This is a South Carolina divorce form, a Financial Declaration. Adapt to fit the circumstances of your case.

South Carolina Financial Declaration

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out South Carolina Financial Declaration?

Creating documents isn't the most easy process, especially for those who rarely deal with legal paperwork. That's why we recommend using correct South Carolina Financial Declaration samples created by professional lawyers. It gives you the ability to prevent problems when in court or dealing with official organizations. Find the files you require on our website for top-quality forms and correct explanations.

If you’re a user with a US Legal Forms subscription, just log in your account. Once you’re in, the Download button will automatically appear on the file page. After getting the sample, it will be stored in the My Forms menu.

Customers with no an activated subscription can quickly create an account. Utilize this brief step-by-step guide to get your South Carolina Financial Declaration:

- Make certain that the document you found is eligible for use in the state it’s required in.

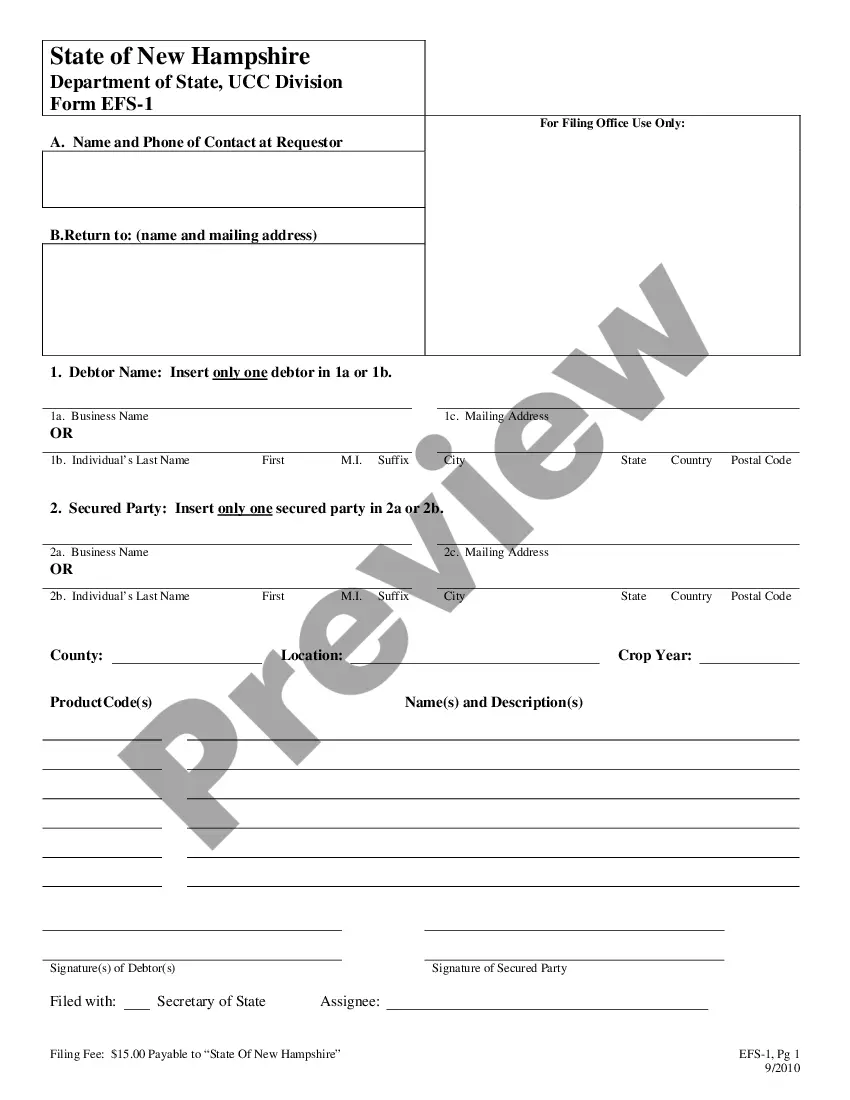

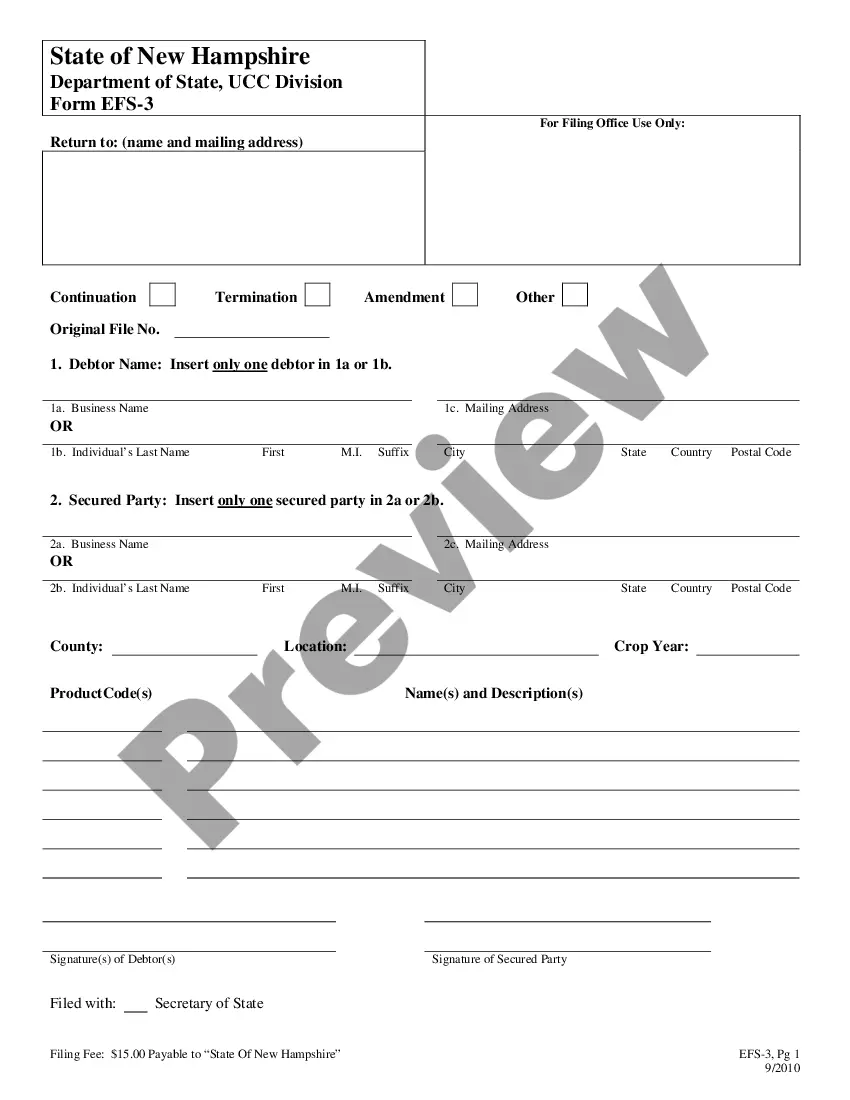

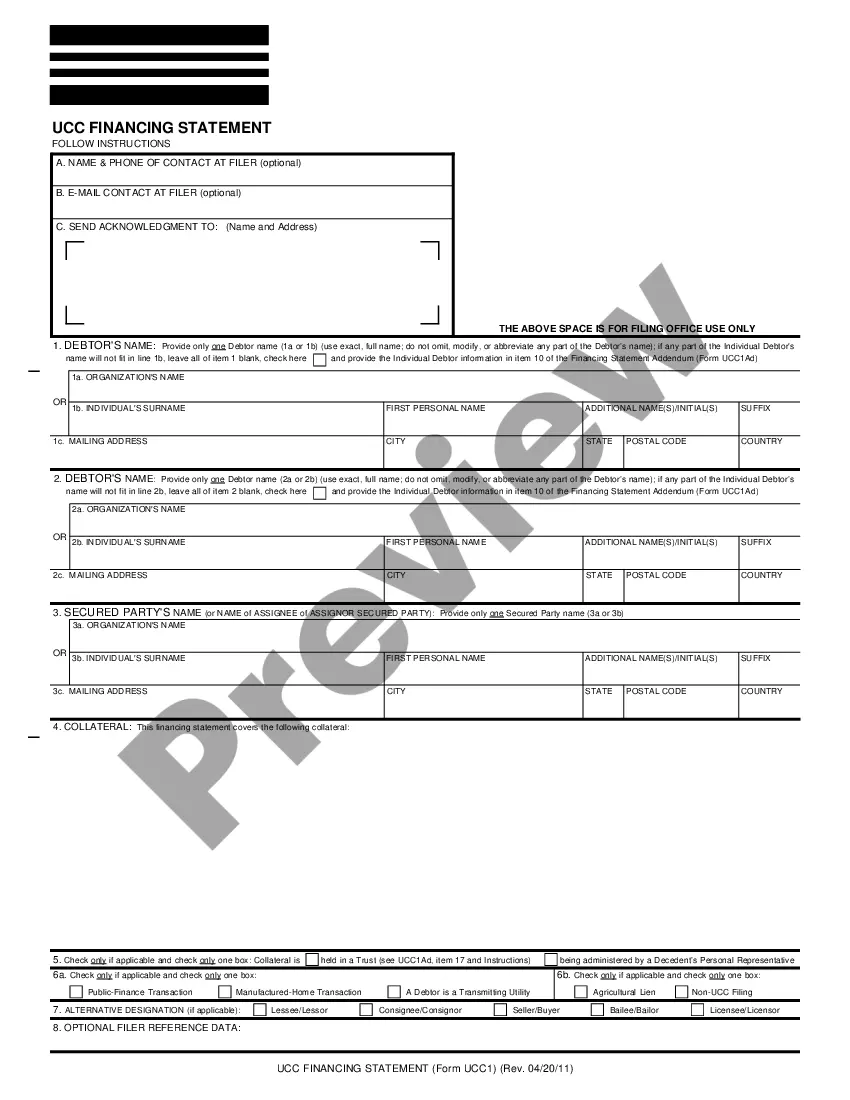

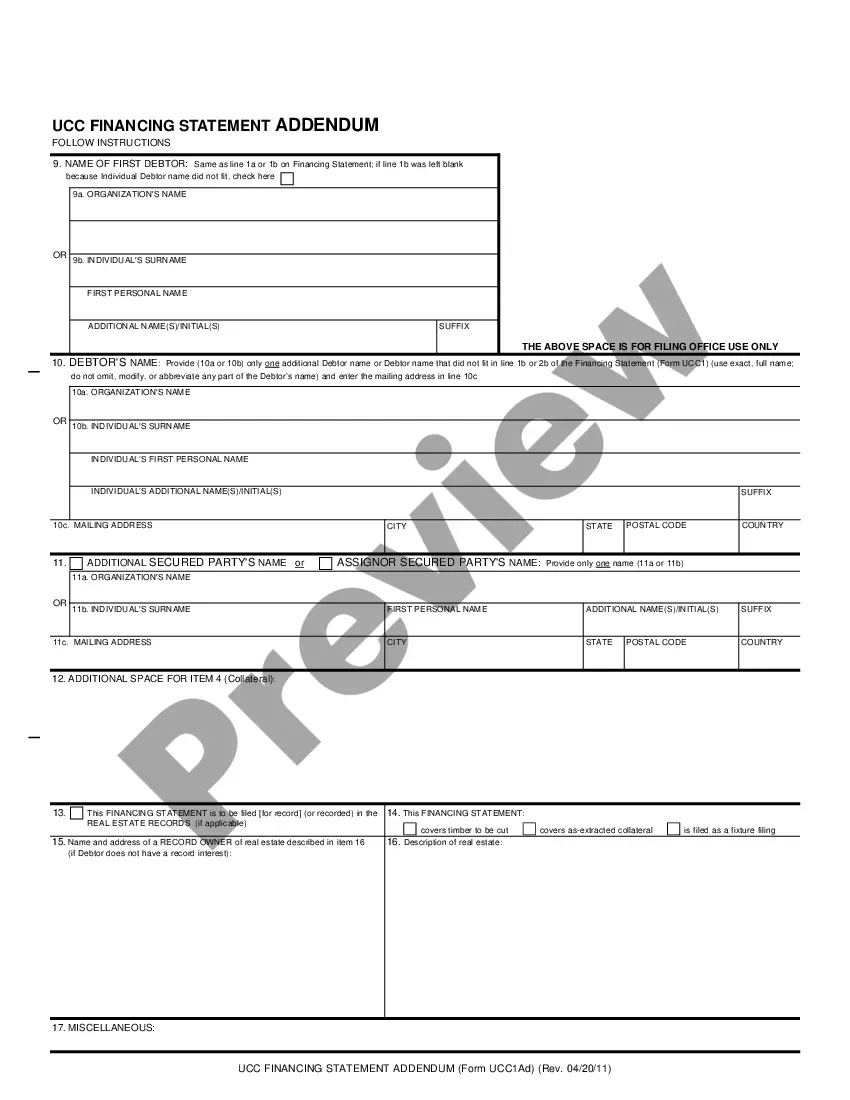

- Confirm the file. Use the Preview option or read its description (if readily available).

- Click Buy Now if this form is what you need or return to the Search field to find a different one.

- Choose a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a required format.

Right after completing these easy steps, you are able to fill out the sample in a preferred editor. Check the filled in info and consider asking an attorney to examine your South Carolina Financial Declaration for correctness. With US Legal Forms, everything becomes much easier. Try it now!

Form popularity

FAQ

Be wary of well-meaning advice. Track expenses and anticipate future ones. Gather documentation. Prepare for resistance. Refrain from big financial decisions. Be conservative when spending and saving. Know when to get help.

To compute Principal Earnings from Employment, first determine whether you are paid semi-monthly, biweekly, or weekly.If you are paid biweekly, multiply the gross amount of your pay check by 26 and then divide by 12. If you are paid weekly, multiply the amount of your paycheck by 52 and divide by twelve.

What is a Financial Declaration in South Carolina? A family court financial declaration is basically a statement of your income, expenses, and assets.

Do not estimate your monthly expenses. Make sure you account for all income. Report assets at their proper fair market value. Make sure all the assets and liabilities are accounted for. Update your financial statement.

At divorce, community property is generally divided equally between the spouses, while each spouse keeps his or her separate property. Equitable distribution. In all other states, assets and earnings accumulated during marriage are divided equitably (fairly), but not necessarily equally.

Balance Sheet. A balance shows the assets, liabilities and shareholder equity during a specific period. Income Sheet. Statement of Cash Flow. Step 1: Make A Sales Forecast. Step 2: Create A Budget for Your Expenses. Step 3: Develop Cash Flow Statement. Step 4: Project Net Profit. Step 5: Deal with Your Assets and Liabilities.

Information from your accounting journal and your general ledger is used in the preparation of your business's financial statement. The income statement, the statement of retained earnings, the balance sheet, and the statement of cash flows all make up your financial statements.

To compute Principal Earnings from Employment, first determine whether you are paid semi-monthly, biweekly, or weekly.If you are paid biweekly, multiply the gross amount of your pay check by 26 and then divide by 12. If you are paid weekly, multiply the amount of your paycheck by 52 and divide by twelve.