South Carolina Certification of Facts (Motion for Relief From the Automatic Stay)

Description

How to fill out South Carolina Certification Of Facts (Motion For Relief From The Automatic Stay)?

How much time and resources do you usually spend on composing formal documentation? There’s a greater option to get such forms than hiring legal experts or spending hours searching the web for a proper template. US Legal Forms is the top online library that offers professionally drafted and verified state-specific legal documents for any purpose, including the South Carolina Certification of Facts (Motion for Relief From the Automatic Stay).

To obtain and complete a suitable South Carolina Certification of Facts (Motion for Relief From the Automatic Stay) template, follow these simple instructions:

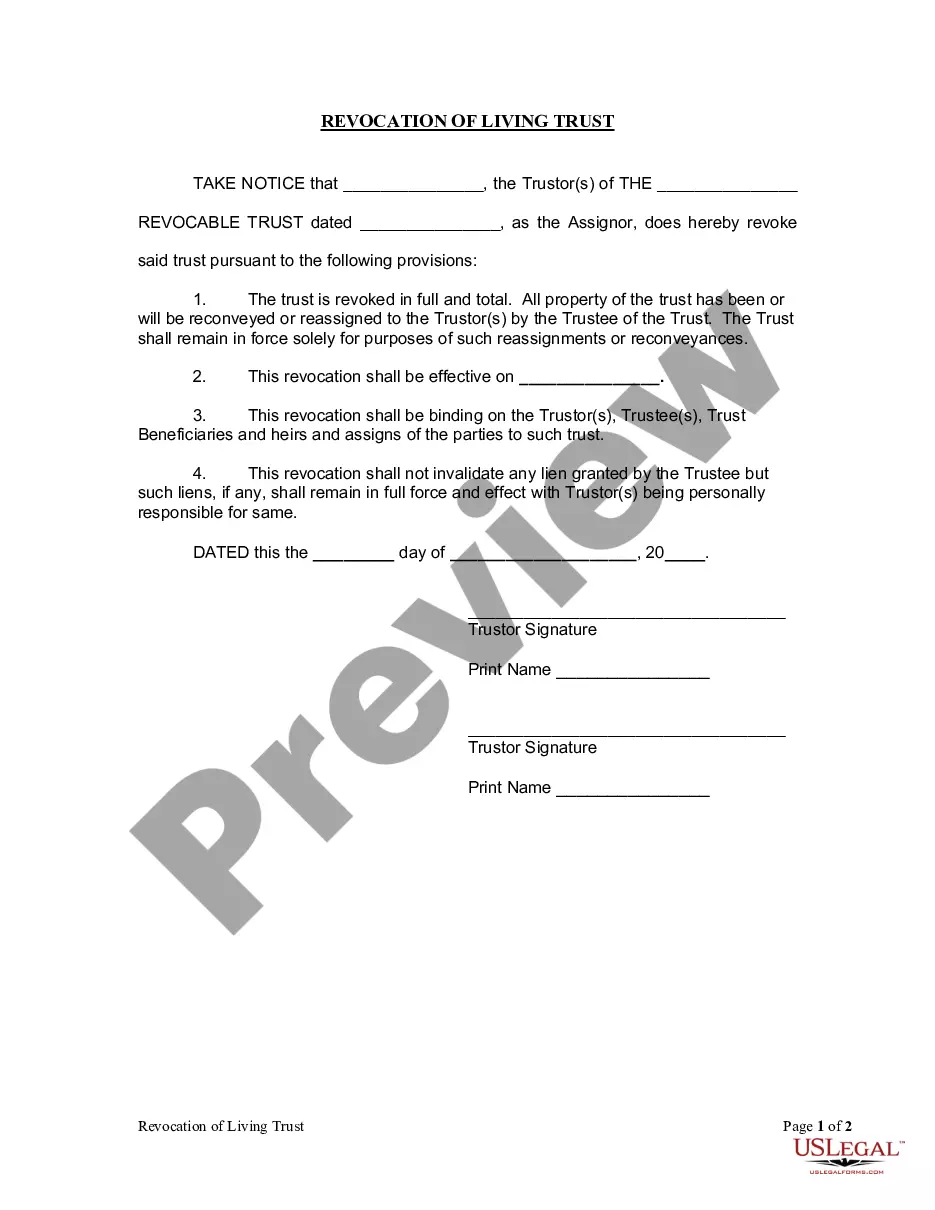

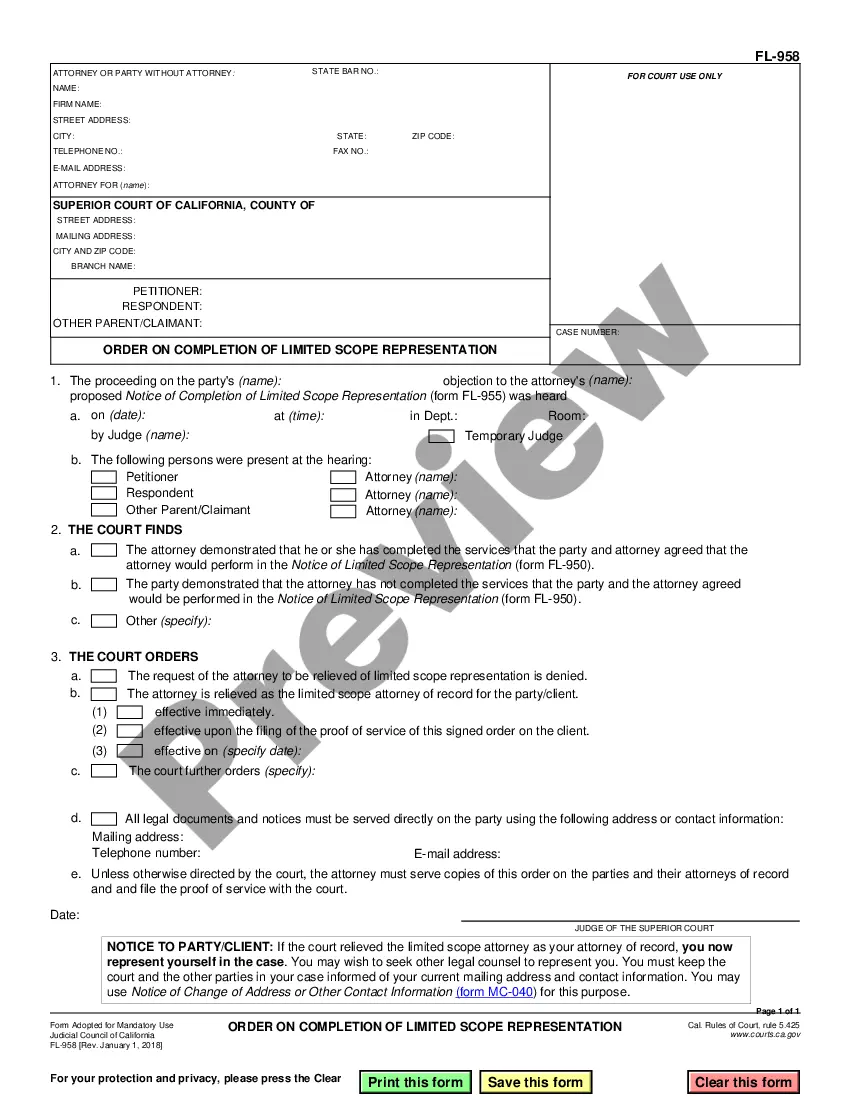

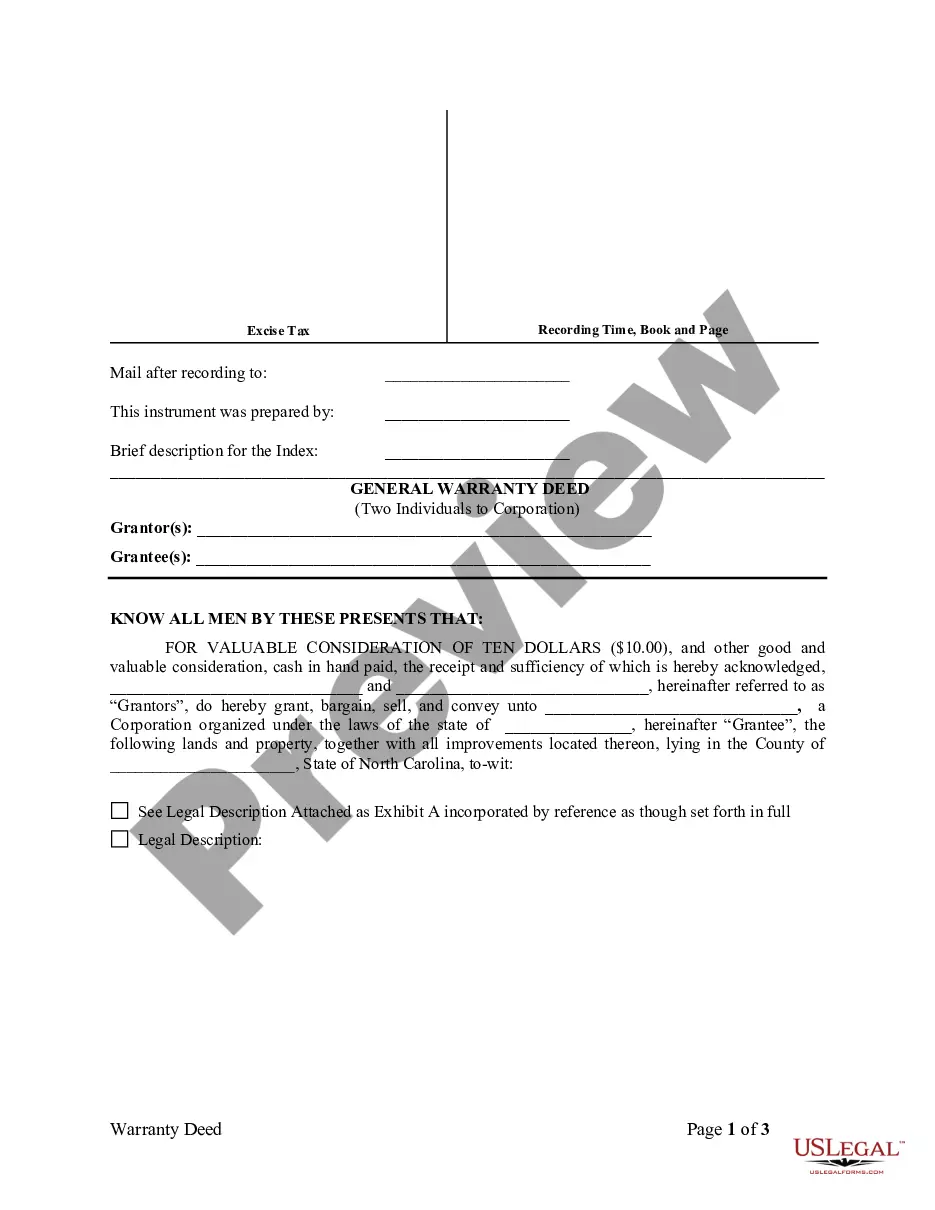

- Examine the form content to ensure it meets your state requirements. To do so, check the form description or take advantage of the Preview option.

- In case your legal template doesn’t meet your needs, find a different one using the search tab at the top of the page.

- If you are already registered with our service, log in and download the South Carolina Certification of Facts (Motion for Relief From the Automatic Stay). Otherwise, proceed to the next steps.

- Click Buy now once you find the right blank. Choose the subscription plan that suits you best to access our library’s full service.

- Register for an account and pay for your subscription. You can make a payment with your credit card or via PayPal - our service is absolutely safe for that.

- Download your South Carolina Certification of Facts (Motion for Relief From the Automatic Stay) on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously acquired documents that you safely store in your profile in the My Forms tab. Pick them up anytime and re-complete your paperwork as frequently as you need.

Save time and effort completing official paperwork with US Legal Forms, one of the most reliable web solutions. Join us today!

Form popularity

FAQ

The stay requires creditors to cease actions against the debtor and the debtor's property as described in 11 U.S.C. § 362(a). The stay continues until either the case is dismissed or closed or, in an individual case, until the granting or denial of discharge.

This Standard Clause for use in a forbearance or restructuring agreement provides for a defaulting borrower to waive its right to assert the automatic stay against a lender if it later files for bankruptcy. This Standard Clause has integrated notes with important explanations and drafting tips.

Motion for Relief from the Automatic Stay is a request by a creditor to allow the creditor to take action against the debtor or the debtor's property that would otherwise be prohibited by the automatic stay.

The automatic stay remains in effect until the case is closed or dismissed or, in an individual case, until the granting or denial of the debtor's discharge, whichever happens first. Creditors may file a Motion for Relief from the Automatic Stay requesting the stay be lifted to allow them to pursue their legal rights.

An automatic stay stops creditors from trying to collect debts from a debtor who has filed for bankruptcy until court proceedings are completed. Creditors, collection agencies, and others who violate the automatic stay can be sued by the debtor.

The automatic stay is one of the fundamental debtor protections provided by the bankruptcy laws. It gives the debtor a breathing spell from his creditors. It stops all collection efforts, all harassment, and all foreclosure actions.

First, once a person files a bankruptcy petition, the automatic stay immediately stops the bank from foreclosing on, or repossessing, the debtor's real or personal property. Examples include the debtor's home or her car. The automatic stay doesn't allow the debtor to avoid mortgage or car payments.

The most commonly sought exceptions are actions by parties to securities contracts to close out open positions; eviction of a debtor by a landlord where the lease has been fully terminated prior to the bankruptcy filing; actions by taxing authorities to conduct tax audits, issue deficiency notices, demand tax returns