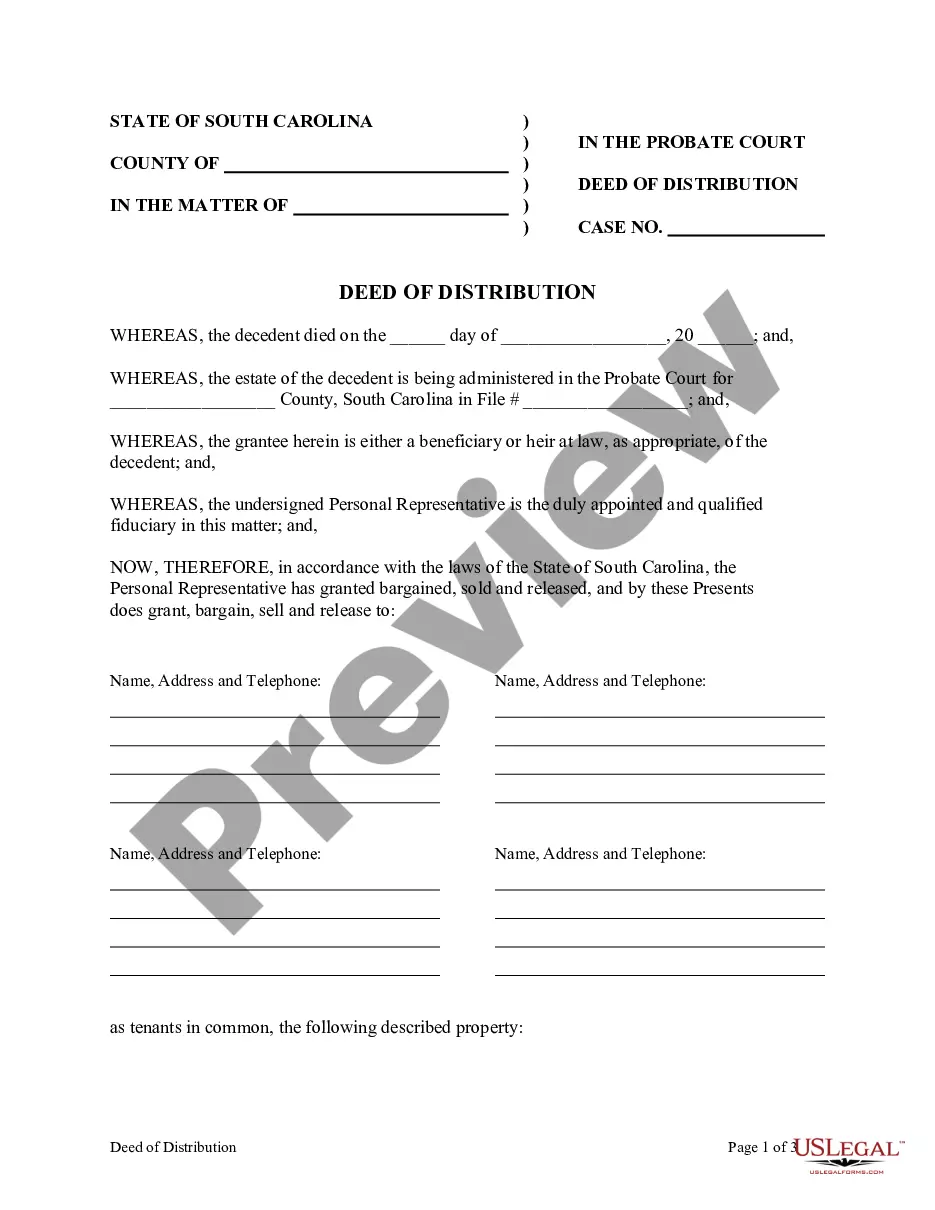

South Carolina Deed of Distribution - Personal Representative to Four Beneficiaries

Description What Is A Deed Of Distribution In Sc

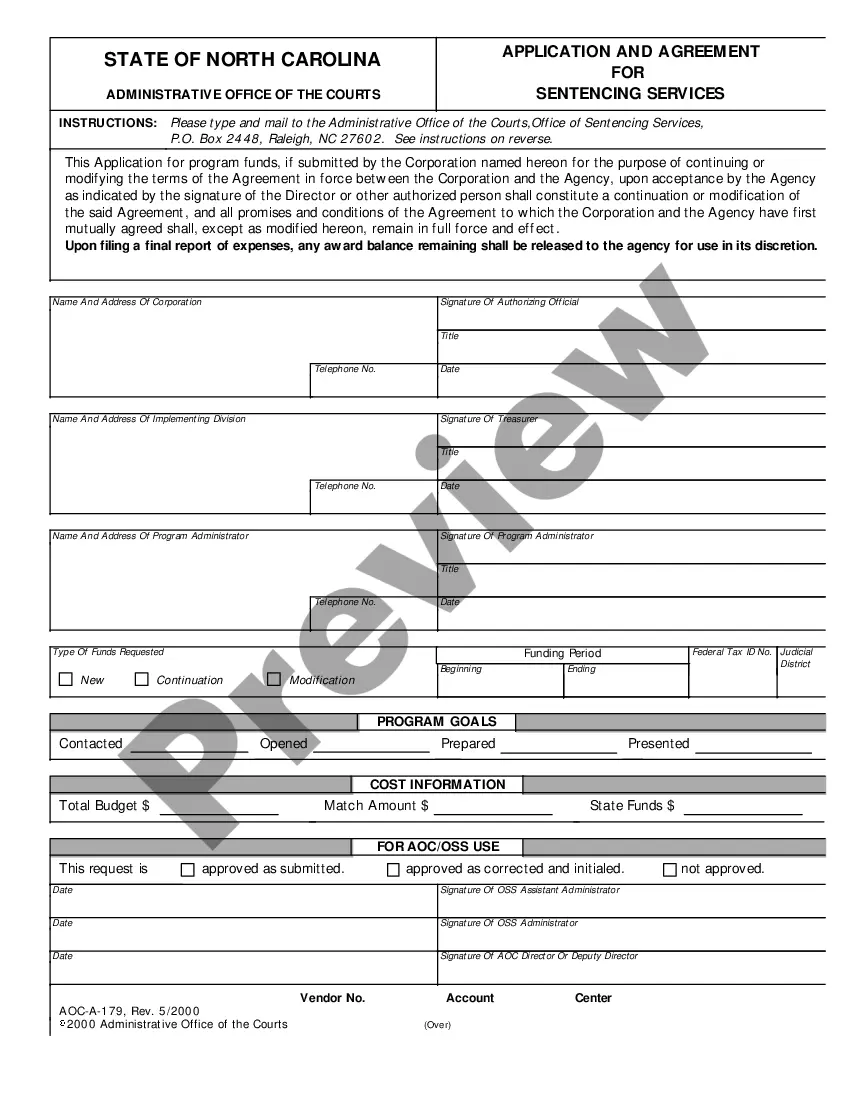

How to fill out South Carolina Deed Of Distribution - Personal Representative To Four Beneficiaries?

The work with documents isn't the most uncomplicated job, especially for people who almost never deal with legal papers. That's why we recommend utilizing correct South Carolina Deed of Distribution - Personal Representative to Four Beneficiaries templates created by professional attorneys. It gives you the ability to stay away from problems when in court or handling official institutions. Find the templates you require on our website for high-quality forms and accurate explanations.

If you’re a user with a US Legal Forms subscription, simply log in your account. Once you’re in, the Download button will immediately appear on the file webpage. After accessing the sample, it will be stored in the My Forms menu.

Customers without an activated subscription can quickly get an account. Look at this simple step-by-step guide to get the South Carolina Deed of Distribution - Personal Representative to Four Beneficiaries:

- Make certain that the sample you found is eligible for use in the state it is needed in.

- Verify the document. Use the Preview feature or read its description (if available).

- Buy Now if this form is what you need or utilize the Search field to find another one.

- Choose a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

After finishing these easy steps, you are able to complete the sample in a preferred editor. Recheck filled in information and consider requesting an attorney to review your South Carolina Deed of Distribution - Personal Representative to Four Beneficiaries for correctness. With US Legal Forms, everything becomes easier. Test it now!

South Carolina Deed Of Distribution Form popularity

FAQ

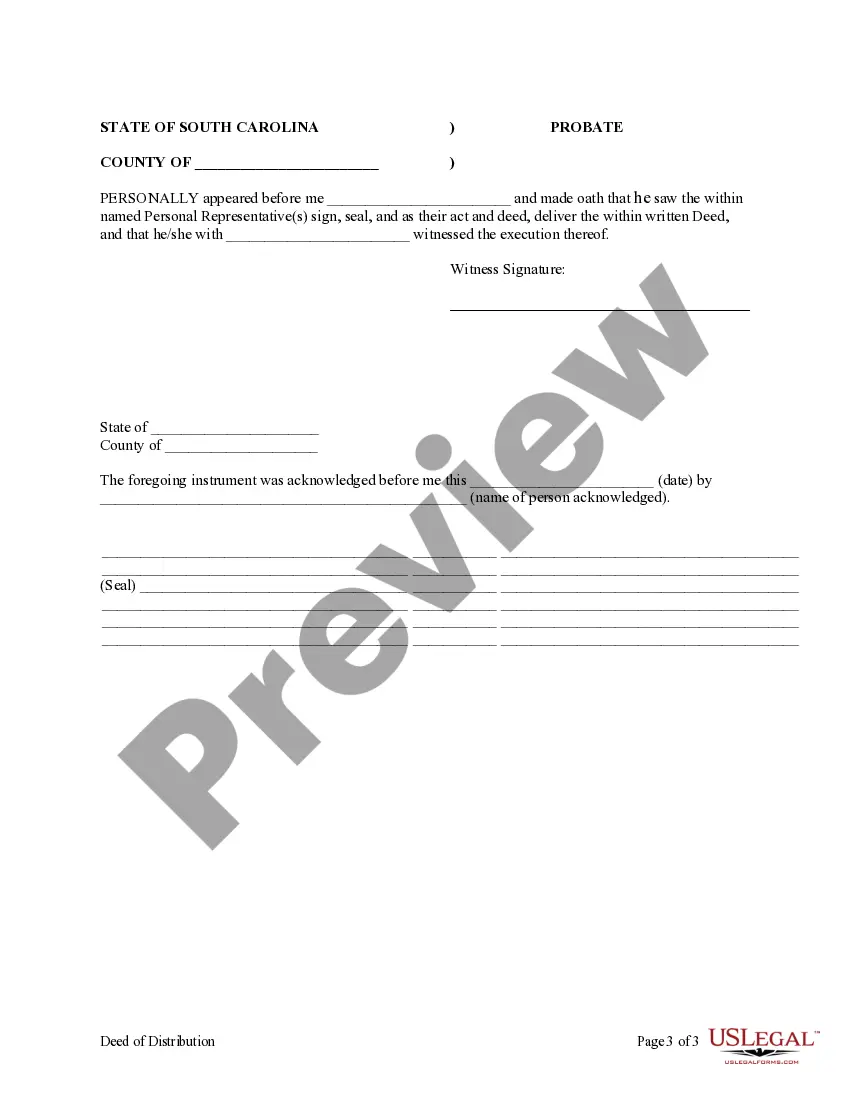

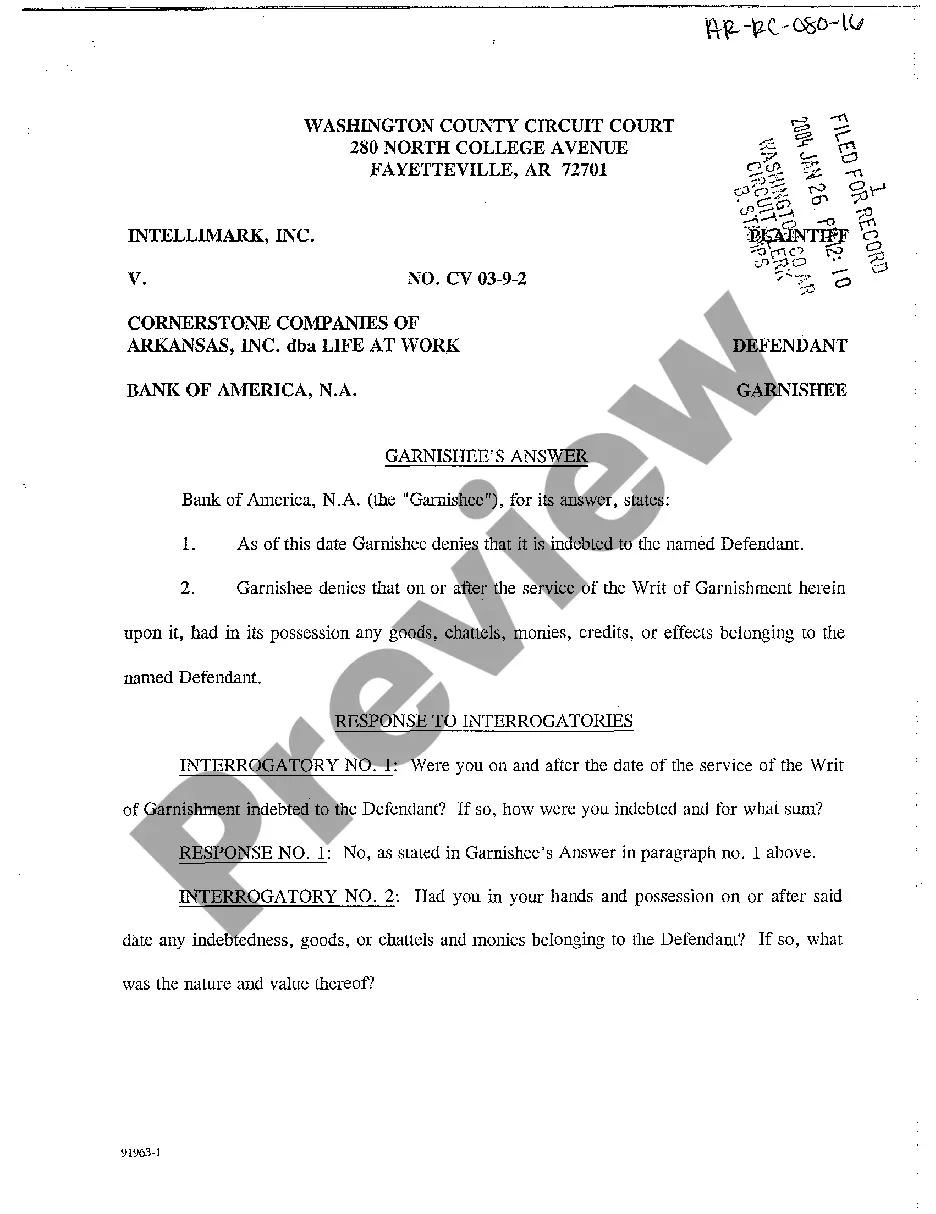

The deed of distribution is evidence of the beneficiary's title to the house, land or other real property interest of the decedent. An ancillary probate is often opened in South Carolina for the purpose of preparing a deed of distribution when an out-of-state decedent died owning real property in South Carolina.

In South Carolina, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

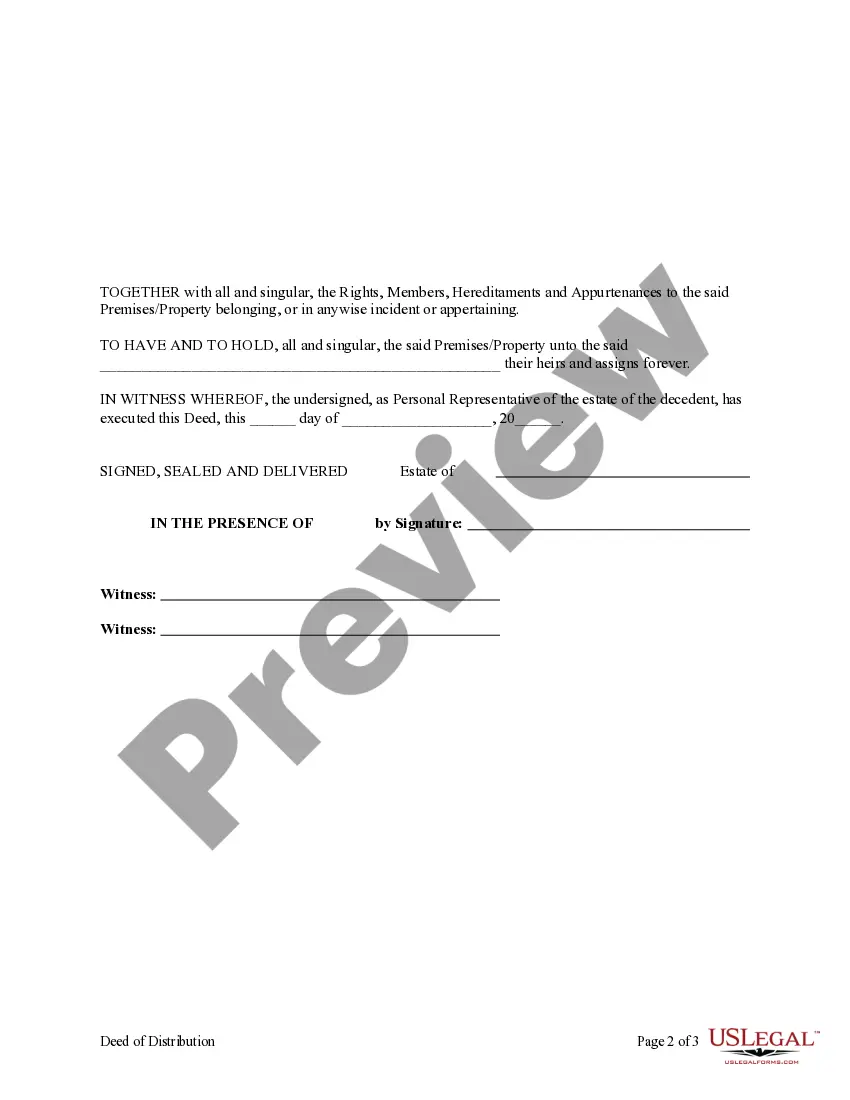

In South Carolina, the grantor must sign the deed in front of two witnesses and in the presence of an individual authorized by the state to administer an oath. Record the completed deed at the local county Recorder's office, along with an Affidavit of True Consideration (S.C. Code Ann.

South Carolina does not allow real estate to be transferred with transfer-on-death deeds.

Review the property title to see who is officially listed on it. Sign the title over to the new owner in the place that is noted. Complete a general warranty deed to show the transfer of ownership from you to another. Pay the real estate transfer tax as levied in South Carolina.

In South Carolina, it will take a minimum of eight months to probate because the law requires it to remain open to allow creditors to file claims. Beyond the minimum eight months, several factors determine how long probate takes to conclude.

A distribution deed is a way to legally transfer real property when the party who is supposed to receive the property cannot be determined from the decedent's will. In most cases, the distribution of a deceased person's estate will be done in accordance with the directions contained in the terms of their will.