South Carolina Determination of "Value" and Exemptions to Recording Fees under 12-40-40 is a state law that determines the value of documents to be recorded with the Register of Deeds. It also outlines the exemptions to the fees associated with recording. Under this law, the value of documents is determined by the fair market value of the real estate or other interest conveyed, or the amount of debt secured or assumed, as applicable. The amount of the recording fee is then calculated based on the value of the document being recorded. There are several exemptions to the recording fees outlined in 12-40-40, including: 1. Deeds or other instruments of writing when the consideration is less than $500. 2. Releases of mortgage, deeds of trust, and assignments of mortgage or deed of trust when the consideration is less than $500. 3. Instruments of writing conveying real estate in which the granter or grantee is the state, county, or municipality. 4. Documents of writing conveying real estate for which no consideration is paid. 5. Deeds, mortgages, or other instruments of writing conveying or mortgaging real estate when the granter or grantee is a nonprofit or charitable organization. 6. Deeds, mortgages, or other instruments of writing conveying or mortgaging real estate when the granter is a trustee or personal representative of an estate. 7. Deeds, mortgages, or other instruments of writing conveying real estate when the consideration is less than $5,000. 8. Instruments of writing which are not required to be recorded with the Register of Deeds.

South Carolina Determination of "Value" and Exemptions to Recording Fees under 12-40-40

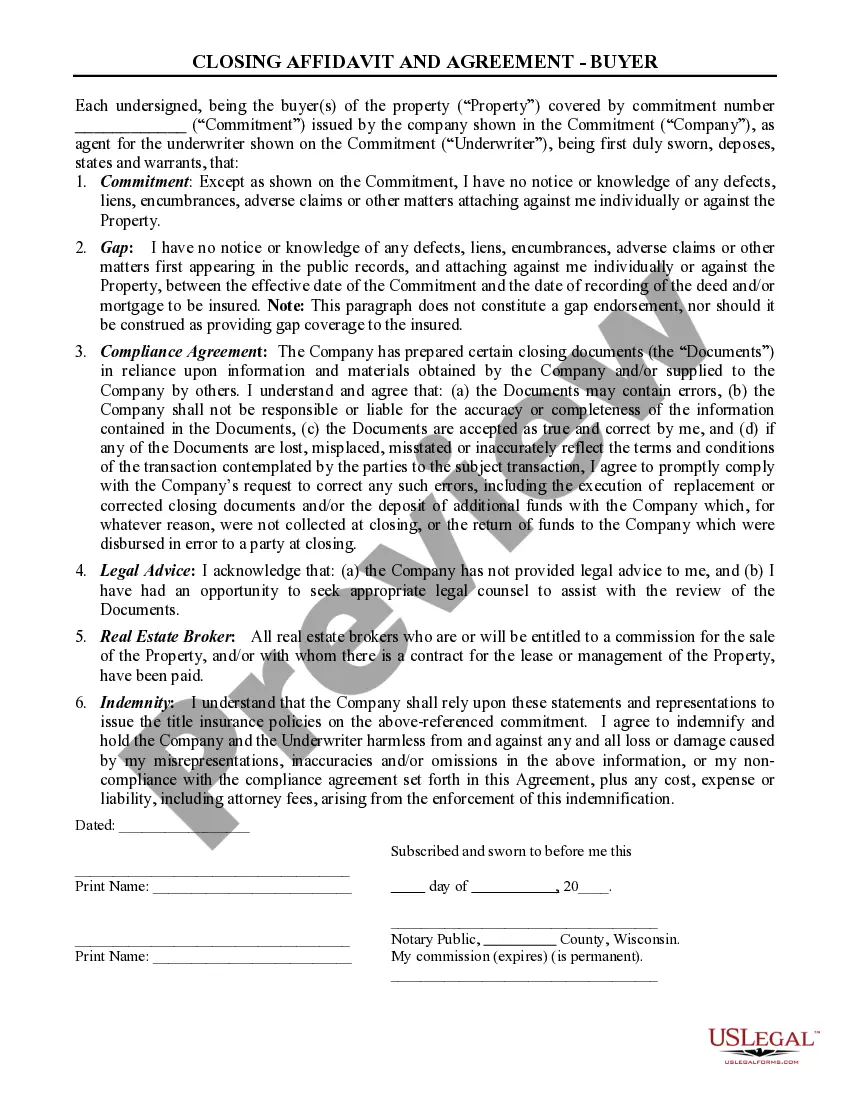

Description

How to fill out South Carolina Determination Of "Value" And Exemptions To Recording Fees Under 12-40-40?

If you’re looking for a way to properly prepare the South Carolina Determination of "Value" and Exemptions to Recording Fees under 12-40-40 without hiring a lawyer, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reliable library of official templates for every private and business situation. Every piece of paperwork you find on our online service is designed in accordance with federal and state regulations, so you can be certain that your documents are in order.

Follow these simple instructions on how to obtain the ready-to-use South Carolina Determination of "Value" and Exemptions to Recording Fees under 12-40-40:

- Make sure the document you see on the page corresponds with your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Enter the document title in the Search tab on the top of the page and choose your state from the dropdown to find another template if there are any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Create an account with the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The blank will be available to download right after.

- Decide in what format you want to save your South Carolina Determination of "Value" and Exemptions to Recording Fees under 12-40-40 and download it by clicking the appropriate button.

- Import your template to an online editor to complete and sign it quickly or print it out to prepare your hard copy manually.

Another wonderful thing about US Legal Forms is that you never lose the paperwork you acquired - you can find any of your downloaded templates in the My Forms tab of your profile whenever you need it.