, deed of trust, or other instrument securing the payment of money and being a lien upon real property and that has not been assigned, hypothecated, or otherwise disposed of. The affidavit must be recorded along with the satisfaction. The maker of any affidavit which is false is guilty of perjury and punished as by law provided for the punishment of perjury.

The signature of owner or holder of the instrument which has been lost or destroyed to which this section applies may be proved in the manner provided above or in the alternative may also be acknowledged by the owner or holder of the instrument in the presence of two witnesses, taken before an officer competent to administer an oath. The form of the acknowledgement must be as provided in Section 30-5-30(C) and if the acknowledgement is taken outside this State, it may be taken in the manner provided in Section 30-5-30(B).

(d) If the mortgage, deed of trust, or other written instrument was recorded in counterparts, the original of the instrument need not be presented and the satisfaction of it may be evidenced by an instrument of satisfaction, release, or discharge, which may be executed in counterparts, executed by the mortgagee, the holder of the mortgage, the legal representative, or the attorney-in-fact. Upon presentation of the instrument of satisfaction, release, or discharge, or a counterpart of it, the officer or his deputy having charge of the recording of instruments shall record the same.

(e) Any licensed attorney admitted to practice in the State of South Carolina who can provide proof of payment of funds by evidence of payment made payable to the mortgagee, holder of record, servicer, or other party entitled to receive payment may record, or cause to be recorded, an affidavit, in writing, duly executed in the presence of two witnesses and probated or acknowledged, which states that full payment of the balance or pay-off amount of the mortgage or other instrument securing the payment of money and being a lien upon real property has been made and that evidence of payment from the mortgagee, assignee, or servicer exists. This affidavit, duly recorded in the appropriate county, shall serve as notice of satisfaction of the mortgage and release of the lien upon the real property. The filing of the affidavit shall be sufficient to satisfy, release, or discharge the lien. Upon presentation of the instrument of satisfaction, release, or discharge, the officer or his deputy having charge of the recording of instruments shall record the same. This section may not be construed to require an attorney to record an affidavit pursuant to Section 29-3-330(e) or to create liability for failure to file such affidavit. The licensed attorney signing any such instrument which is false is guilty of perjury and subject to Section 16-9-10 and shall be liable for damages that any person may sustain as a result of the false affidavit, including reasonable attorney's fees incurred in connection with the recovery of such damages.

SECTION 29-3-340. Certificate of satisfaction.

The recording officer or his deputy shall enter on the original mortgage, deed of trust, or other instrument securing the payment and being a lien upon real property when it is produced before him a certificate that a satisfaction has been entered of record and the date of the entry.

Assignments Generally:

Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rule is that the assignment must be in proper written format and recorded to provide notice of the assignment.

Satisfactions Generally:

Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

South Carolina Law

Assignment:

It is recommended that an assignment be in writing and recorded.

Demand to Satisfy:

Mortgagor must demand satisfaction in writting, by certified mail or other form of delivery with proof of delivery. Mortgagee has 3 months to enter satisfaction of record.

Recording Satisfaction:

In the presence of the officer or his deputy write across the face of the record of the instrument the words, "The debt secured is paid in full and the lien of this instrument is satisfied", or words of like meaning and date the notation and sign it, the signature to be witnessed by the officer or his deputy. Other methods are possible. See code section 29-3-330, below.

Marginal Satisfaction:

Satisfaction may be indicated in the margin of the mortgage document. See code section 29-3-330, below.

Penalty:

If Mortgagee fails to record within the 3 month period following the written request, penalty is a sum of money not exceeding one-half of the amount of the debt secured by the mortgage, or twenty-five thousand dollars, whichever is less, plus actual damages, costs, and attorney's fees in the discretion of the court, to be recovered by action in any court of competent jurisdiction within the State. And on judgment being rendered for the plaintiff in any such action, the presiding judge shall order satisfaction to be entered.

Acknowledgment:

An assignment or satisfaction must contain a proper South Carolina acknowledgment, or other acknowledgment approved by Statute.

South Carolina Statutes

SECTION 29-3-310. Satisfaction shall be entered upon full payment.

Any holder of record of a mortgage who has received full payment or satisfaction or to whom a legal tender has been made of his debts, damages, costs, and charges secured by mortgage of real estate shall, at the request by certified mail or other form of delivery with a proof of delivery of the mortgagor or of his legal representative or any other person being a creditor of the debtor or a purchaser under him or having an interest in any estate bound by the mortgage and on tender of the fees of office for entering satisfaction, within three months after the certified mail, or other form of delivery, with a proof of delivery, request is made, enter satisfaction in the proper office on the mortgage which shall forever thereafter discharge and satisfy the mortgage.

SECTION 29-3-320. Liability for failure to enter satisfaction.

Any holder of record of a mortgage having received such payment, satisfaction, or tender as aforesaid who shall not, by himself or his attorney, within three months after such certified mail, or other form of delivery, with a proof of delivery, request and tender of fees of office, repair to the proper office and enter satisfaction as aforesaid shall forfeit and pay to the person aggrieved a sum of money not exceeding one-half of the amount of the debt secured by the mortgage, or twenty-five thousand dollars, whichever is less, plus actual damages, costs, and attorney's fees in the discretion of the court, to be recovered by action in any court of competent jurisdiction within the State. And on judgment being rendered for the plaintiff in any such action, the presiding judge shall order satisfaction to be entered on the judgment or mortgage aforesaid by the clerk, register, or other proper officer whose duty it shall be, on receiving such order, to record it and to enter satisfaction accordingly.

Notwithstanding any limitations under Sections 37-2-202 and 37-3-202, the holder of record of the mortgage may charge a reasonable fee at the time of the satisfaction not to exceed twenty-five dollars to cover the cost of processing and recording the satisfaction or cancellation. If the mortgagor or his legal representative instructs the holder of record of the mortgage that the mortgagor will be responsible for filing the satisfaction, the holder of the mortgage shall mail or deliver the satisfied mortgage to the mortgagor or his legal representative with no satisfaction fee charged.

SECTION 29-3-330. Methods of entering satisfaction.

Any mortgage, deed of trust, or other written instrument securing the payment of money and being a lien upon real property may be cancelled, discharged, and released by any of the following methods:

(a) The mortgagee or other person being the owner or holder of the mortgage, as appears by the record of the instrument or any assignment of the instrument, or the legal representative or attorney in fact, under a written instrument duly recorded, of the holder of the instrument, may exhibit the instrument to the officer or his deputy who has charge of the recording of the instrument and then in the presence of the officer or his deputy write across the face of the record of the instrument the words, "The debt secured is paid in full and the lien of this instrument is satisfied", or words of like meaning and date the notation and sign it, the signature to be witnessed by the officer or his deputy;

(b) The satisfaction of the mortgage, deed of trust, or other instrument securing the payment of money and being a lien upon real property may be written upon or attached to the original instrument and executed by any person above named in the presence of one or more witnesses, in which event the satisfaction must be recorded across the face of the record of the original instrument; or

(c) In case the original mortgage, deed of trust, or other instrument securing the payment of money and being a lien upon real property has been lost or destroyed it may be satisfied, either by the owner and holder of the instrument in person or his personal representative or duly authorized attorney in fact, by an instrument in writing duly executed in the presence of two witnesses and probated, and in addition the person executing the satisfaction shall make an affidavit that he or the person he represents is at the time of the satisfaction a bona fide owner and holder of the mortgage, deed of trust, or other instrument securing the payment of money and being a lien upon real property and that has not been assigned, hypothecated, or otherwise disposed of. The affidavit must be recorded along with the satisfaction. The maker of any affidavit which is false is guilty of perjury and punished as by law provided for the punishment of perjury.

The signature of owner or holder of the instrument which has been lost or destroyed to which this section applies may be proved in the manner provided above or in the alternative may also be acknowledged by the owner or holder of the instrument in the presence of two witnesses, taken before an officer competent to administer an oath. The form of the acknowledgement must be as provided in Section 30-5-30(C) and if the acknowledgement is taken outside this State, it may be taken in the manner provided in Section 30-5-30(B).

(d) If the mortgage, deed of trust, or other written instrument was recorded in counterparts, the original of the instrument need not be presented and the satisfaction of it may be evidenced by an instrument of satisfaction, release, or discharge, which may be executed in counterparts, executed by the mortgagee, the holder of the mortgage, the legal representative, or the attorney-in-fact. Upon presentation of the instrument of satisfaction, release, or discharge, or a counterpart of it, the officer or his deputy having charge of the recording of instruments shall record the same.

(e) Any licensed attorney admitted to practice in the State of South Carolina who can provide proof of payment of funds by evidence of payment made payable to the mortgagee, holder of record, servicer, or other party entitled to receive payment may record, or cause to be recorded, an affidavit, in writing, duly executed in the presence of two witnesses and probated or acknowledged, which states that full payment of the balance or pay-off amount of the mortgage or other instrument securing the payment of money and being a lien upon real property has been made and that evidence of payment from the mortgagee, assignee, or servicer exists. This affidavit, duly recorded in the appropriate county, shall serve as notice of satisfaction of the mortgage and release of the lien upon the real property. The filing of the affidavit shall be sufficient to satisfy, release, or discharge the lien. Upon presentation of the instrument of satisfaction, release, or discharge, the officer or his deputy having charge of the recording of instruments shall record the same. This section may not be construed to require an attorney to record an affidavit pursuant to Section 29-3-330(e) or to create liability for failure to file such affidavit. The licensed attorney signing any such instrument which is false is guilty of perjury and subject to Section 16-9-10 and shall be liable for damages that any person may sustain as a result of the false affidavit, including reasonable attorney's fees incurred in connection with the recovery of such damages.

SECTION 29-3-340. Certificate of satisfaction.

The recording officer or his deputy shall enter on the original mortgage, deed of trust, or other instrument securing the payment and being a lien upon real property when it is produced before him a certificate that a satisfaction has been entered of record and the date of the entry.