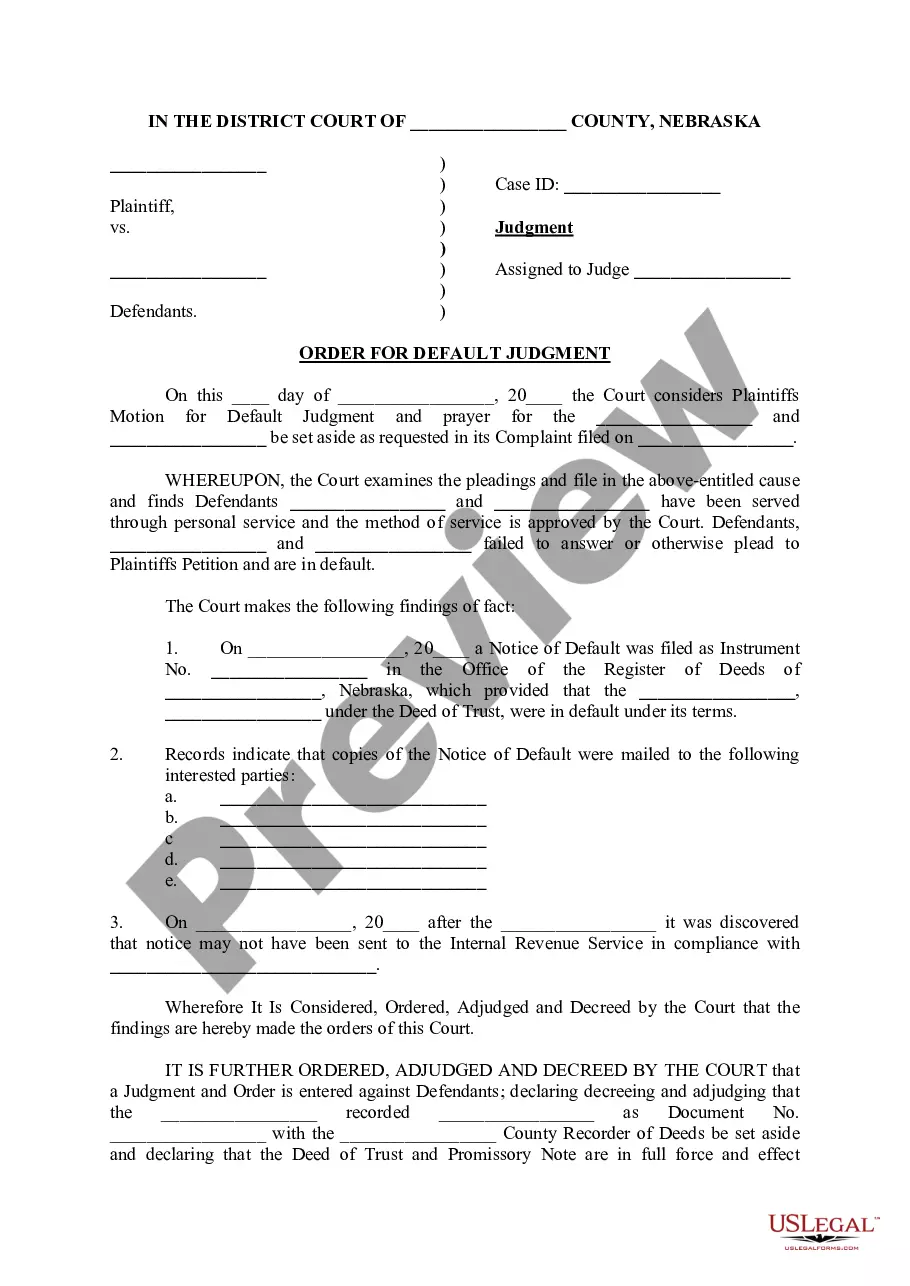

A South Carolina Avoid Security Interest (Motion) is a motion that is filed in a South Carolina court with the purpose of preventing a creditor from using a security interest to collect a debt. It is used when a debtor wants to protect their property from being taken or sold to cover a debt. There are two types of South Carolina Avoid Security Interest (Motion): 1) a motion to avoid a security interest created by a debtor before the filing of a bankruptcy case; and 2) a motion to avoid a security interest created by a third party after the filing of a bankruptcy case. Both motions require the debtor to explain why they believe the security interest should be avoided. The court will then decide whether the security interest should be avoided.

A South Carolina Avoid Security Interest (Motion) is a motion that is filed in a South Carolina court with the purpose of preventing a creditor from using a security interest to collect a debt. It is used when a debtor wants to protect their property from being taken or sold to cover a debt. There are two types of South Carolina Avoid Security Interest (Motion): 1) a motion to avoid a security interest created by a debtor before the filing of a bankruptcy case; and 2) a motion to avoid a security interest created by a third party after the filing of a bankruptcy case. Both motions require the debtor to explain why they believe the security interest should be avoided. The court will then decide whether the security interest should be avoided.