South Carolina General Warranty Deed for Husband and Wife from Joint Tenants to Tenants in Common

Description Joint Tenants Common

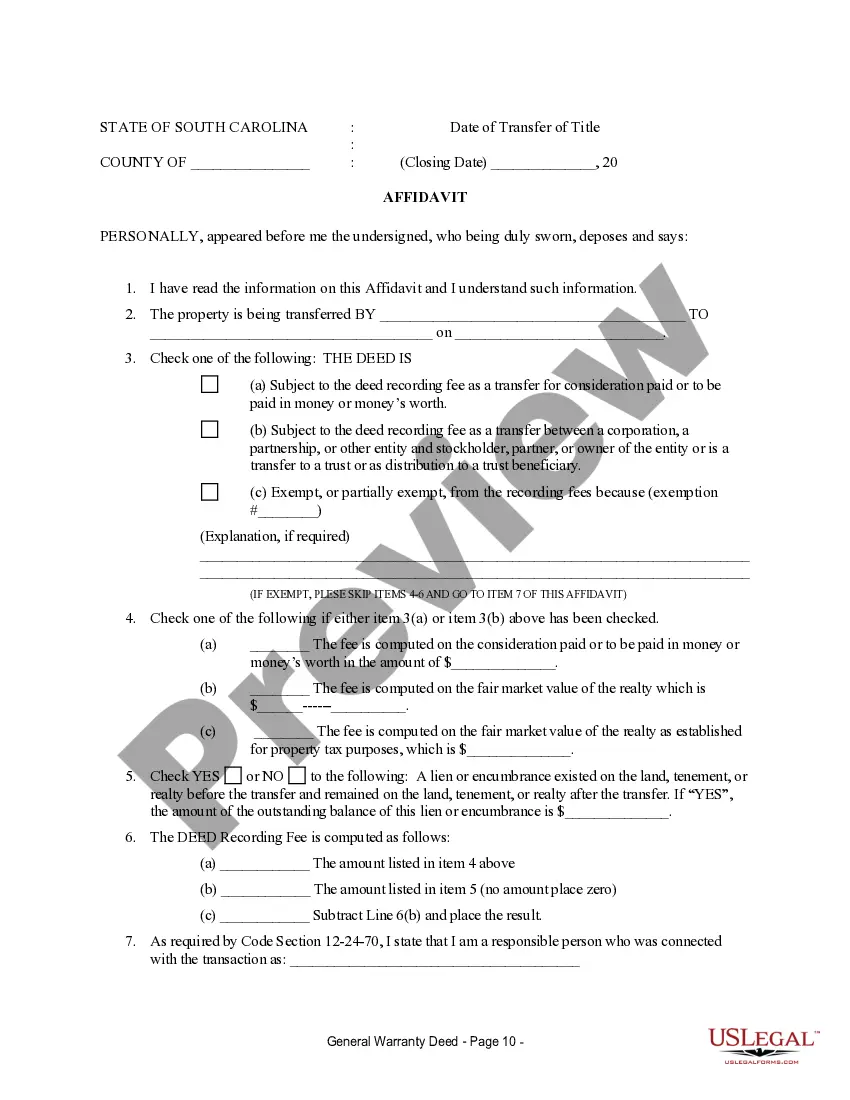

How to fill out Sc General Warranty Deed?

Among lots of free and paid examples that you’re able to find online, you can't be certain about their reliability. For example, who made them or if they’re qualified enough to take care of the thing you need these to. Keep calm and utilize US Legal Forms! Discover South Carolina General Warranty Deed for Husband and Wife from Joint Tenants to Tenants in Common samples developed by professional legal representatives and avoid the high-priced and time-consuming process of looking for an lawyer and after that having to pay them to write a papers for you that you can find on your own.

If you already have a subscription, log in to your account and find the Download button near the form you’re seeking. You'll also be able to access all of your earlier acquired samples in the My Forms menu.

If you’re utilizing our website for the first time, follow the instructions below to get your South Carolina General Warranty Deed for Husband and Wife from Joint Tenants to Tenants in Common fast:

- Make sure that the document you discover is valid in the state where you live.

- Review the file by reading the description for using the Preview function.

- Click Buy Now to start the ordering procedure or find another example using the Search field found in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred format.

As soon as you have signed up and bought your subscription, you may use your South Carolina General Warranty Deed for Husband and Wife from Joint Tenants to Tenants in Common as many times as you need or for as long as it stays active where you live. Revise it with your preferred offline or online editor, fill it out, sign it, and create a hard copy of it. Do much more for less with US Legal Forms!

Husband Common Template Form popularity

Joint Common Template Other Form Names

Husband Joint Tenants FAQ

South Carolina Fillable Forms is a FREE product and is only for filing your South Carolina return. South Carolina Fillable Forms provides the option to fill out your return online and mail it to the SCDOR OR to submit your return the SCDOR electronically.

If you qualify for a paper copy of a tax form based on these criteria, you can email your paper form request to forms@dor.sc.gov or call 1-844-898-8542 to speak to a representative. You will need to provide your name, address, and the form you are requesting.

Employee instructions Complete the SC W-4 so your employer can withhold the correct South Carolina Income Tax from your pay. If you have too much tax withheld, you will receive a refund when you file your tax return.

File SC1040, including all federal taxable income, and attach SC1040TC to claim a credit for taxes paid to another state.