South Carolina Sale (Report of) is a document that is used to report the details of a sale of property located in South Carolina. It is used to record information such as the buyer's name, address, and contact information; seller's name, address, and contact information; property address; sale price; and deed book and page information. There are two types of South Carolina Sale (Report of): a Short Form and a Long Form. The Short Form is used to report the sale of real estate with an estimated value of $10,000 or less, while the Long Form is used to report the sale of real estate with an estimated value of more than $10,000. Both forms must be signed and notarized before they can be filed with the county recorder's office.

South Carolina Sale (Report of)

Description

How to fill out South Carolina Sale (Report Of)?

Working with official documentation requires attention, precision, and using well-drafted blanks. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your South Carolina Sale (Report of) template from our library, you can be certain it meets federal and state regulations.

Dealing with our service is simple and quick. To obtain the required paperwork, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to obtain your South Carolina Sale (Report of) within minutes:

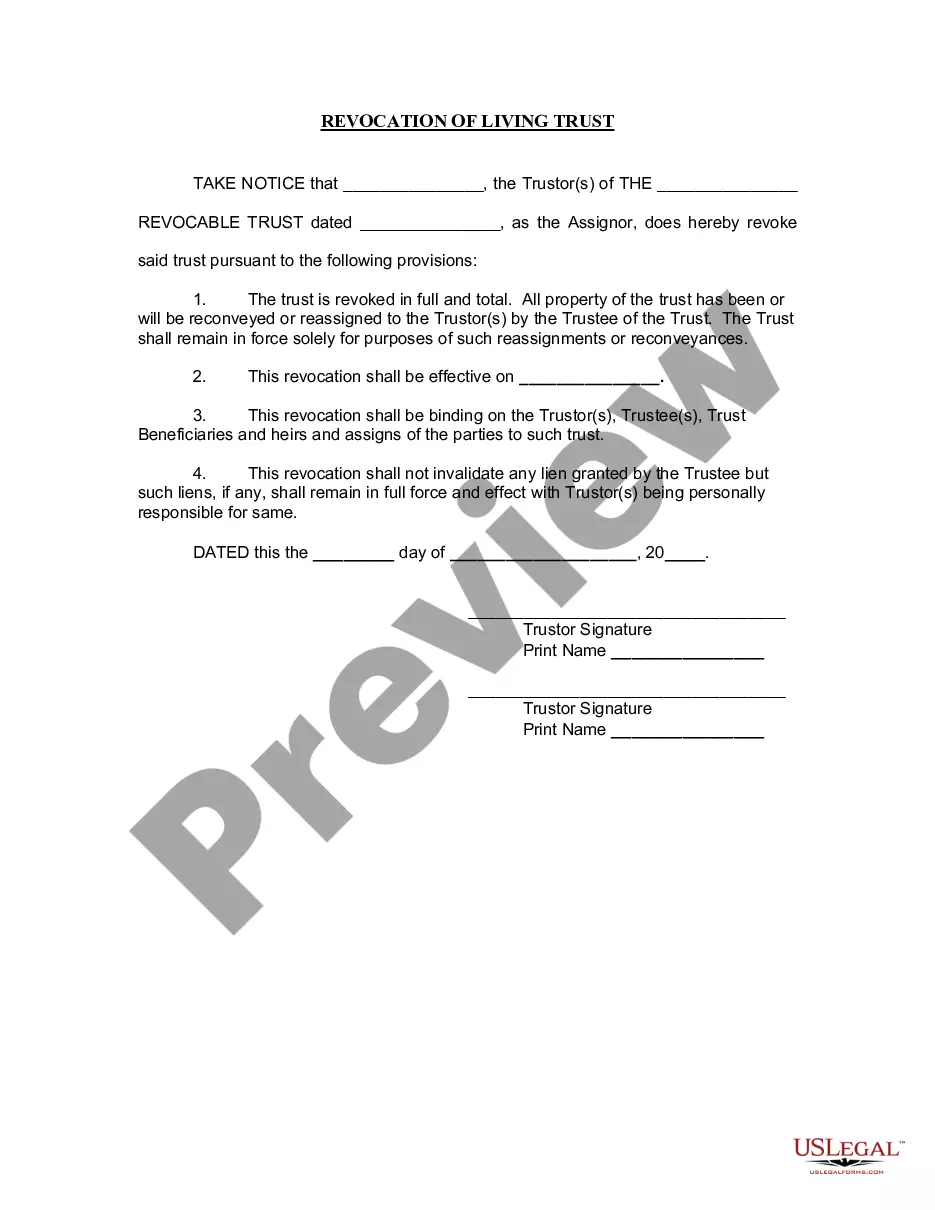

- Make sure to attentively examine the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Search for an alternative official blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the South Carolina Sale (Report of) in the format you need. If it’s your first time with our website, click Buy now to continue.

- Create an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to save your form and click Download. Print the blank or add it to a professional PDF editor to submit it paper-free.

All documents are created for multi-usage, like the South Carolina Sale (Report of) you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

The Sales Tax is imposed on all retailers within South Carolina and applies to all retail sales of tangible personal property within the state. Retailers making sales of tangible personal property in South Carolina are required to remit the Sales Tax to the SCDOR.

The state of South Carolina requires all corporations to file a South Carolina Corporation Income Tax Return ? which includes an annual report.

South Carolina's general state Sales and Use Tax rate is 6%. In certain counties, local Sales and Use Taxes are imposed in addition to the 6% state rate. The general local Sales and Use Tax collected on behalf of local jurisdictions is for school projects, road improvements, capital projects, and other purposes.

Anyone who buys tangible personal property from out-of-state and brings it into South Carolina is responsible for paying a Use Tax of 6% on the sales price of the property. Businesses that regularly make non-taxed purchases from out of state report and pay the Use Tax on their monthly Sales & Use Tax return.

South Carolina exempts sales tax on the gross proceeds of the sales of tangible personal property where the seller, by contract of sale, is obligated to deliver to the buyer, an agent of the buyer or a donee of the buyer, at a point outside of South Carolina or to deliver it to a carrier or to the mails for

South Carolina has a 6.00 percent state sales tax rate, a max local sales tax rate of 3.00 percent, and an average combined state and local sales tax rate of 7.43 percent. South Carolina's tax system ranks 31st overall on our 2023 State Business Tax Climate Index.

The statewide sales and use tax rate is six percent (6%).

Tax-exempt goods Examples include most non-prepared food items, prescription drugs, and medical supplies. We recommend businesses review the laws and rules put forth by the South Carolina Department of Revenue to stay up to date on which goods are taxable and which are exempt, and under what conditions.